Summary:

- Mastercard is a key player in the global payment facilitation industry, focusing on payment network growth and value-added services.

- Mastercard’s shareholder rewards include reliable dividends with robust growth and significant share repurchases supported by strong cash-generation capabilities.

- The company is substantially more pricey than its close competitor – Visa; however, MA has consequentially delivered stronger revenue growth in recent quarters.

- I am overweighing Visa, as I believe it to be a stronger ‘buy’ case, but both entities are worth including in a well-structured portfolio.

gazanfer

Investment Thesis

We are all getting used to the fact that change is the only constant. At Cash Flow Venue, we build a resilient, dividend-oriented portfolio, generating steady and growing income. Accordingly, my attention is always caught by cutting-edge enterprises revolutionizing our world by providing mission-critical infrastructure.

I believe that to be the case for Mastercard (NYSE:MA), one of the key technological players offering robust dividend growth and potential for multiple expansion. During recent quarters, Mastercard outperformed the industry-leading Visa (V) regarding revenue growth. Therefore, the market awarded it with a noticeably higher valuation.

Despite the narrow margin of safety and limited potential for multiple expansion, there is still room for further upside. Combined with:

- reliable, mission-critical business model

- high profitability, resulting in the fact that MA is a cash-flow machine

- robust dividend growth accompanied by meaningful share repurchases

Mastercard is a compelling ‘buy’ case for me. Even with potential volatility in stock price, current and entry-level shareholders will do relatively well with Mastercard. I am bullish on MA.

For transparency, I’m accumulating and overweighing Visa, as I believe that to be a stronger ‘buy’ case – mostly due to its valuation. Nevertheless, both entities are worth including in a well-structured portfolio, and today, we focus on Mastercard. Enjoy the read!

Mastercard – Who Are You?

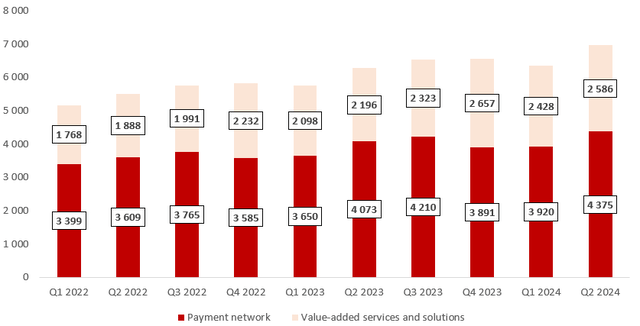

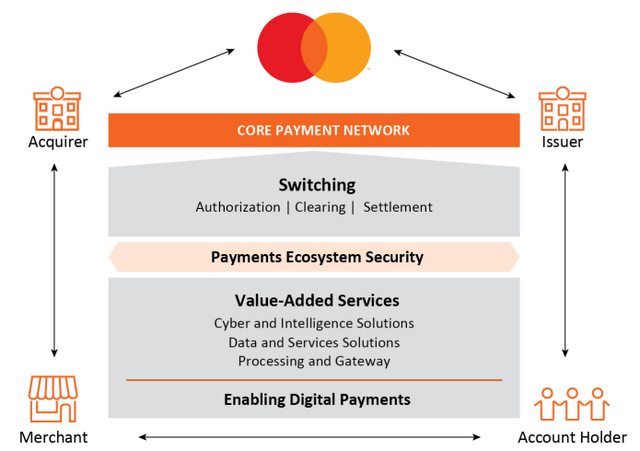

Mastercard is one of the key players in the global payment facilitation industry. The Company distinguishes (for reporting purposes) two revenue sources:

- payment network: the main growth driver of this segment is based on the domestic and cross-border Gross Dollar Volume realised through MA-branded cards

- value-added services, which include, inter alia, payment processing, gateway, security, intelligence solutions, data processing, open banking solutions, and digital identity solutions

Revenue generated within the payment network usually exceeds 60% of MA’s total revenue; however, the growth dynamic of value-added services has been noticeably higher during recent quarters. If that tendency is upheld, the significance of this segment will increase.

Please review the chart below (in $ m) for details regarding the development of MA’s revenue by business segment during the Q1 2022 – Q2 2024 period.

