Summary:

- Palantir’s Azure integration in government sectors drives growth, leveraging GPT-4 and classified cloud for high-value contracts.

- RPO surged to $1.37B in Q2 2024, up 14% over two years, signaling faster revenue recognition and higher contract value.

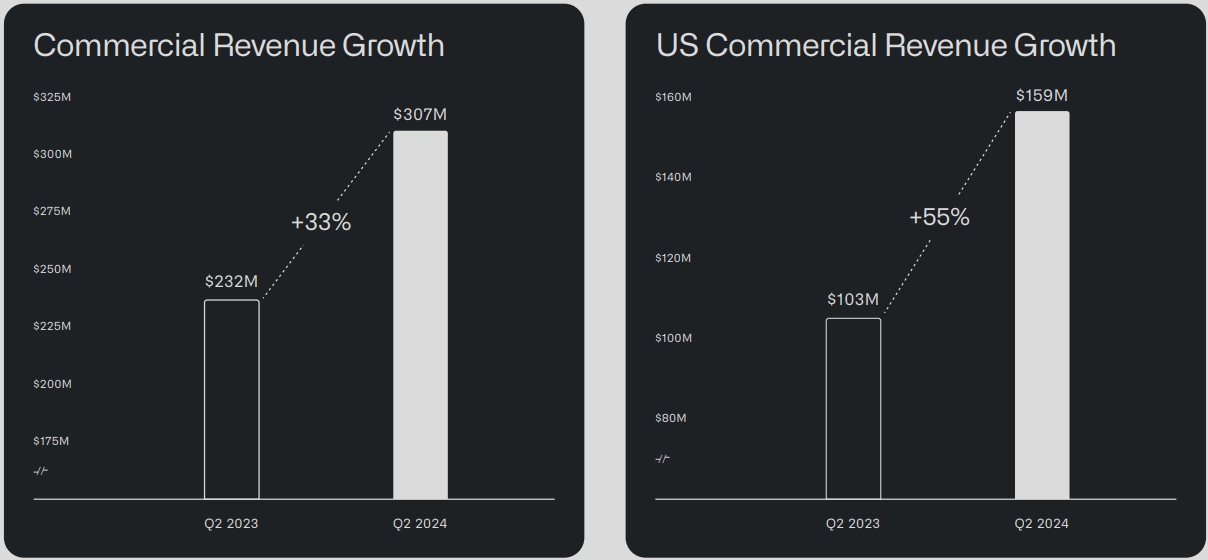

- US commercial revenue grew 55% YoY, with an 83% increase in customers, reflecting strong AI sector growth.

- Palantir secured 96 US deals over $1M in Q2 2024, contributing to a 152% YoY increase in contract value.

- Palantir’s stock is trading at $32, with a target of $39 for 2024 and potential to reach $50, driven by solid fundamentals.

koto_feja

Investment Thesis

In our earlier coverage, we took a bullish stance on Palantir Technologies Inc. (NYSE:PLTR) ahead of its Q2 earnings, supported by solid fundamentals, strategic positioning in the Industry 5.0 space, and a revised SARs (Stock Appreciation Rights) scheme that helped mitigate stock-based compensation (SBC) dilution. Following its Q2 2024 release, Palantir’s stock has performed well, leading us to upgrade our target price to $39 for 2024.

