Summary:

- Intel Corporation is facing challenges in the semiconductor sector despite turnaround efforts, with poor financials, competitive pressure, and lagging innovation.

- Stock performance has been underwhelming compared to competitors like NVIDIA and Taiwan Semiconductor Manufacturing, with a significant decline in market share.

- The shift to a foundry business model has not been successful, with substantial operating losses and a high debt burden posing risks to Intel’s profitability and competitiveness.

Robert Way

Investment Thesis

I am bearish on Intel Corporation (NASDAQ:INTC) despite its turnaround initiatives such as a change of business model and cost control measures. Recognized for its integrated circuits and microprocessors, Intel has been integral in the semiconductor sector for many years. Nevertheless, recent data and trends indicate that it might not be a good investment at the moment.

My lack of optimism even with the above strategic decisions stems from the company’s poor financials particularly the high debt burden and the yet-to-deliver foundry business. Further, the competitive landscape has proven a rough sea for INTC to sail in something which adds to my skepticism.

A Review Of Price Movement: A Reflection Of Competitive Pressure

While INTC is present in the majority of PCs, its stock has not taken part in the recent massive boom market for semiconductor stocks.

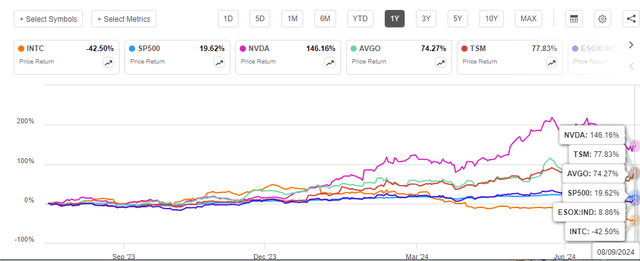

Since they laid the groundwork for the artificial intelligence boom, semiconductor companies such as Broadcom (AVGO), NVIDIA (NVDA), and Taiwan Semiconductor Manufacturing (TSM) have enjoyed enormous rallies in the last year. Over the past 12 months, NVidia has soared 146%, Broadcom by 74%, and TSMC by 77%. All these booms have come against INTC’s more than 42% slump not only underperforming its peers but also the overall ESOX: IND.

With a market share of about 78% in central processing units, the company leads the market, but it is having difficulty keeping up with the kinds of semiconductor chips needed for artificial intelligence [AI], especially graphics processing units. This competition explains why its stock performance has been poor. Its stock has dropped over 61% year to date. In the long term, the stats are even more dismal: Intel is currently trading at about $20 per share, down roughly 64% over the last three years.

The Competitive Landscape: Intel Lags Its Competitors’ Innovation

Currently, the talk of the day in the tech industry is the AI which is a revolutionary force. This has taken effect even in the chip market, especially in the GPU. With this in mind, it means that for Intel to remain competitive and viable in the industry, it has to match or even outdo its rivals in the AI chip market. On the contrary, INTC appears to lag behind its competitors in the AI chip market.

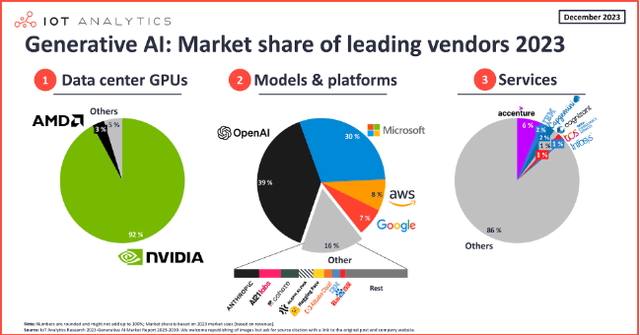

In terms of market dominance, as of 2023, NVDA was the leading vendor with a market share of about 92% followed by a 3% market share of AMD this meant that INTC made part of the remaining 5%. According to Bank of America, INTC has less than 1% of the AI chip market with NVDA maintaining a higher market share at high double-digit figures.

