Summary:

- PepsiCo is expected to see revenue growth acceleration in the coming quarters due to easing year-over-year comparisons and increased investments in advertising and price-pack changes.

- The company’s margins are expected to continue improving as it benefits from sales leverage, mix shift to higher margin categories, and ongoing cost-cutting initiatives.

- PepsiCo is currently trading below historical P/E averages, with a good forward dividend yield and expected EPS growth, making it a buy.

Jonathan Knowles

Investment Thesis

PepsiCo, Inc. (NASDAQ:PEP) should see revenue growth acceleration in the coming quarters, benefiting from easing year-over-year comparisons. The Quaker Foods North America (QFNA) segment should also see recovery and gain self-space in the coming quarters after experiencing product recalls last year and early this year. In addition, the company has also increased investments in advertising and is focusing on price-pack changes to increase value offerings in an inflationary environment and attract demand within its Frito-Lay North America (FLNA) segment, which should support revenue growth. Further, the company’s revenue growth should also benefit from healthy demand for zero-sugar beverages and good traction in high-growth emerging markets. I believe these factors should help the company accelerate its sales growth in the second half of the current year and beyond.

On the margin front, the company should benefit from operating leverage, moderating inflation, improving margin mix, and productivity and cost-saving initiatives. Furthermore, the company is also trading below its historical averages and has a good forward dividend yield. This favorable valuation along with good revenue and margin growth prospects ahead makes the stock a buy.

PepsiCo’s Revenue Analysis and Outlook

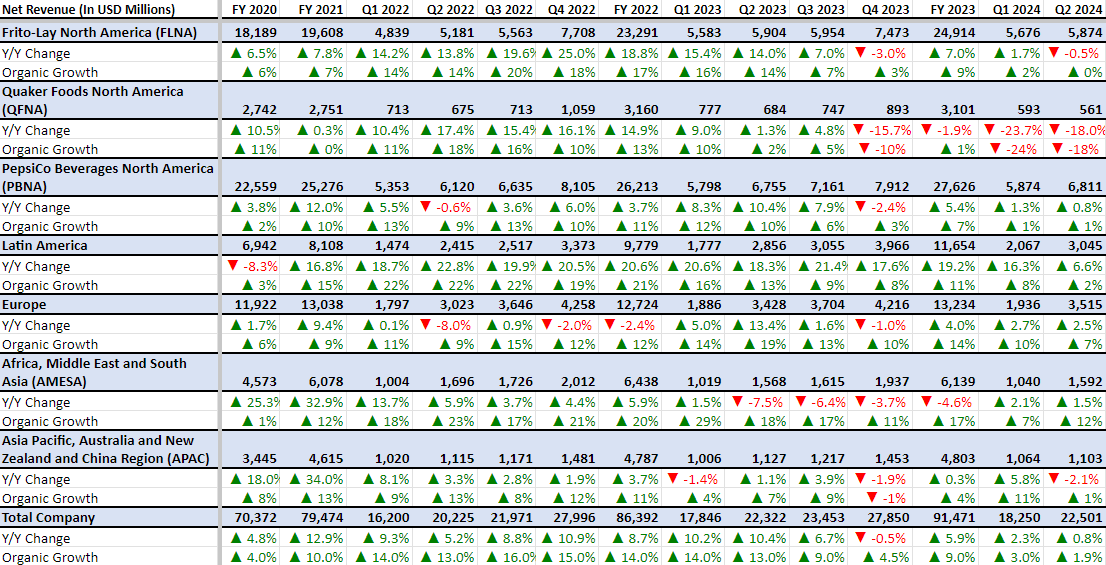

Over the last year, the company’s revenue growth benefited from price increases in response to inflationary cost pressure and adverse forex. This helped it offset headwinds from lower volumes due to tight consumer spending.

