Summary:

- StoneCo opts for a more capital-intensive business in acquiring. When it comes to granting credit, it has competition from banks that have been doing this for over 50 years.

- For this reason, I have the feeling that competitors’ businesses are more complementary.

- Despite having the best financial indicators, the valuation has little potential for appreciation in my view.

JERO SenneGs/iStock via Getty Images

Investment Thesis

I recommend holding StoneCo (NASDAQ:STNE) shares. Although the company has good financial indicators, I don’t see a good margin of safety in the valuation by P/E multiple against sectoral peers.

Furthermore, the option for a business model focused on card machines (intense in working capital) and credit products (competition with banks and little differentiation) makes me skeptical about the complementarity of the solutions.

Introduction

The Brazilian acquiring sector has very peculiar characteristics, this is because banks and even retail players see the market as having great potential to complement their solutions.

According to Fitch, in 2024 the Brazilian acquiring market should grow 11%. It is worth highlighting that the acquiring market has constantly grown above GDP, due to the still low penetration of cards and constant increase in the penetration of e-commerce.

In this sense, the last survey in 2022 showed Cielo (OTCPK:CIOXY) as the market leader with 31% market share, in second place was the Itaú (ITUB) brand called Redecard, in third place was the Santander brand (BSBR) with 26%, followed by PagSeguro (PAGS) and StoneCo with 13% each.

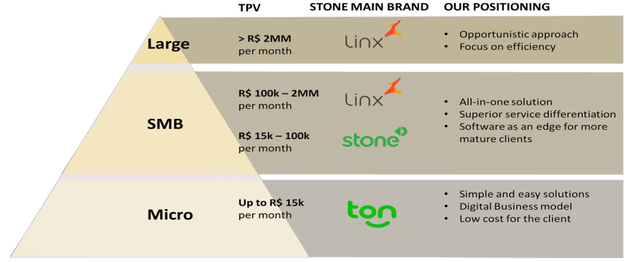

It is also appropriate to say that, although one competes against the other, each focused on a specific segment of customers. Cielo, Redecard and Getnet have always focused on players with the highest added value, or the tip of the pyramid.

StoneCo specializes in offering solutions for the small and medium business segment, or the middle of the pyramid. And finally, PagSeguro specialized in serving microentrepreneurs (MEIs), or the base of the pyramid.

Other players complete the market, such as Safra, retailer MercadoLibre (MELI) through MercadoPago, retailer Magazine Luiza through MagaluPay and several others. Now that we’ve learned a little more about the sector, let’s better understand how StoneCo positions itself in this market.

History And Business Model

StoneCo was created in 2012 and is a Brazilian payment methods fintech. In the financial segment, the company integrates payment offerings, such as card machines, in addition to credit solutions for customers. The financial segment represents 88% of the company’s revenue.

In the software solutions segment, StoneCo offers POS, ERP, and CRM solutions as well as e-commerce tools for its customers. The company indicates that this segment represents 12% of the company’s revenue.

The middle of the pyramid is the main niche, where the company uses the StoneCo brand and Linx, which was a recently acquired company. Through Linx, StoneCo also serves the high-income segment, competing with Redecard, Getnet and Cielo. At the base of the pyramid, the company launched the Ton brand, where the competition is mainly with PagSeguro.

It is interesting to note that the company opted for a different strategy than the competition, in my opinion. Large banks, for example, have already made a lot of investment in Capex to have several bank branches, in addition, the acquiring segment complements credit products.

When we talk about the retail segment, the customer accesses the company’s website in search of a product, and the company already offers the payment solution to increase revenue from the customer, just like MercadoLibre does.

PagSeguro, for example, has the acquiring business but also focuses on digital banking. It faces competition from large players such as Nu, which apparently has a pilot project in the acquiring segment.

StoneCo opted for the card machine business and disrupted the market with abrupt growth. It also had a strong focus on credit operations, until adjusting the operation in the latest results.

However, I believe the thesis is a bit complex due to the card machine business being capital-intensive. In the credit segment, the company has massive competition with large banks, and has little differentiation, in my view.

This is different from the case of Nu, where a brand and a “movement” were created against the incumbent banks. Furthermore, the bank has become synonymous with agility and ease, which is why it got its credit operation right, in my opinion.

It is undeniable that the company’s strategy is good, otherwise, it would not have grown so much, but I have doubts about the perpetuity of the strategy. I believe that peers such as PagSeguro, Nu, Itaú and Santander have more complementarity in their solutions with the acquiring segment and this corroborates my thesis of holding the shares.

StoneCo Fundamentals

Below, we will carry out a financial analysis of StoneCo against its competitors, PagSeguro and Cielo, to identify the companies’ strengths.

| Ticker | STNE | PAGS | CIOXY |

| Market Cap | $3.69B | $3.64B | $2.83B |

| Revenue | $2.35B | $3.23B | $2.11B |

| Revenue Growth 3 Years [CAGR] | 53% | 33% | -1.7% |

| Net Income Margin | 14.8% | 10.9% | 20.3% |

| ROE | 12.3% | 13.6% | 17.4% |

StoneCo has the highest market cap compared to its competitors, despite PagSeguro having the highest revenue. However, StoneCo stands out again with the highest revenue growth compared to its competitors and good net income margin and ROE numbers, and is this reflected in the valuation?