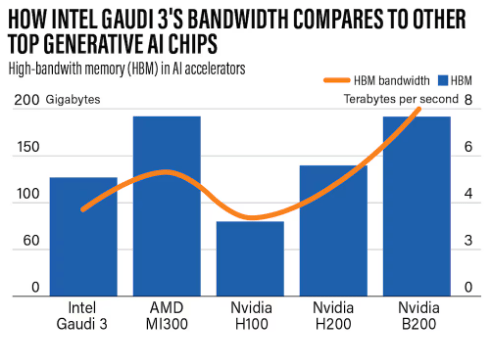

In my view, the company’s lack of significant market share in this market is its lack of innovations to match its major rivals NVDA and AMD. For instance, in April, INTC unveiled the Gaudi 3, one of its most innovative products. It outperformed NVidia’s H100 GPUs in terms of inference and power efficiency by around 50% and 40%, respectively. Even while it appears that this device will compete directly with AMD and NVDA, I don’t think it will present much of a threat to its two major rivals.

To begin with, Gaudi 3 is not expected to be available for purchase anytime soon since volume production is anticipated to begin in Q3 2024. Conversely, NVDA anticipates shipping H200 chips in Q3 2024 after completing mass manufacturing in Q2; moreover, INTC Gaudi 3 is being matched with H100, which is a generation older considering the H200 and B200 products from NVDA and AMD’s MI 300.

IEEE

Given these events, it appears to me that INTC is significantly behind its competitors in terms of innovation. This puts them at a significant competitive disadvantage and bodes poorly for the performance of its stock.

The Foundry Business Model: Far From Promising

Intel made a strategic shift from its traditional IDM-focused operations to a foundry business model. This transition is in line with its IDM 2.0 strategy, which intends to bring together the flexibility of a foundry service model and the strengths of internal manufacturing capabilities. The goal of the relocation is to provide clients with cutting-edge solutions through ongoing technological advancements and to build a more robust, sustainable, and secure supply chain.

The chief financial officer, Dave Zinsner, states that this model was intended to generate major cost reductions, operational efficiencies, and asset value. They anticipated accelerating to meet their 2030 goals of 40% non-GAAP operating margins and 60% non-GAAP gross margins.

While this ambitious move sounded like a game changer and perhaps a significant turnaround strategy, the results have been astonishing and far from pleasing. The foundry section reported an astounding operating loss of $7 billion in 2023 which was much higher than the $5.2 billion reported in 2022.

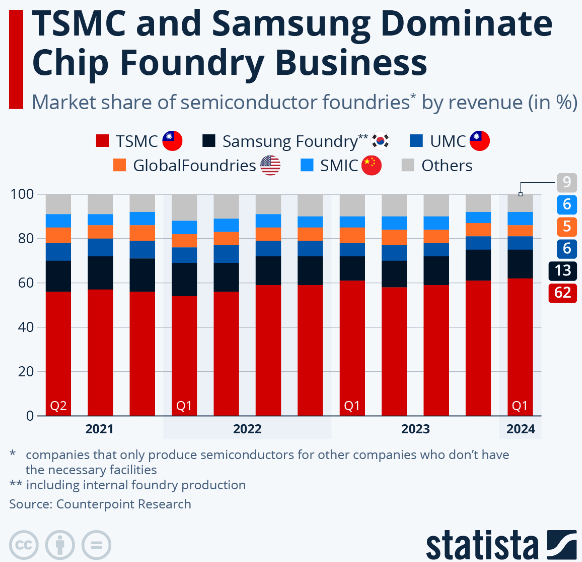

With a whopping net income of $26.88 billion in 2023 compared to Intel’s enormous loss, Taiwan Semiconductor Manufacturing, an established leader in the foundry industry, will be a formidable competitor for INTC which adds to the competitive woes.

Statista

In the Q2 2024 report dated 1st August 2024, the foundry’s operating loss was $2.8 billion, and the company anticipates that operating losses will remain roughly the same in Q3. This awful trajectory which speaks volumes about how far the new model is from profitability and worse enough, how far the company is from matching its competitor’s profitability milestones.

