Summary:

- Medtronic stock underperformed the market, up only 4% in the past year.

- The options market predicts a 3.3% stock price swing post-earnings.

- Mid-single-digit EPS growth, rising dividends, and historically high yield for Medtronic are positive factors.

- I highlight key price levels to watch ahead of its Q1 2025 report and assess the options situation.

JHVEPhoto

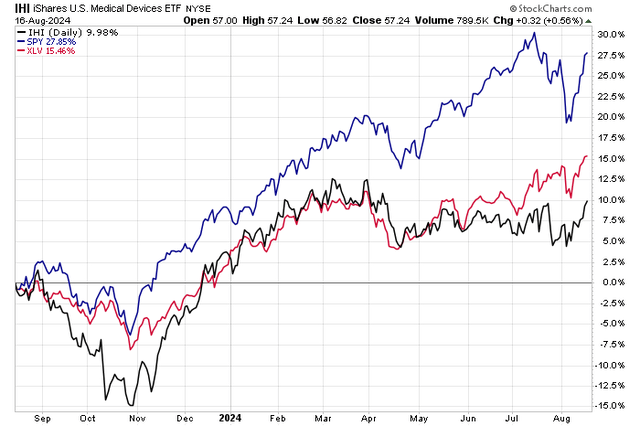

Medtronic (NYSE:MDT) continues to tread water as the broader market advances. The stock is up just 4% over the past 12 months, significantly underperforming the iShares U.S. Medical Devices ETF (IHI) which is higher by 10%. The Health Care Sector ETF (XLV) has returned better than 15% while the S&P 500 has beaten them all with a 28% performance from year-ago levels.

I reiterate a buy rating on MDT, though. I see the stock as still undervalued today ahead of its Q1 2025 earnings report due out Tuesday this week. The company has topped estimates in each of the previous eight quarters, though the stock traded lower post-earnings back in May.

This time around, the options market has priced in a modest 3.3% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the Q1 report, according to data from Option Research & Technology Services (ORATS).

But let’s take a holistic view of Medtronic and where things stand on this $109 billion market cap Health Care Equipment industry company.

Medical Device Stocks Sag Relative to the SPX, YoY

Stockcharts.com

According to Bank of America Global Research, Medtronic is a MedTech company that develops, manufactures, and markets medical devices and technologies to hospitals, physicians, clinicians, and patients. The company operates in four business segments: Cardiac & Vascular Group, Medical Surgical, Neuroscience, and Diabetes.

Back in May, MDT reported a solid set of quarterly results. Q4 non-GAAP EPS of $1.46 was a penny beat while revenue of $8.6 billion, up just 0.6% from the same period a year earlier, was a material $150 million beat. The management team increased the company’s dividend to $0.70 per share, marking the 47th consecutive year of dividend hikes, reaffirming MDT as a leading dividend aristocrat in the S&P 500.

As for the guide, Medtronic now expects FY 2025 organic sales growth to be in the 4% to 5% range, ex-currency impacts. There could be an FX tailwind in the quarter now underway, given that the US Dollar Index has slumped to its worst level since January. The management team forecasts ‘25 diluted non-GAAP EPS of $5.40 to $5.50.

Big picture, mid-single-digit top line and earnings growth is expected given its diverse worldwide exposure. What’s encouraging is that 2024 marked a series of low-bar EPS quarters, so the upcoming quarterly reports could have a tailwind from the year-on-year perspective. The firm’s healthy device pipeline and ongoing R&D efforts also set the stage for better bottom-line growth through 2027.

All the while, dividends and buybacks support the shareholder proposition. For the quarter about to be reported, trends in its Electrophysiology (EP) will be important to watch on the growth side of the ledger and updates to its Affera Sphere-9 device could drive price action on Tuesday. Analysts at UBS recently came out positive on MDT’s diabetes turnaround, but Stifel sees a muted growth outlook.

