Summary:

- Advanced Micro Devices, Inc.’s AI Data Center strength in CPUs and GPUs is not appreciated enough.

- Data Center growth has been hampered by supply constraints.

- AMD has gained and continues to gain market share from Intel in Data Center and PCs.

- Its acquisition of Silo AI enables it to offer a seamless and comprehensive AI software and hardware System-on-Chip.

Javier Lizarazo Guerra/iStock via Getty Images

I last wrote about Advanced Micro Devices, Inc. (NASDAQ:AMD) on March 30th, 2023, recommending it as a Hold at $98 per share, to buy if the price dropped between $75-$80. My thesis was that it was on the comeback trail, and while its two cyclical divisions would take time to come out of their troughs, overall, the company had enough strengths to do well in the upcoming years. I did buy in the mid-eighties in May, and then added over $100, believing that it also had a shot at AI Data Center revenues. I’ve summarized below the main reasons for liking the company from my previous article.

It’s making a lot of strides in the Data Center and Embedded segments and with a floundering Intel, has captured a decent chunk of the Data Center market.

While it has a small presence in Generational AI for now, I can see a lot of growth coming its way as well, with their new processor the MI300, which was built for their Datacenter clients needing supercomputing and other high-performance computing applications in.

AMD’s prowess with hybrid computing through APU’s (Accelerated Processing Units) is a major factor that puts them front and center with generational AI for data centers.

One of the biggest competitive advantages with the merger is AMD’s ability to offer customized solutions from a much wider repertoire, which now includes FPGA’s, adaptive SOC’s and DPU’s and the use of common software platform.

Not only that, but I believe in all of these reasons and am excited to see the momentum with a run rate of $4.5Bn a year in AI Data Center revenue.

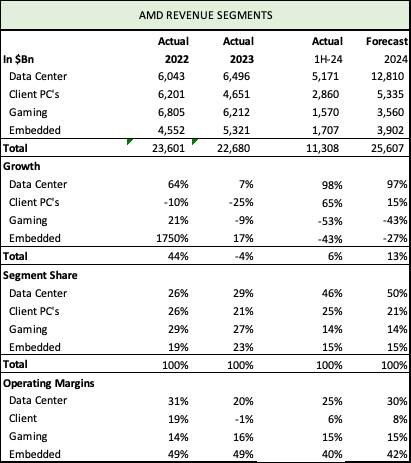

Revenue segments

For AMD to do well, all four segments need to grow. Otherwise, the cyclical segments destroy all the positive momentum from AI; $4.5Bn in annual AI sales is just 18% of total revenues.

AMD Revenue Segments (AMD, Seeking Alpha, Fountainhead)

Data Center: The first half of the year did show an impressive turnaround, as overall revenues grew 6%, with a big 97% gain in Data Center revenue. There was a steep ramp in MI300X shipments, which competes with Nvidia’s (NVDA) Hopper series, and, similar to Nvidia, also faced supply constraints. At this run rate, management was confident of a $4.5Bn run rate for 2024. Should supply pick up, this could be a conservative estimate. Data Center generated 25% operating profits, and while this is lower as AMD uses lower price points to penetrate hyperscaler clients’ Data Centers, it will improve over time.

Client: The other good news was an average 14% price increase in mobile and desktop processors. Coupled with a 44% increase in unit shipments, Client revenues jumped 65% to $2.9Bn YoY. Operating margins also moved into the black to 6% after dropping in 2023.

Gaming: Gaming continued to struggle for the 1H of 2024, dropping a huge 53%, on weak console sales, which are now at the end of a 5-year cycle. Q2 was worse — while it is also a seasonally weak period, the drop was 59%, and it will take a while to clear inventories and return to growth. Nvidia grew gaming revenues by 18% for the quarter ended April 2024 but expects only 8% growth in Q2-2025, and 5% overall growth for the year ended Jan 2025. So, not quite out of the woods yet.

Embedded: Another weak quarter with a 41% drop, and an overall 43% drop for the 1H, a slight improvement. However, the embedded segment’s big problem is a glut of post COVID-19 inventory, which hasn’t cleared yet but should get better in 2H of 2024, to a total decline of 17%. Most of it will come at a cost, its operating margins have dropped to 40% from 49% last year.

