Summary:

- 2022 was not kind to Meta Platforms, with regulatory, personnel, and financial woes shaking the company.

- Yet, the Meta Platforms’ core businesses remain healthy and are growing.

- We are cautiously optimistic about Meta Platforms in 2023 and are looking forward to the company’s upcoming annual report.

Kira-Yan

A Year To Forget In The Meta Platforms Timeline

To put things charitably, 2022 was unkind to Meta Platforms, Inc. (NASDAQ:META), the parent company of Facebook, Instagram, WhatsApp, and the much maligned Metaverse of Reality Labs. META stock drastically underperformed its peers in the S&P 500 Index (SP500), and the company struggled to convince the world that the Metaverse – a virtual reality world where participants can do anything they can in the real world, except, you know, virtually – was going to take off. Unfortunately, the Metaverse failed to launch and failed in a very public fashion. Indeed, it seems that, at least as of now, people aren’t interested in attending virtual business meetings or being virtually harassed on the virtual street when all of those things are easily experienced in real life.

All told, the Metaverse generated billions of dollars of losses in 2022, and according to a recent Meta 8-K, it expects that Reality Labs will continue to lose even more money in subsequent years, all while sucking in greater and greater amounts of cash (Meta’s Q3 capital expenditures were $9.4 billion – up 117% year-over-year and largely attributable to the development of the Metaverse).

The company also contended with multiple key leadership departures in 2022, most notably of Sheryl Sandberg, who had served not only as the stalwart operator of the company but as Wall Street’s perceived adult in the room.

Furthermore, key leaders in the development of the Metaverse have departed, and not on good terms. While he lacks the name recognition of a Sheryl Sandberg, John Carmack’s departure is incredibly foreboding. His tale (in the link above) tells of a company without clear direction, bent on creating from scratch something that has already been done (by games such as Minecraft, in which a full-scale digital world is rendered by a powerful software engine), and without the requisite technology or know-how.

Meta found itself in the regulator’s crosshairs as well in 2022, paying hundreds of millions of dollars to Irish regulators for violating privacy guidelines (Meta plans to appeal). The company also shelled out $750 million dollars to settle the Cambridge Analytica dispute (remember Cambridge Analytica?). While settling lawsuits is a cost of doing business for large companies in the 21st century, Meta’s legal struggles are often public and reinforce a notion that the company continues to do the wrong things when it comes to customer privacy, whether the allegations are true or not.

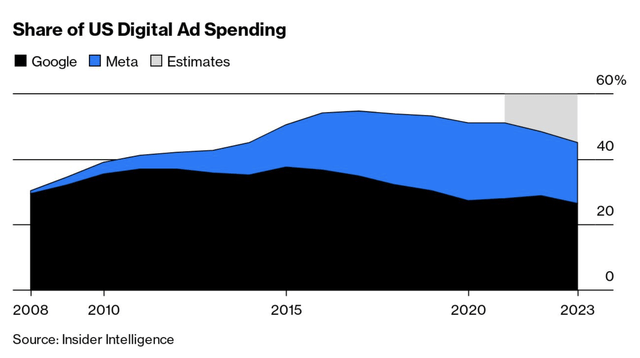

More pressing for its core business, Meta has yet to find an effective way to work around Apple’s sweeping 2021 privacy overhaul, which made it much more difficult and in some cases impossible for Meta to provide the hyper-accurate ad targeting that it was famous among marketers for. As a result, marketers are increasingly spreading their ad dollars on competing platforms (see chart below from linked article).

Platform Ad Spend Share (Bloomberg)

Looking across the competitive landscape offers no solace, either. While Snap Inc. (SNAP) seems to be vanquished as a true competitor to Meta, the company has yet to find a fully effective counter to TikTok, which is wildly popular among Gen Z and is rapidly gaining market share.

For what it’s worth, 2022 was a banner year for Meta, in the sense that it is likely to be remembered as an aberration in the history of the company’s otherwise stellar growth record, or perhaps in the sense that we will all look back on 2022 as the year that the Great Decline in Meta began.

Things, however, aren’t all bad. Let’s take a step back and review the positives for Meta Platforms.

Hunt The Good Things

For what it’s worth, a lot of buy-side investors believe that 2023 will be a positive year for Meta and its social media properties. J.P. Morgan recently released a survey in which respondents believed that Meta would be a top performer in the coming year.

Additionally, despite the problems of the Metaverse, Meta’s other units are doing quite well. WhatsApp has now surpassed 2 billion active daily users, and daily and monthly active users on Facebook continue to grow in the low single digits.

Meta also provided color in its Reels Engagement over the last few earnings reports. Reels – short, disappearing videos presented to users via an algorithm a la TikTok – have been very successful in capturing their audience, with 150 billion of them playing each day. Management estimates that, projected out, this equates to $3 billion annually across both Facebook and Instagram.