Key risks include disappointing clinical data around its devices, weaker revenue growth and guidance if new products fail to gain a foothold in the healthcare space, pipeline delays, and increased competition.

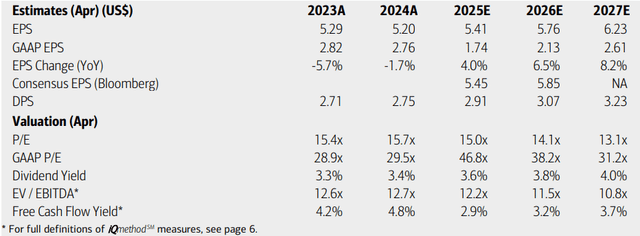

On the earnings outlook, analysts at BofA see EPS rising 4% this year, with even better operating per-share earnings growth in 2026. By 2027, non-GAAP EPS could top $6. The current Seeking Alpha consensus numbers are about on par with what BofA projects, so there is a decent amount of confidence in the profit numbers. As for Medtronic’s revenue, consistent sales growth between 3% and 5% is forecast through FY 2027.

Dividends, meanwhile, are projected to continue their rise, likely surpassing $3 per share in the out year, resulting in a yield that could top 3.5% in the coming months – a historically high rate. With a mid-teens P/E and reliable free cash flow trends, I continue to like MDT from a value point of view.

Medtronic: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

On valuation, If we assume $5.60 of non-GAAP EPS over the coming 12 months and apply the stock’s 5-year average P/E, then MDT should trade near $109.

But given its below-market EPS growth rate, shaving at least a turn off the earnings multiple is appropriate. So, an 18x P/E on the same amount of EPS yields a target of $101, a modest increase from my previous analysis in the springtime.

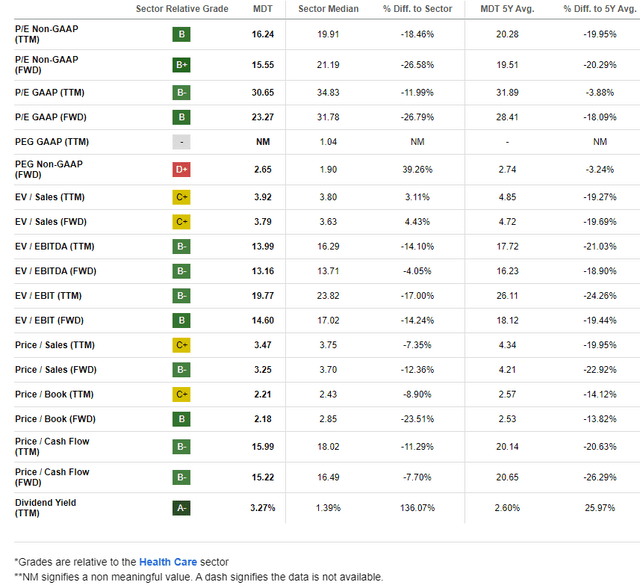

Medtronic: Encouraging Valuation Metrics, Historically High Yield

Seeking Alpha

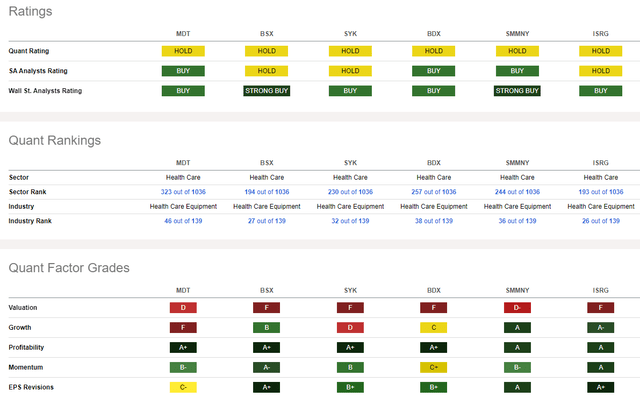

Compared to its peers, MDT features a soft valuation rating, but we see that across the MedTech space. Its growth trajectory has been admittedly weak, but the outlook appears more sanguine. Meanwhile, Medtronic’s profitability is very healthy, evidenced by the current 4.6% free cash flow yield and steady EPS.