In the second quarter of fiscal 2024, these dynamics continued. In addition to price increases, the company’s revenue also benefited from good demand in international markets and increasing traction towards zero-sugar beverages. This was offset by lower volumes as a result of tight consumer spending and the negative impact of certain product recalls. As a result, the company’s sales increased by 0.8% Y/Y to $22.5 billion. Excluding a 1 percentage point headwind from FX, organic sales increased 1.9% Y/Y, reflecting a 5 percentage point benefit from price increases and a 3 percentage point headwind from volume decline.

On a segment basis, the Frito-Lay North America segment’s revenue decreased by 1% Y/Y organically due to lower demand in an inflationary environment, which more than offset benefits from price increases. The Quaker Foods North America segment’s net revenue decreased by 18% Y/Y organically due to a decline in volumes as a result of product recalls. The PepsiCo Beverages North America (PBNA) segment’s revenue increased by 1% Y/Y organically due to price increases and good demand for zero-sugar products, partially offset by lower volumes due to tight consumer budgets. The Latin America segment’s revenue increased by 6.6% Y/Y and 2% Y/Y organically (excluding favorable FX) due to price increases. The Europe segment’s revenue increased by 2.5% Y/Y and 7% Y/Y organically (excluding adverse FX) due to an increase in prices and good demand for the Convenience foods category. The Africa, Middle East and South Asia (AMESA) segment’s revenue increased by 1.5% Y/Y and 12% Y/Y organically (excluding adverse FX) due to pricing benefits and demand in emerging markets like India. Lastly, the Asia Pacific, Australia, New Zealand, and China region (APAC) segment’s revenue decreased by 2.1% Y/Y and increased by 1% Y/Y organically (excluding adverse FX) as a result of price increases and good demand for beverages.

PEP’s Historical Revenue (Company Data, GS Analytics Research)

Moving forward, PepsiCo is poised to see an acceleration in revenue growth in the coming quarters.

The Y/Y comparisons are getting much easier moving into the back half of this year. Compared to 13% Y/Y organic growth in Q2 2023, the company’s organic growth slowed to 9% Y/Y in Q3 2023 and 4.5% Y/Y in Q4 2023. This should help the company’s Y/Y sales growth in the back half. Specifically, the Quaker Foods North America segment should see a significant rebound as the company laps challenging comparisons from last year’s product recalls. Management is expecting a full recovery in Quaker supply chain/shelf re-fill by the fourth quarter of this year. So, this should be a big positive.

Management is also increasing branding and advertising investments and implementing price pack changes in its Frito-Lay North America business. This business has been under some pressure in recent quarters as the whole snacking category has been impacted by downbeat consumer spending in the inflationary environment. I believe a focus on value offering by adjusting the Price Pack Architecture and communicating the value proposition should help in stimulating this segment’s growth in the coming quarters.

The company’s PepsiCo Beverages North America segment has also seen improving trends. According to management, Gatorade has gained meaningful market share year-to-date and is accelerating. Mountain Dew has also returned to growth. Management made the strategic decision to have multiple flavors driving the brand and made Baja a structural part of the portfolio, and this is working well for Mountain Dew.

The segment’s zero-calorie offering is also seeing good momentum not only in soft drinks but also in Gatorade, teas, and coffee. Further, the company is also focusing on increasing its penetration among fragmented/local restaurants and I expect distribution gains among these customers in the food service channel should also help the segment sales moving forward.

PepsiCo should also continue to see good growth in its international business. The international revenue accounts for ~40% of the company’s total revenues and is growing twice as fast compared to the U.S. The company’s focus is on high-potential emerging markets where the company’s products have lower per capita consumption and its strategy to continue expanding its product offering in these markets should help the company’s growth moving forward.

Overall, I expect sales growth acceleration in North America and continued strength in the International market in the coming quarters to improve the company’s sales growth.

