Summary:

- Visa is a dominant player in the credit card industry, with high margins and consistent growth.

- The company operates a five-sided network that facilitates transactions between consumers, banks, and merchants.

- Analysts predict future revenue and income growth for Visa, but the stock may be overvalued at its current price of $260.

The Good Brigade

Visa (NYSE:V) really is a wonderful business. Credit cards are now utterly ubiquitous; they have effectively replaced cash as the fundamental means of exchange in the modern economy. Visa operates the largest credit card business, in what is really a duopoly with Mastercard (MA).

This article argues that Visa is a great business, but not a great long-term investment because it is fairly valued, or even overvalued. If you hold this company for the long term, you will receive a nice dividend that will grow and you will own a business that will stick around forever. My problem is that it is too expensive.

I use the investing framework of Phil Town, who work can be found in the book Rule #1 and the website https://www.ruleoneinvesting.com, among other places. He seeks to distill Warren Buffett’s style with a focus on finding wonderful businesses that are on sale due to short term events.

Visa’s Business

If you think about it, credit cards have unlocked a number of key features of the modern economy. You can use your credit card internationally and on the Internet. Without credit cards, Amazon (AMZN) would not be able to exist.

Many people cannot pinpoint what Visa actually does. They don’t extend credit (banks do this); they don’t take risks on transactions. What they do is operate a five-sided network. When you go to CVS and buy a can of Coke and tap your Visa card there are five parties in the transaction: you, your bank, CVS, CVS’s bank, and Visa. Basically, Visa provides the technology that allows the two banks to speak to each other; authenticate the transaction, remove money from the ledger of your bank account, and credit it to CVS’s bank.

Visa is like a massive clearing house. Your transaction is digitized by those machines operated by companies. Visa runs the technology to facilitate the clearing house. They operate data centers that match all those transactions. It’s important to realize that banks couldn’t do this without a third-party network (fifth party?), there are too many banks that would need to have 1-1 relationships to be practical or feasible.

This is a win-win-win-win-win. You win because of the convenience credit cards provide. Before credit cards, people would apply for microloans in a bank to finance large purchases, like a fridge or a bed. Now you can swipe your card. CVS wins because the convenience factor brings them more customers. The banks win big time; they have many people drawing on credit and making money on the interest fees.

Visa’s Margins

The lens that really underscores Visa’s business power is its margins. They currently have 97.8% gross margins and 54.7% net income margins. Google is famous for having great margins, but they are 57.6% gross and 26.7%. Visa essentially have no cost of revenues. They built their data centers in the 70’s and the company simply needs to maintain them.

A key question for an investor is, ‘Will Visa be able to maintain these margins?’ I think almost certainly, the answer is ‘Yes.’ Creating the five-sided network was an amazing feat. Master Card and Visa built theirs at the same time. Now that these networks exist it is inconceivable for another party to build a competing network.

Visa’s Growth

Visa is a classic example of a ‘mature’ company. They are a well-established company, with a giant moat and pay a nice dividend. They are not growing fast, though they are growing faster than the economy.

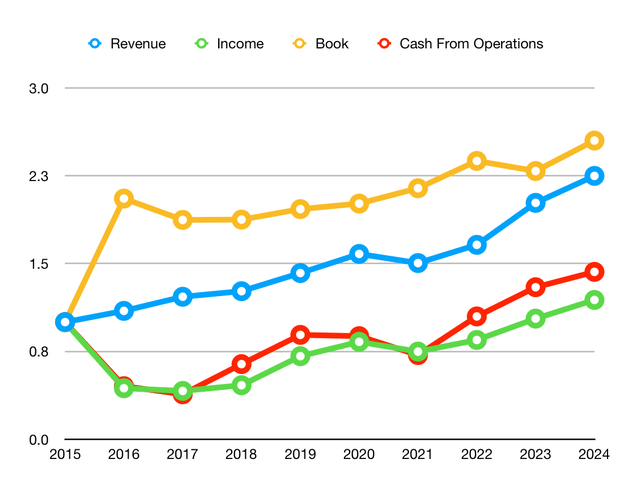

To get a feel for the future growth it is helpful to look at the past growth. I like to look at the big four growth numbers: revenue, income, book value, and cash from operations. For the last ten years, each of these numbers has been growing consistently at about ~10%. You can see that the income took a stumble in one year (2016), but apart from that Visa is a consistently growing company.

