Summary:

- Verizon’s Q2 performance showed positive trends, including a positive dynamics in operating metrics and a 2.8% YoY growth in non-GAAP EBITDA.

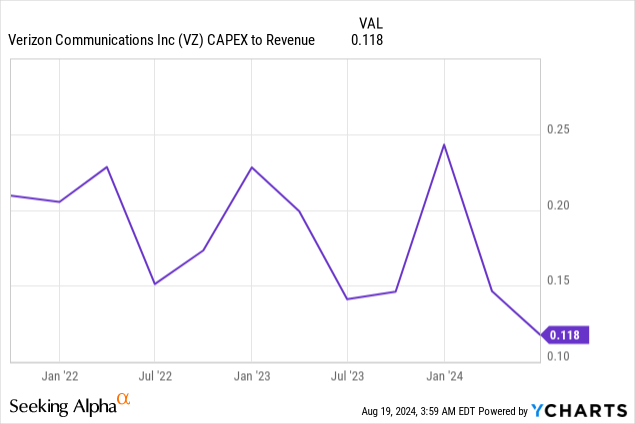

- Moderating CapEx and improving free cash flow indicate improved dividend safety and future growth probability.

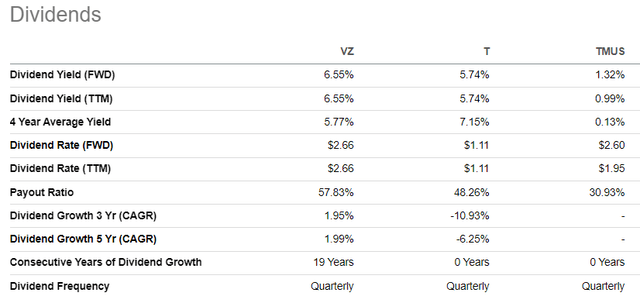

- Verizon’s dividend yield and growth record are the best-in-class among the three largest U.S. telecom players.

- My valuation analysis suggests the stock is around 46% undervalued.

M. Suhail

Introduction

I had a ‘Strong Buy’ thesis about Verizon (NYSE:VZ)(NEOE:VZ:CA) in May, and the stock’s total return (5.51%) was behind the S&P 500 since the article was published at Seeking Alpha. Nevertheless, I am quite optimistic because VZ is a safe dividend play, in my opinion. The company’s management continues to demonstrate a holistic approach to developing the business, balancing between improving operating metrics and cost discipline. Additionally, the management’s sound capital allocation approach is another reason why I believe the stock’s high dividend yield is safe and poised to demonstrate modest but stable growth. The stock is around 41% undervalued, which makes me reiterate my ‘Strong Buy’ rating for VZ.

Fundamental analysis

Verizon’s Q2 release added to my optimism due to several positive trends in the company’s quarterly performance. The company delivered in-line with consensus EPS despite a slight miss in revenue, with revenue remaining almost perfectly flat on a year-over-year basis. The non-GAAP EPS declined YoY from $1.21 to $1.15, mainly due to a $404 million increase in interest expense. This is a temporary factor due to the tight stance of the U.S. monetary policy. Moreover, the Fed is expected to start cutting rates soon, which will be beneficial for VZ. A positive sign indicating improved operating efficiency at Verizon is a 2.8% YoY growth in adjusted EBITDA. While some may consider this improvement modest, I consider any expansion in EBITDA for a mature business like VZ to be positive, especially considering flat revenue. Moreover, the EBITDA expansion accelerated in Q2 compared to a 1.4% YoY growth in Q1.

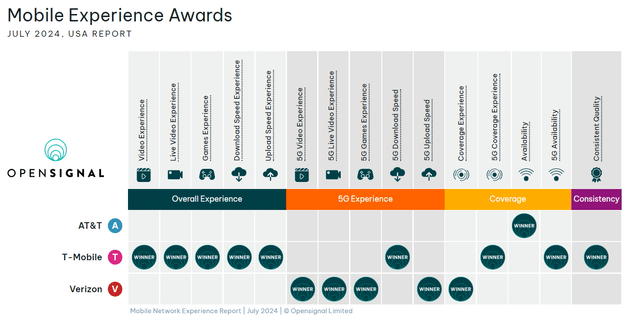

The company’s revenue is growing slow because of a nearly 100% telecom penetration in the U.S., and the entire industry is experiencing subtle growth. Verizon operates in a very mature oligopoly, where key customer metrics are crucial for success, as healthy consumer metrics are highly likely to prevent expanding churn rates. Therefore, I consider Q2’s 9.3% YoY growth in wireless retail postpaid and a 12.0% YoY growth in consumer wireless retail postpaid gross adds to be a solid indication of the business expanding its footprint. Verizon’s churn rates also improved on a sequential basis, with wireless retail postpaid churn decreasing from 1.15% to 1.11% and wireless retail postpaid phone churn from 0.90% to 0.85%. The churn rate dynamic looks quite positive and adds optimism to me. The favorable trend in Verizon’s consumer metrics appears justified as the company provides an unmatched 5G experience, according to opensignal.com.

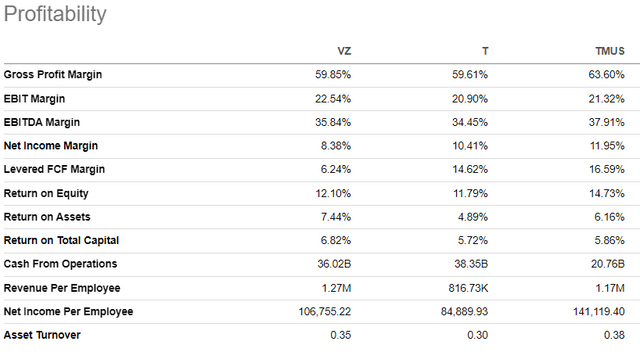

The management’s holistic approach to developing both the top and bottom lines can be seen by its better than competitors’ ROA and return on total capital metrics, which reflect the efficiency of assets and capital employed. I would also like to emphasize that VZ has strong per employee metrics compared to rivals, meaning that the company efficiently manages its headcount.

