Summary:

- The operating metrics for FY24 look encouraging.

- The cloud vertical may surprise positively.

- Valuations are hugely compelling.

- The risk-reward on the charts looks promising, and institutional support has picked up.

Sean Gallup

Introduction

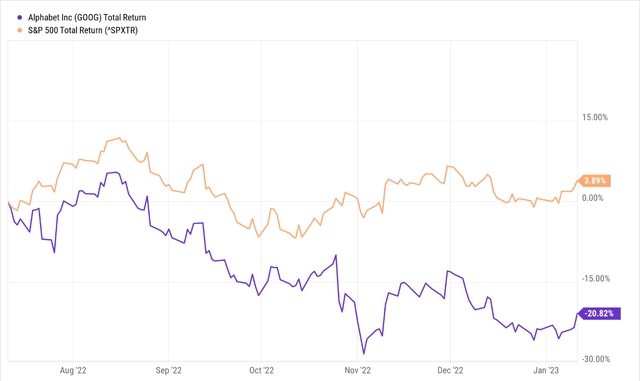

Alphabet, Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) hasn’t been a rewarding pick for investors over the past six months; at a time when the benchmark delivered positive returns of ~4%, the stock has seen one-fifth of its market-cap being wiped off.

Investors have primarily shunned the stock on account of macro concerns and what this could do for ad-related spending. Granted, in an uncertain economic environment such as this, clients are unlikely to be eager to devote too many resources to their respective ad budgets. But investors shouldn’t also dismiss the challenges of churning out elite growth rates when your base year is so strong; this elevated base effect will likely persist and only ease by the end of Q1-23.

Nonetheless, if investors can be a little more broad-minded and look beyond the pullback in ad-spend, I believe there are still a lot of other encouraging sub-plots which support a BUY thesis.

Here are 4 reasons why I’m bullish on the stock at this juncture.

Operating Dynamics Could Improve

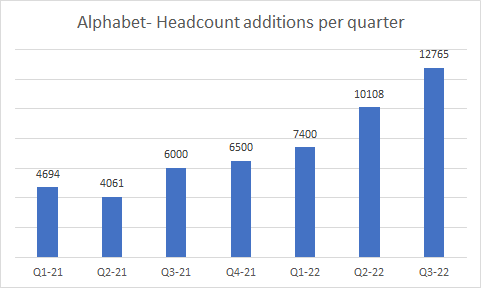

Operationally, Alphabet hasn’t been faring too well recently; after a flattish performance in Q2-22, Q3 operating income dipped by 19% YoY. Whilst higher data center-related and hardware costs have played a part, don’t also dismiss the impact of a very aggressive hiring trajectory on the cost base.

Since Q2-21, the number of additions across different verticals (R&D, sales, etc.) has picked up every single quarter; in effect, over the last 5 quarters, we’ve seen over a 3x spike in headcount additions per quarter (in Q2 and Q3-22, headcount growth per year has come in at whopping levels of 149% and 113% respectively).

Quarterly earnings transcripts

Fortunately, it looks like things have peaked here, and going forward we will see a dramatic reversal in the hiring trajectory well into 2023. The CFO of Alphabet is on record stating that hiring in Q4 will be roughly 50% lower than the levels seen in Q3; this should bring the headcount addition down to less than 6400 employees or so, which would represent a decline in YoY terms (Q4-21 additions were 6500 employees).

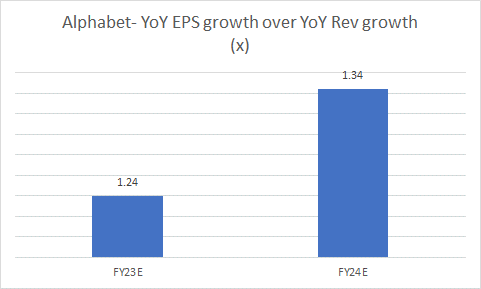

A less expansive labor force strategy should start leaving a positive mark on Alphabet’s operating leverage going forward. For instance, consider that in FY23, Alphabet’s consensus EPS growth (10.7% YoY growth) will exceed revenue growth (8.7% YoY growth) by 1.24x, but in FY24, this will improve even further to 1.34x (17% growth on the bottom line, vs 12.7% on the top line).

YCharts

Besides a slower pace of hiring, in the medium term, expect currency dynamics to reflect favorably on the operating cost base. In Q2, and Q3, FX had dampened Alphabet’s reported revenue by 300bp s and 500bps respectively. Since most of Alphabet’s R&D is based in the US, the strength of the dollar tends to weigh even more adversely on the cost base. In October, Alphabet’s management stated that they expect an even greater negative impact from FX in Q4, but I believe it won’t be as bad as initially expected, as the dollar has since corrected by~7% since Alphabet’s last published results. The DXY also recently broke down below a base it had formed since the turn of December 2022, which doesn’t bode well for its prospects.

