Summary:

- Sequoia Capital’s Global Leader Roelof F. Botha bought $25M worth of Block Inc. stock, following a previous $27.5M purchase.

- Block Inc. Q2 earnings beat estimates, with raised guidance for EBITDA and increasing Gross Payment Volume.

- The company is now focused on reducing costs, ramping up bitcoin efforts, and testing its own chips for bitcoin mining.

- Loss-making MicroStrategy is priced at 56x to sales, while Block is trading at 1.55x.

The Good Brigade

A director of Block Inc. (NYSE:SQ) has made a substantial purchase of shares in the last week and in this investment thesis, I will look at the company’s outlook and consider the timing.

Sequoia’s Botha buys $25M worth of SQ stock

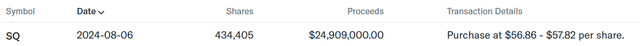

An insider transaction from Roelof F. Botha on August 8, showed the South African venture capitalist buying up $25 million worth of Block Inc. stock.

Roelof Botha Insider Transaction (Yahoo Finance)

The latest purchase by the Sequoia Capital leader follows a similar insider purchase of $27.5 million in November 2023. Botha was named Global Leader of the VC heavyweight in April 2022 and has been a board member of Block Inc. since April 2011.

After more than 13 years on the board, it is interesting that Botha, who sits on the board of around seven other companies, has chosen to ramp up his investment in this company.

Botha was a Chief Financial Officer at PayPal ahead of its Initial Public Offering and is obviously comfortable with the fiscal path of Block Inc.

Block Inc. Q2 earnings beat estimates

Block Inc. released its second-quarter earnings on August 1, beating earnings by a wide mark and raising guidance for EBITDA.

The parent of Square and Cash App raised its 2024 adjusted EBITDA target to $2.90B, vs. the Visible Alpha estimate of $2.81B. It was also much higher than management’s previous guidance of $2.76B. Adjusted EBITDA margin is also expected to be higher at 33% vs. the previous guidance of 31%.

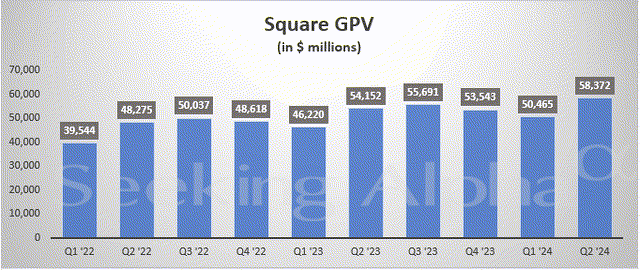

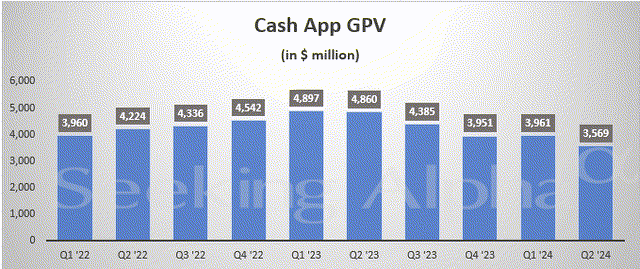

Gross payment volume of $61.9B was up from $54.4B in Q1 and $59.0B from the year-ago period. One negative in the earnings release was a miss on revenue with $6.16B, missing the $6.30B consensus. However, the figure was higher than the $5.96B posted in the previous quarter and $5.53B from a year ago. Excluding the company’s bitcoin returns, revenue was 13% year-on-year.

Square’s Gross Payment Volume is on an upward trend Q-on-Q.

However, CashApp has seen a decline since Q1 2023 and has returned to its GPV from Q1 2022.

Costs reduced, bitcoin efforts ramping up

Jack Dorsey’s firm is now focused on driving profitable growth at the payments company by cutting jobs, reducing its real estate holdings, and scaling back on non-essential spending.

Block had said last year that it wanted to reduce its headcount from 13,000 to 12,000 and announced in January of this year that around 1,000 staff would be impacted. With a large number of layoffs being executed across the tech industry, management likely saw it as an opportune time to cut costs in my opinion.