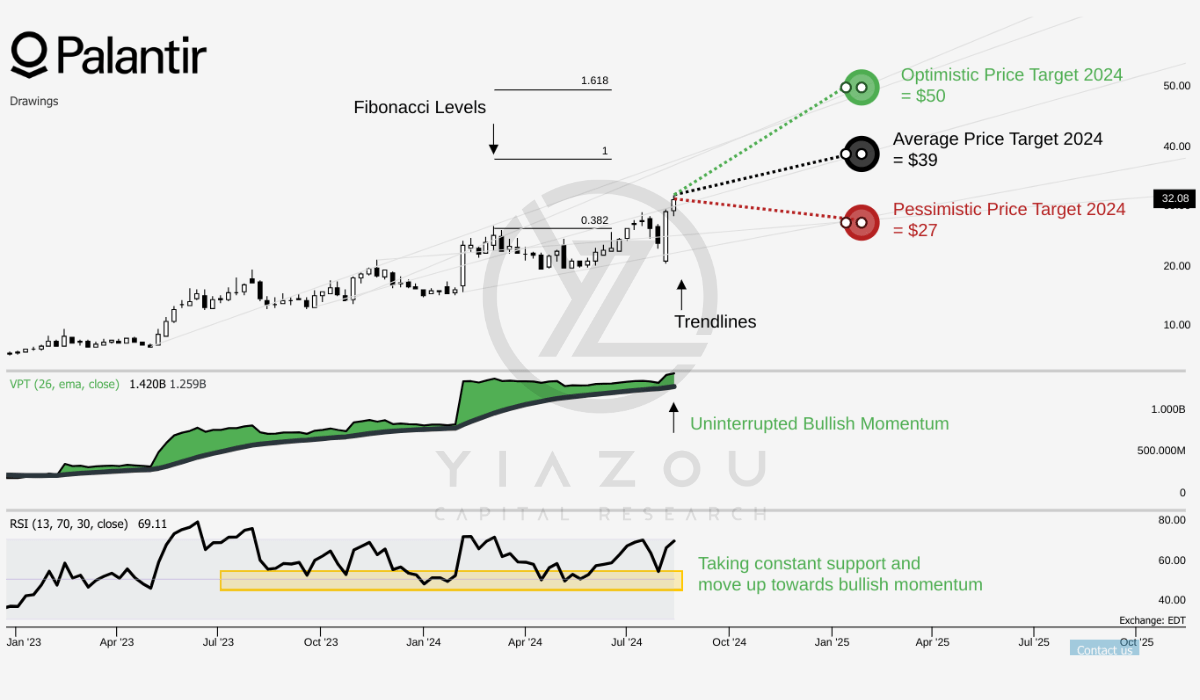

Technical Take: $39 Price Target For 2024

Palantir stock’s current price is $32, with an average price target of $39 for 2024. This target aligns with the Fibonacci 1 level, suggesting a moderate upside in the stock price. An optimistic target of $50 correlates with the Fibonacci 1.618 extension, indicating a potential breakout to higher resistance. Conversely, a pessimistic target of $27 aligns with the Fibonacci 0.382 level, suggesting possible retracement support in case of downward pressure.

The Relative Strength Index (RSI) stands at 69, nearing overbought territory, and there is a bearish divergence, signaling potential price weakness. However, the RSI line is trending upwards, indicating a temporary recovery in momentum. The long setup at RSI of 50 suggests that Palantir previously touched a support level, which could provide a solid entry point.

Regarding volume dynamics, the Volume Price Trend (VPT) line is also reverting upwards, with a current value of 1.42 billion. This exceeds its moving average of 1.26 billion, signaling increased buying interest and prolonged momentum. The VPT-based long setup can be marked as the support observed on the moving average, reinforcing the potential for recovery after corrections.

Author (trendspider.com)

Partnership with Microsoft: A Significant Advancement

Palantir’s partnership with Microsoft represents a core fundamental that may lead to its rapid top-line growth. This partnership will integrate Palantir’s sharp AI capabilities in its Foundry, Gotham, Apollo, and AIP platforms with Microsoft’s cloud infrastructure in Azure Government cloud environments.

