Summary:

- Comcast is a robust dividend option with consistent cash flow distribution and diverse operations beyond TV.

- The company’s competitive edges include distribution power, economy of scale, and brand power, making long-term projections reliable, despite risks in networks and video.

- Comcast offers a defensive position with a high dividend and shareholder yield in the media industry, with a solid financial performance and future prospects.

- The buy rating is due to Comcast’s high shareholder yield and strong free cash flow, offering a significant margin of safety, despite these risks.

jetcityimage/iStock Editorial via Getty Images

Comcast (NASDAQ:CMCSA) is a robust dividend alternative for the long run. The company has consistently managed to increase its cash flow and distribute it via dividends and share repurchases, demonstrating its discipline and good capital allocation. Still far from being a dying business when analyzed as a whole, Comcast’s operations go far beyond its cable TVs and encompass broadband, studios, theme parks, streaming, and more.

These operations in a number of sectors also have some important competitive edges, such as distribution power through its bundles, economy of scale which is essential in its main sectors, and even brand power. This makes long-term projections more reliable, and they don’t even need to be aggressive to maintain a high level of profitability for shareholders, given their current low multiples.

Combining these factors, Comcast is a solid option for investors looking for a defensive position with a high dividend and shareholder yield in the media industry.

Comcast’s Financial Performance and Future Prospects

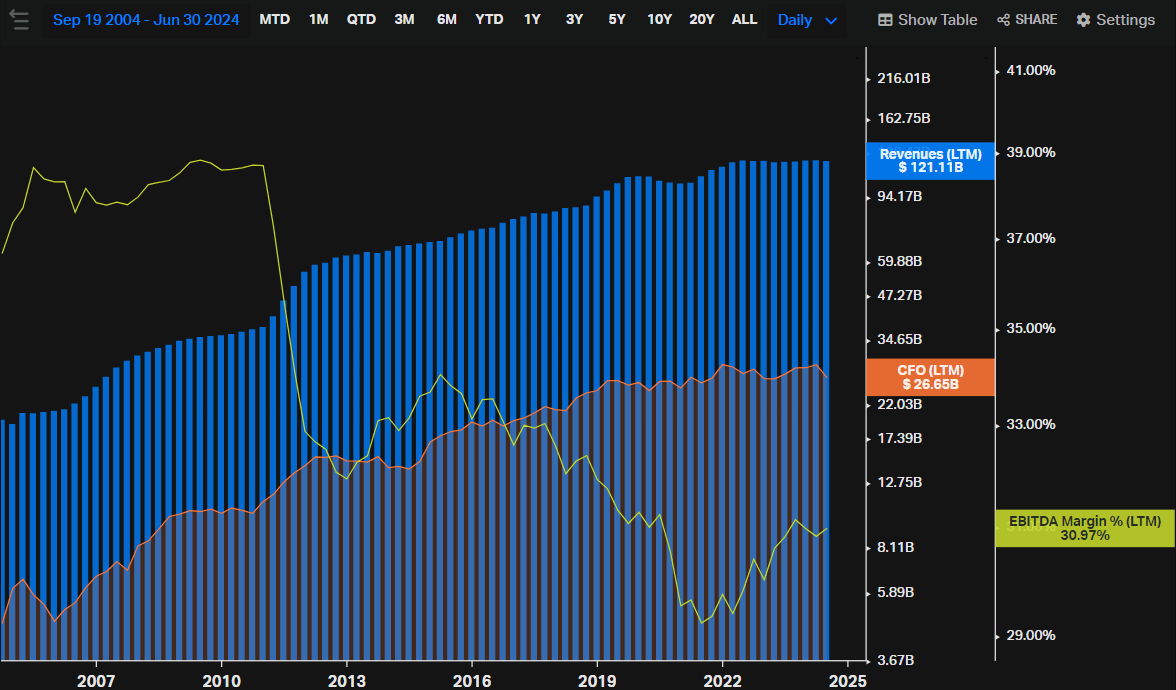

Over the last 20 years, Comcast has been a cash machine. It has consistently increased its net revenue and cash from operations, even with a significant reduction in EBITDA margin. In recent quarters, these indicators have begun to stagnate, but it’s worth noting the good recovery in EBITDA margin. In 2023, 35% of revenue came from Content & Experiences, while 65% came from Connectivity & Platforms. As the latter has a much better margin, it represented 83% of revenue.

