Summary:

- Boeing’s shares have dropped by over 30% YTD due to the regulatory scrutiny, but the company is actively working on improving its safety standards to fix its ongoing issues.

- At this stage, Boeing has a number of growth catalysts that should help it improve its performance and lead to the recovery of its business.

- Despite facing several challenges, Boeing also appears to be undervalued and its shares represent a decent upside at the current price.

Wolterk

Since the start of the year, Boeing’s (NYSE:BA) shares have lost over 30% of their value, primarily as a result of the regulatory scrutiny that happened at the beginning of 2024 due to a safety accident that occurred on one of its planes. In recent months, Boeing has been actively working on preventing similar accidents from happening in the future and complying with the regulator’s requests.

While it seems that the company has made good progress in improving its safety standards, its shares have failed to rebound and continue to trade below the company’s fair value to this day. In my opinion, the latest selloff of its shares doesn’t make a lot of sense, given that the business is on track to recovery. For that reason, I’m sticking with a BUY rating for Boeing’s stock, since it’s relatively safe to assume that the worst-case scenario has been averted and the company’s future looks promising.

The Future Looks Bright

Back in May, I published my latest article on Boeing. In it, I noted that while the company will likely face monetary consequences due to the blowout of the midair door on the Alaska Airlines (ALK) 737 MAX 9 aircraft that happened in January, Boeing will likely avoid a 2019-type scenario where its newest jets were grounded for a long time. That’s exactly what has happened as the FAA allowed 737 Max 9 jets to return to the skies, but a cap on the production of new planes has been implemented.

Even though Boeing has avoided the worst-case scenario so far, its shares barely moved in any direction since the publication of my latest article, and the release of the latest earnings results for Q2 failed to revive the stock’s momentum. This is primarily due to the fact that Boeing’s revenues in Q2 declined by 14.6% Y/Y to $16.87 billion and were below the estimates by $480 million. At the same time, the non-GAAP EPS of -$2.90 was below the expectations by $0.89.

However, there are reasons for optimism going forward. First of all, last week, Kelly Ortberg was appointed as the new CEO of Boeing. Unlike most of the recent CEOs, Kelly Ortberg has a degree in Mechanical Engineering, which means that we are finally going to see an engineer at the helm of the company. For years, investors blamed the culture of cost-cutting, which was implemented by financers who ran the company in the past to increase profits, for the latest incidents. Under the new leadership, the safety of planes could become the highest priority, which will be beneficial for all the shareholders in the long term as it could prevent major incidents that lead to great losses happening again in the future.

In late May, Boeing has already submitted its safety and quality plan to the FAA that aims to improve the production of its planes. Then earlier this month, the company announced that it is working on design changes to prevent door panel blowouts from happening again in the future.

What’s also important to mention is that during the recent conference call, Boeing’s management stated that the company has reactivated its third assembly line for Boeing 737 MAX and increased the production of planes in June in July. This could indicate that the business’s performance could improve in the following quarters, especially since Boeing aims to increase the production of its 737 MAXs to 38 planes per month by the end of the current year.

On top of all of that, it seems that the latest safety incidents did not dramatically hinder the demand for Boeing’s planes. At the end of Q2, Boeing had a backlog of $516 billion, which includes orders for over, 5400 commercial planes. At the same time, during the latest Farnborough Airshow, the company secured 118 orders and commitments worth $17.1 billion, which signals that the demand for Boeing aircraft remains significant. If Boeing manages to improve its safety protocols under the new leadership and the FAA removes its production cap on 737 MAXs, then the company will likely once again regain its momentum, especially since it was already making great progress in 2023. Add to all of this that IATA expects the air travel market to reach a new record this year, while Airbus (OTCPK:EADSY) forecasts a significant increase in air traffic in the following years, and it becomes obvious that Boeing has more than enough growth opportunities which it can monetize as long as it’s able to fix its current issues.

Considering all the good and bad that Boeing has going for it, it all comes down to whether the growth opportunities outweigh the risks at the current price to justify a long position in the company. Back in May, my DCF model showed Boeing’s fair value to be $200.41 per share. Given that the company had a weak start to the year and missed the expectations in Q2, it makes sense to update that model to better reflect the reality.

