Summary:

- Tesla, Inc.’s stock performance has been volatile, currently down 19% year-to-date at $217/share.

- Q2 2024 earnings show mixed results, with revenue up 2% year-on-year but EPS falling short of expectations.

- Tesla faces challenges in China and Europe due to increasing competition from local manufacturers and changing consumer preferences. All things considered, Tesla is a SELL.

Mesut Dogan/iStock Editorial via Getty Images

This is only my third article focusing on Tesla, Inc. (NASDAQ:TSLA), a company well-known to all and heavily analyzed by many experts. While my primary focus has been on stocks in the energy sector, particularly oil, gas, and oil tanker companies, I believe it’s crucial to monitor opportunities related to the energy transition. Given Tesla’s role in this space, an analysis of the company is almost unavoidable. Therefore, I’ve decided to weigh in.

In this article, I’ll be reviewing Tesla’s Q2 2024 results, released a few weeks ago, and explaining why I consider the Tesla to be a SELL. In my previous article from October 2023, I recommended buying Tesla’s shares, assuming that an average electric vehicle (“EV”) selling price of $37,500 would be sufficient to capture the European market. While this strategy proved successful in 2023, with the Tesla Model Y becoming the best-selling car in the EU, 2024 is telling a different story. The Model Y has now dropped to the 8th spot in sales for the first half of the year. As I will discuss later in this article, simply cutting prices is no longer a sustainable strategy for making Tesla vehicles stand out in Europe and Asia.

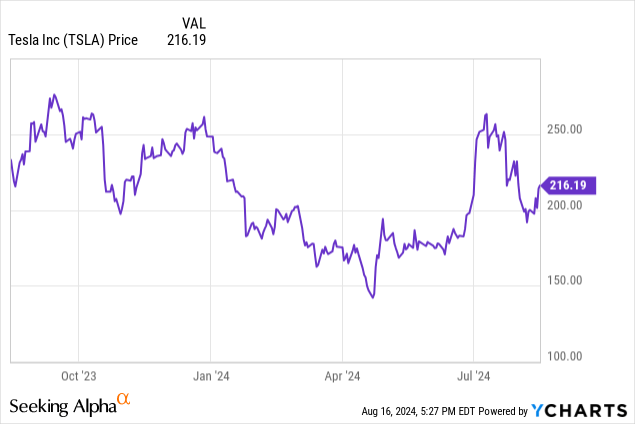

Stock performance

Over the last 52 weeks, Tesla’s stock performance has been highly volatile. It reached a high of $278.98 and a low of $138.80. This fluctuation reflects the broader market trends and the company’s internal developments. Despite these swings, the stock has seen a recent decline and is currently down by about 10% year-to-date in 2024. Currently, Tesla is trading at $222/share, equivalent to a market cap of $711 billion.

Tesla 2024-Q2 earnings results

Tesla’s Q2 2024 earnings were a mixed bag. The company reported a total revenue of $25.5 billion, slightly above expectations. However, earnings per share (EPS) fell short, with a non-GAAP EPS of $0.52 compared to the expected $0.61.

Focusing on sales, total revenues were up 2% year-on-year to $25.5 billion, with the main driver of growth being the revenues generated from the “Energy Generation and Storage” unit (+100% y-o-y) thanks to a record 9.4 GWh of storage deployed in Q2. Even service revenues increased by 21% y-o-y while revenues from the automotive sector were down 7% from $21.2 billion in Q2-2023 to $19.8 billion in Q2-2024.

However, revenues look better if compared to the previous quarter: in this case, all three business units showed a quarterly increase with automotive at +14%, energy generation and storage at +84%, and service at +14%.