Koyfin

On the Connectivity & Platforms side, which is largely responsible for EBITDA, there are greater gains in scale that guarantee a higher barrier to entry, as well as being a recurring business with good margins. In the residential connectivity sub-segments, there are more predictable tailwinds, as the growth forecasts for broadband/wireless subscribers show. According to Point Topic, broadband subscribers around the world are expected to grow by 15% by 2030. This is also evidenced by the past few years’ history of wireless domestic growth, which has consistently delivered double-digit growth. Couple this with the power of price pass-through (inflation) and cross-selling, and we possibly have revenue that increases in small doses year on year.

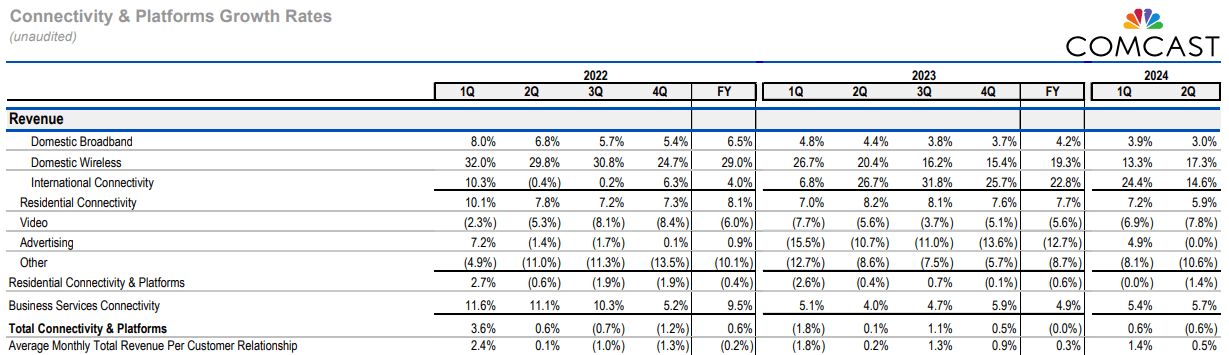

On the other hand, Connectivity & Platforms also includes Video, which accounted for 35% of 2023 revenue. Thus, the Video sub-segment is relevant to Comcast’s revenue and EBITDA, and this line of revenue concerns pay-per-view, some transactional revenue and franchise fees, and hardware sales. For this segment in particular, the outlook is poor, and in recent quarters, it has shown a decline close to the high single digits. Illustrating the size of the disruption that is taking place, in the first quarter of 2022 the company had 17.6 million domestic video customers, in Q2 2024, that number had already fallen to 13.19 million.

For this reason, in the Connectivity & Platforms consolidated report, revenue is still well balanced, with consistent growth in residential connectivity, offsetting the declines in Video and advertising and making revenue and average monthly total revenue per customer relationship stable.

Comcast’s IR

On the Content & Experiences side, it’s a more volatile segment and also one with a mixed outlook. Of the $10bn of revenue in Q2, $6.3bn was characterized as “Media”, which encompasses Domestic Advertising and Distribution and International Networks, in other words, a relevant part is advertising in the legacy operation of television channels, but also counting on about $1bn from Peacock. In my opinion, even though total media has managed to show stability over the last few quarters, this is a revenue line that is doomed to a continuous decline and, together with the “Video” part, is the bad part that should hold back revenue growth in the medium and long term, while the other sources of revenue counterbalance this. I don’t believe in a complete disruption of this media legacy overnight, but rather that it should happen steadily year on year, as consumer behavior changes and advertisers switch to modern forms. The optimistic side is that Comcast also has these new forms of advertising and subscribers, such as streaming, movies, original shows, and so on.