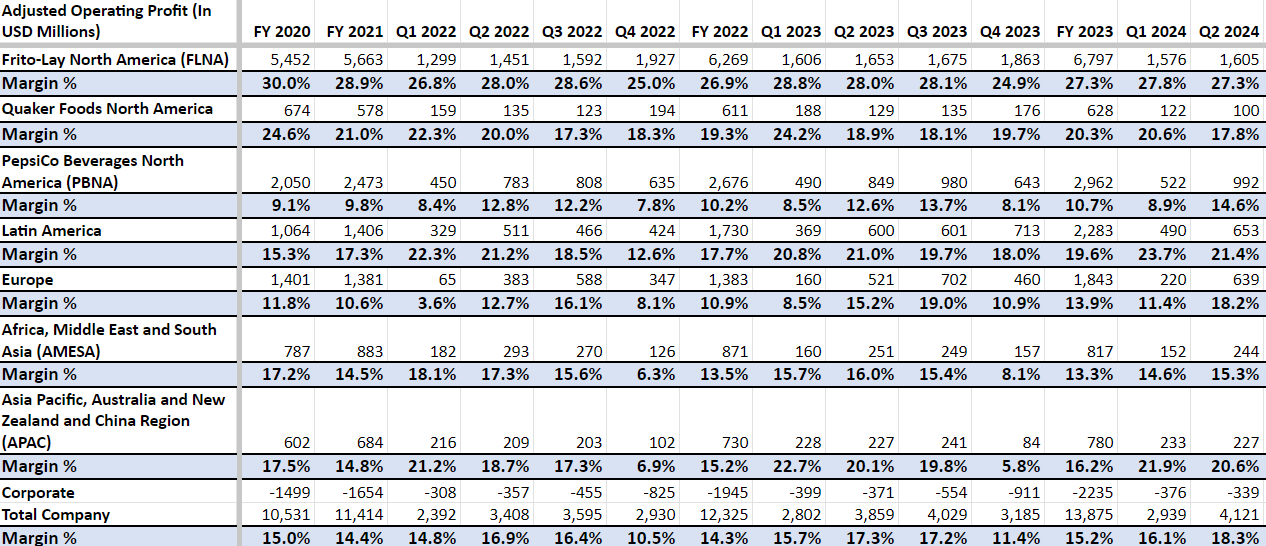

PepsiCo’s Margin Analysis and Outlook

PepsiCo’s margins have benefitted from price increases in recent years. In the second quarter of fiscal 2024, increases in price increases continued to benefit the company’s margins. In addition, cost saving and productivity gains also helped in margin growth. This resulted in a 100 bps Y/Y growth in adjusted operating margin to 18.3%

On a segment basis, the FLNA segment’s margin declined by 70 bps Y/Y due to an increase in advertising investments and volume deleverage, partially offset by productivity savings. The QFNA segment’s margin declined by 110 bps Y/Y due to volume deleverage and inflationary costs. The PBNA segment’s margin improved by 200 bps Y/Y due to an increase in prices and productivity savings. The Latin America segment’s margin improved by 40 bps Y/Y due to an increase in prices and productivity gains, partially offset by volume deleverage and higher marketing expenses. The Europe segment’s margin increased by 300 bps Y/Y due to productivity savings partially offset by raw material inflation. The AMESA segment’s margin declined by 70 bps Y/Y due to inflationary costs, partially offset by price increases and productivity savings. The APAC segment’s margins improved by 50 bps Y/Y due to an increase in prices.

PEP’s Segment-wise Adjusted Operating Profit Margins (Company Data, GS Analytics Research)

I expect the company’s margins to continue improving moving forward as it benefits from sales leverage due to accelerating revenue growth and moderating inflation. Further, the mix shift to higher margin zero sugar and sports drink categories which are growing at a higher pace should also help the margin mix. In addition, the company is doing a good job in terms of cost-cutting and productivity improvements through advancing plant and warehouse automation, driving more efficiencies within transportation and distribution, and reducing waste across the supply chain. According to management, these productivity initiatives are strategic rather than tactical in nature and should drive multiyear improvement in margins moving forward. Below is the relevant excerpt from their last earnings call:

We feel good about our productivity pipeline, it’s not tactical. It’s super strategic and it’s multiyear and it’s based on automation, it’s based on digitalization, simplification of the company, standardization, different service models to the business. So there is a whole portfolio of productivity ideas that are multiyear in nature and we don’t think that we will slow down our productivity in the coming years.”

