Summary:

- Semiconductor stocks surged after early-August lows, but sustainability of the rally is uncertain.

- Applied Materials (AMAT) faces stiff resistance at $214 on price chart, underperforming peers and S&P 500, with unfavorable seasonality ahead.

- Q3 results for AMAT were fine but not enough to support valuation, with concerns about long-term margins driving the decision to move the stock to sell.

Sundry Photography

The semiconductor stocks as a group have been hammered in the past few weeks. Even leaders like NVIDIA (NVDA) lost massive portions of their value into the early-August low, but the group has surged once again since then. Whether this is a bounce or the start of a new, sustained rally remains to be seen.

In this article, we’ll take a fresh look at Applied Materials (NASDAQ:AMAT), which reported third quarter earnings on the 15th. The last time I covered AMAT I came to the conclusion that second quarter earnings weren’t good enough; I have a similar view of third quarter earnings. Let’s dig in.

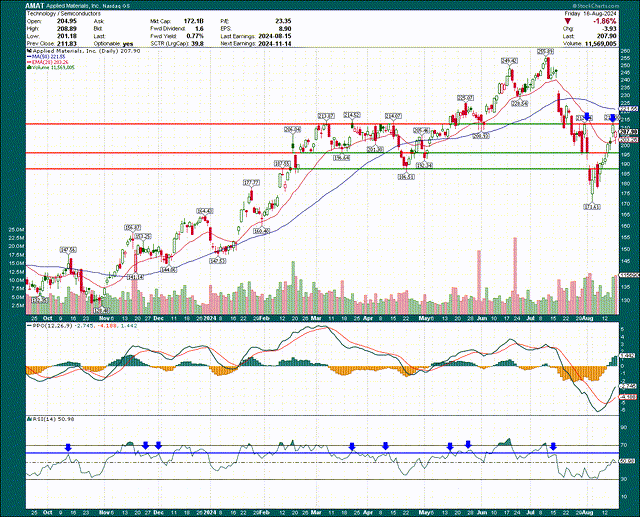

Stiff resistance above

We’ll start with the chart as we always do, and in AMAT’s case, I think we’ve got a very tough level overhead for the bulls to negotiate, if indeed they can.

We can see very clearly on the daily chart that level is $214. That was the high from March (twice), as well as April. In addition, after it was broken, it was support in June, then again in July. Now that it’s been broken, it’s been resistance that has failed twice in recent weeks. Point being, it’s really difficult to get bullish on AMAT under that level because it looks to me like $214 is a brick wall right now.

The RSI is also struggling to clear 60, which I’ve marked in the bottom panel with a blue line. That’s a level that is hard to crest during sideways or bearish phases, and AMAT hasn’t seen a value ahead of that since early July. The RSI suggests the bears are in control until further notice.

On a relative strength basis, it’s even worse.

AMAT has underperformed its peers (top panel) by a massive amount in the past several months. And in the bottom panel we can see since June the semis as a group have underperformed the S&P 500. While a lot of that has been erased with the bounce we’ve seen, the fact is AMAT is a terrible performer in a weak group.

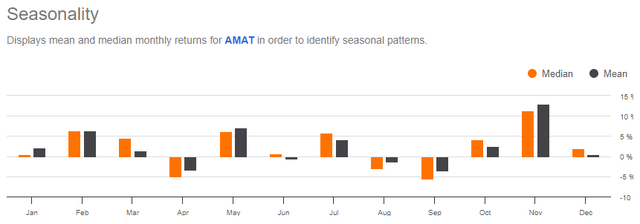

Finally, seasonality is very unkind to AMAT for the next six weeks or so.

September is the worst month for AMAT of the year, so if I put that with the relative strength and the price chart itself, I see the odds of $214 holding as extremely high. If you’re a buyer of AMAT, it means I think you can wait it out and get a potentially much better price.

