Summary:

- JPMorgan Chase has outperformed the iShares U.S. Financials ETF in 2024 with a 24% total return.

- The bank’s Q2 2024 results significantly benefitted from the Visa share sale transaction, with an ROTCE of 28%, or 20% excluding the one-off effect.

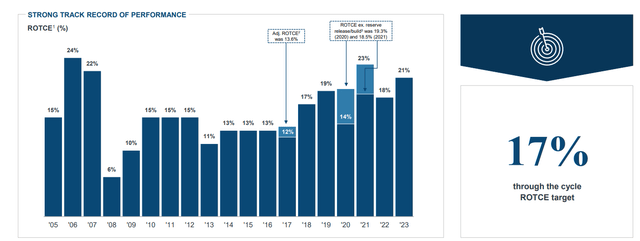

- Against the expectations for lower Fed rates, profitability is likely to decline to the bank’s medium-term target of 17%.

- Naked long investors are likely looking at a high single-digit return, while a covered call strategy may produce a low-double-digit gain.

- Key risks in selling covered calls include limiting your upside while keeping all the downside, coupled with the Fed not cutting rates as fast as markets currently price in.

JayLazarin

Introduction

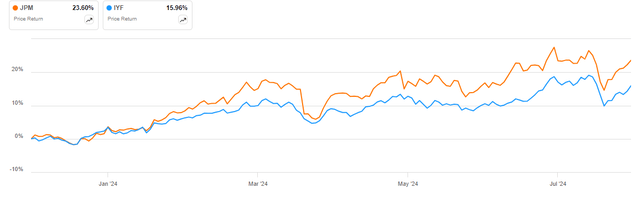

JPMorgan Chase & Co. (NYSE:JPM) has outperformed the iShares U.S. Financials ETF (IYF) so far in 2024, delivering a total return of about 24% versus the circa 16% gain in the benchmark ETF:

JPM vs IYF in 2024 (Seeking Alpha)

I also covered JPMorgan Chase & Co. 4.20% DP PFD MM (JPM.PR.M) preferred shares back in June 2024 arguing they could provide a low-double-digit annualized return during the anticipated Fed rate-cutting cycle. Today I highlight an opportunity to sell covered call options on the bank’s common stock to generate extra income, potentially outperforming a buy-and-hold strategy as profitability declines to the bank’s long-term target as a result of Fed monetary easing.

Company Overview

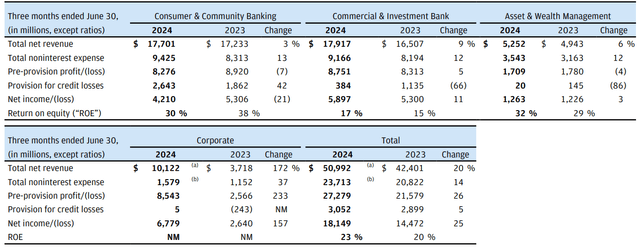

You can access all company results here. JPMorgan Chase reports results in three business segments, as well as a Corporate segment. Consumer & Community Banking, or CCB, accounted for 35% of Q2 2024 revenues, and Commercial & Investment Bank, or CIB, also contributed 35%. Asset & Wealth Management, or AWM, brought 10% of revenues, leaving Corporate with an unusually large 20% revenue contribution as the bank booked a $7.9 billion pre-tax gain on Visa shares sale during the quarter.

Segment results (JPMorgan Chase Form 10-Q for Q2 2024)

Net interest income, or NII, accounted for 45% of Q2 2024 revenue, while non-interest income contributed 55%. However, due to the outsized effect of the Visa transaction, looking at annual totals gives a better representation of the bank’s interest rate exposure, as measured by NII contribution to total revenues:

| PeriodRevenue Split | Net interest income | Non-interest income |

| Q2 2024 | 45% | 55% |

| 2023 | 56% | 44% |

| 2022 | 52% | 48% |

| 2021 | 43% | 57% |

Source: Author calculations based on company data

We observe that the significance of NII to the company’s revenues has increased following the Fed rate hiking cycle of 2022-2023, rising from 43% in 2021 to 56% in 2023, which was likely its peak for the foreseeable future.

Operational Overview

Consumer & Community Banking reported a 3% Y/Y increase in Q2 2024 revenues, driven by Card Services & Auto, as well as Home Lending. Expenses shot up 13% Y/Y on continued personnel investments and First Republic-related expenses. Provision for credit losses also skyrocketed 42% Y/Y driven by Card Services. The combined effect was a 21% Y/Y slump in segment net income.

Commercial & Investment Bank was the best-performing segment, delivering 9% Y/Y revenue growth in the quarter, with strength in both Banking & Payments and Markets & Securities Services. Expenses, however, were 12% Y/Y higher on elevated employee costs. Provision for credit losses was very benign, declining 66% Y/Y. In total, net income increased 11% Y/Y.

Asset & Wealth Management revenue was 6% higher Y/Y, helped by higher management fees, with assets under management up 15%. Expenses were again a weak spot, increasing 12% Y/Y on growth in private banking, as well as higher legal expenses and distribution fees. Still, with an 86% decline in credit provisions, net income managed a 3% Y/Y increase in the quarter.

For the bank as a whole, the return on tangible common equity, or ROTCE, came in at 28% in Q2 2024, or 20% excluding the Visa transaction. Revenues increased 22% Y/Y while expenses rose 14% Y/Y. Provision for credit losses was 5% higher. EPS was $6.12/share, up 29% Y/Y, with the Visa transaction contributing $2.04/share. The tangible book value stood at $92.77/share, up 4.9% Q/Q.