Recent trends in Verizon’s performance add a lot of optimism to me because key business metrics demonstrate positive trends and EBITDA expansion suggests that the management’s cost-saving initiatives are efficient. Since Verizon appears to be at the forefront of the 5G experience quality, I believe that higher uptake rates compared to competitors will be fair over the long term.

Once again, I want to praise the management’s disciplined approach in respect of the capital allocation. The company’s net debt position improved by around $2.5 billion on a QoQ basis, which is positive. Another favorable trend for investors is the moderation of CapEx as a result of greater progress in the 5G network build out. According to the company’s cash flow statement, CapEx decreased by around 10% on a YoY basis, positively impacting free cash flow. With EBITDA demonstrating improvements, stabilization of debt levels, and CapEx decreasing, I think that the dividend’s safety and its future growth probability is improving.

To add more, the current sentiment in the stock market is likely to favor strong dividend players like VZ. As Q2 earnings season is almost over, we see that none of the big tech growth stocks rallied after their latest earnings releases. This highly likely suggests that aggressive growth expectations are already priced in and a rotation to more defensive plays is likely to occur. Despite achieving almost full penetration, I believe the telecom industry to be a safe haven given that we all use our devices, which are useless without connection between each other. And among telecom names, VZ provides the highest dividend yield and its dividend growth record is far better compared to AT&T (T), which offers approximately comparable dividend yield. T-Mobile’s (TMUS) dividend yield is not even close to VZ and T.

Valuation analysis

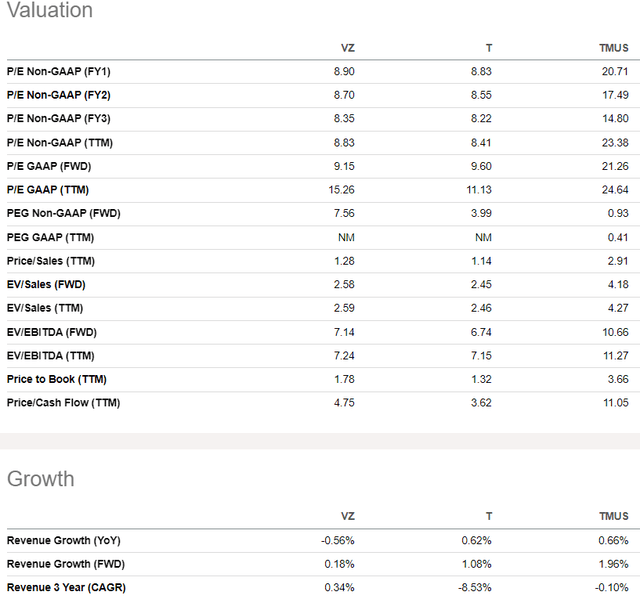

Verizon, AT&T and T-Mobile are by far the largest U.S. telecom companies. Therefore, I want to start my valuation analysis by comparing VZ’s ratios to its closest peers. Verizon’s valuation ratios are significantly lower compared to TMUS, despite having about the same revenue dynamic over the last three years. The fact that Verizon’s valuation ratios are slightly higher compared to T appears to be fair, given that T’s revenue recorded a -8.5% revenue CAGR over the last three years. It is also worth mentioning that most of Verizon’s profitability ratios are better compared to T. Therefore, peer valuation ratio analysis suggests that Verizon is attractively valued.

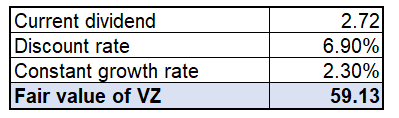

To determine VZ’s fair share price, I implement a dividend discount model (“DDM”) with a 6.9% cost of equity as a required rate of return. FY 2025 dividend is expected by consensus to be $2.72. According to Seeking Alpha, the last decade’s dividend CAGR is 2.30% which appears to be a fair assumption for my DDM calculations.

Calculated by the author

My DDM calculations suggest that VZ’s fair share price is approximately $59, far above the current $40.6 share price. That said, the current share price is attractive and there is a 46% upside potential.

Mitigating factors

Since VZ serves millions of users and possesses sensitive data of users, there is always a risk of data leakage or illegal sharing of it. If this is the case, any data leakage might lead to substantial fines from authorities and also carry substantial reputational risks for VZ. For example, in April 2024 the company was fined for a total of $47 million for illegally sharing location data of users. Operating in an oligopoly also means that Verizon’s operations are under thorough scrutiny from various governmental bodies, which means elevated risks of new charges.

Verizon’s substantial indebtedness is likely to be a red flag for risk-averse investors. The company’s total debt is $178 billion, way higher than the company’s market cap. I am highly confident that VZ is able to serve its debt obligations given stability in revenues coupled with capital allocation and cost discipline. However, it will likely take several quarters before we see a notable deleveraging. This factor might be dragging on the stock’s price in its path towards its fair value. That said, VZ’s solid upside potential might be locked until the market sees significant improvement in the company’s leverage.

Conclusion

Verizon appears to remain a ‘Strong Buy’, especially considering its 46% upside potential. The stock currently offers the best-in-class dividend yield of 6.55%, which is still growing. The company’s operating performance is improving, and high-interest rates are the only factor that weighs on the bottom line, but it is temporary. The management is disciplined in terms of capital allocation and costs, which means that the dividend is highly likely safe and poised to continue growing approximately in line with historical inflation rates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.