Summary:

- FuelCell Energy reported another set of disappointing quarterly results with revenues missing consensus expectations by a mile, gross margins at multi-year lows, and cash burn increasing to new all-time highs.

- The company finished the quarter with unrestricted cash and cash equivalents of $297.5 million, down $56.2 million sequentially, as the company abstained from selling additional shares in the open market.

- A projected lack of module replacements will impact revenues in the coming years, with the issue likely to result in the company missing FY2024 consensus expectations by a mile.

- With the legacy, natural gas-powered molten carbonate fuel cell platform not likely to make a comeback anytime soon, and the new solid oxide offering still in its infancy, I would expect FuelCell to struggle for years to come.

- Due to the company’s weak prospects, material cash burn, and resulting high likelihood of further dilution for common shareholders, I am downgrading FCEL shares to “Sell” from “Hold”.

David McNew

Note: I have covered FuelCell Energy, Inc. or “FuelCell Energy” (NASDAQ:FCEL, OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

FuelCell Energy Q1 Earnings Review

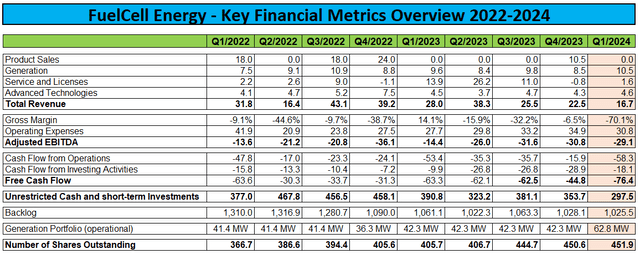

On Thursday, FuelCell Energy reported another set of disappointing quarterly results with revenues missing consensus expectations by a mile, gross margins at multi-year lows, and cash burn increasing to new all-time highs:

Free cash flow for the quarter was negative $76.4, a new record high for the company, due to a combination of heavy losses from operations and unfavorable working capital movements.

The company finished the quarter with unrestricted cash and cash equivalents of $297.5 million, down $56.2 million sequentially, as the company abstained from issuing additional shares under its “Open Market Sale Agreement” with a number of leading investment banks.

As of the end of Q1, approximately 32.2 million shares remained available for issuance under the Open Market Sale Agreement. However, in order to sell additional shares on the open market, the company must file a prospectus supplement to its registration statement on form S-3.

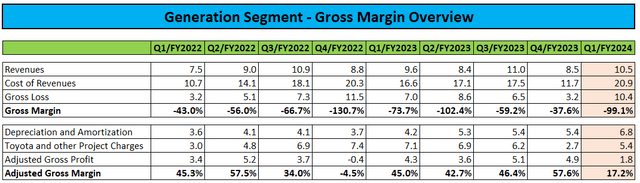

In the absence of product sales and module exchanges, the majority of Q1/FY2024 revenues were derived from the company’s generation portfolio. However, segment margin performance left much to be desired:

Even adjusted for depreciation and a number of charges related to the Toyota Tri-Generation project in Long Beach as well as an unfavorable natural gas supply contract, segment gross margin came in well below the average mid-40% number achieved in recent years.

In the company’s quarterly report on form 10-Q, FuelCell Energy states maintenance activities performed at two plants and higher overall expenses resulting from the recent addition of three completed projects to its generation fleet as the primary drivers behind the weak performance.

As the plants in Derby became operational rather late in the quarter, segment revenue should increase quite meaningfully going forward.

Beginning in Q2, I would expect quarterly generation revenues to increase to $16 million and, assuming no unplanned maintenance requirements, gross margin to rebound to the 40% to 50% range.

However, growing generation revenues beyond this level will be a difficult task, as there are no further projects under development for the company’s core molten carbonate fuel cell platform.

While the company has high hopes for its new solid oxide fuel cell and electrolysis platform, commercialization remains in its infancy, with just one small project at Trinity College in Hartford currently under development and another with the University of Connecticut having been signed recently.

In aggregate, these plants will increase installed capacity of the company’s generation portfolio by a meager 2%.

In addition, one solid oxide unit currently under construction will be delivered to Idaho National Laboratory for development of a high-efficiency electrolysis demonstration platform.

This project, done in conjunction with the U.S. Department of Energy, is intended to demonstrate that the Company’s platform can operate at higher electrical efficiency than currently available electrolysis technologies through the inclusion of an external heat source.

Nevertheless, FuelCell Energy is planning substantial investments to expand manufacturing capacity for its solid oxide platform in Canada from 4 MW to 40 MW per year (as compared to 1.25 MW in projects secured so far).

