Summary:

- Both Nvidia and Intel have fallen in price by over 40% in the last year.

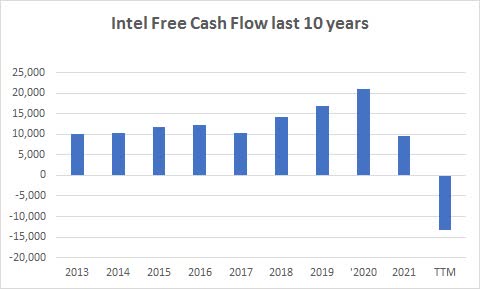

- Intel’s usual substantial FCF ( Free Cash Flow) has become negative $13 billion in the last year.

- Nvidia’s revenue has fallen by more than 25% in the last two quarters.

Overview

sankai

NVIDIA Corporation (NASDAQ:NVDA) and Intel Corporation (NASDAQ:INTC) are both well-known micro-chip companies with two very different approaches to business.

Nvidia designs high-end chips, especially for graphics and AI (Artificial intelligence) purposes. However, they do not manufacture their own chips they subcontract their production of them to others, mainly Taiwan Semiconductor (TSM).

Intel, of course, is famous for designing the X86 chip which it has manufactured since 1978. The X86 is still used extensively in servers, laptops, and desktop PCs. It also manufactures other chips including graphics chips.

NVDA will continue on its path to bigger, faster, and more resilient chips but will always use third parties to actually manufacture the chips.

Intel, on the other hand, will continue to design and make its own chips, but has decided that its future will mainly depend upon manufacturing chips for others ala TSM. Intel has committed to spending $10’s of billions of dollars over the next five years on new fabs (fabrication facilities) to achieve this goal including new fab facilities in Arizona, Ohio, and Europe.

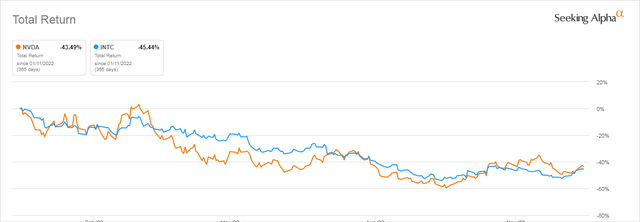

One thing both companies do have in common is the huge Total Return (share price plus dividends) losses they have endured over the last year with NVDA down 44% and Intel down 45% over that time period.

Seeking Alpha

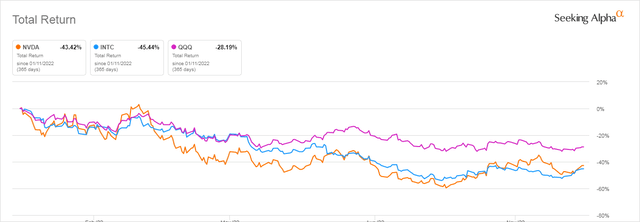

To see how bad it has been for tech stocks in general over the last 12 months, the next chart adds Invesco QQQ Trust (QQQ) as a proxy for the tech market in general. It shows that QQQ, down “only” 28%, has performed much better than either NVDA or Intel.

Seeking Alpha

Despite the bad year, few believe that these two tech stalwarts are not going to outperform most stocks over the coming years.

In this article, I will compare Nvidia and Intel head-to-head to see which one is the better 2023 investment.

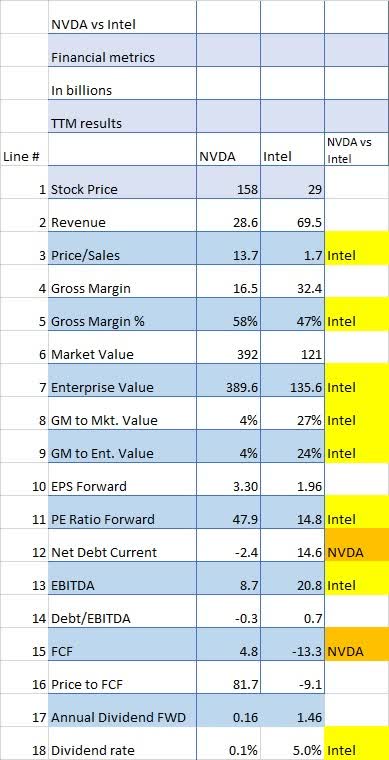

NVDA And INTC Stock Key Metrics

As you can easily see in the table below, Intel is a much larger company based on revenue (Line 2). But when it comes to Price/Sales (Line 3) Intel appears to be a much better value with a ratio of 1.7x versus NVDA’s 13.7x.

