Summary:

- Coupang went public in 2021 and has fallen by over two-thirds since then. However, things have bounced back, and the company is on a solid path.

- CPNG’s core ecommerce segment, new offerings growth, and reasonable valuation make it an attractive investment opportunity.

- Selling put options on CPNG appears to be the best way to play the stock.

- Doing so generates a substantial cash yield (22%!) while retaining the opportunity for investors to buy the shares if they dip more than ~10%.

- We rate CPNG stock a ‘Buy’.

Sundry Photography

Back in the Spring of 2021, Coupang (NYSE:CPNG) went public on the New York Stock Exchange to a considerable amount of fanfare. The IPO was, at the time, one of the larger, more respectable companies that was offering shares – if you remember, that period saw a huge number of SPACs merging with low quality companies, many of which have since gone bust.

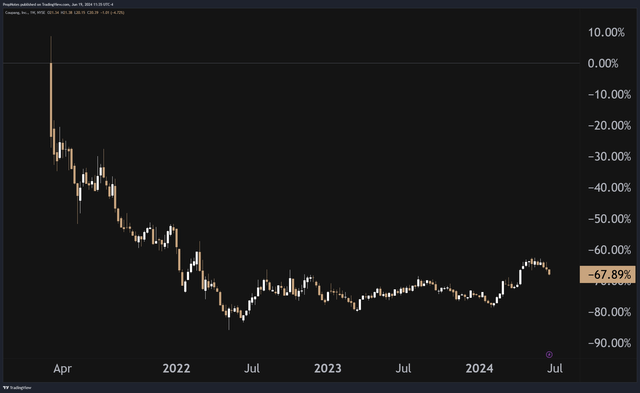

Often likened to the ‘Amazon of Korea’ (AMZN), this ecommerce company made quite the initial splash, but has since petered out, falling by more than two thirds since its opening print:

A combination of higher rates, inflation, and negative consumer sentiment soured investor appetite for CPNG shares throughout 2022 and 2023, and the stock’s multiple shrunk considerably over this period.

However, as time has gone on, the company has continued to execute, and sales have grown considerably. Profitability has also improved, and over the last twelve months, FCF grew to more than $1 billion, an impressive feat for a company that was significantly in the red only a few short years ago.

Our thesis here is simple: in our view, CPNG as a GARP opportunity is compelling, but we’re not sure that investors are yet ready to pile back into the stock, despite the attractive looking valuation.

Thus, selling put options on CPNG shares seems like the best way to play the opportunity. Selling puts does cap upside if the stock appreciates between now and option expiry, but it also produces a considerable cash yield for investors and offers an opportunity for you to buy the stock at a lower price if shares take a dip.

Today, we’ll explore CPNG’s value, its future prospects, and this compelling option opportunity.

Sound good? Let’s dive in.

Coupang’s Financials

As always, let’s start by taking a look at CPNG’s financial situation.

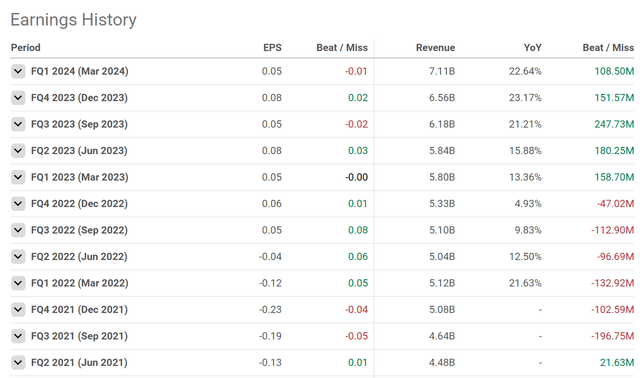

Over the last few years, CPNG has turned in a somewhat mixed track record of beats and misses on both the top and bottom line:

Clearly, CPNG’s road to profitable growth has been bumpy, and analysts have had a hard time modeling where the company is headed next.

In 2022, CPNG’s sales growth slowed to a crawl as inflation took a bite out of the Korean consumer, and management notched a number of misses on this front.

However, as inflation has abated and the global consumer has improved, so too have CPNG’s results. Sure, the company missed EPS estimates in its most recent quarter, but the company has made strides in growing a number of new and interesting lines of business.

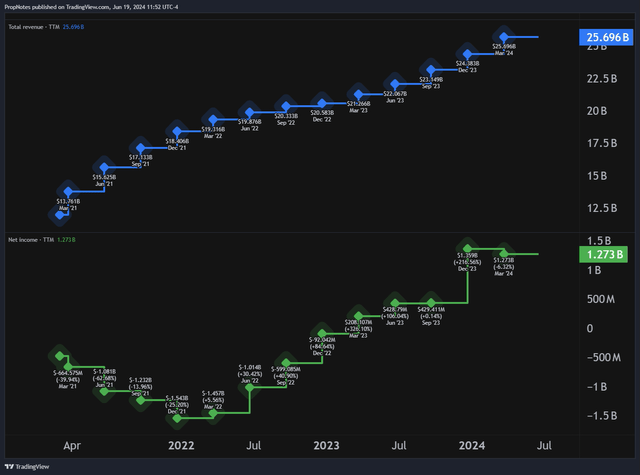

You can see this progress if you zoom out a bit.

