Summary:

- Penn Entertainment stock has fallen due to failed digital efforts, including $850m investment in Barstool Sportsbook, with less than 5% market share.

- Recent moves, including a $1.5b partnership with ESPN for ESPN Bet, have not excited investors, with stock trading below $20.

- S&P Global downgraded Penn’s ratings to B+ due to expected digital losses of $350m to $420m, making the stock a risky investment.

PENN BOUGHT ARRACTIVE DEMOS TWICE. NIETHER BARSTOOL FOR ESPN TO DATE HAVEN’T PROVEN THAT ASSUMPTION.

Hirurg

- Penn Entertainment (NASDAQ:PENN): Two key moves needed to turn Mr. Market positive on the stock again

- Little question that a succession of questionable moves has sunk the once glowing prospects for Penn shares to a sell call by several analysts—including me.

- My core bull position on the shares turned bearish on my appraisal of the brick and mortar management savvy, having failed in two digital efforts—to date.

- Penn’s strength has always been its smarts that drove its regional casino business to leadership volume and earnings.

Premise: My positive position on the stock going back three years was built off execution of a smart, ground rooting blue-collar management culture. But Penn fell in love with digital when its strategy from day one was to buy, not develop, from scratch, a sports betting database. We saw this from the Barstool buy in 2020, eventually costing the company $850m. The result was marginal. Barstool sports book generated a less than 5% market share. Even a dream existing demo (55m stoolies) encountered massive competitive headwinds from, the two sector leaders, Flutter Entertainment (FLUT) and DraftKings (DKNG).

Well behind the leaders, there were another 10 marginal platforms in the sector. Casino operators MGM and Caesars had the resources to build share by throwing money at the business. But neither has thus far come close to a market share anywhere near the top two.

MGM partnered with UK giant Entain and CZR bought legacy platform both in brick and mortar sportsbooks and their own 65m customer database. Yet, each has yet to penetrate the combined 70% share of Flutter and Draft Kings. Both are still lingering in single figure/ low double figure shares despite aggressive marketing spend over 5 years.

Above: Trade continues to fall below $20. A falling knife?

Stipulation: On June 27, I published an SA article based on info from the Hollywood gossip site, The Ankler. The piece dealt with the ongoing controversy between Wall Street analysts. Many Hollywood executives resent the sometimes intrusive judgments of analysts on streaming management.

The example cited was the horrific call by 30-year veteran superstar BofA’s Jessica Reif Ehrlich: Just before the ATT spinoff, she said the deal had an 82% upside ahead. It now trades at $19.26. She branded it the “worst call I’d ever made” and confessed to being “mortified” that so many people lost money on her call.

I included myself among the intrusive analysts. But I do claim a bit of immunity from the critiques. In all the pieces I write with advice to the streamers, a great deal of its POV springs from my 30 years as a senior executive in many multi-billion dollar gaming and entertainment companies. My goal is always to round out investors’ knowledge base in a stock that attempts to explain how and why certain decisions are made. The idea is to infuse a knowledge track that would help investors understand the inside of decision processes well beyond what any standard metric will do.

The digital failure to date

After a constant tussle with Barstool’s Dave Portnoy over the annoying, if not painful intrusions of licensing officials, Snowden wanted him gone. So Penn emptied the digital treasury of $500m, paying the maverick media mogul to just go away. The overall digital bill for Penn then grew to $850m.

With no lesson learned by the first wrong turn, Penn then moved to Disney’s ESPN, essentially buying a marketing partnership for another $1.5b over ten years as a rebranded cloak for Penn’s sports betting platform. The brand: ESPN Bet. It’s early, but to date, the new subscriber base is bigger than the Barstool Sportsbook was (ESPN estimated 71m, down 20% over the last five years).

Dave Portnoy really wasn’t the problem. Frustrating yes. But the core problem was excess optimism over the Barstool 55m database.

