Summary:

- Accenture focuses on GenAI strategy, leading to $2 billion boost in new bookings.

- Company’s acquisition-led growth strategy shows signs of success with modest growth in new bookings, demonstrating the first signs of growth in over two years.

- At 21x forward earnings, valuation looks appealing with expected revenue growth and dividend increase, reiterating Buy rating.

HJBC

Investment Thesis

Accenture (NYSE:NYSE:ACN) has been on a buying spree in the past many months trying to carve out its own niche of consulting and managed services in the rapidly evolving world of GenAI.

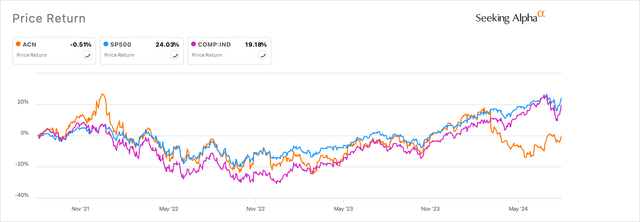

The Dublin, Ireland-based professional services company, as they now prefer calling themselves, has seen business growth come to a standstill after months of decline that started with the release of ChatGPT in November 2022. Accenture trades closely within a few deviations of the broader market indices, but with growth clearly slowing down due to corporate budget reallocations, the company’s stock finds itself in a rare place below the markets.

Exhibit A: Accenture’s stock versus markets on a three-year timeline (Seeking Alpha)

Over the past many months, Accenture’s management switched strategies to fuel growth via an acquisition-led strategy, and the first signs of growth have started to appear, and new bookings saw modest growth driven by new bookings in GenAI.

Accenture put up a respectable Q3 FY24 quarter, and I believe the company is still undervalued, leading me to reiterate the Buy rating on the company.

Accenture’s GenAI Strategy Delivers a $2Bn Boost to New Bookings

I have been covering Accenture quite regularly since the start of the year, and I have stayed bullish on this company. My last coverage on Accenture noted some moderate levels of challenges Accenture’s management was facing, but my resolve in the company’s outlook stayed strong. I had expected the company to see an “uptick in the back half of 2024.”

The company’s Q3 FY24 report is exactly the kind of performance I expected, where I noted strong signs of reacceleration in the company’s new bookings.

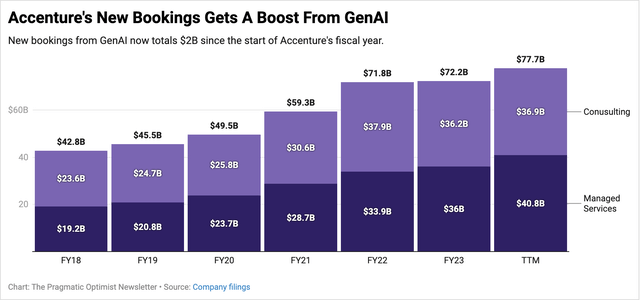

New bookings, or the value of new contracts Accenture signed with customers, 22% y/y to $21.06 billion, led by a record volume of new bookings in the company’s Managed Services. Managed services’ new bookings were $11.8 billion with a robust book-to-bill of 1.5, while Consulting new bookings were $9.3 billion with a book-to-bill of 1.1. Overall, the company’s book-to-bill ratio stood at 1.3, higher than the 1-1.1 level they saw all through last year, implying a rising level of demand for their services.

As can be seen in Exhibit B below, on a TTM basis, Accenture now looks set to return to growth for the first time in two years, and I continue to expect it to close out its upcoming Q4 quarter on a high in terms of new bookings.

Exhibit B: Accenture’s new bookings returns to growth mode with record volume of bookings in Managed Services. (Company filings)

Accenture quickly pivoted strategies last year to double-down on benefiting from GenAI when their core consulting engine showed signs of slowing down amid corporate budgets shifting to GenAI solutions. The company decided to work its massive cash pile of almost $9.1 billion in the fourth quarter of last year to acquire companies across GenAI, cybersecurity, managed services, cloud, and digital transformations.

In 2024 alone, Accenture acquired at least 27 companies and startups to bolster its professional services portfolio and position the company as their client’s trusted partner in their “large-scale transformations” journey. Accenture’s management has been very vocal about their acquisition-led strategy to be their client’s large-scale transformation partner and most recently revealed on the Q3 call why they were and are focusing on large-scale transformations.

We also have leaned into the new area of growth, GenAI, which comprises smaller projects as our clients primarily are in experimentation mode, and this quarter we hit two important milestones. With over $900 million in new GenAI bookings this quarter, we now have $2 billion in GenAI sales year-to-date, and we have also achieved $500 million in revenue year-to-date. This compares to approximately $300 million in sales and roughly $100 million in revenue from GenAI in FY 2023. Leading in GenAI positions us to help our clients take the actions needed to reinvent and to benefit from GenAI, which frequently means large-scale transformations.

Accenture has sourced $2 billion worth of new bookings directly related to GenAI, which has been responsible for their Managed Services segment growing meaningfully.

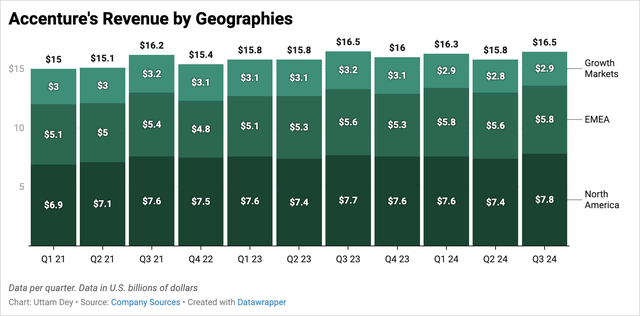

While the company’s third quarter revenue and earnings performance were a miss, the company more than made it up with its forward guidance for the year, where it expects to close out its FY24 year next month with total FY24 revenue projected to rise ~2% y/y at the midpoint of its guidance to $65.4 billion. In addition, I was encouraged to see revenue growth return in its North America region, which accounts for almost half of its annual revenues.