Gross Margins (Lines 5, 8 and 9) are also interesting with INTC having a much better gross margin overall (Line 5) 58% to 47%, and a higher GM percentage (27%) than Nvidia’s 4% when compared to Market Value (Line 8).

This could imply that Intel is relatively underpriced compared to Nvidia.

The PE Ratio (Line 11) is another metric where Intel’s PE (14.8x) appears to be undervalued compared to Nvidia’s rather high 47.9x.

Seeking Alpha and author

Another significant difference is Intel’s huge EBITDA which is more than double Nvidia’s. Free cash flow (FCF) is an area where NVDA clearly outperforms INTC, whose FCF is negative due to the huge CAPEX required for the new fabs being built. That puts the Price/FCF ratio strongly in Nvidia’s favor.

But historically, Intel has generated huge FCF as shown by the chart below. I think it is safe to say Intel’s FCF will return to its lofty levels eventually, the question becomes when?

Seeking Alpha and author

Intel’s dividend is a significant 5% but again the question becomes will Intel be able to maintain that lofty level with the current FCF issues?

Based on current financial metrics, Intel has better numbers than Nvidia.

Is Nvidia A Direct Competitor To Intel?

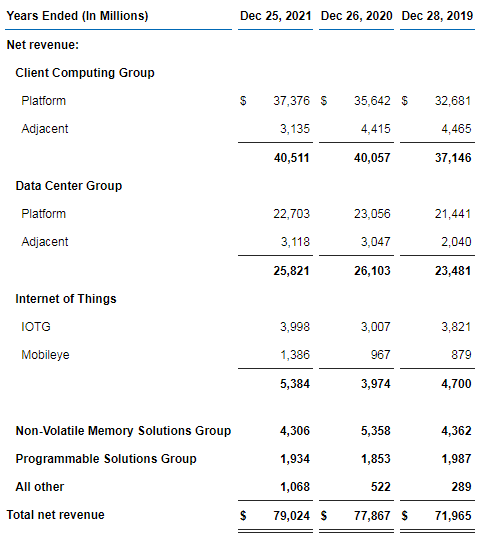

Nvidia and Intel compete in what both call “Data Center”, although I would guess that both have slightly different markets. Nvidia utilizes graphics chips to manipulate large amounts of data with parallel processing for AI purposes while Intel’s Data Center Group provides more traditional Server chips in server farms type of installations.

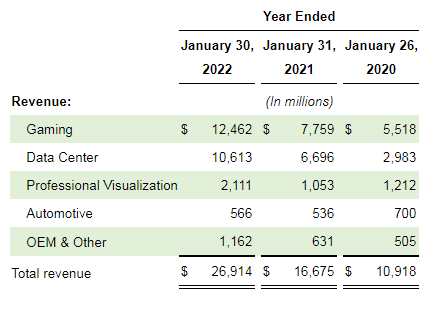

Below is the revenue breakdown of each company from their most recent 10Ks.

Nvidia:

Nvidia 10k

Intel:

Intel 10k

Nvidia also has “gaming” which is either non-existent with Intel or buried in one of the larger groups like Client Computing.

Interestingly, Nvidia’s Automotive is probably similar to Intel’s Mobileye (MBLY) which was recently spun off by Intel and currently has a market value of $26 billion. Intel still owns a majority of the shares of Mobileye.

But direct head-to-head competition between the two would appear to be minimal.

How Are Nvidia And INTC Stock Different?

The biggest difference between INTC and Nvidia revolves around Nvidia’s fabless production. In addition, Intel’s future emphasis on producing chips for others is completely opposite of Nvidia’s goals. In fact, I would not be surprised if someday in the future Intel manufactures some of Nvidia’s chips.

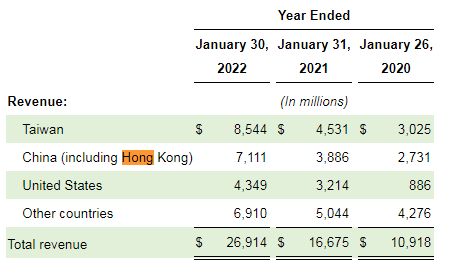

One other potential difference is Nvidia’s reliance on China and Hong Kong for a significant amount of its revenue.

