Summary:

- Meta transformed from a superior growth stock to a value investment and finally to a speculative turnaround bet.

- Meta temporarily collapsed around 77% to $88 from its all-time-high $384.33 marked on August 30, 2021 during the ongoing bear market.

- Mismanagement, regulatory scrutiny, increasing competition as well as lack of adequate corporate governance, vision and strategic direction by management weigh on the share.

- While it could be tempting to buy considering the share price crash, the technical and fundamental situation, the macroeconomic environment and corporate issues indicate a high risk low reward turnaround bet rather than a promising investment.

Derick Hudson

1. Introduction

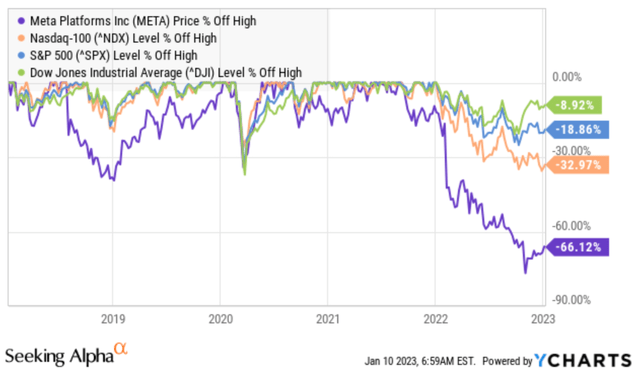

We are in the midst of a bear market and Meta Platforms (NASDAQ:META) collapsed around 62% from its 52-week-high of $337.

Consequently, Meta has underperformed all the major indices, such as the S&P 500, Dow Jones as well as the Nasdaq (see chart).

Price % off high – Meta vs major indices (YCharts)

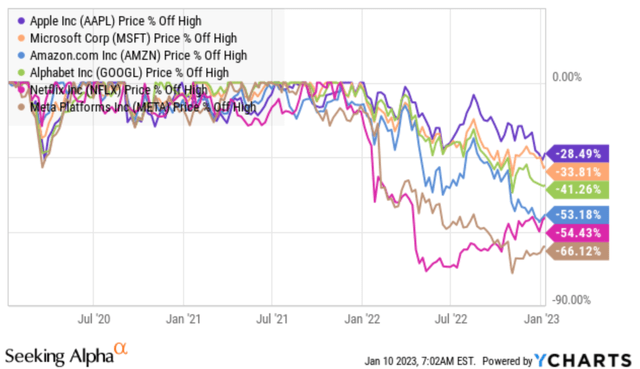

Meta has also vastly underperformed its so-called FAANG peers (see chart).

Meta vs so-called FAANG peers (YCharts)

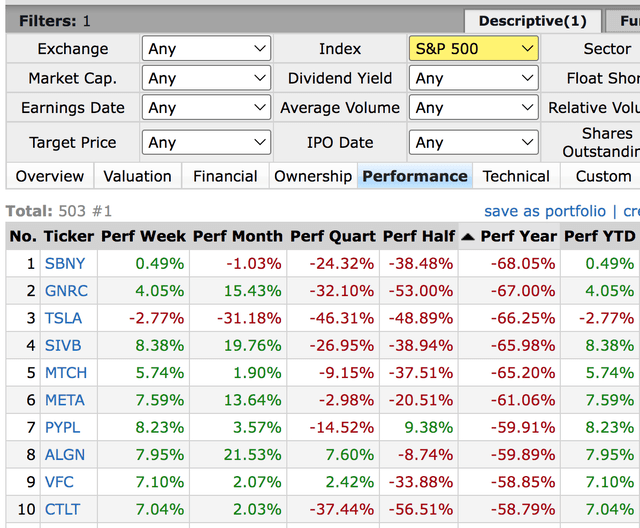

Additionally, Meta is among the 10 worst performing S&P 500 stocks in the course of the last 12 months (see chart).

Meta vs. S&P 500 stocks (Finviz)

So, is now a tempting opportunity to buy?