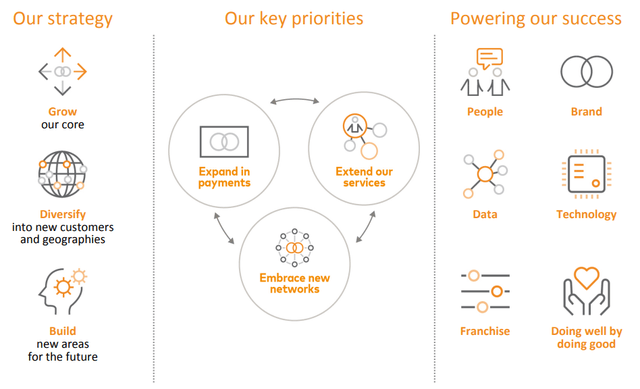

Mastercard’s strategy concentrates on developing its payment network and business scale through customer and geography diversification, adopting new organic and external opportunities to offer better solutions for consumers, governments, and businesses. Moreover, its business will be supported by:

- proceeding shift from cash to digital payments

- ever-growing significance of e-commerce entailing non-present, usually digital settlements

- further innovations increasing the convenience of digital transactions, security systems around them, and user experience

Quick Peek At Visa – Mastercard Is Growing Faster

The payment processing industry leader and MA’s closest competitor – Visa. V has recently released (fiscal) Q3 2024 results. Visa fell short of the analysts’ expectations, delivering ~$20m revenue below the consensus. Still, it grew its revenue by 9.6% year-over-year, much above what most businesses can wish for during the ‘bad’ quarter.

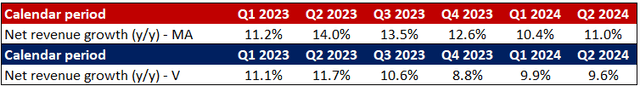

Nevertheless, Mastercard delivered more dynamic revenue growth during calendar Q2 2024, and that has been the case during previous quarters. The last calendar quarter in which both entities delivered similar revenue growth was Q1, 2023. For clarity, I’m using ‘fiscal’ vs ‘calendar’ nomenclature as Visa’s fiscal year doesn’t align with the calendar year – it’s technical to ensure that we are comparing apples to apples.

For details, please review the table below depicting each entity’s y/o/y net revenue growth rate.

Author based on Mastercard and Visa

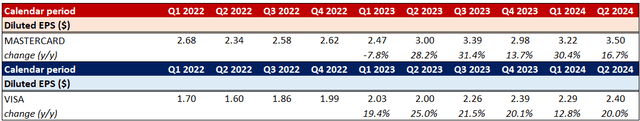

One thing to consider is that Visa delivered more dynamic diluted EPS growth over the last couple of years. The compound quarterly growth rate of the above metric during Q2 2022 – Q2 2024 amounted to 3.9% and 3.0% for Visa and Mastercard, respectively. For details, please review the table below.

Author based on Mastercard and Visa

Major Shareholder Rewards

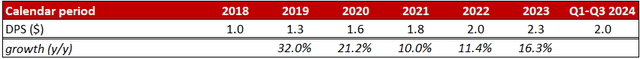

As mentioned earlier, at Cash Flow Venue, we concentrate on building a resilient portfolio that generates reliable, growing income. While MA’s dividend yield won’t be tempting for many investors, as it’s currently amounting to a modest ~0.6%, it’s crucial to consider the DPS growth rate Mastercard delivered.

During the 2019 – 2023 period (with 2018 as a base year), MA recorded a compound annual DPS growth rate amounting to 17.9%, which is higher than Visa’s 16.3%. However, the CAGR was noticeably influenced by the growth recorded in 2019, amounting to 32%, so if we look at the shorter period – let’s say – 2020 – 2023, the CAGR would amount to 14.6% (vs Visa’s 15.5%). Naturally, it’s always a matter of the period under analysis. Nevertheless, I expect MA’s DPS growth rate to remain at 14-16% in the long term. Also, MA’s annualized DPS recorded in 2024 implies a 15.8% y/o/y growth rate compared to dividends paid in 2023.

Please refer to the table below for details regarding MA’s DPS development in recent years.

It’s also important to factor in share repurchases, which constitute a large portion of shareholder rewards. During the six months ending June 2024, the Company spent ~$1.2B on dividends and almost four times this much on treasury stock purchases – ~$4.6B.

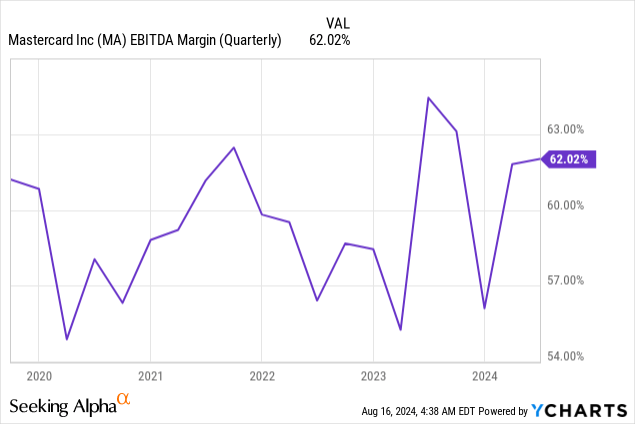

MA can uphold and grow dividend payments and overall shareholder rewards due to the cash-machine-like characteristic of its business. Mastercard operates on a high EBITDA margin, which ensures significant cash generation within its operational activity, amounting to $4.8B in Q1 – Q2 2024.