Cloud Vertical Could Prove To Be A Dark Horse In This Environment

Whilst advertising appetite may likely remain subdued in a difficult macroeconomic environment, I don’t believe the same can be said for enterprise-related spending on cloud initiatives which will continue to stay resilient on account of the cost advantages and efficiencies that prospective clients can garner. Rather than focusing on managing the infrastructure and neglecting projects, clients can leave this to the expertise of cloud vendors such as Google who provide managed services, managed databases, managed warehouses, etc. at competitive prices. The incentive to generate greater productivity via cloud initiatives should not be dismissed.

Besides, rather than pursue big-bang CAPEX projects to set up one’s own infrastructure in this environment, I suspect a lot of clients would prefer to spread costs and shift to a subscription-oriented model which could abet FCF generation.

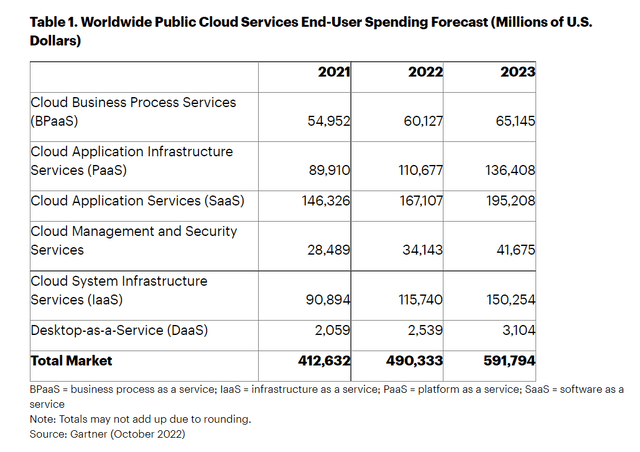

All in all, Gartner believes that global spending on public cloud services will actually grow by an even larger margin this year, despite the high base effect of FY22; in FY22 global public cloud spending grew by 19%, and this year it will likely grow by 21%!

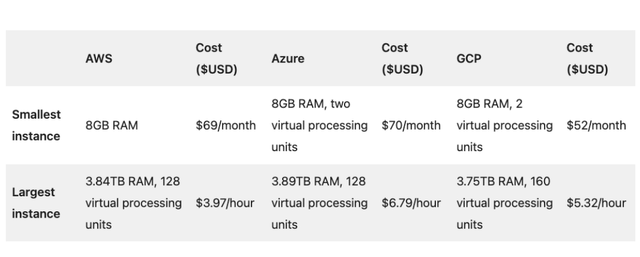

Some of you may question if Google Cloud can exploit conditions here, given its relatively low market share of 11% which is more than 3x lower than that of Amazon’s AWS (Meanwhile Microsoft Azure has a share of 21%) However I feel that Google have a competitive offering that could generate plenty of traction (particularly with smaller clients) in this environment, as it is priced quite competitively. Ascertaining a one-size-fits-all pricing comparison may be difficult given the variation in different pricing models across firms, but a useful study from Megaport in Nov last year showed that the Google Cloud Platform’s (GCP) cost per specs (25-26% relative discount vs its peers whilst offering 8GB RAM and 2 processors at the lower end) were quite compelling. Even at the higher end, the offering isn’t too bad.

Also, for the uninitiated, in the recently concluded Q3, Google Cloud actually outpaced its larger peers with growth in GCP coming in at a greater pace.

The Valuation Angle Suggests That This Opportunity Is Too Good To Pass

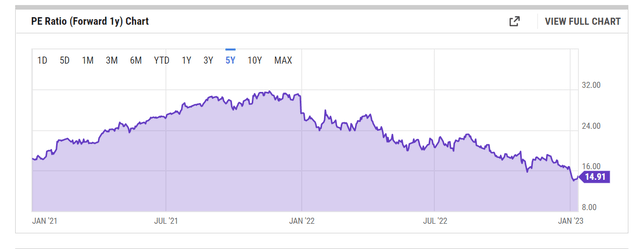

YCharts estimates point to an FY23e EPS figure of $6.20; that would imply a 1 year-forward P/E multiple of just 14.9x. That multiple feels criminally low, for a ubiquitous tech company that continues to leave strong imprints in the twenty-first century. Even if you want to dismiss this as plain fluff, and just talk numbers, consider the degree of earnings growth you’re getting at that multiple.

As noted in the earlier section of this article, you’re looking at pretty impressive earnings growth of 17% in FY24. A P/E of 14.8x would then translate to a lowly PEG ratio of less than 1 (just 0.87x), a figure you’d normally associate with a staid, defensive stock with limited growth prospects. It’s also worth noting that Alphabet’s current P/E multiple is a good~38% cheaper than its- 5-year average multiple.