Q3 was okay, but not good enough to buy

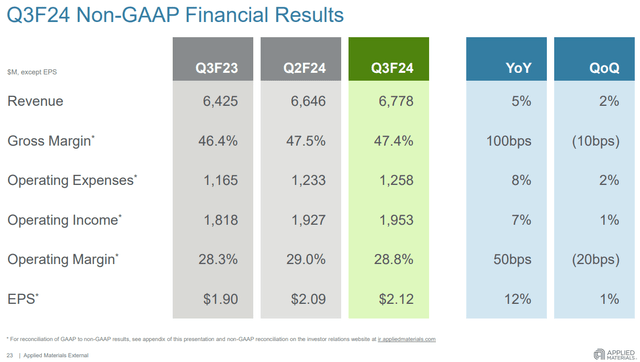

I mentioned I had about the same reaction to Q3 results as I did for Q2, and it’s one of results being fine, but not enough to support the valuation.

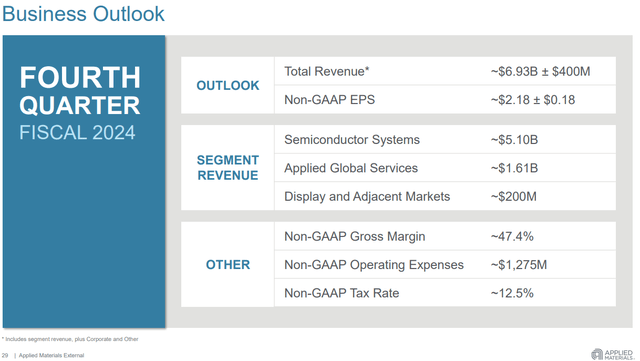

Adjusted earnings-per-share came to $2.12, which was a dime ahead of estimates. Revenue was up 5.4% year-over-year to $6.78 billion, and crested expectations by $110 million. That’s all fine, and guidance was basically in-line for Q4. Again, fine, but not exactly spectacular.

Management said the race for AI leadership is fueling demand for the company’s products and services, and I don’t doubt that. But at the same time, if you look at the growth rates for other names in the semi space, AMAT’s growth rates look more like a consumer staples stock; it should be valued as such.

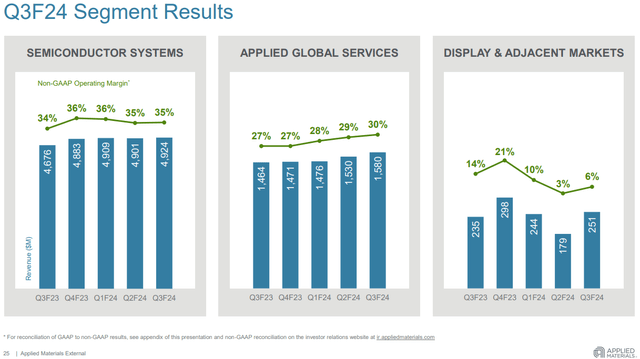

The core semiconductor systems segment saw $4.924 billion, a gain of $248 million from last year’s Q3. Guidance for Q4 was for $2.18 in EPS, three cents ahead of estimates from analysts. Revenue is expected in-line at $6.93 billion.

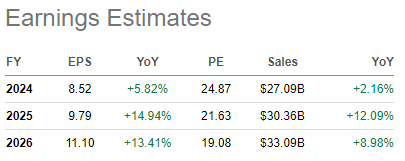

Here’s what estimates look like heading into the last quarter of the year.

Seeking Alpha

Sales growth is quite muted this year, but is expected to pick up in ‘25/’26. Importantly, analysts expect EPS to outgrow revenue for the foreseeable future. That implies strong margins and/or strong buyback activity to make that happen. Let’s dig into Q3 results and see if AMAT’s on the right track to accomplish that.

We can see operating income rose more quickly than revenue, and that’s because gross margins rose 100bps year-over-year to 47.4% of revenue. Part of that was offset by higher expenses, which rose 8%, eroding half that gross margin gain. This is a key variable going forward.

Operating margins in the company’s largest segment have been flat for several quarters, so moving the needle is hard. AGS is seeing sustainably higher margins but its contribution to revenue is fairly small, so when results are consolidated, it isn’t making a massive difference. DAM is negligible in terms of revenue and margins. Point being, unless AMAT has a wildcard up its sleeve for semiconductor systems to see meaningful margin gain, it’s likely to be more of the same going forward.