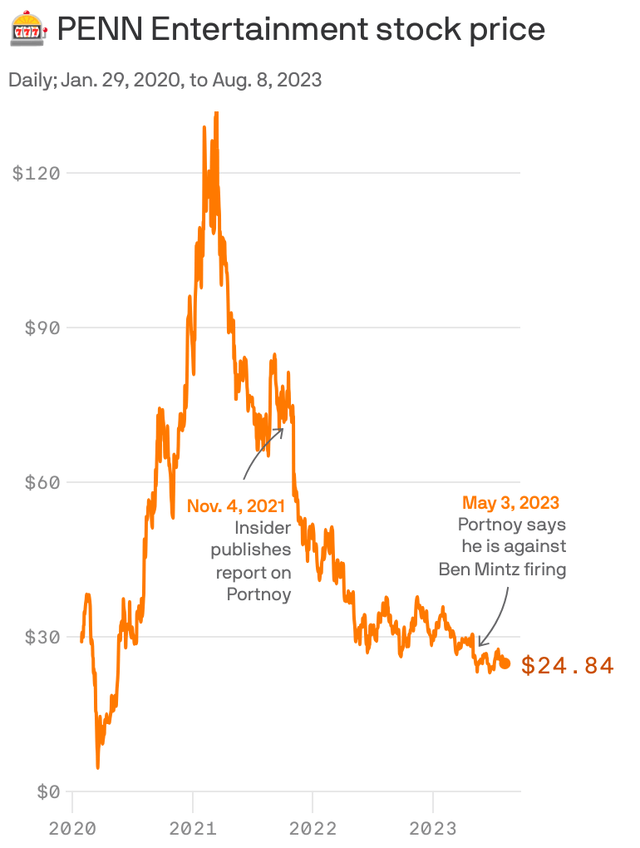

But results to date have yet to move Wall Street. When the Barstool deal was announced in 2020, Penn traded at ~ $33. News of the Penn buy out last March saw the stock dip to $22.20. But since encouraging first week sign-ups, there has been nothing in the ESPN Bet performance exciting Mr. Market. While the sector continues to grow at a CAGR 10.3% rate, the new brand remains in the basement of sports betting platforms—that’s to date.

There is much time ahead for the ESPN Bet to move up in a sector with ebullient growth, it is true. But at this point, the two sports betting moves by Penn have racked up a sunk investment now reaching toward $2 billion.

Essentially, flat Penn YoY revenue and earnings for its casinos suggest that the company may well have lost its way in the eyes of investors. The dynamic of property acquisitions and improving earnings from its existing casinos, which was part of the rationale for strong positive sentiment on the stock, appears gone.

Adding to the digital uncertainties was a quantum leap in the Penn customer service standards by instituting an ongoing test of a “contactless” process for customers from check in to check out. In other words, in the test properties now, a customer arrives, is greeted by a welcoming video, checked in by screens, asked if help with luggage is needed, moves to a room and using the smart phone can:

1. Establish a customer rewards ID so that play earning points can be calculated against comps, scan or make all reservations for in property amenities, dining, spa, shows etc.

2. This digital service clearly eliminates tons of payroll in the long run—an early response to the threat of AI, as well as cost of labor.

But in my 35 years of experience running casino marketing and related operations, our priority was based on our assumption that everyone has a slot machine and a buffet. The key way to differentiate one property from another was to deliver visibly better personal customer service. Survey after survey of customers proved this truth.

So while I liked the bold, innovative test by Penn beating the inevitable to the punch, I think the final judgment of the test may still discover a significant customer segment that prefers high contact personal service. Overall, Penn’s move to digitize the business may be premature. Thus far, its ESPN Bet deal has lost nearly $200m in four months. Add that to the prior failed Barstool deal and you have $1b in the tank. Add that the ESPN deal has more than nine years to run with Disney at $150m per. When and if the rebranding marketing effort will turn profitable remains to be seen.

The Penn trading history YTD is still not pretty

Consider the underperformance of its casino business over several quarters, its fumbles on digital, the price history shouldn’t stun investors. Just a few highlights and low lights.

Price at writing: $19.28

June 2018: $33.59. (This is a month after the SCOTUS decision).

All-time high: February 2021 (a post covid recovery year): $128

Stock at Jan 2024:

Short interest: 14+%, almost two percent above float, on the cusp of concern.

Price at Jan 2024: $25.95

Forward prospects

A casino stock with 42 properties and a customer rewards base in the area of 20m experiencing a plummeting of its share price anywhere near its March 2021 high ~$142% commands our attention. It’s worth a look to see if there is any catalyst in the near or intermediate term that could start the stock climbing back at a pace making it a BUY.

We see little thus far.

Financials intruding: Last February, S&P Global downgraded Penn ratings—B+.

Current ratio: 1.04

Leverage: 6.5X

Long-term debt to 2/24: $7.1b

Downgrade entirely attributable to expected losses in digital they believe can run $$350m to $420m this year in promotion of ESPN Bet.

So Penn stock’s fate at the moment is totally in the hands of its digital performance, not any exponential growth in its casinos. Adding the anticipated losses thus far to what SP Global thinks it will lose in digital this year, brings the grand sunk total to over $2b.

The digital gambling sector will show a healthy growth to 2023, but the fundamental business model is still flawed. That won’t change for ESPN Bet. It is a low margin business, requiring platforms to sustain growth in spite of a need to reduce promotional spend. It is also a low barrier to entry sector, already crowded with nearly 15 platforms. And ESPN Bet is among the late comers.

Our view now: If you hold at current prices bearing even a small profit, sell to avoid a falling knife scenario, as continued losses in Penn digital will spell rising short interest rates. If you see a possible bargain, take a pass for now. The stock is nowhere near where some fundamentals suggest it’s worth a buy signal.

If you hold a small position, you might want to roll the dice for the next quarter to reflect a sector wide spike in sports betting springing for the start of the NFL season.

A strong surge of ESPN Bet beyond its weak start might be a short-term hold. A market share gain to a high single digit number head to head with MGM or CZR could turn some sentiment positive. The Penn geography is deep into states with powerful football fandom.

Penn was a stock we were strongly bullish on when it was turning out earnings and strong revenue gains from properties long owned and recently acquired. We saw digital as a small, but future contributor to the group. We liked management’s skill sets. But in time, we did not like its surrender of treasury and management focus to digital long after it had proven a dead loser—at least short term.

At this point, at best, Penn is a watch list stock.

On the casino side, Penn has basic strength in its geographic diversity, and well run properties in highly competitive markets. But we don’t see more properties being added this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.