Share-price momentum has also taken a slightly improved turn, but I will note a key resistance level on the chart to monitor through the upcoming quarterly release. Finally, the sellside remains unimpressed with MDT, indicated by a high 15 downward EPS revisions compared with just eight upgrades in the past 90 days.

Competitor Analysis

Seeking Alpha

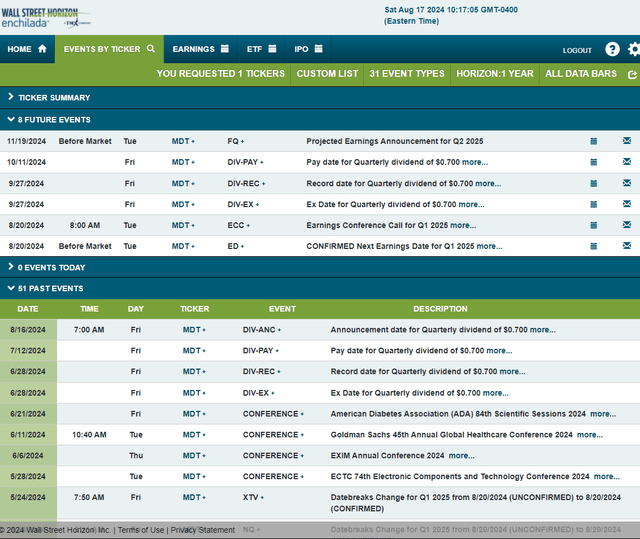

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q1 2025 earnings date of Tuesday, August 20 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. Shares then trade ex a $0.70 dividend on Friday, September 27.

Corporate Event Risk Calendar

Wall Street Horizon

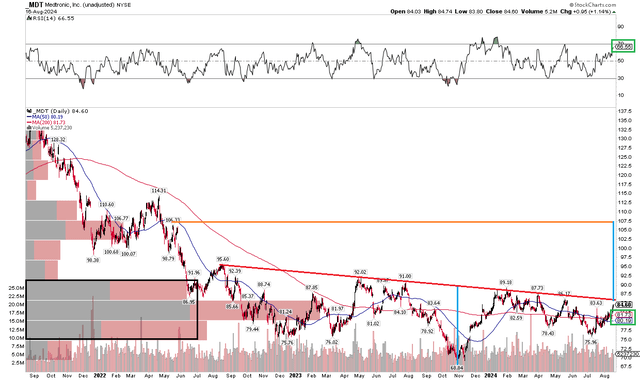

The Technical Take

MDT has traded sideways following my last analysis, posting decent earnings numbers but lacking a real bullish spark. Notice in the chart below that shares remain under key resistance, currently near $85. But if the stock breaks through that line, then a bullish upside measured move price objective to about $107 would be in play based on the height of the current consolidation, added on top of the hypothetical breakout point. What’s also encouraging is that the RSI momentum oscillator at the top of the graph has hit its best mark in three months, helping to confirm the price rise, also the best since May.

I see support in the mid-$70s, where a downtrend support line comes into play. Moreover, the lows from late 2022 and early 2023 are in the $75 to $76 zone, so that could be long-term support. But with a rather flat long-term 200-day moving average, the bulls have yet to regain control of the primary trend for now. Still, MDT is above both the 200dma and the shorter-term 50dma.

Overall, I like the stock’s rally right today and its one-month outperformance. That augers well for how shares might respond post-earnings this week.

Shares Under Resistance, Positive RSI Trends, Mid-$70s Support

Stockcharts.com

The Bottom Line

I have a buy rating on Medtronic. I see this dividend aristocrat as a solid value play going into earnings, while its technical chart has some positive signals despite the stock being under resistance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.