Summary:

- Nvidia Corporation stock is still expensive relative to peers’ according to valuation ratios.

- The company’s profitability indicators are high.

- Nvidia has a great track record of exceeding analysts’ forecasts. But these expectations only get higher.

- Nvidia is still the market leader and enjoys its FAANG customers’ loyalty.

- Nvidia stock is not a great buy because it is not cheap enough.

BING-JHEN HONG

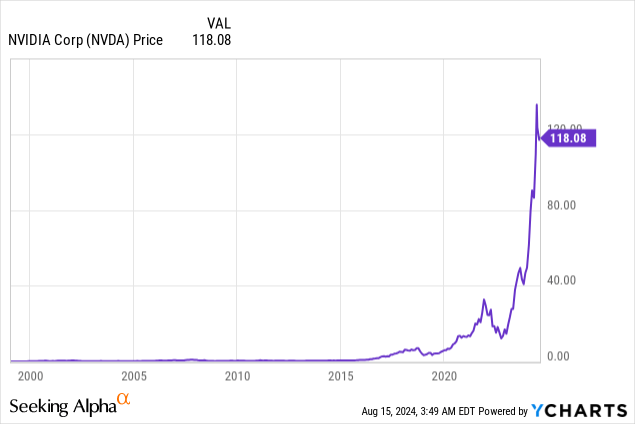

NVIDIA Corporation (NASDAQ:NVDA) stock has recently corrected somewhat after Intel Corporation’s (INTC) worse-than-expected results, but most importantly, recession expectations. Some investors consider the recent correction to be a superb opportunity to buy some more shares of the highly popular chipmaker. However, I strongly disagree that NVDA stock is trading at a favorable price. In this article, I will explain why.

Recap of my previous article on Nvidia

I have been covering Nvidia for a while. In my previous analysis of this company, I wrote that Nvidia’s stock rally intensified, driven by investor enthusiasm about the AI boom. However, competition from Advanced Micro Devices, Inc. (AMD) and Intel was high and rising, posing a threat to Nvidia’s dominance in the chip-making industry. Despite Nvidia’s impressive growth, I wrote that its stock valuations were extremely high, raising concerns about the corporation’s EPS growth sustainability.

Well, my thesis remains intact despite the recent correction of the NVDA stock price.

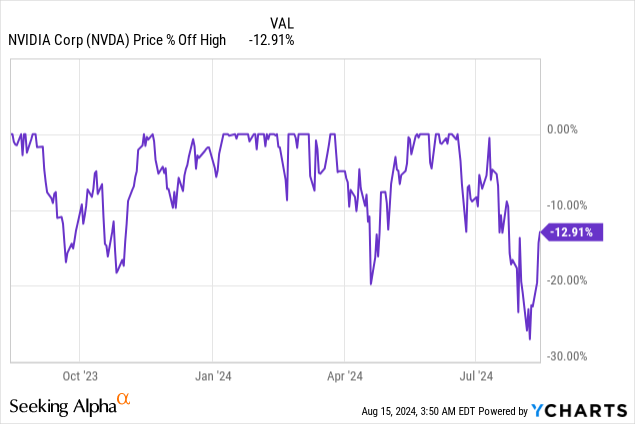

NVDA’s stock correction

There are at least several reasons for the recent correction.

Earlier this month, the stock plunged from $140 per share to just less than $120 as of the time of writing. That was a decrease of about 13%.

But what were the reasons for this decline?

The first one was Super Micro Computer, Inc.’s (SMCI) disappointing margins, which sent the company’s stock down 20%. The reason that also led to Nvidia’s decline was because both NVDA and SMCI operate in the artificial intelligence sector, and both of the companies are seen by some investors as highly overvalued.

Furthermore, Intel, one of Nvidia’s close competitors, remained under pressure following its second quarter results. Intel announced a 15% workforce reduction and the suspension of its dividend, with the aim of reducing costs and keeping its $48 billion debt under control, a sign of substantial financial restraint. Many analysts also raised concerns about the corporation’s profit margins and lowered the stock price targets. Many market participants, in my opinion, became more skeptical about the industry as a whole, including the fast-growing Nvidia.

Furthermore, it was reported that the launch of Nvidia’s new Blackwell chip could possibly be delayed due to a design flaw. Customers who have ordered the new Blackwell chips are expected to receive their shipments later this year. However, due to the delay, they may now have to wait until 2025. This delay is expected to be a major disruption for Nvidia’s clients like Alphabet Inc. (GOOG) (GOOGL), Microsoft Corporation (MSFT), and Meta Platforms, Inc. (META). These have already ordered tens of billions of dollars worth of Nvidia chips.