When it comes to Studios and Theme Parks, which are the other 40% of Content & Experiences, I’m more optimistic, even with the weak Q2 indicators. This quarter, Theme Parks’ revenue shrank by 10.6% while Studios’ fell by 27%, and EBITDA fell by 24% and 51% respectively. The explanation for this is that Theme Parks were affected by lower attendance, while Studios is due to the strong comparison base that included The Super Marios Bros. Movie (which was a success). Even so, my outlook is optimistic for the long term as these sectors are harder to disrupt and have interesting optionalities.

Theme parks have a demand that allows the company to pass on inflation to the average ticket over the years, but also to increase revenue by expanding existing parks and building new attractions, such as Super Nintendo World and others to come in the next few years, such as Universal Epic Universe and a new horror-themed experience in Las Vegas, both in 2025. Studios, on the other hand, not only complements the other businesses, being able to take advantage of production, distribution channels, and advertisers, but after its launch, it can also leverage Comcast’s catalog and/or continue to earn revenue from licensing. Both can take advantage of technological developments in both production and customer experience, such as augmented reality.

To summarize the outlook, I’m going to divide the revenue into three. 1. The portion of revenue that has a prospect of decline, which accounts for 44% of Q2 revenue, and, to simplify and increase caution, includes Video and total Media, which is not totally declining because it has more stable and even growing sources of revenue such as Peacock. 2. The portion of revenue that has good prospects and greater predictability, accounts for 29.4% and should deliver steady growth. 3. The “others”, which account for 26.4%, are more volatile but can also be expected to grow in the long term, as they include Theme Parks and Studios. Adding it all up, most of it is “good” revenue, even being conservative and consolidating Peacock within the portion with the worst assumptions, so the result of this equation in the long term should be a revenue CAGR that can continue to grow in the mid-single digit, especially as the company manages to reinvent itself and the Video/Networks portion is less relevant within that.

So when you look at Comcast as a whole, the company is still a colossus with competitive advantages and shouldn’t be considered a dying company, even though a significant part of its revenue has a cloudy to poor outlook.

Key Risks and Challenges for Comcast

After this consideration, it is clear that the main risk of the thesis is not in legacy revenue, but rather that the positive part of the revenue will not be able to grow at a pace that compensates for the deceleration of legacy revenue. This could happen either in the short term, with the “bad” part slowing down much more than expected, or in the medium and long term, with the other sources of revenue growing too slowly.

As the first option is the least likely, let’s focus on the second. There are some obstacles that could make secular tailwinds materialize for the market, but not for Comcast, such as competitive pressures. Even with relevant entry barriers, the broadband and wireless market is not shielded from competition, which could cause a loss of market share in its main markets to traditional competitors or even new entrants if disruptive technologies such as Starlink materialize.

The revenue mix also needs to be monitored in-depth, since segments such as Studios, Theme Parks and even Media have substantially worse margins than Connectivity & Platforms, so if this revenue mix structurally changes and favors the part with the lowest margin, there is also a deterioration in the generation of shareholder value even though revenue remains at high levels.

Finally, another factor that can negatively affect margin is cost and expense pressures and CapEx. While on the one hand technology is a barrier to entry and can be a factor that boosts profitability in the long term, in the short term these upgrades and building a robust technological infrastructure require capital, which can put pressure on both operating margins and Cash Flow. We know that the streaming environment is very competitive, and this comes with a constant need for production, which erodes some of the operating cash as I illustrated in the Netflix (NFLX) article.