2. Fundamental Analysis

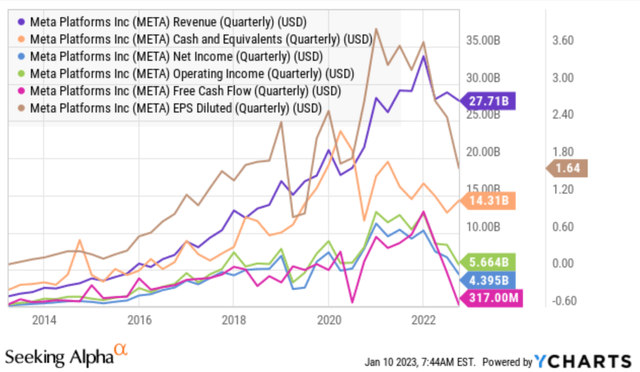

As you can see in the following figure, Meta’s key performance metrics are deteriorating since 2021. With key performance metrics I mean revenues, cash & cash equivalents, net income, operating income, free cash flow and earnings per share.

I expect the deterioration to intensify if the macroeconomic environment worsens, i.e. we enter into a recession, or management keeps struggling to turn the tide.

Meta key performance metrics deteriorate since 2021 (YCharts)

3. Technical Analysis

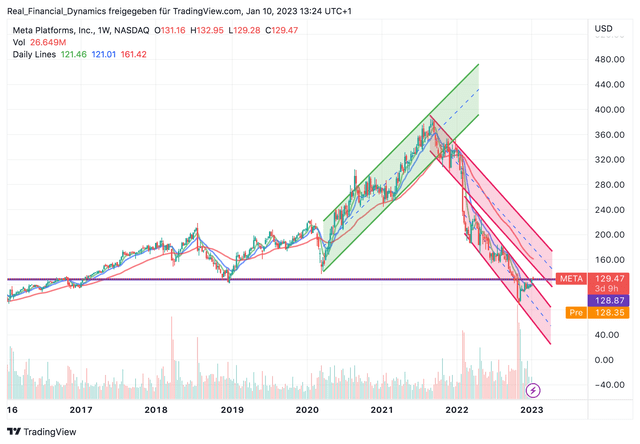

Looking at the chart, it is striking that Meta is caught in a downtrend, which favors a further decline in the share price (see following chart).

At one point, the share price had even accelerated its downtrend and entered a steeper downtrend (see lower red channel in the chart).

On the one hand, the stock erased all Post-COVID gains. On the other hand, if you look at Meta’s historic price movements, the current price could serve as a support and/or resistance.

However, the stock seems to be trying a break-out from the steeper downtrend to the upside. A break-out above could temporarily move the stock to around $166 (the upper line of the first downtrend channel). A failure and close below $129, however, could lead to a much further collapse.

Consequently, the risk-reward ratio doesn’t seem very tempting yet from a technical point of view.

Meta weekly chart – caught in a downtrend (TradingView)