Is Valuation Attractive?

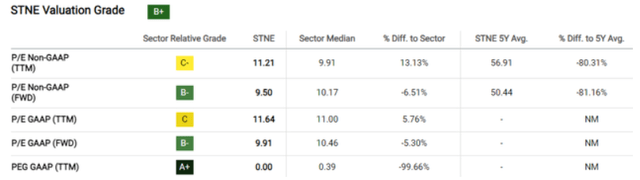

As the company is profitable, I will use a comparative analysis of the company against its competitors using the P/E multiple:

According to Seeking Alpha’s valuation metrics, StoneCo is cheap on several metrics. However, when looking at the P/E GAAP (fwd), the company has an upside potential of 5.3% for the industry average, which I consider too little to give a buy recommendation. Let’s look at these metrics in more depth.

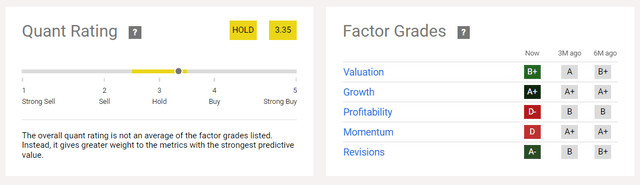

Quant Rating And Factor Grades

As we can see, according to the Seeking Alpha tools, StoneCo has excellent ratings, growth, and reviews. However, the company has poor grades for momentum and profitability.

Quant Rating & Factor Grades (IR Company)

Because of these divergences, Seeking Alpha’s Quant tool gives a recommendation to hold the shares, corroborating my thesis and leaving me quite confident about my recommendation.

Latest Earning Results

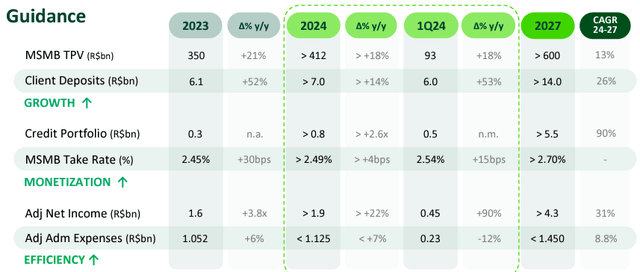

The company’s revenues reached $588 million (+16.7% y/y), mainly due to the increase in the customer base and client deposits.

The company added 205 thousand small and medium-sized companies (SMEs) to its customer base, now with 3.7 million companies (+32% y/y), and had a gain in operational leverage in the quarter.

However, one thing that caught my attention was the Capex of $61 million in the quarter, representing 10% of revenue, while in the previous quarter it was 8.8% and in 3Q23 it was 5.6%.

As I said, StoneCo’s strategy is a more capital-intensive business. I believe that the Capex level will be between 10% and 15% of revenue in the quarter, which corroborates my recommendation to hold the shares due to the low margin of security.

Potential Risks To The Bullish Thesis

As it operates in a sector marked by the advancement of technology and innovation, the biggest risk for the company is competition. But I want to make a provocation that perhaps no analyst has done, among the risks to StoneCo’s thesis. What if Nu (NU) entered the acquiring segment?

It is worth highlighting that Nu is the main digital banking case in the world, having reached 100 million customers in 10 years. Few people know, but Nu is in the acquiring segment. However, the proposal is different.

Nu uses its own app as a credit card machine. Furthermore, the modality is only available to business account users and only for Android cell phones, and that catches my attention.

Nu has always stood out for launching a product and for having extreme focus and assertiveness in launching this product. When the product is meeting expectations, the company launches a new product. In other words, it seems to me that this is an indication that Nu could enter the segment with strength one day.

It is worth remembering that the company launched into the telecom segment with the possibility of selling cell phone plans to its customer base, a move that no investor expected. The company indicates that its focus is on expansion in Mexico and reaching the high-income segment in Brazil, however, I would not be surprised by a bolder move in the acquiring segment.

The Bottom Line

StoneCo operates in a segment marked by innovation and with extremely agile competitors. In this sense, I see little complementarity between StoneCo’s main businesses compared to other players.

It is worth highlighting that StoneCo opts for a capital-intensive business in the acquiring segment. In credit operations, for example, the company faces competition from banks that have been carrying out this operation for over 50 years.

Finally, the company has good financial indicators and has experienced rapid growth, showing that its managers have a lot of quality. However, the P/E valuation method presents only 5.5% upside potential against the sector average.

Based on this analysis, I recommend holding the company’s shares. In my view, investors should pay attention to the business model of the company and its competitors and ask themselves questions about the perpetuity of the strategy. With little potential for appreciation, the risk-return ratio does not seem attractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.