Comcast’s Yield and Margin of Safety Makes a More Compelling Thesis

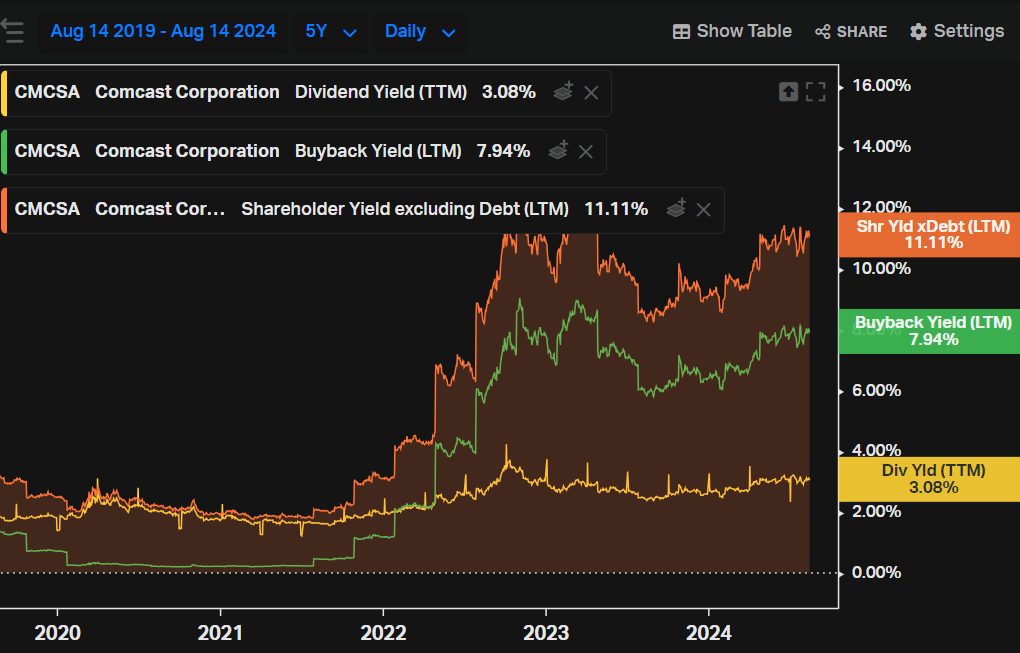

Even with these risks, Comcast’s valuation can take some heat. Even if we assume that the positive trends will only offset the negative trends, making the Free Cash Flow stable for the next few years so that it is sufficient to maintain shareholder remuneration, we would already have a shareholder yield of more than 11%, made up of almost 8% buyback yield and 3% dividend yield. This level is already very interesting considering a 10-year treasury of 3.83% plus a risk premium of 6%.

Koyfin

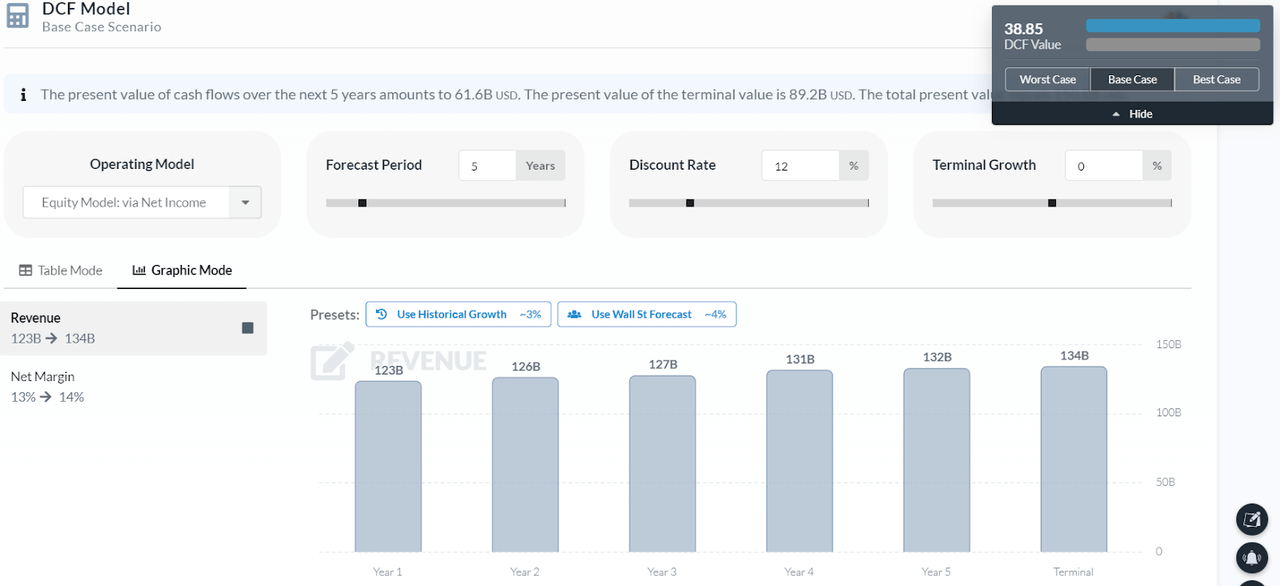

Historically, Net Income has been slightly below free cash flow, so let’s use it as a proxy to plot a Reverse DCF. With revenue growing at under 3% per year for the next 5 years, and a net margin that ends up at 14.07%, it is already possible to find the current price of Comcast Stocks by using a discount rate of 12% and considering a terminal growth of 0%.