But according to statements made in the 10-Q, this is just the beginning:

The expansion of the Calgary manufacturing facility is phase 1 of the Company’s planned operational expansion of production capability. While this expansion is expected to increase our production capacity from 4 MW per year to 40 MW per year of SOECs, the Company also plans to add an additional 400 MW of solid oxide manufacturing capacity in the United States. Early facility design and engineering requirements have been developed, and the Company has engaged in an extensive search in the United States for a potential location for a new manufacturing facility, which would be incremental to the Calgary facility. Decisions with respect to the Company’s investment in facility expansion will be paced by market demand.

Please note that the company’s legacy molten carbonate fuel cell production facility in Torrington is currently running at approximately one third of its 100 MW annual nameplate capacity.

In combination with upgrades to the Torrington facility related to carbon capture and CO2 recovery, FuelCell Energy expects FY2024 capital expenditures in a range of $60 million to $75 million. Another $7 million to $10 million will be required to complete the solid oxide fuel cell installation at Trinity College in the second half of this year.

In addition, the company expects to spend between $60 million and $70 million on research and development expenses.

While the lack of new projects might be disappointing for growth investors, the resulting in much lower investment in project assets should benefit cash flow in FY2024.

However, with up to $85 million in projected capital expenditures, negative gross margins, and quarterly operating expenses above $30 million, FY2024 cash burn will still be substantial.

Assuming negative cash flow from operations of $125 million (down from $140 million in FY2023) and capital expenditures of $75 million, FY2024 cash usage would calculate to $200 million, thus leaving the company with remaining liquidity of approximately $175 million at year-end.

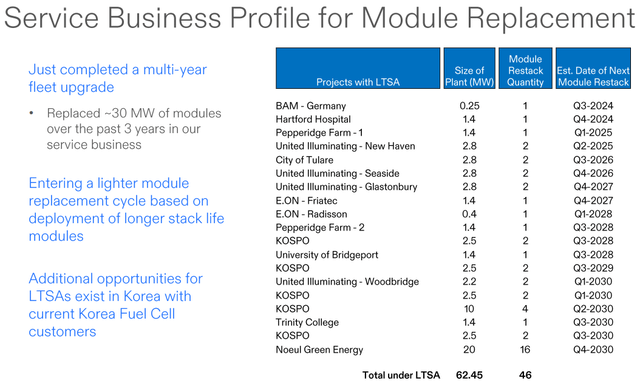

Perhaps most importantly, FuelCell Energy is likely to miss consensus top-line expectations by a wide margin this year due to a very light module exchange schedule (emphasis added by author):

The Company completed a multi-year fleet upgrade in fiscal year 2023 and is now entering a lighter module replacement cycle based on the deployment of longer life modules during the fleet upgrade. As a result, we expect lower service agreements revenues in fiscal year 2024 compared to fiscal year 2023. The Company currently does not expect any module exchanges to occur until the fourth quarter of fiscal year 2024.

Based on the company’s first quarter results and considering the projected year-over-year reduction in service revenues, I would anticipate full-year revenue of between $85 million and $95 million, as compared to current analyst expectations of $134 million.

Even worse, module exchanges are expected to remain limited until the end of the decade:

While management hopes to secure additional service contracts from former POSCO Energy customers in Korea, progress remains yet to be seen.

Please note also that potential commercialization of the company’s carbon capture solution developed in collaboration with a division of Exxon Mobil (XOM) would still be years in the future, with the next step being the construction of a pilot plant at Exxon Mobil’s Rotterdam Manufacturing Complex in the Netherlands:

The pilot plant aims to obtain data on performance and operability of the carbonate fuel cell (CFC) technology, jointly developed with FuelCell Energy. Additionally, the pilot aims to address potential technical issues that may occur in a commercial environment and better understand the costs of installing and operating a CFC plant for carbon capture.

Considering these issues, it’s hard to be optimistic about FuelCell Energy’s near- and medium-term prospects. With the legacy, natural gas-powered molten carbonate fuel cell platform not likely to make a comeback anytime soon, and the new solid oxide offering still in its infancy, I would expect the company to struggle for years to come.

Bottom Line

FuelCell Energy reported weak Q1/FY2024 results, with revenues falling short of consensus estimates and record cash burn.

Even worse, the company’s full-year results are likely to miss analyst expectations by a wide margin due to a lack of module replacements, an issue that is expected to persist for the foreseeable future.

With commercialization of the new solid oxide platform still in its very early innings and a lack of projects utilizing the company’s legacy molten carbonate fuel cell solution, I would expect tough years ahead for FuelCell Energy.

Due to the company’s weak prospects, material cash burn and resulting high likelihood of further dilution for common shareholders, I am downgrading FuelCell Energy’s shares to “Sell” from “Hold“.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.