Nvidia 10k

Although there is some overlap, generally speaking, Nvidia and INTC operate in different markets.

Are These Stocks Fairly Valued?

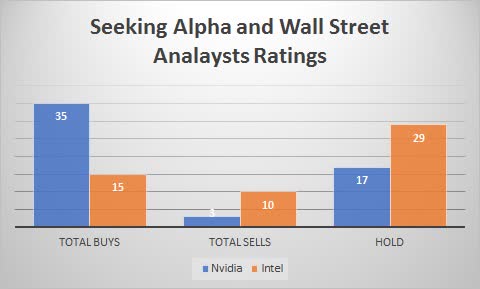

If we look at analysts’ ratings for both stocks we see that Nvidia is highly rated and Intel not so much. Nvidia has 35 Buy recommendations and only three Sell recommendations. That is impressive.

Intel on the other hand has only 15 Buys but almost as many Sells at 10. Obviously, some analysts are less than enamored with Intel’s plans and performance.

Seeking Alpha and author

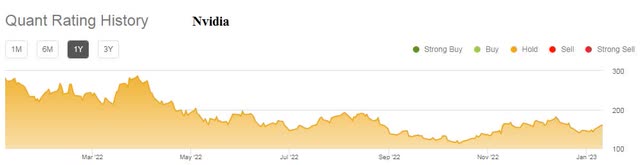

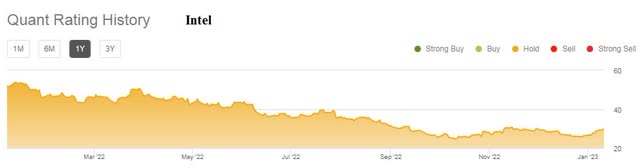

Looking at the quant ratings both companies currently have a Hold rating.

Do the quants know something about Nvidia the analysts don’t?

Seeking Alpha

Seeking Alpha

Both these stocks are more fairly valued than they were one year ago, but are they reasonable enough for investment in 2023 considering the risks for the world economy, chip sourcing, and customer indecision?

In my opinion, both these stocks are underrated based on historical performance and the inevitable turnaround will show up in the next year or two.

Having said that, I would rate Nvidia as a better value at this point based on a shorter lead time for new business compared to Intel.

Is Nvidia Or INTC Stock A Better Buy for 2023?

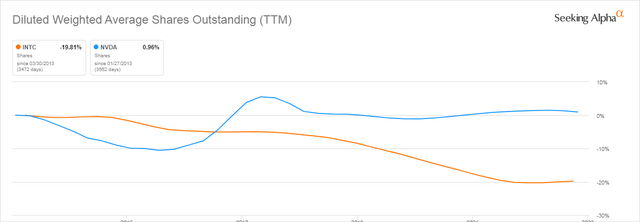

One of the advantages Intel has over Nvidia is the consistent share buyback plan that has been in place for years. Looking at the share comparison between the two companies we can see that Intel’s share count has dropped by 20% over the last 10 years while Nvidia’s is roughly unchanged.

Seeking Alpha

As we saw in the Financial metrics section above, INTC has a large advantage when it comes to the dividend with a current yield of 5% versus 0.1% for NVDA. A legitimate question is whether Intel will be forced to cut or eliminate its dividend in the near future while they spend huge sums for the new fabs before the fabs begin to generate revenue. Perhaps Intel could use the Mobileye investment dollars to fund the dividend for at least the near future.

The obvious investment question is whether now is the time to buy either INTC or Nvidia. Both have shown significant share price losses over the last year.

Intel is at its lowest price since 2014 and in between those low points, we can see significant possible capital gains if it just gets back to its previous levels, let alone higher levels.

Seeking Alpha

Nvidia is not without its own set of issues. Revenues have fallen from $8.3 billion in the May 2022 quarter to $5.9 billion in the current quarter, a stunning drop of 29% in just six months.

For the long term, both are excellent choices, but for 2023 I see Intel as a classic turnaround stock with its battered share price able to begin recovery by the end of 2023.

At their current prices, Intel is a Buy and Nvidia is a Hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.