Summary:

- Palantir investors felt pain in early August as the stock fell into a bear market before staging a remarkable recovery.

- In Palantir’s Q2 earnings, the company wowed investors with solid execution and raised guidance.

- It has likely validated its go-to-market strategy with its novel boot camp approach. But how long can it last?

- The recent partnership with Microsoft is expected to accelerate its government business.

- I argue that PLTR’s optimism is justified. But too much optimism is unwise. At the current levels, it’s better to be safe than sorry.

hapabapa

Palantir Technologies Inc. (NYSE:PLTR) investors have enjoyed a remarkable revival over the past week, even though last week’s market volatility threatened to scupper its uptrend bias. Accordingly, PLTR fell almost 30% through its early August 2024 lows before posting a fantastic recovery in the same week. I assessed much of the market’s optimism is predicated on its solid execution and raised guidance in its recent earnings scorecard. In Palantir’s Q2 earnings release, management provided crucial insights, justifying its “A+” buying momentum. Given the stock’s status as one of the leading pure-play AI stocks, it has also helped brush aside near-term AI monetization fears.

In my previous Palantir article, I urged investors to be cautious, as I gleaned that PLTR’s valuation reached frothy levels. My caution played out as PLTR suffered a significant downside, as the stock underperformed the market initially. Although the stock has likely bottomed out after its earnings release, investors who bought its plunge in August have outperformed investors who bought at its July 2024 highs. What drove these investors to regain confidence in Palantir’s bullish thesis over the past two weeks?

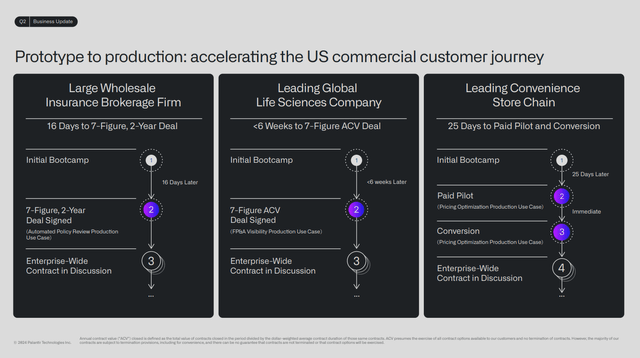

How Palantir accelerates its US commercial strategy (Palantir filings)

Palantir’s Q2 earnings commentary corroborates the company’s confidence in its go-to-market motion through its innovative boot camp sessions. As a result, it has accelerated its commercial market ramp, landing customers rapidly and ramping the “prototype to production” momentum.

Boot camps are designed to help customers understand Palantir’s AIP better, promoting “the rapid prototyping of AI solutions.” In addition, it also allows customers to gain firsthand experience of the company’s applications in “real-world scenarios.” While the approach is assessed to be novel, the company’s execution has been stellar, as it lifted commercial revenue growth markedly.

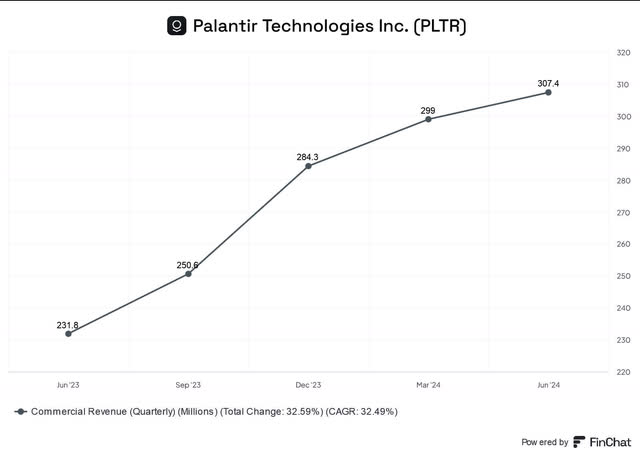

Palantir’s commercial revenue (FinChat)

As seen above, its commercial business grew 32.4% YoY in Q2, reaching $307.4M. When excluding strategic deals, the growth rate was closer to 40%. Notably, the US commercial business performed much better, as revenue surged 70% YoY (excluding strategic contracts). Hence, it demonstrates that the company’s boot camp-driven approach has worked immensely well, as customers understood the value of Palantir’s AIP.