Guidance for Q4 suggests flat gross margins to Q3, but perhaps slightly higher operating margins as expense growth is expected to be lower than revenue growth. That’s assuming the company hits $6.93 billion, but note the range of revenue guidance is +/- $400M, which is a big number. We shall see but my point is that it doesn’t look like margins are going to be driving earnings meaningfully anytime soon.

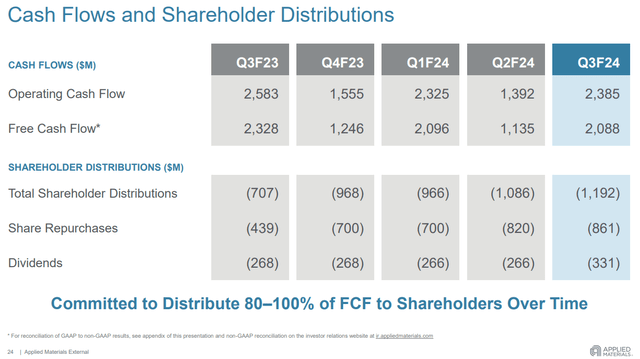

AMAT does a nice job of distributing cash and we can see it’s been pretty reliably spending $700M to $800M per quarter on buybacks.

That’s a ~2% tailwind to EPS annually as the float is reduced. So long as that continues, we should see EPS growth outperform revenue growth. FCF has been well ahead of total distributions so there’s no concern over sustainability there.

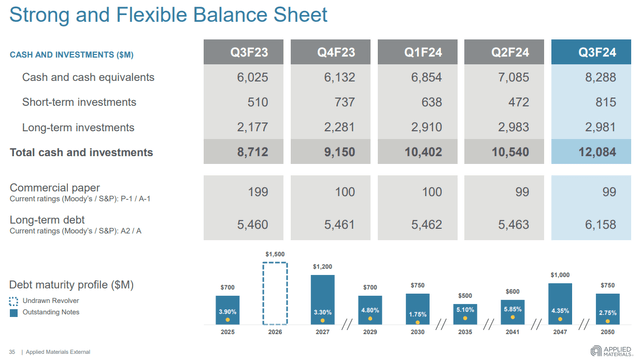

This is particularly true when considering AMAT’s balance sheet, which looks quite robust.

The company has $12 billion in cash and equivalents, with net debt of about -$5.8 billion. Absolutely no balance sheet concerns here and it gives AMAT flexibility to invest in growth, acquisitions, buybacks, or whatever else it wants.

Moving AMAT to sell after Q3 results

The final piece to the puzzle here is the valuation, and for me, it’s the nail in the coffin on the bull case for AMAT. To be clear, AMAT could just blow through resistance and all the fundamental stuff we’ve gone through to new highs. I just don’t think that’s going to happen, and I believe the odds are we’ll see lower prices before we see higher prices. For that reason, I’m moving the stock from hold to sell.

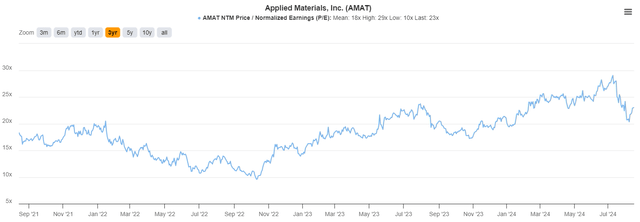

The stock is trading for ~23X times earnings today, which is 5 handles above its three-year average, although it is near the low valuation for 2024 thus far.

With AMAT growing at pedestrian rates recently but also for the foreseeable future, I can’t see paying 23X earnings. Valuations are always in the eye of the beholder, but for me, there are better values out there. I’d be interested at 18X to 20X times earnings, but at 23X the risk is simply too high.

Wrapping up, Q3 results were fine. Q4 guidance is fine. I’m still concerned about long-term margins being able to support EPS growth as revenue growth and the buyback are both good for only modest gains in earnings. The price chart and seasonality suggest we’ll see $190 before we see $220, so for that reason, I’m putting a sell rating on AMAT. I am NOT suggesting you run out and short; I’m simply saying there are better places for your money right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.