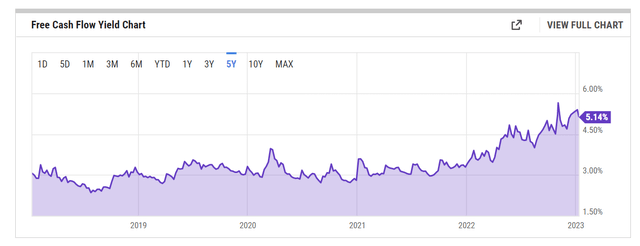

Meanwhile, it also helps that this a company that has a long and consistent track record of generating free cash flow, something that would be extremely integral to funding its growth ambitions, without getting bogged down with an overdose of external funds. If you pursue the Alphabet stock at this juncture, you’d be getting in when the FCF yield is close to record highs of over 5.1%, a solid 180 bps higher than the historical average of 3.34%.

All in all, I just feel that opportunities to own an elite tech brand such as Google at such discounted valuations won’t come along too often.

Decent Risk-Reward On The Charts Backed By Growing Institutional Interest

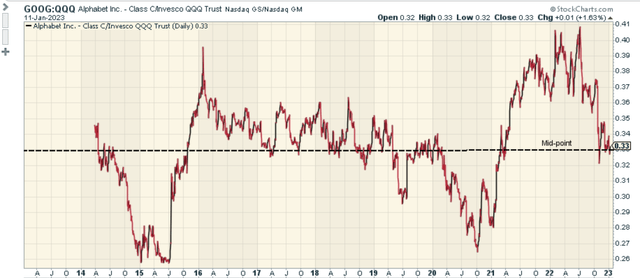

In the middle of last year, it was questionable if one should have jumped to own the GOOG stock as it had look very overbought relative to its peers in the Nasdaq. That is no longer the case as the ratio has reverted to its mean, trading at the mid-point of its life-long range.

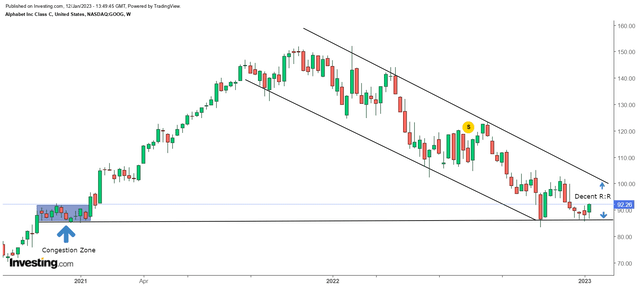

Besides that, you may even see some buying interest pickup, considering the developments on the weekly chart of Alphabet. Note that the stock has been following a descending channel since peaking in November 2021. I couldn’t be definite but there’s a reasonable probability that it attempts to form a bottom at current levels, as this also coincides with an old congestion zone seen in late 2020 and early 2021. Besides after making a hard bottom in late October 2022, there was another attempt to take the stock lower but it failed with plenty of candles with wicks (reflecting the impact of bargain hunters). Even if you’re not keen to hold the stock for too long, the risk-reward across the descending channel boundaries does not look too shabby at this price point.

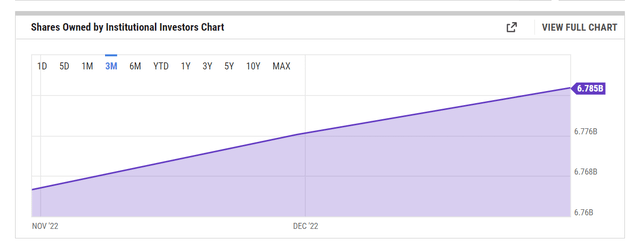

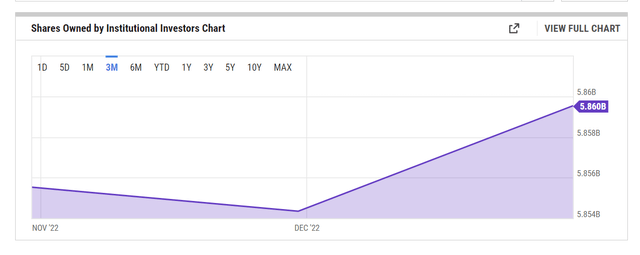

Finally, also note that the folks with deep pockets- the institutional brethren – have also begun to turn constructive on Alphabet. GOOGL saw an increase in net shares owned by these institutions in November itself, whilst interest in GOOG picked up last month.

Closing Thoughts

Given the headwinds tied to the core advertising business, the Alphabet stock’s recovery is unlikely to be plain sailing. However as noted in this article, there are quite a few other encouraging narratives that make this an intriguing bet. Alphabet is a BUY.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.