Summary:

- Target shares currently trade over 40% below their 2021 all-time-highs, presenting an excellent entry for long-term investors.

- The companies private-label brands, strategic store expansion and remodels, and “sticky” innovations suggest a multi-year profit recovery.

- Positive economic signals, such as July’s strong retail sales report and consumer sentiment, suggest a strong U.S. consumer.

JHVEPhoto

Thesis

Target (NYSE:TGT) has faced a slew of challenges in recent years, including macroeconomic pressures, rising shrinkage, and slowing comparable sales growth due to market share losses. Shares remain more than 40% below all-time highs reached in 2021, and ongoing fears about the strength of the U.S. consumer have created a “second bite at the apple” opportunity for investors. Target has been on my radar for a while, and I view this recent pullback as an excellent entry point for long-term shareholders.

I believe most of Target’s challenges are cyclical rather than structural, presenting an opportunity for long-term investors to take advantage of Mr. Market’s short-sighted impatience. I see Target as a cyclical recovery play on the U.S. consumer, with prospects for multi-year profit growth and a return to robust comparable sales growth. As we approach Q2 earnings this week, I’ve been backing up the truck on Target stock, aggressively adding shares in the $130 to $140 range.

In this article, I will outline my long-term bullish case for Target, centered upon a strengthening U.S. consumer, the company’s “owned brands”, new stores and remodels, and innovative strategies creating a “stickier” business. I am assigning a “Strong Buy” rating on Target stock and am highly confident the turnaround is just getting started, and here’s why:

The state of the U.S. consumer

Fears about a slowing U.S. consumer are nothing new, but recent headlines have created plenty of noise and gained significant attention. Just a few weeks ago, a weak July jobs report sent Wall Street into a frenzy, with some analysts yelling the dreaded “R” word – recession. This panic sent the VIX spiking to $65, levels not seen since the COVID-19 pandemic and the Great Financial Crisis. Amidst the panic, there were even calls for emergency rate cuts of up to 75 basis points. However, this kind of overreaction shouldn’t come as a surprise; Wall Street has a long-dated history of shooting first and asking questions later.

Fast-forward two weeks, and some positive economic data reports suggest that fears of a hard-landing scenario may have been overblown.

First, the July U.S. retail sales report showed a 1% increase in the month. This was well above the consensus forecast of 0.3% and a significant rebound from the lousy June report, which was revised downward to a 0.2% decline. Consumers speak with their wallets, and this report signals that the economic situation might not be as gloomy as many had feared.

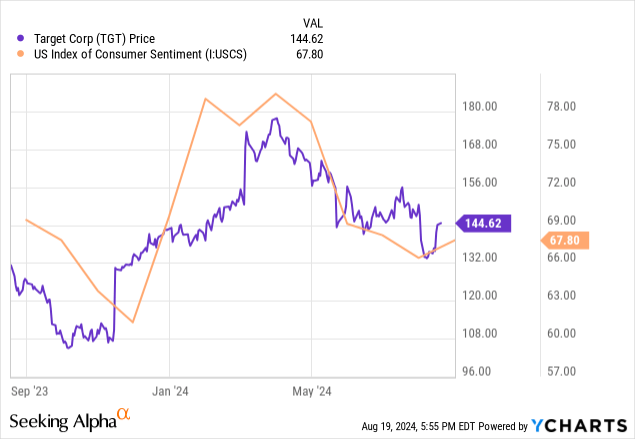

The day after this strong retail sales report, we saw the first uptick in consumer sentiment in five months. The August reading of the University of Michigan consumer sentiment survey was 67.8, slightly above estimates of 67.0.

Finally, last week, Walmart (NYSE:WMT) reported a strong double-beat earnings report fueled by a 4.2% increase in U.S. same-store sales. These stellar results sent shares flying to fresh all-time highs and buoyed the entire retail sector, with Target shares rising nearly 5%. While the results were great, the key was the optimistic outlook and bullish commentary on behalf of Walmart’s management. CEO Doug McMillon noted that “we aren’t experiencing a weaker consumer overall,” highlighting strong August foot traffic and back-to-school shopping trends.

While this article is about my long-term bull case for Target and not this past month’s economic data breakdown, it’s key for investors to understand how closely Target’s success is linked to consumer health. The chart below, which overlays Target’s stock performance with U.S. consumer sentiment, is an excellent depiction of this connection.

Unlike other consumer staples, Target relies more heavily on discretionary spending and is positioned as a premium brand within the retail sector. Target operates higher up the value chain than rivals like Walmart or Costco and performs best when consumers have extra cash and are inclined to make impulse purchases. For instance, impulse buys account for 21% of Target’s sales, compared to just 12% at Walmart. This premium reputation was evident during the pandemic when Target’s stock nearly tripled as middle-class consumers, loaded with stimulus cash, flocked to the store. Target’s average shopper, suburban mothers aged 35 to 44 with some college education and household incomes of $80,000, fit this bill.

As macroeconomic pressures and cyclical headwinds begin to ease, I expect the focus on bargain hunting and value to diminish. With discretionary spending rising, I am confident consumers will climb up the value chain and Target will reclaim market share.

The push for private-label

Private-label brands have been a retail staple for a long time, often cycling through periods of defensiveness as consumers tighten their wallets. However, in today’s value-focused environment, private-label brands have been met with unprecedented success, with sales reaching all-time highs in the first half of 2024. One of the key drivers of this growth has been consumers seeking value without compromising on quality or feeling “cheap” buying them. Enter the solution: private labels with trendy packaging and high-quality products, all at attractive price points. Shoppers have warmly welcomed this shift, with 94% of consumers rating private brands as equal to or better than their name-brand counterparts.