At the start of 2022, CPNG’s net income was -$1.54 billion, a dreadful showing for an ecommerce company in a strong position and $18 billion in revenue:

However, moving ahead to present, CPNG’s net income has grown to ~$1.3 billion on a revenue base of ~$26 billion. This is a lot of progress in a short time.

But what’s driving these results?

From a base level, CPNG’s core ecommerce ‘product commerce’ segment has been quite strong, growing revenues up 15% YoY, and 25% YoY if you remove some accounting changes for the company’s fast growing ‘FLC’ division (which is similar to fulfillment by Amazon, or ‘FBA’).

EBITDA margins here are also relatively strong at 7.2%, which means that in Q1 of this year, CPNG’s core offering produced roughly $450 million in EBITDA, up $179 million (or 66%) YoY.

These results are great and showcase CPNG’s strong focus on operational execution and cash conversion. For comparison, Amazon’s NA ecommerce operating margins last quarter were around 5.5%, so CPNG is doing a good job here in a business with traditionally thin margins.

This core commerce segment contains some interesting growth stories, including the aforementioned FLC division, which has seen rapid growth in the relatively untapped Korean market:

We continue to see impressive growth in FLC, which recorded a 130% increase in units sold year-over-year. As a result, the assortment available to customers with the convenience of overnight, same-day, or next-day delivery is expanding with each passing day. And FLC is providing critical support to thousands of merchants who are able to grow faster by selling their products with Rocket service levels without investing in prohibitively expensive infrastructure and technology. FLC sellers, over 80% of whom are SMEs, have seen their sales on average more than double within 90 days of converting to FLC.

The company’s Fresh (grocery) service has also grown about 70% YoY, which is compelling. Management attributes this advantage to selection, pricing, and speed of delivery, which are enabled by the company’s considerable logistics network.

All in all, the company appears to be doing a great job in the core Korean retail business, but there are other green shoots in the ‘Developing Offerings’ segment as well.

This includes Eats, a food delivery offering, the recent acquisition of Farfetch (which management hopes to have operating on a breakeven basis by the end of the year), and a new core offering expansion to Taiwan.

Between these markets (FLC, Grocery, Food Delivery, Farfetch, and Taiwan), there is a significant growth opportunity for CPNG as it continues to execute:

While we’re further along in Korea, it’s important to note that we’re still just single digit share of a massive and highly fragmented $560 billion commerce opportunity.

Customers cast a new vote with every purchase they make and will not hesitate to spend their money at another venue they deem to be better. We have to win their vote each and every time by offering them the best selection, price and service. And we strive relentlessly to make that value proposition better every day.

To that end, we plan to continue investing billions of dollars in CapEx over the next several years to strengthen our fulfillment and logistics infrastructure.

In our view, this is the right approach to winning stable market share in the space – through focused Capex spend that provides a long-term advantage against new market entrants.

All in all, we like CPNG’s growth and profitability profile, and think the company is poised for further gains as it capitalizes on its Asian ecommerce opportunity.

Coupang’s Value

But what is the stock worth?

All of this would mean little if the stock was wildly expensive.