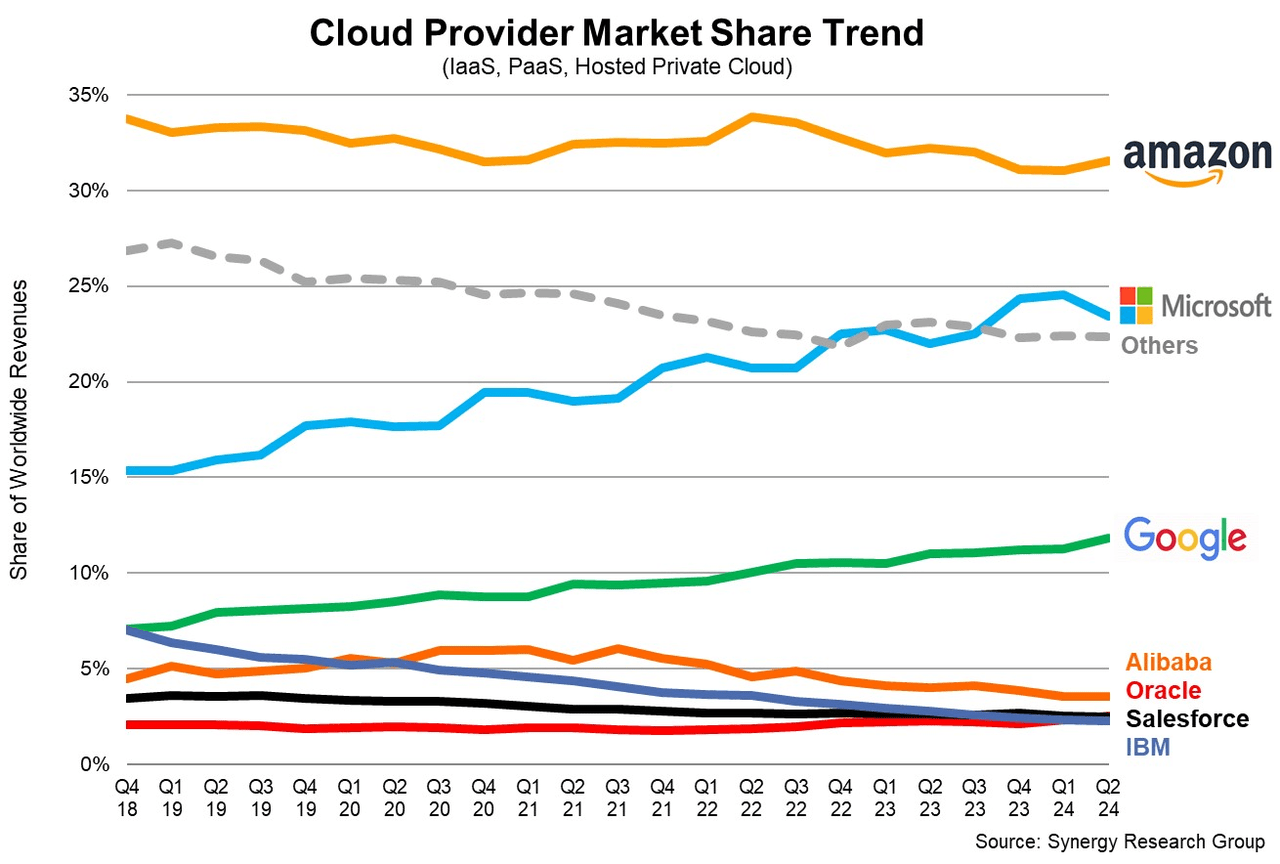

This partnership will support Palantir’s business by creating advanced AI-driven solutions and securing high service quality in critical national security operations. Microsoft is already leading the cloud market through Azure with a 23% market share as of Q2 2024.

Further, Palantir will leverage Microsoft’s large language models (LLMs) like GPT-4 within classified cloud environments, providing the company an advantage in the government sector. Palantir’s solutions are increasingly being deployed in government environments classified as Top Secret (DoD Impact Level 6). This high placement level with the government suggests Palantir’s ability to operationalize and monetize advanced AI in government environments.

Finally, the market for AI-driven operational workloads in defense and intelligence has significant potential. Palantir’s solutions address critical logistics, contracting, and action planning challenges. Through this partnership, Palantir increased its capacity to capitalize on high-level government contracts to ensure a growing revenue stream from government operations.

Similarly, this suggests the company’s growth potential in the broader AI and cloud analytics sector. The secure deployment of Palantir’s platforms in government settings also suggests its capacity to expand into highly regulated industries and markets, further cementing Palantir’s long-term revenue growth.

Palantir’s Explosive RPO Growth Signals Strong Contract Momentum and Revenue Surge