4. Fair Value Calculation

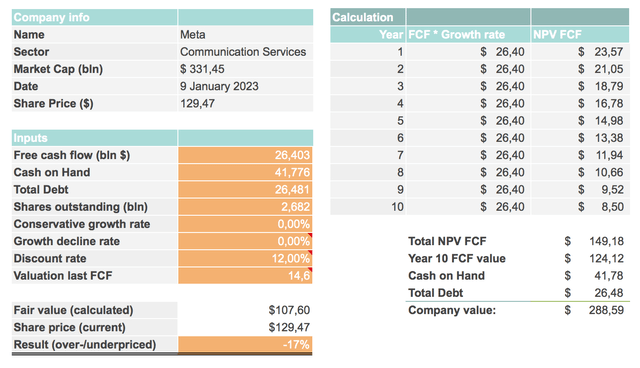

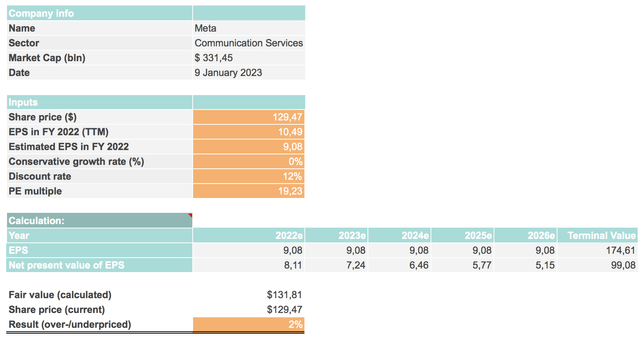

I prepared two valuation models in order to make a more accurate assessment of the valuation. I have chosen a conservative approach due to the monetary tightening phase of central banks on a global scale and the related rapidly rising interest rate environment. Other factors favoring a conservative approach include the uncertain macroeconomic and political environment and rising recession risks, which have probably not yet been fully priced in.

Furthermore, accept it or not, Meta currently has a struggling business model and Zuckerberg is trying to re-invent the company. Additionally, the advertising business, where Facebook generates 98% of its revenues, is cyclical and therefore vulnerable to economic cycles.

Given the deteriorating key performance metrics and due to a turnaround speculation, I have chosen a growth rate of 0% in both valuation models. Why? Because as a (value) investor I want a reasonable margin of safety and it is difficult to estimate when Zuckerberg will succeed in turning the tide again.

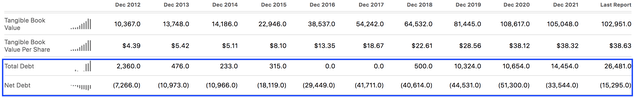

Furthermore, I have chosen 12% as the discount rate. Meta has robust financials with $42 billion in cash, but as we have seen, the cash is currently melting away and the net debt position is deteriorating for the third year now (see following chart).

Meta total and net debt (Seeking Alpha)

The first valuation method is based on a DCF calculation. In terms of Price/Cash flow multiple, I have chosen a multiple of 14.60 for the last FCF, which represents the current average FCF multiple of the S&P 500 and is well above Meta’s current FCF multiple of 6.56 but close to its 5-year-average of 16.80, according to Morningstar.

In the first valuation method based on a DCF calculation, the fair value is $107.60, which corresponds to an overvaluation of the stock of 17% (see figure below).

Meta fair value calculation based on DCF (Author’s calculation)

The second valuation method is based on an earnings-per-share calculation. In terms of P/E multiple, I have chosen a multiple of 19.23 for calculating the terminal value, which represents the current P/E multiple of the S&P 500 and is well above the current P/E multiple of Meta of 12.35, according to Morningstar.

In the second valuation method the fair value is $131.81, which corresponds to a slight undervaluation of the stock of 2% and thus indicates a current fair valuation (see figure below).

Meta fair value calculation based on EPS (Author’s calculation)

5. Conclusion

In summary, the fundamental, technical and business trend at Meta is clearly pointing downwards.

As long as Zuckerberg does not succeed in turning the tide, the stock will probably not be able to recover sustainably any time soon.

While Facebook is becoming increasingly obsolete for today’s young people, Meta has also failed to invent or buy another notable cash cow besides the Instagram acquisition.

While costs also seem to have run out of control in the past, margins, cash flow and profits are now dwindling as well.

In the long term, I could imagine a split-up of Meta if the turnaround will not be successful. In my opinion, Zuckerberg currently has only one option to turn things around: land a lucky coup like the Instagram takeover.

My fair value calculation based on a DCF method shows a current overvaluation of 17% and my fair value calculation based on an EPS method indicates a fair valuation, leaving no margin of safety.

The current uncertain macroeconomic environment and the central banks’ rapid monetary tightening process should further weigh on the stock.

Consequently, the risk-reward ratio seems far too bad to consider an investment at the current stage.

To conclude, it is sad to say that Meta first transformed from a superior growth stock to a value investment and now has become a speculative turnaround bet.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.