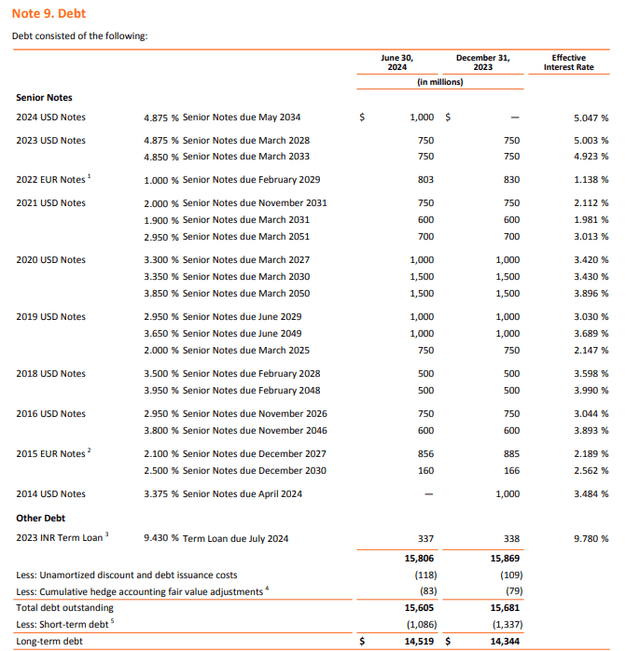

Dividend payments and growth are supported by a safe financing structure characterized by well-laddered debt maturities, with $337m debt maturing in July 2024 and no further maturities until November 2026. The Company remains well-capable of refinancing its debt. During the Q1 – Q2 2024 period, MA paid the $1.0B principal resulting from 3.375% Senior Notes due in April 2024 and issued the same amount in May at 4.875%, with a slight negative impact on its cost of debt. The favourable debt maturity schedule limits the risks associated with the high-interest rate environment.

Valuation Outlook – No Free Lunches

As an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors and transactions.

With that said, the forward-looking EV/EBITDA multiple stood at:

For some P/E advocates, the forward-looking GAAP P/E stood at:

- 27.0x for Visa

- 32.7x for Mastercard

Clearly, Mastercard is relatively pricey compared to Visa. This phenomenon can be rationalised through a simple argument – Mastercard has been growing faster. Should this dynamic be upheld, MA would continue to improve its relative position to Visa, possibly leading to overtaking the leadership position.

Naturally, this sounds compelling and paints an optimistic picture. However, investors have to be aware that there’s less margin of safety and lower dividend yield resulting from investment in MA over Visa. Nevertheless, current and entry-level shareholders will do relatively well with Mastercard (as long as the long-term perspective is in place).

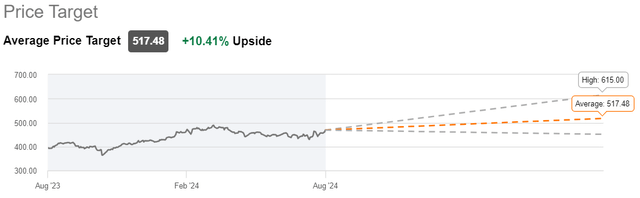

Should MA uphold its track record, I believe it is capable of reaching the average Wall St. Analysts’ price targets, implying multiple expansion to ~28x EV/EBITDA.

The Bottom Line

Mastercard has mission-critical solutions, which make its business model reliable and highly profitable. The value drivers resulting from both internally driven activities and external secular trends are still in place to facilitate the Company’s further development.

Should it uphold its track record, there’s a potential room for multiple expansion, which, combined with substantial shareholder returns through stock repurchases and growing, well-covered dividends, paints a reasonable risk-to-reward scenario.

With that said, let me state that again:

- the margin of safety isn’t as wide as in the case of Visa

- the potential upside resulting from multiple expansion is limited

Also, there are noticeable risk factors to be aware of:

- high interest rate environment may negatively impact MA’s cost of debt upon future refinancing activities

- potential recession and global tensions may limit its ability to grow the scale of its business both in terms of pricing power, revenue drivers (GDV growth), and signing new contracts or expanding into new geographies

- Mastercard is a key technological player responsible for mission-critical infrastructure. Therefore, any cyberattacks or data leakages would hurt its brand reputation, financial results, and potentially lead to higher stock price volatility

- any other material adverse changes can occur

I believe that MA still looks buyable, but the ‘buy’ window is relatively narrow, so further multiple expansion would shift my views to ‘hold’, even with the growth dynamic upheld. That’s a ‘buy’ rating from me – cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

I'm also looking forward to initiating my MA position in the upcoming weeks. However, I'm accumulating and overweighing Visa as I believe that to be a stronger 'buy' case, but both are worth considering.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.