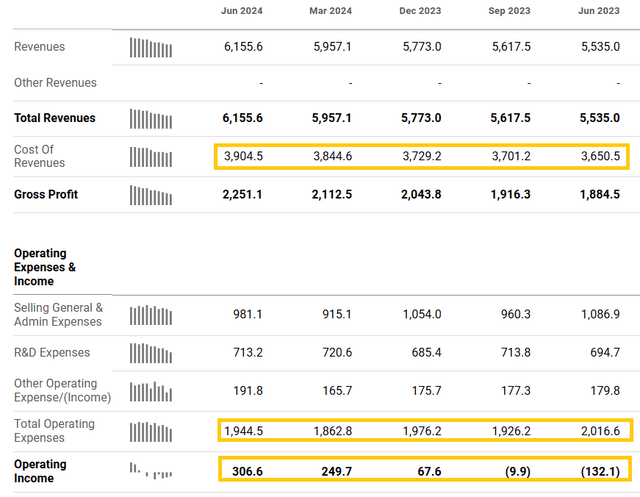

Block Inc. Financials (Seeking Alpha)

Taking a look at the quarterly financials over the last year, the company’s cost of revenue and operating expenses have not altered much, but operating income is showing impressive growth. A loss of $132 million a year ago is now a $306 million gain. Any cost-cutting measures have the potential to squeeze further profitability from the company.

Plant, property, and equipment were $610 million a year ago and are now at $528 million, but may be reduced further.

On bitcoin, the company’s shareholder letter noted that as of June 30, 2024, Block held approximately 8,211 bitcoins with a fair value of $515 million. The statement also said that another 173 bitcoins were purchased in the second quarter.

A key takeaway from the second quarter was the company’s deal to supply its chips to bitcoin miner Core Scientific (CORZ). Block is seeking to decentralize bitcoin mining and marks a step further than simple BTC ownership.

“I’m fully confident and have no doubt that this is going to be a significant business for us and we’re going to take a majority of the market share,” Jack Dorsey said.

J.P. Morgan has estimated that the Core deal could pull in $225 million to $300 million for Block, but said it will take time to assess the long-term potential.

“We have more to learn in terms of margins of this business, so we are hesitant to underwrite this until we learn more around cadence and economics,” analysts said.

In my opinion, margins are irrelevant in the near-term when a company is trying to revolutionize the world of bitcoin mining.

Another key takeaway from the Q2 earnings was a significant capital raise.

“During the second quarter of 2024, we issued $2.0 billion in senior unsecured notes due in 2032. Including the net proceeds from this debt offering, we ended the second quarter of 2024 with $10.3 billion in available liquidity,” management said.

In my opinion, Block Inc. may be planning further bitcoin purchases on top of its previous commitment, or it may have plans to ramp up its bitcoin mining/chip operations, or commit to an acquisition.

Valuation outlook and downside risk

Block Inc. is already trading at sales metrics that are lower than the sector median.

Price to sales on a forward basis is only 1.55x, according to Seeking Alpha data, which is lower than the sector average of 2.69x. Enterprise value/sales is similar at 1.50x on a forward basis versus 3.15x.

An important consideration in this respect is that it does not take into account the potential for bitcoin gains. Another company that allocates capital to bitcoin is MicroStrategy and the company has a price/sales ratio of 53x on a forward basis.

It is ironic that MicroStrategy is a loss-making company making an oversized directional bet on the world’s largest cryptocurrency, while Block is making calculated purchases and is growing as a profitable payments company and seeking to be a sector leader in bitcoin mining.

For this investment thesis, the downside risk is that Square and CashApp get ousted as payment options. However, the recent news that CashApp has been integrated to Google Play recently has given me confidence that the platform is relevant and growing. I also believe the recent capital raise has been done to load up on bitcoin or embark on an acquisition.

Conclusion

The Global Manager of one of the most famous Silicon Valley venture capital funds has decided to load up again on Block Inc. stock. His $27.5 million purchase in late 2023 has been followed by a $25 million purchase in the last week. If Silicon Valley’s most famous investors are diving in, maybe we should follow. Former PayPal CFO Roelof Botha has committed substantial personal capital to Block Inc. in the last six months. The company is growing profitably as a diversified payments company, embracing artificial intelligence, and is trading at a discount to its sector peers without considering its bitcoin holdings. The company is also testing its own chips with a plan to diversify bitcoin mining. That could lead to an increase in the company’s bitcoin asset holdings and a valuation more aligned with other bitcoin holding firms. I am happy to buy into Block Inc. at its current valuation and trajectory, but in my opinion, I feel that there may be some game-changing news or business moves ahead that add fuel to the fire.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.