Company Wide: The first six months have shown AMD turning around. Besides the 6% growth, AMD has improved margins as well, gross margins have improved to 48% compared to 45% in the first half of 2023, with Q2, improving further to 49%, a great sign in the right direction.

GAAP operating income increased to $305Mn, from a loss of 165Mn, with the bulk of $269Mn coming in Q2. Low margins for sure, but improvements from one of its worst years in recent history, 2023, when AMD earned only $401Mn on 22.68Bn in sales.

While I laud the impressive strides in Data Center, the other three segments have to get back on their feet for AMD to get anything close to a decent valuation.

AI — Datacenter

AMD will exceed $4.5Bn in AI revenue in 2024, about 35% of Data Center’s total revenue of $12.8Bn. In Q2-24, GPUs accounted for $1Bn and CPUs and others for $1.8Bn of total Data Center revenue of $2.8Bn. This is the first time GPUs have taken such a large share of Data Center revenue, it is the fastest ramping product in AMD’s history and a harbinger of the future as AI demand continues to improve. AMD could have sold more if it weren’t for supply constraints, which will improve over the next two years. The other notable positive is that Nvidia’s price increases will help AMD, which can also increase prices as the second supplier because it’s discounted to Nvidia’s Hopper and Blackwell series. AMD’s average prices are around $15,000 as compared to over $30,000 for Nvidia.

AMD does have AI strengths distinct from Nvidia, The MI300x series has more memory, which is better suited for inference. The thicker HBM memory of the MI300X makes it the preferred choice over an H100, when you need fewer devices for the work – it’s cheaper and more efficient to use AMD GPUs.

Hyperscalers like Amazon (AMZN), Alphabet (GOOGL) (GOOG), Meta Platforms (META), and Microsoft (MSFT) have been spending Capex like drunken sailors. The demand for Data Center GPUs and CPUs is truly humongous. From a Next Platform interview between Timothy Prickett Morgan and Forrest Norrod, General Manager of AMD’s Data Center business, emphasis mine…

Forrest Norrod: I understand that. The scale of what’s being contemplated is mind-blowing. Now, will all of that come to pass? I don’t know. But there are public reports of very sober people contemplating spending tens of billions of dollars or even a hundred billion dollars on training clusters.

But some of the training clusters that are being contemplated are truly mindboggling….

TPM: What’s the biggest AI training cluster that somebody is serious about – you don’t have to name names. Has somebody come to you and said with MI500, I need 1.2 million GPUs or whatever.

Forrest Norrod: It’s in that range? Yes.