In my previous article, I reminded investors why Palantir’s ontology helps make Generative AI actionable. The company has provided more insights into how Chain-of-Thought prompting is embedded within AIP to enhance the transparency of its AI systems. Accordingly, Palantir emphasized that “CoT prompting can make AI systems appear more explainable.” However, shortcomings in its reasoning process must still be considered. Despite that, the value of CoT in helping make AI responses “easier to audit and analyze” is a crucial underpinning. As a result, Palantir believes its AI platform has demonstrated its ability to make GenAI usable and more effective, helping to mitigate the limitations generally associated with LLMs.

As a result, I’m not surprised that Microsoft (MSFT) and Palantir highlighted their recent partnership to bolster their offerings for top-level customers in the defense and intelligence community. Accordingly, the two leading AI software players are “collaborating to bring secure cloud, AI, and analytics capabilities to the US defense and intelligence community.” Therefore, I assess the collaboration as validating Palantir’s platform leadership. It has also allowed Palantir to capitalize on Microsoft’s Azure OpenAI service to drive growth momentum in Palantir’s government business.

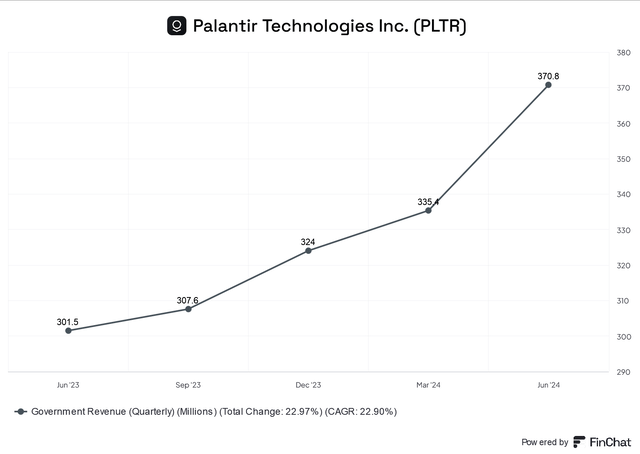

Palantir’s government revenue (FinChat)

Palantir’s government segment has already enjoyed a revival in Q2, as revenue increased by 23% YoY. It also marked an acceleration in topline growth, underscored by a 10.7% QoQ uptick. Therefore, I assess that Palantir’s US government business has likely received a further boost with the Microsoft partnership. It has also validated the “mission-critical” factors of the company’s AI platform in the DoD’s strategy, enhancing its reputation as a top-class AI platform provider. Consequently, Palantir’s ability to drive broad-based growth across its commercial and government business justifies the market optimism. However, questions must also be asked on whether the recent recovery has been too fast, too furious?

Wall Street estimates on Palantir have been upgraded, underscoring its growth inflection, driven by the AI gold rush. Palantir’s raised guidance and ability to maintain GAAP profitability have afforded investors more confidence to stay invested. Notwithstanding the market’s optimism, I believe it’s still too early to assess whether Palantir’s boot camp-driven GTM strategy is sustainable. Why? PLTR’s growth-adjusted valuation metrics suggest the market has baked in significant optimism, pricing the stock for perfection.

There’s little doubt that the hyperscalers have committed to massive AI investment spending. Management also observed that “the revenue expectations from the AI ecosystem’s infrastructure build-out have grown from $200B to $600B per year in just nine months.” However, there are lingering doubts about whether the $1T in GenAI spending will eventually pay off. The market still needs to assess the monetization growth story, which is still in its infancy.

Consequently, while optimism in Palantir’s bullish proposition isn’t misplaced, taking it too far could be painful if a more robust AI monetization doesn’t pan out. PLTR’s forward adjusted PEG ratio of 3.63 is almost 95% above its tech sector median. Therefore, I find it incredibly challenging to justify a Buy rating, even though I assess that its uptrend continuation thesis could carry on. In other words, there are sufficient fundamental reasons in the AI gold rush to believe that PLTR’s “A+” momentum grade is justified. However, buying a stock priced for perfection at the current levels doesn’t seem wise.

If anything, the significant market volatility experienced in early August should have provided clues into why investors should wait patiently for possible pullbacks to improve their risk/reward.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!