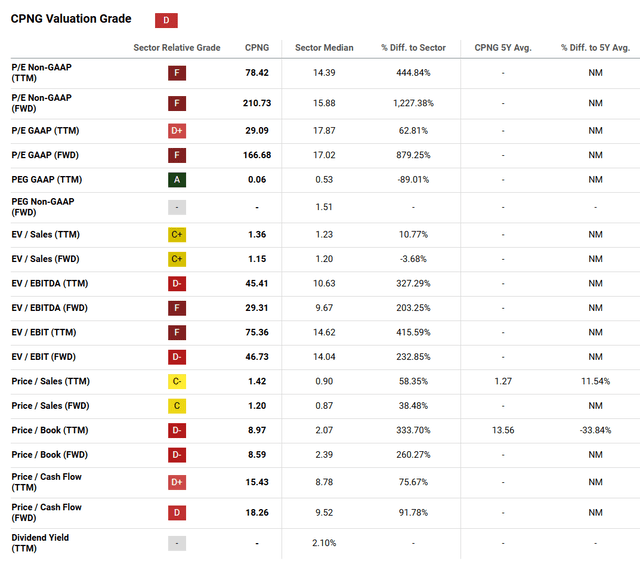

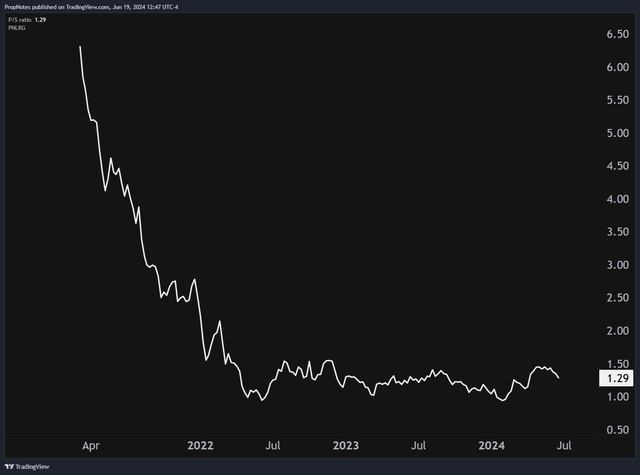

Thankfully, it’s not. Right now, shares trade at around 1.4x sales, which is only slightly above CPNG’s long-term average sales multiple:

Additionally, Seeking Alpha’s quant rating scheme doesn’t like CPNG’s projected earnings multiples for the coming year, which we think is unfair. Almost all of these grades are largely influenced heavily by the FTCH acquisition, which is skewing earnings to be lower than they are in reality on an operating basis.

At a base level, this $36 billion dollar company is raking in $281 million per quarter in EBITDA, which translates (at a consistent FWD run rate, which is extremely conservative given the company’s growth) to roughly a 32x FWD multiple. This isn’t particularly expensive for a scaled ecommerce player in a growth market with limited competition. It’s also not expensive for a profitable company with multiple segments that are growing at more than 70%+ YoY.

If you zoom out to a multiyear view, the company’s sales multiple appears reasonable vs. the more speculative heights shares experienced in 2021 as well:

In our view, as things continue to grow, CPNG’s multiple has room to expand somewhat as early efforts in Taiwan and FTCH begin showing results. Given management’s solid execution elsewhere, this seems highly probable.

The Trade

However, those efforts should take some time, which is why we’re not quite as bullish on the stock over the short and medium term. Sure, the stock is working from a stable platform of operational results and a manageable valuation, but it could take time for some of the company’s recent bets to pay off.

Thus, our trade idea: selling put options.

When you sell a put option, you collect cash up front in return for a promise to buy shares if they fall to a certain price or below. The very basic premise here is that it’s a win-win trade when you sell an option on a good stock – either you get a solid cash payout with no further involvement, or you get the payout anyway but are obligated to buy the stock at a better price than what you’d get in the open market right now. Not bad!

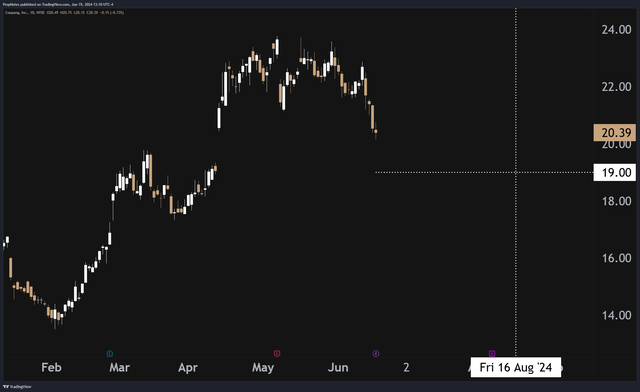

In this case, we like the $19 strike, 8/16 options that are currently trading for $66 per contract:

Given that each contract requires $1,900 in margin to sell, the $66 payout is a return of about 3.66% on capital over 58 days, which annualizes to 22%.

If the stock goes up or sideways, you keep the money, and if the stock goes down, you keep the cash, but your $1,900 is used by the broker to buy the stock.

As we mentioned before, with CPNG’s growth and reasonable valuation, it’s hard to see this 10% breakeven discount on the stock as anything but a win-win.

Risks

That said, there are some risks. The first risk is that earnings are set to be reported the Wednesday the week before the option expires, and an adverse reaction in the stock could send shares below the strike price and towards assignment.

As we said, assignment doesn’t tend to be the ‘worst thing’ in most cases, but walking away with the cash is typically preferable because it frees up capital to use in another trade right away.

Additionally, there are some geopolitical risks to be aware of. CPNG operates in the two hottest Asian geopolitical countries at the moment – South Korea and Taiwan. If things go sideways from a war/conflict perspective, then it’s likely that CPNG’s value will collapse overnight.

Selling puts on this company in that context doesn’t entail more risk than simply owning shares outright, but it’s likely that a good chunk of capital invested into the underlying could be materially destroyed for the medium/long term.

Finally, there’s always a risk that management stops executing or runs into a number of snags that hurt the business. If the company’s growth slows meaningfully, then the multiple could drop to a more meager valuation, which could cause long-term impairment of capital invested into this position.

Summary

That said, with a solid base of profitable growth, multiple green shoots in big new markets, and a reasonable valuation, we think that CPNG has a bright future.

Selling options appears to be the best way to play it.

We initiate our coverage on CPNG with a ‘Buy’ rating.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.