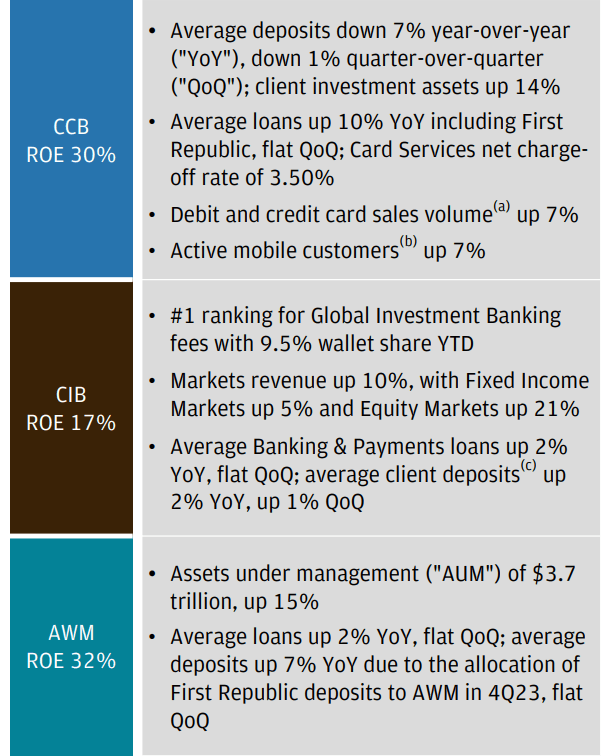

Business segment operational highlights (JPMorgan Chase Form 10-Q for Q2 2024)

Capital Position

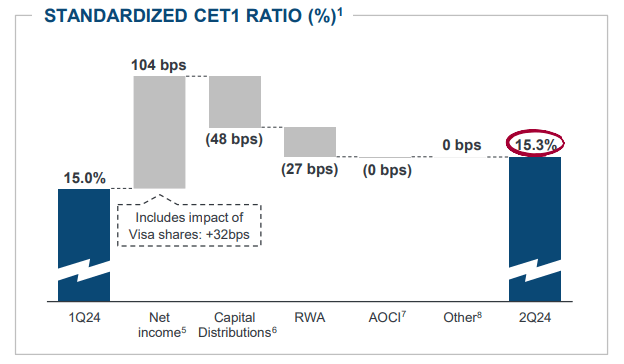

JPMorgan Chase ended Q2 2024 with a standardized CET1 of 15.3%, up 0.3% Q/Q, driven by retained earnings:

Quarterly capital development (JPMorgan Chase Q2 2024 Results Presentation)

The bank has been consistently strengthening its capital position over the past year, with the trailing twelve-month payout ratio standing at just 45%. As a result, JPMorgan Chase enjoys a 3.4% capital buffer relative to its 11.9% regulatory CET1 requirement.

The case for covered calls

I expect the bank to face significant NII headwinds as the Fed embarks on its monetary easing in the near future. Current futures prices indicate a Fed funds rate of about 3.25-3.50% in July 2025, some 2% lower than current levels. This will likely push profitability closer to the bank’s 17% ROTCE long-term goal. Indeed, applying a 17% ROTCE against the current tangible book value results in an earnings yield of about 7.5% at the current share price of about $210/share.

ROTCE between 2005-2023 (JPMorgan 2024 Investor Day Presentation)

Even if we factor in some earnings growth from non-interest revenue, I think it is reasonable to assume the bank only delivers a high-single-digit return over the medium term.

I reckon investors can improve their returns by selling covered calls against their JPM stock. Some options I think are worth considering are outlined in the table below:

| Option ExpirationAnnualized option return at the strike price | $210 | $220 |

| December 2024 | 17.7% | 11% |

| June 2025 | 10.9% | 8.2% |

Source: Author calculations

As we can see from the table above, the most aggressive covered call selling strategy, choosing calls with a strike price at the current share price of about $210/share, resulting in a low-double-digit return. Of course, we should note the 4-month December option entails significant rollover risk.

At the same time, the slightly out-of-the-money $220 strike price options offer some capital gain potential (which is not included in the table of annualized returns) and increase the chance of you collecting the 2.21% dividend in the meantime, which is likely to increase over the next year.

Lastly, since you get the option premium upfront, you can use it for other investments, which again increases your potential return (again not included in the table).

In any case, I think it is quite likely a covered call strategy which manages to collect some dividends will outperform a buy-and-hold strategy.

Risks

The main risk with covered calls is that you limit your upside while remaining exposed to significant draw-downs, which for bank stocks happen more often than not. The silver lining is that covered calls will mitigate your losses in a downturn, i.e., absorbing some price declines as the option expires worthless. As such, covered calls are better than naked long positions during market pullbacks.

The other risk to mention is that the Fed does not cut rates, or does so at a pace much slower than priced into the markets. However, even in that scenario, assuming that ROTCE stays at about 20%, which is above the cycle average, JPM will still deliver an earnings yield of about 8.8% against the current share price. Hence, the option selling strategy might still outperform, but you are most likely to have your stock called, which at the all-time high for the share price may not be such a bad trade after all.

Conclusion

JPMorgan Chase recorded a stellar Q2 2024 performance, helped by the Visa shares transaction. Looking under the hood, we observe that expenses outpaced revenue growth in all three business segments, indicating the bank is likely to glide down to its long-term ROTCE target of about 17% in the medium term. Given the elevated tangible book premium at the current share price and expectations for Fed rate cuts, I think investors naked long investors are looking at a high single-digit return for the medium term.

Instead, I reckon a covered call selling strategy may outperform in such an environment, potentially delivering a small double-digit gain, or alternatively, mitigating some share price losses in a correction.

Thank you for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.