Exhibit C: Accenture’s revenue by geography points to a return to growth in the North America region. (Company filings)

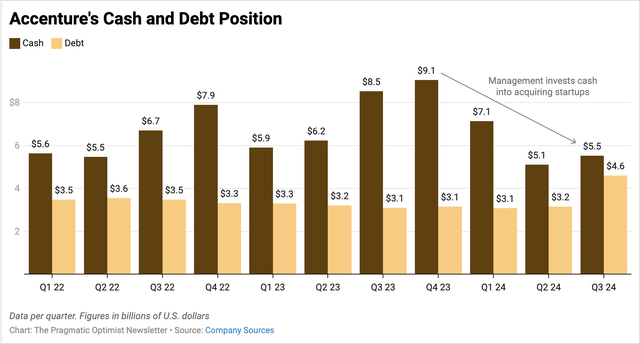

Now, investors may have concerns about the company’s cash and debt levels on its books given the rapid pace of acquisitions. However, my housekeeping checks indicate that the company is managing its books at levels that are sustainable enough to generate long-term shareholder value.

Exhibit D: Accenture continues to manage its debt and cash levels at appropriate levels. (Company filings)

Per its Q3 report, Accenture carries ~$5.5 billion in cash & equivalents and ~$4.6 billion in debt. Their Q3 did mark a significant increase in debt, however, total debt levels remain very manageable with the company’s leverage ratio healthily sitting under 1x.

Accenture’s Valuation Looks Appealing, Dividend Raised.

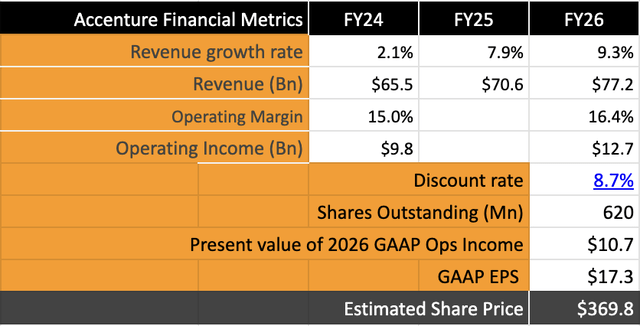

I had previously estimated Accenture to post 6.5% growth through FY26. Part of this was anchored on my expectations for the company to deliver marginal growth of ~1.5% in FY24. But with the encouraging outlook in its Q3, management now expects to close out FY24 with ~2% revenue growth. They also expect net bookings to continue to grow through next year, giving them additional runway for revenue growth. Based on this outlook, I now believe Accenture can deliver 8.6% growth through FY26. This is still under consensus expectations of ~8.8% CAGR growth for the same time period.

Management expects to deliver a GAAP operating margin of ~14.8% for the full year FY24. I still expect ~65 bp of margin expansion as revenue growth returns to Accenture starting next year. This implies 13.6% growth in operating income.

My model assumes a share dilution rate of -0.9% and a discount rate of 8.7%.

Exhibit E: Accenture’s valuation model shows moderate upside (Author)

Based on this model, I believe Accenture should be valued at 21x forward earnings, which implies 13-15% upside from current levels.

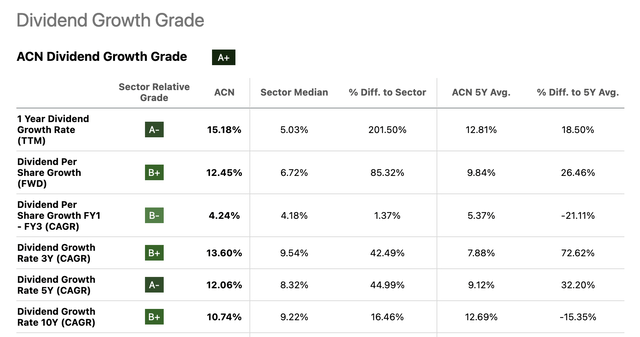

In addition to the upside, Accenture’s management has been prioritizing shareholder returns well. With strong dividend growth as seen in Exhibit F below, Accenture’s current forward dividend yield stands at 1.6% and is estimated to rise to 1.8% per consensus estimate. This 1.6% dividend yield would be an added annual benefit to shareholders.

Exhibit F: Accenture’s dividend scorecard (Seeking Alpha)

Risks & Other Factors To Be Aware Of

Like most professional services and consulting companies, Accenture has been hit as corporate budgets were re-allocated to spend on GenAI digital transformations and GenAI proof-of-concepts. Most recently, McKinsey reported a return to growth as well and is seeing signs of discretionary IT spending returning to the overall consulting business. On the Q3 call, management said that they are expecting a return to growth next year and “are also well-positioned to capture increases in discretionary spend when it comes back.”

But if there are any further slowdowns in business spending, the general economy, or other anticipated broader macro challenges that emerge, it would impact Accenture’s growth rates again.

Takeaway

Accenture continues to be a bellwether of the IT services company that offers a compelling narrative for investors. The professional services company had a challenging task of quickly pivoting its business in the face of GenAI and pursued an acquisition-led strategy to position itself as the client’s digital transformation partner. This strategy is working with bookings seeing growth again and revenue poised to return to growth as it closes out FY24.

I continue to be bullish on Accenture and reiterate my Buy rating on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.