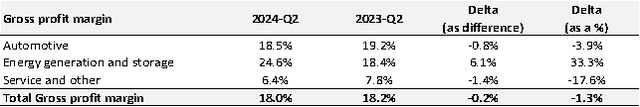

Moving to the cost side, the total cost of revenues increased by 2.6% driven by the rise in energy generation and storage (+85%, but still less than the increase in revenues) and in services (+23.1%). The cost for the automotive business declined by 5.7%, less proportionally than the 6.5% decrease in revenues. As a result, Tesla’s gross operating profit for 2024-Q2 stands at 18.0% versus 18.2% of one year earlier.

Even EBIT margin declined year-over-year from 9.6% to 6.3%: the main aspects that negatively impacted the margins were:

- Reduced average S3XY vehicle average selling price (ASP) due to pricing policies.

- Decline in S3XY vehicle deliveries (-5% year-on-year, from 466k in Q2-2023 to 443k in Q2-2024).

- Some restructuring charges.

- Increase in expenses driven by AI projects (such as Optimus and Robotaxi).

On the other hand, margins were supported by:

- Growth in Energy Generation and Storage gross profit (+$462 million).

- Lower cost per vehicle.

- Reduced cost of production ramp of 4680 battery cells.

Overall, net income for common shareholders (non-GAAP) was $1.8 billion, down 42% y-o-y from $3.1 billion.

Outlook and potential problems ahead

According to Tesla’s Q2-2024 outlook, the company declares that

“in 2024, the growth rates of energy storage deployments and revenue in our Energy Generation and Storage business should outpace the Automotive business.“

I agree with Tesla’s view since I believe several possible obstacles could slow down the growth of the automotive business, particularly in Europe and China.

China stands as Tesla’s second-largest market, representing over 20% of its global sales revenue. Nonetheless, Tesla’s growth in this crucial region is being undermined by increasing competition from domestic players and a slowdown in the Chinese economy. Data from the China Passenger Car Association (PCA) reveals that shipments from Tesla’s Shanghai factory declined by 24.2% year-on-year in June, marking the fourth consecutive month of decline. This trend is occurring as the Chinese government, through generous subsidies, is driving a shift towards new energy vehicles (NEVs). The PCA forecasts a 28% increase in NEV sales for H2-2024 compared to the previous year.

Despite Tesla’s efforts to stimulate demand through price cuts since 2023, its share of the high-end market is diminishing. Indeed, consumers are increasingly opting for more budget-friendly electric and hybrid vehicles from competitors, especially from the Chinese giant BYD Company Limited (OTCPK:BYDDF). Unlike Tesla, BYD is agile in adapting to local market preferences, regularly introducing new models and enhancing its technology to lower production costs. In the second quarter, BYD’s sales of pure EVs grew by 13% compared to the same period last year. Similarly, other domestic brands such as Geely Automobile Holdings Limited (OTCPK:GELYF) reported a notable 41% rise in sales year-on-year during the first half of 2024.

The EU market presents a similar challenge for Tesla. The company faces intense competition from established German luxury brands and the growing influence of Chinese manufacturers. In Europe, consumers generally have lower purchasing power compared to the USA, leading them to set strict budgets when choosing a vehicle and prioritize the best quality-to-price ratio within those limits.

Tesla’s price reductions, which proved successful in 2023, no longer have the same impact. With a growing number of electric vehicles entering the market from various brands, the increase in supply and variety has diminished demand, causing prices to drop. To remain competitive, Tesla must go beyond mere discounts and appealing updates. It needs to introduce innovative and more diversified products across more segments; for instance, the Cybertruck will probably not have strong appeal in the European market.

Why Tesla is a SELL

In conclusion, Tesla’s position in the EU market is increasingly challenged by fierce competition and changing consumer dynamics. The brand’s previous strategies, such as price cuts, are proving less effective in an environment where European buyers are more budget-conscious and have a growing array of EV options to choose from. Even in China, Tesla’s positioning can be at risk due to the strong competition from the local, and cheaper, electric car manufacturers that are becoming more and more structured.

Despite Tesla being profitable and with a healthy balance sheet, I believe that it has a future full of complex challenges that could easily undermine its stock value. That is why for me, Tesla is a SELL.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.