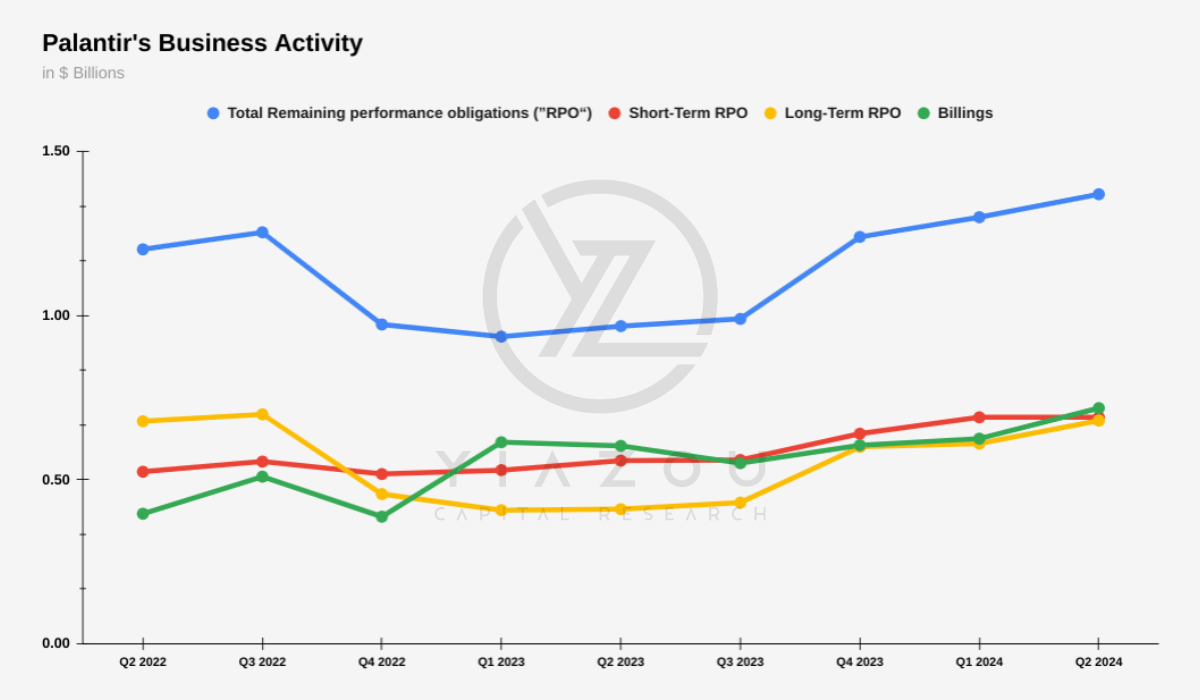

Palantir’s remaining performance obligations (RPO) show a solid upward trend to $1.37 billion in Q2 2024 (from $1.2 billion in Q2 2022). The 14% growth in RPO over two years reflects the company’s expanding client base with the increasing value of its contracts.

Moreover, short-term RPO has improved to $0.69 billion in Q2 2024, reflecting a 33% increase (against $0.52 billion in Q2 2022) in the obligations that will be recognized within the next 12 months. This suggests that Palantir is securing contracts with faster revenue recognition cycles to increase its ability to derive near-term top-line growth.

Further, long-term RPO stabilized at $0.68 billion in Q2 2024 from $0.68 billion in Q2 2022. The dip in long-term RPO in Q4 2022 and Q1 2023 (it reached $0.41 billion) reflects short-term variability in long-term government and commercial contracts. However, the recovery to $0.68 billion in Q2 2024 suggests stability in Palantir’s model in securing long-term contracts.

Lastly, billings increased from $0.40 billion in Q2 2022 to $0.72 billion in Q2 2024, a high 80% growth over the midterm. Therefore, this growth indicates a constant increase in business activity and demand for Palantir’s platforms.

Author’s compilation

Palantir’s US Commercial Surge: 152% Contract Growth and Expanding AI Dominance

Palantir’s US commercial market has experienced significant growth, with commercial revenue increasing 55% year-over-year (YoY) in Q2 2024, highlighting the company’s success in scaling its commercial operations. Additionally, quarter-over-quarter (QoQ) revenue growth of 6% indicates sustained momentum and further traction in the US commercial sector.