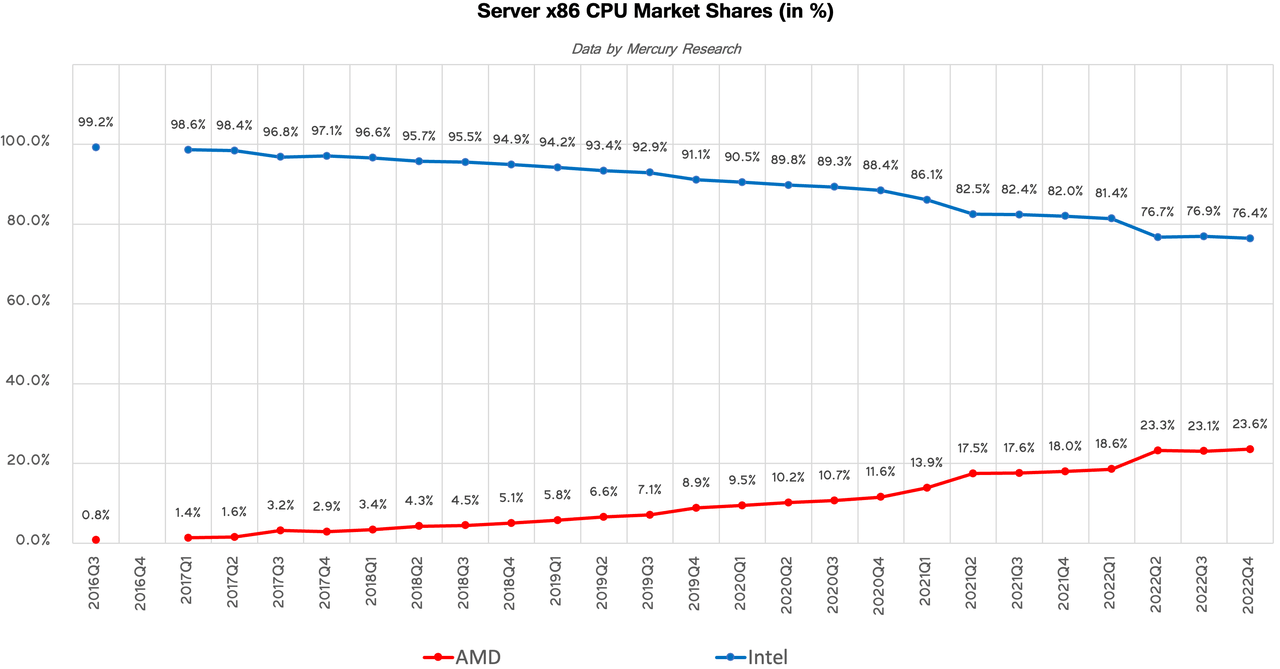

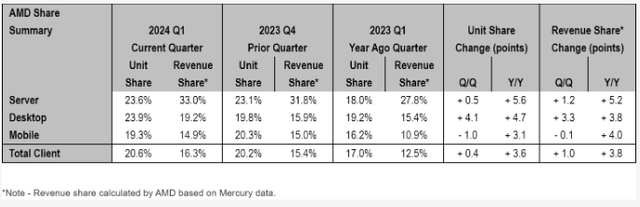

AMD grabbed 5.6% from Intel (INTC) in Q1-24 in Data Center Servers with its EPYC CPUs, growing from 18% in Q1-23 to 23.6% in Q1-24. What’s even more impressive is the revenue share, which is a whopping 10 points higher at 33%, clearly, EPYC is more in demand.

Data Center CPU Market Share (Tom’s Hardware)

Historically, AMD has been gaining market share in servers in units and revenue, as we can see from the steady progress below. The 23.6% it stood at the end of Q1-2024 has grown from a minuscule 1.4% in Q1-2017. That’s a remarkable performance against a giant incumbent. In 2017, Intel had 12x more revenues at $62.7Bn compared to AMD’s 5Bn. In this growing market, AMD is gaining. Cloud deployments to Hyperscalers are key — they’re begging for more power, and AMD is gaining traction in the higher-end, expensive machines with advanced CPUs. Intel is falling short of products to compete with AMD’s 96-core and 128-core processors. If this trend continues, it will be AMD’s battle to lose.

AI — PCs

AMD has grown fourfold in the last decade from $5.5Bn to over $22Bn in revenues today, whereas Intel (INTC) has stagnated at $56Bn in the same period.

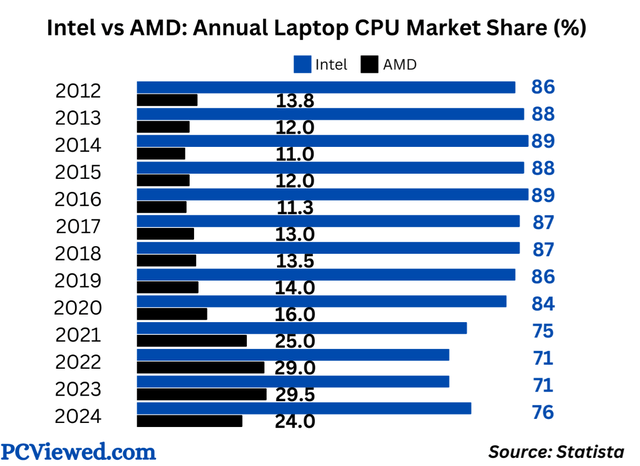

I have faith in AMD getting a decent share in AI PCs, similar to how it constantly took market share from Intel in PCs. As we can see below, AMD grew its PC market share from 13.8% from 2012 to 24% in 2024.

AMD PC CPU market share (Statista)

The AI PC market will grow strongly in 2024 and 2025, Qualcomm (QCOM) was first out of the blocks with an exclusive with Microsoft in 2024, but in the future all 5, Qualcomm, Apple (AAPL), AMD, Intel, and Nvidia will be jostling for market share.