Why I Believe The Foundry Model Could Be Unsustainable

While the model has been characterized by declining revenues from $27.5 billion in 2022 and $18.9 billion in 2023 as well as the worsening profitability mentioned above, I find it an uphill task for Intel to turn this model fruitful, especially given the competition highlighted above.

First off, currently, Intel’s foundry generates a significant amount of revenue from internal sources as opposed to outside clients. This reduces the possibility of increased profits from growing markets. While the company anticipates breakeven in 2027 and realizes external revenue of about $15 billion in 2030, it calls for massive investments and innovations to not only match but also exceed competition. Having said that, INTC is almost incapacitated to do this for it calls for intensive capital something which would stretch what I believe is overstretched debt burden.

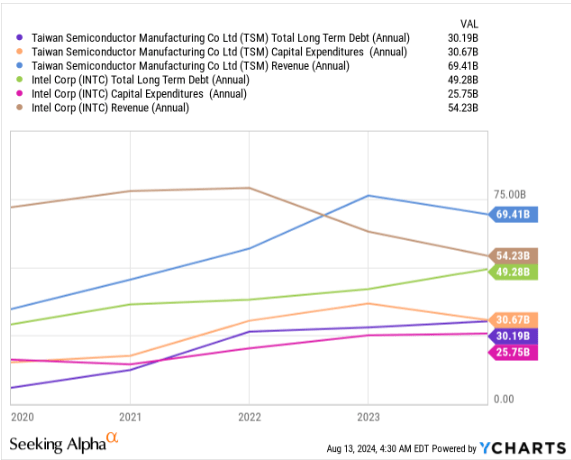

Compared to TSM a major foundry competitor, INTC has an annual total debt of $49.28 billion against $30.19 billion for TSM. This is not only a higher burden than its competitor but also very unsustainable considering Intel’s low revenue base compared to TSM.

YCharts

Furthermore, its debt has increased significantly over the past five years, nearly doubling in just that time, from $29 billion in 2019 to its current level. Its $9.77 billion negative unlevered cash flow further indicates that the mounting debt is a burden. Due to its increasing debt and inadequate cash flows to pay it off, the company is unlikely to reach TSM because funding further developments and innovations to catch up with competitors may call for additional debt which would further add to what appears as unsustainable debt.

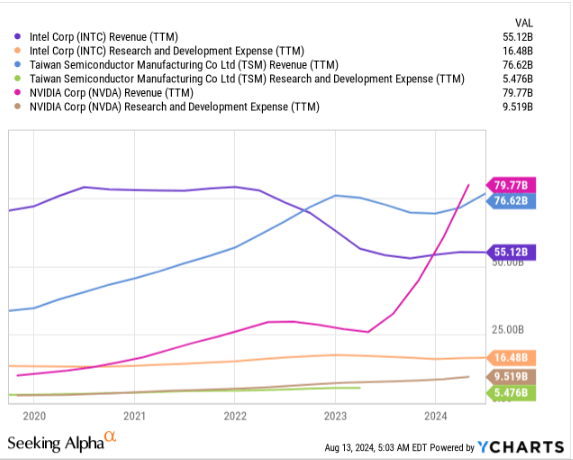

Debt burden aside, I am concerned about the company’s R&D and Innovation. The corporation has had a significant R&D expenditure, currently trailing at $16.48 billion, accounting for about 30% of its revenue. Despite this enormous investment, the corporation has struggled to turn its R&D spending into market-leading products. Competitors, like as NVIDIA and TSM, have been more successful in capturing market share and driving innovation despite lower R&D investments than Intel.

YCharts

Conclusion

While Intel is still a key player in the semiconductor sector, several reasons indicate that it may not be a good investment option at this moment. Lagging technological developments, high debt burden concerns, strategic hurdles, particularly the foundry business model, R&D and innovation issues, and underwhelming stock performance all contribute to my bearish outlook for Intel. I believe it also explains its 31 EPS and 38 revenue downward revisions and zero upward revisions which further inform my sell decision.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.