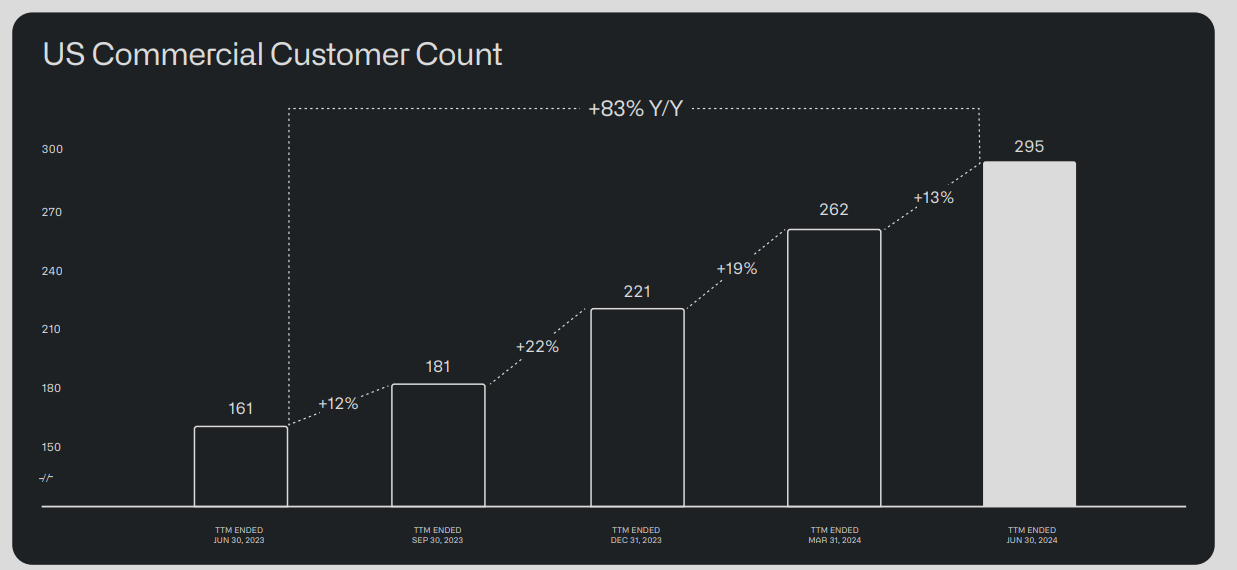

Additionally, the US commercial customer count increased 83% YoY to 295 in Q2 2024 from 161 in Q2 2023. This 2X client growth in one year reflects Palantir’s ability to attract commercial clients across industries rapidly. The company’s focus on providing enterprise AI solutions is leading to rapidly expanding its client base.

Moreover, the remaining deal value in Palantir’s US commercial business surged 103% YoY in Q2 2024. Meanwhile, the number of deals closed grew 98% YoY, which suggests the increasing value of Palantir’s contracts, with more significant deals being signed across its US commercial operations. The closing of 123 US commercial deals in Q2 2024 indicates the company’s growing footprint in the commercial sector.

Finally, Palantir’s commercial contracts, worth over $1 million, have also increased rapidly. In Q2 2024, the company closed 96 deals worth over $1 million, with 33 deals exceeding $5 million and 27 deals worth over $10 million. This shift towards more significant deals reflects the growing moat in the US commercial market with Palantir’s ability to deliver enterprise-grade AI solutions. The company’s commercial total contract value (TCV) reached $262 million in Q2 2024, a staggering 152% increase YoY, demonstrating the accelerating adoption of its platforms by large commercial clients.

investors.palantir.com

Palantir’s Overdependence Risk: Slowing Customer Growth Raises Concerns

Palantir’s revenue mix is concentrated among a few large customers. For example, revenue derived from its top 20 clients has grown 9% YoY and now stands at $57 million per customer. Hence, there might be slower growth associated with it, therefore, an associated possible over-reliance on a small number of clients; any reduction in business from these critical customers could, therefore, make an enormous adverse impact on Palantir’s total revenue.

Besides, the QoQ growth rate of US commercial customers decreased to 13% in Q2 2024 from 19% in Q1 2024 and 22% in Q4 2023. Because of this, the stock price would be capped at the increase in the near term. If it persists, it can cause a long-term downward spiral of stock prices because the commercial category holds the key to Palantir’s growth beyond government contracts. A stagnation in commercial growth would undermine efforts to diversify the company’s revenue streams and sustain top-line growth.

investors.palantir.com

Takeaway

Palantir remains well-positioned for growth with a key Microsoft partnership that is driving expansion in the government and AI sectors. Strong RPO growth and rapid gains in its US commercial market underscore the company’s momentum. However, overdependence on a few large customers and slowing commercial client growth pose risks. Finally, with a current price of $32, Palantir’s 2024 target is $39, with a potential upside of $50, but downside support at $27 reflects caution amid possible market volatility.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.