AMD’s Ryzen AI300 is their flagship product in this market. With an estimated 50 TOPS performance, it is their third-generation processor with deals with OEMs like Acer, ASUS, Lenovo, and HP.

While Arm Holdings (ARM) chips are more energy (battery) efficient, the current PC market is dominated by X86 processors, which have over 80% market share, dominated by Intel and AMD. While AMD is confident that X86 processing will hold its own, it has made a smart move by also making ARM-based chips from 2025. It doesn’t make sense to be stuck behind when the user would prefer a longer battery life.

Furthermore, advances in AI and chip production technology from ARM could make them more powerful and energy efficient.

Standard-bearer Apple replaced Intel’s CPU with its ARM-based SOC’s (System on Chips) more than 4 years back, Qualcomm followed suit with its Snapdragon series and its CEO believes that 50% of PCs will run on ARM’s architecture.

Weaknesses

AMD has a hard time generating high margins, GAAP operating margins are in the high single digits, and adjusted operating margins, are stuck below 20%. AMD’s products don’t have pricing power, with even the new AI GPUs selling for 50% of Nvidia’s Hopper series. Similarly, we saw client and gaming operating margins at 6% and 15% respectively, cleaning out excess inventory. The Client, Gaming, and Embedded segments are subject to economic cycles, with little product differentiation, inventory gluts and price reductions. These still total 50% of AMD’s revenues and hamper its growth and valuation.

Going forward, these will pick up and overall, I do expect 2025 and 2026 adjusted margins to be around 22-24% as gaming and embedded segments return to growth.

In server CPUs, AMD’s largest competitor is the struggling incumbent Intel, but in GPUs, it competes with Nvidia with more than 90% market share.

In PCs, there are three other major competitors such as Qualcomm, Apple, and Nvidia. We also have rosy forecasts for AI PCs, which may not materialize, there is a limit to AI that can be done locally, you need serious computing power from the cloud.

Investment case and valuation

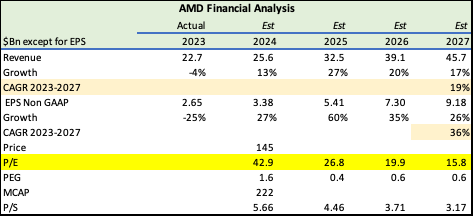

I made small tweaks to my earlier model, I was expecting a faster turnaround in 2024, but was a tad conservative through 2027; instead, the next three years will be a lot better according to consensus analyst estimates. Overall, the differences are nominal.

AMD Forecast (AMD, Seeking Alpha, Fountainhead)

AMD, assuming it grows at 36% for the next four years, is a bargain at 43x 2024 earnings. The P/E drops to 16 and the PEG ratio drops to 0.6 by 2027. It’s also reasonable from a P/S valuation of 5.7x for a 19% grower in the fastest-growing sector in the world right now, where it’s not demand but supply constraints that are reducing sales!

It is a strong and growing number two in market share for AI Data Centers, an enviable position to be in.

Valuations aside, AMD has proven to be an extremely scrappy competitor, grabbing 24% of the CPU server market from Intel in a short 7 years, against an opponent that was 12 times its size. That too, while it was dealing with cyclical PC and Gaming markets and a post-COVID inventory glut, which it will come out by 2024. Its share of the CPU server market will only grow. In GPUs, its MI300x series is a solid competitor with its memory strength. AMD will keep chipping away in this market and starting from less than 5% market share, it has only one way to go, up.

Nvidia can’t supply 100% of the market, and AMD at about 50% of Nvidia’s price will cater to a portion of the market that does not need massive computational workloads. Its purchase of Silo AI is an excellent move to beef up its AI and software capabilities. Silo AI’s team has a lot of expertise in AI solutions and large language model development for marquee customers like Allianz (OTCPK:ALIZF), Ericsson (ERIC), Finnair (OTCPK:FNNNF), Nokia (NOK), and Unilever (UL). It enables AMD to compete with Nvidia’s CUDA and offer a seamless and comprehensive hardware and software package to Hyperscalers and CSPs.

I own Nvidia and AMD, having bought and recommended Nvidia in July 2023, and March 2023, and I strongly believe that both will do extremely well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, MSFT, GOOG, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.