As highlighted in the first section, it seems quite unlikely that Comcast won’t be able to achieve at least a high-single-digit, since part of its revenue has very favorable trends and moats that allow it to pass on inflation. In a more optimistic scenario and considering that terminal growth could be 3%, the undervaluation goes to 16%, with a fair price close to $46.5.

In other words, there is a significant safety margin for Comcast’s thesis, since it doesn’t take tremendous growth to surprise market estimates, so any positive surprise or change in narrative can already have a considerable effect.

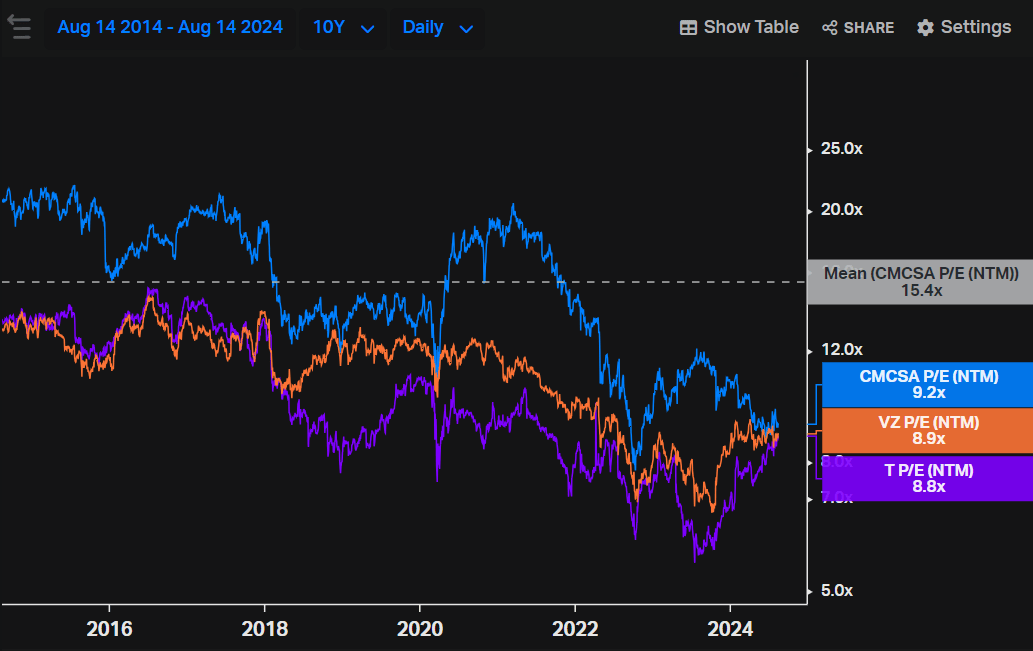

At the same time, it’s not so plausible to count on a rapid multiple expansion. Even with forward price-to-earnings under pressure and far from its historical average of the last 10 years, this level is in line with other similar companies such as AT&T (T) and Verizon (VZ). As it has a cloudy outlook for a significant portion of its revenue, this multiple should not be 20x either but should be traded at a discount to the market, unless there is a really abrupt change.

Koyfin

Final Thoughts

In view of the above information, the margin of safety seems sufficient to expose Comcast. There are relevant risks for a portion of its operations that could compress shareholder value generation in the short and medium term, but these are mitigated by an even larger portion of revenues that have positive operating prospects, good market trends, and barriers to entry.

It should be mentioned that the thesis is not one of growth or anything like that, but of value and income, which is better suited to those value investors who are looking for a high shareholder/dividend yield and are willing to take a little more risk to do so, but still in a solid company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.