– Ramon Laguarta, CEO and Chairman, PepsiCo

So, I remain optimistic about the company’s margins driven by cost reduction, mix improvement, and sales leverage.

Valuation

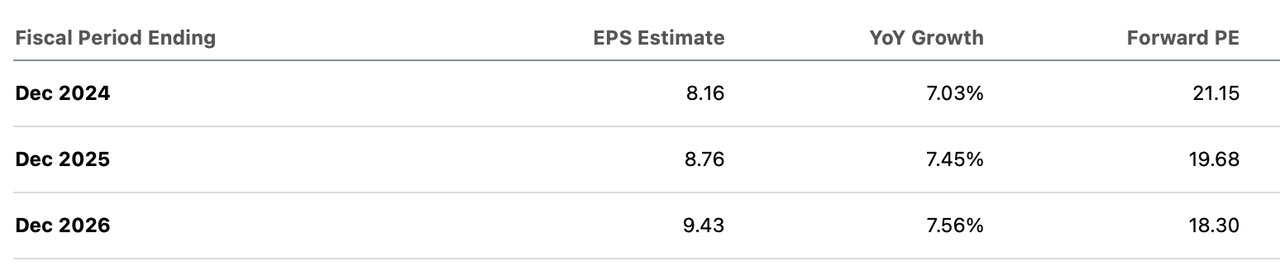

PepsiCo is currently trading at a 21.15x FY24 consensus EPS estimate of $8.16 and a 19.68x FY25 consensus EPS estimate of $8.76, which is lower than the historical 5-year P/E (forward) average of 24.31x.

I believe the company’s revenue growth reacceleration in the second half of the year, driven by easing comparisons, an increase in advertising, and price-pack changes focusing on value offerings, should help drive an upward re-rating in P/E multiple.

PEP Consensus EPS estimates and Forward P/E (Seeking Alpha)

Further, the company also has an attractive forward dividend yield of ~3.12% and its EPS is estimated to grow at over 7% annually in the next couple of years. So, even if the company’s P/E multiple does not re-rate much, an attractive dividend yield and good EPS growth should help the stock deliver double-digit total annual returns in the medium term. Hence, I have a buy rating on the stock.

Risks

-

The company is exposed to risk from adverse foreign currency movements due to its international exposure.

-

If inflationary headwinds worsen due to some reason, they could further weigh on consumer spending and negatively impact growth in the near term.

Takeaway

In my view, PepsiCo’s revenue growth should accelerate moving forward. The company’s sales over the previous year faced headwinds from lower consumer spending and certain product recalls within its Quaker Foods North America Segment, which resulted in lower volumes. The company is set to lap these challenges from the previous year in the second half of the current year, making year-over-year comparisons favorable moving ahead. This combined with increased investments in advertising and marketing, a focus on changing price-pack architecture emphasizing value offerings, good demand for zero-sugar beverages, and product expansion in high-growth emerging markets should help the company reaccelerate its sales growth in the back half of fiscal 2024 and beyond. This accelerating revenue growth should provide good operating leverage over fixed costs, which along with productivity and cost savings gains, and improving margin mix bodes well for overall margin growth.

I believe as the company starts seeing accelerating revenue growth, its P/E multiple should re-rate. Moreover, the company also has an attractive forward dividend yield of ~3.12% and its EPS is expected to grow by over 7% over the coming years. So, with an upside potential due to accelerating growth, attractive dividend yield, and healthy EPS growth, the stock should provide a good upside in the medium term. As a result, I rate PepsiCo stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.