Most promising in our view, however, is that Meta is finding new ways to generate cash-for-clicks. As businesses spend less on direct ads, they are ramping up spending on Meta’s Click-to-Message feature. This paid feature allows customers to contact a business directly from their Instagram or Facebook page, and the company has disclosed that there are about 140 million Click-to-Message engagements daily. The annualized revenue for Click-to-Message is around $9 billion, the company says.

We are most excited about the growth of Click-to-Message for several reasons:

- It reduces Meta’s reliance on traditional ad spend and provides steady, consistent revenue.

- It increases user stickiness. Users who become accustomed to interacting with a business on social media will become comfortable and adopt the platform as the chief way to interact with certain companies.

- It raises virtually no privacy concerns, which have dogged Meta (at great cost) for years.

- It opens the door for business to gather the sort of customer data they were once able to if Meta were to create some sort of opt-in function when customers contact a business.

Lastly, we are always reminded that the current troubles brought on by the Metaverse could – and may well be – easily solved by a spinoff. This is something that investors have begun to clamor for, and will only grow louder, we believe, if Zuckerberg’s pet project continues to show no signs of life.

Let’s Talk Valuation

So where do things stand heading into 2023? From a pure valuation standpoint, Meta is currently a bargain.

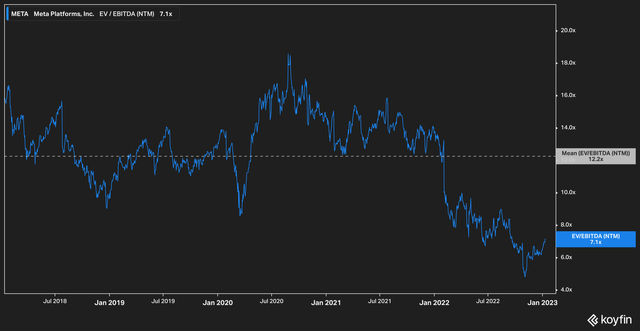

The above chart shows the forward EV/EBITDA for Meta over the past five years. As is obvious, the current valuation is the lowest that it has been during that time frame at 7.1x. Given the fact that the core problem within the business is the Metaverse while the other units remain healthy and growing, it seems as though investors may be throwing out the baby with the bathwater to an extent, especially when one considers that the 5-year average EV/EBITDA for Meta is 12.2x.

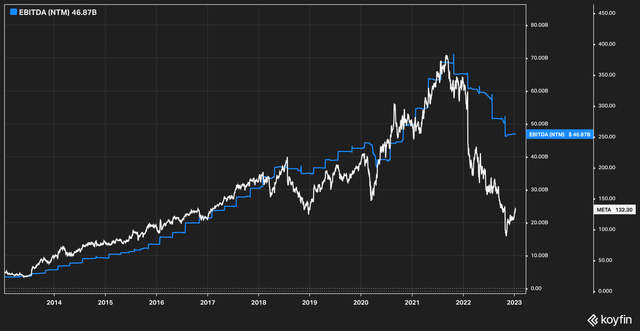

Further evidence of investor fears when it comes to Meta’s future prospects can be seen in the chart above. For the past ten years, Meta’s price has moved in relative lockstep with its forecasted EBITDA until the start of 2022 when things begin to break down in a major way.

To be sure, forecasted EBITDA has fallen, especially with the new losses stemming from the Metaverse, but the current schism between price and forecasted earnings is quite stark, and difficult to understand except for the fact that investors are not buying into the Metaverse, don’t understand it, and don’t believe it will work out the way Mark Zuckerberg hopes.

The Bottom Line

While it might be difficult for investors to wrap their heads around Mark Zuckerberg’s baffling insistence on developing the Metaverse, they should be reminded that the core businesses of Meta are still behemoths of the space, and are not ceding ground to other platforms without a fight. Optimistically, in many cases, Meta seems to have a clear path forward to win those fights as well.

The stock is currently undervalued from historical averages, so much so that we believe this creates an opportunity – with a fair degree of risk posed by the potential black hole of cash that is the Metaverse.

Still, Facebook’s balance sheet is healthy, with a hefty amount of cash on hand and stable leverage ratios. If Meta eventually goes off a cliff, it likely won’t be a sudden drop. The warning signs will more than likely flash loud and clear for investors willing to heed them.

That being said, there is ample reason to think 2023 could be a good year for Meta Platforms, Inc. stock, and we feel cautiously bullish, especially when the depressed valuation is taken into account. However, we believe that, all things considered, it might be best to sit on one’s hands for the time being. Meta Platforms, Inc. is set to release its annual report in the coming month, and along with that should come several fresh insights into how the Metaverse will develop. At that time, investors should have much better information with which to make a decision about Meta Platforms, Inc.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.