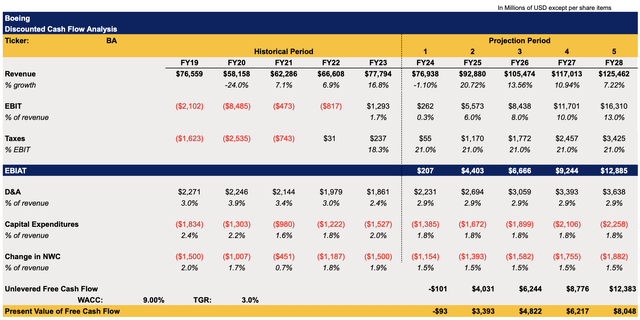

In the updated DCF model below, several things have been changed. First of all, in FY24 revenues are expected to decrease Y/Y, and EBIT is going to be lower than previously expected. In FY25 and beyond, the top-line and bottom-line performance is expected to greatly improve due to the better environment and the improvement of safety standards that should help Boeing scale its production. The revenue and EBIT assumptions in the updated model below closely correlate with the street expectations. The assumptions for other metrics in the updated model remained the same as before, and they closely correlate with Boeing’s historical performance.

Boeing’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

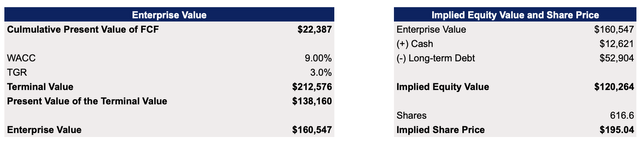

The updated model shows that Boeing’s fair value is $195.04 per share. While this is a lower price target in comparison to the previous model due to the downward revision of several assumptions, there are nevertheless reasons to be optimistic as it appears that Boeing’s shares trade at a discount and represent an upside of ~18% at the current price.

Boeing’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

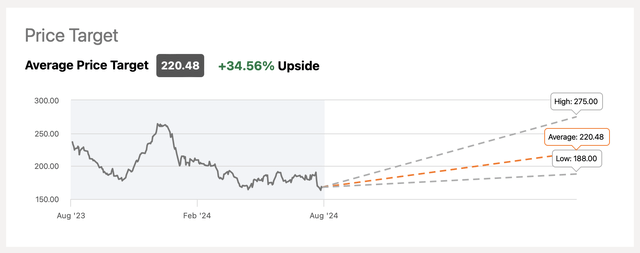

At the same time, the consensus on the street is that Boeing’s shares represent an upside of over 30%. That’s why, despite all the challenges that Boeing currently faces, I still believe that its shares are an attractive investment at the current price.

Boeing’s Consensus Price Target (Seeking Alpha)

The Recovery Is Not Guaranteed

Despite all the growth opportunities, there are nevertheless several risks that investors need to understand. First of all, there’s no guarantee that one of Boeing’s planes won’t have another safety accident that affects the company’s production and financials, as was the case at the beginning of this year. Therefore, while future expectations are made based on the notion that the worst for Boeing is behind, there’s always a possibility that the company could face another crisis that tanks its performance and share price given its recent history.

In addition to that, there’s a risk that Boeing’s aircraft machinists will go on strike in September if their pay is not increased and the pensions are not reinstated. This could have an impact on Boeing’s production schedule and financial performance in the following months and could slow down the company’s recovery.

On top of all of that, the European Airbus continues to extend its lead over Boeing, while the Chinese narrow-body airliner C919 is close to getting approval to fly to the European Union. That’s why, if Boeing once again faces another safety accident, it could start losing a significant portion of the commercial market as buyers will start looking for alternatives. Such a thing is not going to happen overnight, but the constant underperformance by the company is certainly going to have an impact on its market share in the long run.

The Bottom Line

Boeing, without a doubt, continues to face major risks that could undermine its recovery and make the company less relevant over the long term. However, given the amount of growth opportunities that the company has going for it at this time and the fact that its shares appear to be undervalued, it makes sense to assume that at the current price, the risk is tolerable as the upside appears to be significant. That’s why I stick with my BUY rating for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.