I have put some of these numbers on a chart

| 3 Yr average growth | 10 Yr Average Growth | |

| Revenue | 11.5% | 8.2% |

| Income | 13.6% | 10.9% |

| Book | 3.2% | 2.2% |

| Cash from Operations | 8.6% | 8.4 |

Visa’s Future Growth

It is interesting that Visa’s growth has accelerated in the past three years. Visa has developed strategies to increase its growth, including new high-margin products.

Seeking Alpha has a summary of analyst estimates of future revenue growth and income growth. Analysts predict that the revenue will grow at a CAGR of 9–11% in the next three years.

Visa Revenue Growth (Seeking Alpha)

Analysts predict that the income will grow at a CAGR of 11–14% in the next three years.

Visa Income Growth (Seeking Alpha)

Visa Evaluation

Phil Town teaches three evaluation methods.

Margin of Safety

The first lens is about the earning power of a business. A business with a durable competitive advantage will be able to grow its earnings over time. You need to have a sense of what their earnings growth rate has been and what it will likely be in the future, which requires understanding the business. Once you can estimate the earnings growth rate, you can grow the earnings ten years out

Visa currently has an EPS of $9.21. If we grow this for ten years at a compounded rate of 13%, Visa’s EPS will be $31.26 in 2035. The share would be fairly valued then at $812.86, given a PE of 26 (double the growth rate).

Discounting this by a rate of 15% today gives a ‘fair value’ of $200.93. Phil Town seeks a 50% margin of safety, which gives a buy price of $100.46.

Payback Time

The second method is called Payback Time. This lens looks at the free cash flow growth over time. Basically, you think of yourself as owning the business. If you owned it, how much FCF would you get per year? You add up the growing FCF over the years. Town argues that eight years is considered a ‘fair’ amount of time to get your investment returned. If an investment can ‘pay you back’ in eight years in FCF then it’s a good investment.

Visa currently produces $11.35 FCF/share. If we grow this by 13% and add up this cash, each share will produce $163.67 in eight years, which is the ‘buy price’ for PBT. The fair value in this view is $327.33.

Ten Cap

The third method is called the Ten Cap. In this lens, we imagine the business is like a rental property that we own. Each year there is cash coming off the property, which may not be growing, but is a dependable stream of income. However, we need to pay for maintenance fees. This is like Warren Buffett’s concept of Owner Earnings. Phil Town does a similar calculation to FCF, but he takes cash from operations and subtracts only the maintenance Capex, which is a proxy for depreciation, and adds back in the tax benefit. This is the annual owner earnings. If a property pays 10% of its invested capital back a year, its called a ten cap. Anything that is a ten cap or higher is a good investment.

(In millions) the operating cash flow of Visa is $20,213.0; the depreciation is $1007; the tax benefit is $4074.0. These numbers yield owner earnings of $23280 or $13.94 per share. If you held these shares for ten years they would throw off $139.40, which would be a ‘good deal.’ This evaluation implies a fair value of $278.80.

Summary

Providing these three tools is quite helpful. All evolution methods require some guessing about the future. Having three evolutions allows you to have more confidence in your investments. The MOS indicates the Visa is overvalued and the ten cap says it is almost exactly valued. The PBT implies a little bit of upside. Taking these things together leads me to be cautious about Visa as an investment: for the upside Visa needs to execute perfectly on its business plans and the economy needs to grow well.

This makes sense to me. Visa is a profitable and consistent business, but it is not a fast-growing one. If is valued quite highly right now; the stock market has been doing well and we should not be surprised to find wonderful companies priced well.

If you are looking to buy something safe to pocket a dividend, Visa is a great choice. I am looking to do what Buffett advised: buy $10 bills for $5. If Visa got into a range of $150 I would buy this company hand over fist.

.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.