That is why Citigroup Inc. (C) lowered its sales estimates for Nvidia’s fiscal year 2025. However, Citi’s analyst Atif Malik suggested that increased demand for H100 and H200 chips could partly compensate for the impact of the delay, potentially lasting up to three months. Malik cut his fiscal 2025 sales estimates by 5% but kept his fiscal 2026 projections untouched, believing revenues would shift to the next quarter. The analyst, however, kept his “Buy” rating unchanged. And he reiterated his price target of $150 per share.

But does this mean that NVDA stock is a great buy right now, thanks to the recent stock price correction?

Valuations

As I mentioned at the beginning of this article, NVDA stock is still overvalued despite the recent correction.

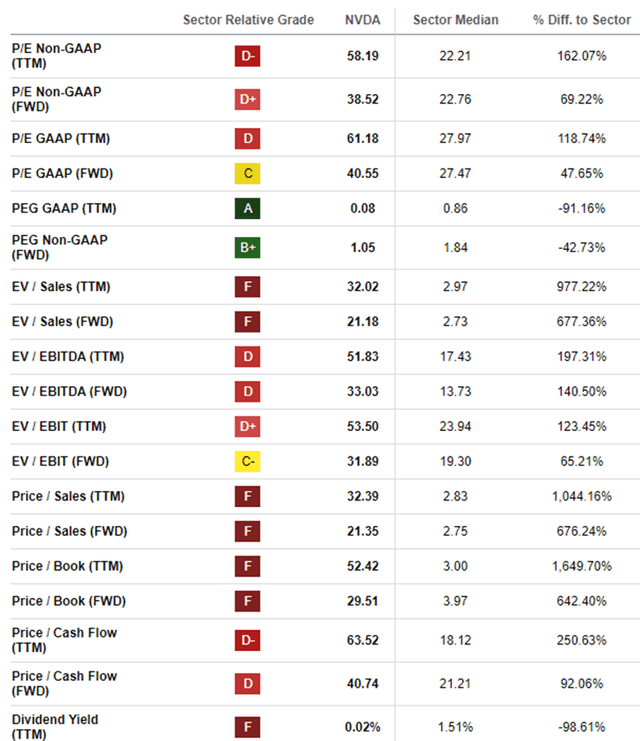

Below is a comparison of the stock’s valuation ratios versus the competitors’ medians.

This is particularly true of the company’s P/E ratios. We all know that Nvidia is highly profitable. This alone should bring its profitability ratios down somewhat compared to competitors. But the stock is so overvalued that its P/E GAAP (TTM) is a whopping 119% higher than its rivals’ median. Nvidia’s price/cash flow and P/B ratios are also much higher than those of its rivals. Despite the company’s profitability, it does not pay its stockholders high dividends. In fact, Nvidia’s dividend yield is just 0.02%.

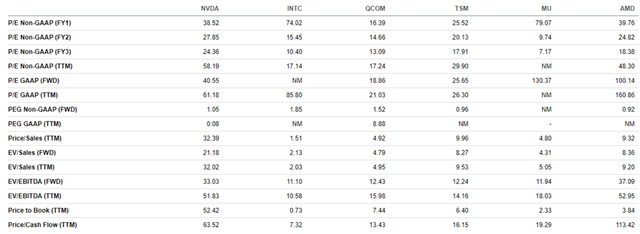

Intel’s P/E ratios are much higher than Nvidia’s due to Intel’s low earnings figures. But otherwise, NVDA’s P/S, EV/Sales, EV/EBITDA, P/B, and P/CF ratios are much higher than its competitors.

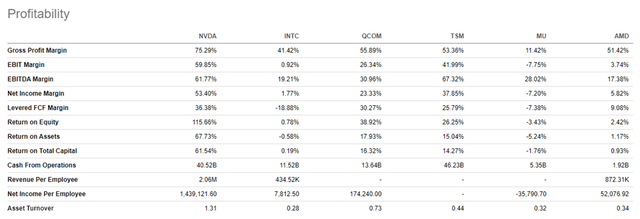

However, Nvidia has the highest profitability margins. Its net income margin is a whopping 53.40%, while its return on equity is 115.66%, over and above its rivals.

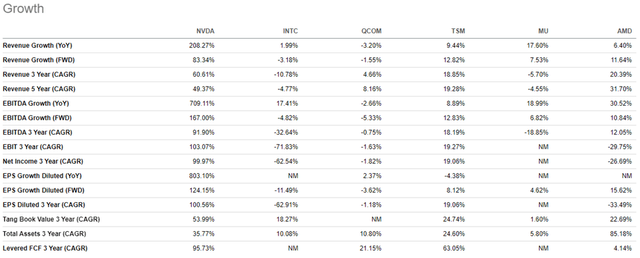

The same is true of the corporation’s earnings and sales growth rates. They are over and above its rivals. However, high growth rates tend to be unsustainable, while it is clear that Nvidia’s valuation ratios are very high.

Upside factors

Here are the main factors that could make Nvidia’s stock soar.

Nvidia has a significant track record of substantially exceeding growth expectations. Companies generally enjoy a rise in their stock prices if they report better than expected sales and earnings, and raise their forecasts each quarter.

Nvidia has had a positive track record of exceeding analysts’ expectations since the second quarter of 2023. It is uncertain if the company’s second-quarter earnings for fiscal 2025 – for the July 2024-ending period, that is-will be a positive surprise for Nvidia’s investors. That is because the expectations are already high due to Nvidia’s brilliant growth.

Here is Nvidia’s earnings data borrowed from Nasdaq since the quarter ending in July 2023. Below, you can see the percentages by which Nvidia exceeded analysts’ EPS forecasts:

- July 2023 earnings surprise: 38.89%

- October 2023 earnings surprise: 26.67%

- January 2024 earnings surprise: 16.67%

- April 2024 earnings surprise: 13.73%.

As you can see from the four earnings surprises above, the percentages by which Nvidia exceeds its estimates only get lower. The first earnings surprise for the July 2023 quarter totaled 38.89%, while the April 2024 earnings surprise was 13.73%.

The July 2024-ending quarter might exceed the estimates even less than the ones for the previous quarter. The expectations are high. According to Barchart, analysts estimate Nvidia will report EPS of $0.59 – a 136% rise from the previous year.

Then, large capital expenditure increases are planned by big Nvidia customers.

Alphabet, Microsoft, Meta, and Amazon.com, Inc. (AMZN), which together account for 40% of Nvidia’s sales, according to Bloomberg, plan to heavily invest in AI-related infrastructure.

That is why demand growth for Nvidia’s graphics processing units (GPUs) – commonly used to train and operate the large language models that power generative artificial intelligence – could remain strong.

According to the Journal, these companies increased their second-quarter capital expenditures by 64% to $58.5 billion.

Here is how that breaks down by company:

- Alphabet: According to the company’s 2Q 2024 earnings report, Alphabet’s future capital expenditures will be “at or above the Q1 level of $12 billion.” CEO Sundar Pichai told investors that overinvesting would be much better than underinvesting for the company.

- Microsoft: According to Microsoft’s CFO, Amy Hood, FY ’25 capital expenditures are expected to be higher than FY ’24.

- Meta: According to Meta’s CFO, Susan Li, the management currently expects significant capex growth in 2025, which is necessary to support the company’s AI research and product development efforts.

- Amazon: During a second quarter investor conference call, the company’s CFO, Brian Olsavsky, said he expected capital investments to increase in the second half of the year. Amazon continues to see strong demand for both generative AI and non-generative AI.

Moreover, Nvidia has a leading market share and innovates at a rapid pace.

According to Jon Peddie Research, Nvidia dominates the GPU market. Its market share is 88% in the first quarter of 2024. In other words, the company has a strategic advantage in the field. However, this advantage is not set in stone. In other words, other companies operating in the same area can make Nvidia lose its share of the pie. In my previous analysis, I mentioned AMD and Intel as the company’s closest competitors.

Downside risks

The first and foremost risk is that of Nvidia’s ridiculous overvaluation. Popular stocks tend to do extremely well during market frenzies, but depreciate when market rallies end. This may be the case with Nvidia precisely because the market expectations of the corporation’s growth may be far too high.

Then, there is a risk of a recession if the Fed does not take the appropriate measures to support the slowing economy. Obviously, this will lead to many manufacturing businesses facing a decrease in demand for their products.

Another big problem is the inability of many companies to quantify AI income, or, in other words, the extent to which their AI investments are supporting revenue and profit growth. According to Raymond James’ managing director, Srini Pajjuri, there is currently no way to monetize AI, so the return on many high-tech companies like Alphabet’s and Meta’s spending is still unclear. The question is, how long this can continue.

Given these companies’ failure to quantify how much sales are attributable to generative AI, it is difficult to see whether the resulting profits are enough to compensate for the high cost of investing.

Conclusion

In conclusion, I would say that Nvidia’s stock is still expensive despite the recent sale. The expectations for the company’s upcoming earnings on August 28th are high and therefore challenging to exceed. Yet, Nvidia has a good track record of surprising its investors. The company’s profitability margins and growth are remarkable. Yet, the company’s stock may fall further if there is a recession. So, investors should not be too optimistic, in my opinion. Therefore, I am neutral on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.