If there is someone who enjoys this trend even more than the consumer, it is retailers. They no longer need to share sales with national brands and can allocate prime shelf space to their private labels. With fewer intermediaries in the supply chain, these private labels offer outstanding margins. While Costco’s Kirkland Signature is often considered the gold standard in the space, there is arguably none better than Target. Target manages a portfolio of nearly 50 “owned brands” that contribute over $30 billion of annual sales. If I had to guess, many readers have likely purchased these owned brands, whether knowingly or not, including popular names like Threshold, Everspring, and All in Motion. Many of these brands would be stand-alone Fortune 100 companies on their own, with top brands like Good & Gather and Up & Up generating impressive annual sales of $4 billion and $3 billion, respectively.

Target’s long-term strategy involves deepening its commitment to these owned brands, significantly enhancing its gross margin profile. As these brands gain traction, Target continues refreshing existing lines and introducing new ones. For instance, Target launched “Dealworthy” earlier this year, offering 400 SKUs priced between $1 and $10. This new brand targets the value-focused consumer with basic, essential items all at entry-level prices. This ties into another key advantage of Target’s owned brands: price control. With Target recently announcing plans to reduce prices on nearly 5,000 items, most of these cuts will likely apply to its own private labels. Not only does this approach help lure back bargain hunters, but it does so without eroding profitability.

However, not all of Target’s owned brands focus solely on value. One of Target’s newest brands, Figmint, is a high-quality kitchenware brand. Figmint has had tremendous success, driving a 500 basis point improvement and flipping the overall kitchenware segment from negative to positive comparable sales. According to the Q4 earnings call, baskets containing a Figmint product are 25% higher in value compared to the previous kitchenware offerings.

Overall, Target’s focus on private labels represents a key competitive advantage that I feel remains underappreciated by the market. The shift towards owned brands continues to be a sustainable driver of profitability and margin enhancement for Target in the medium to long term.

New stores and remodels

Another cornerstone of Target’s long-term strategy is its innovative store redesign and expansion plan. Target intends to remodel most of its nearly 2000 stores, with roughly 1200 already started. Over the next ten years, the company expects to open 300 new locations. These stores will feature several enhanced design elements, including more natural light and reclaimed wood, appealing to Target’s core customer, Gen Z. Most will be about 20,000 square feet larger than traditional layouts to accommodate same-day delivery services. With 95% of digital orders being fulfilled from store inventory and the fast-growing nature of the segment (high-single-digit growth in Q1), the expanded stores include a 5x increase in backroom fulfillment space.

A key part of these remodels and expansions is the strategic use of partnerships with top brands such as Ulta (NYSE:ULTA), Starbucks (NYSE:SBUX), Apple (NYSE:AAPL), and Disney (NYSE:DIS). In 2023 alone, Target introduced 80 new Starbucks cafes, 140 Ulta locations, 40 Apple shops, and 20 Disney clubhouses. An interesting side note regarding these brands, excluding Apple, is that they are all highly regarded premium names that have recently underperformed. These partner brands, including Target, cater to similar consumer demographics. They have all faced the same macroeconomic headwinds, which leads me to believe that the issues all of these brands are grappling with are cyclical rather than structural…

This strategy represents one of Target’s major competitive advantages: a unique, all-in-one shopping experience that rivals fail to match. The model’s success is not just anecdotal, but consistently highlighted in the numbers. For instance, beauty remained a standout category in Q1 of this year, with low single-digit growth driven by the strength of Ulta Beauty at Target stores.

Over the next decade, these new and remodeled stores will generate an additional $15 billion in annual sales. Regarding capital expenditures, management expects between $3.5 billion and $5.5 billion annually starting in 2025. While this is a sizable capex cycle, investors can take comfort in the historically strong returns through remodels. Target’s 15.4% return on invested capital is among the highest in the sector and is expected to climb to the high teens over time.

I applaud Target’s commitment to brick-and-mortar stores at a time when many competitors are leaning into digital and e-commerce. As management highlighted, two-thirds of shopping in the U.S. is still conducted in stores, and I believe a key part of Target’s success is the human connection. For many customers, Target is more than just shopping; it’s a family outing or even a date night. In smaller towns, a local Target can become a central community hub. I fully support this increased investment cycle and believe maintaining an innovative, brick-and-mortar presence is central to the Target bull case.

Creating a “stickier” business

In today’s highly competitive retail landscape, creating customer loyalty has arguably never been more important. Loyal customers spend 43% more on their favorite brands, and over 77% remain committed to a particular brand for at least a decade. Understanding this, Target recently completed a significant relaunch of its Target Circle program this year. Since its debut in 2019, Target Circle has grown to over 100 million members. The members are exceptionally loyal, visiting stores five times more frequently and spending five times more than non-members. Last fiscal year, Target Circle-driven deals and offers generated an additional $1.5 billion in sales.

As a college student and Target Circle member, I recently completed my back-to-school shopping at Target, primarily due to a 20% off coupon for student members. The store was so crowded that employees resorted to stanchions to organize the foot traffic. Management has openly discussed the intentional strategy of building lifelong relationships with college students and remaining relevant at various key life stages. If there’s one thing I know, the strategy worked on me…

Target has done a superb job promoting the revamped rewards program, leveraging its 2.9 million TikTok followers to increase social media mentions by over 500% year over year. During Q1, Target added over 1 million new members to the program. During Target Circle week (July 7th to 13th), the highest traffic to Target’s website and app was seen outside of the Q4 holiday season.

A key feature of the revamped program is Circle 360, Target’s answer to Amazon (NYSE:AMZN) Prime and Walmart+. For $99 a year, members receive unlimited same-day delivery on orders over $35 and free two-day shipping. While Circle 360 is unlikely to achieve the scale of Amazon Prime’s 184 million members, its potential is still significant. If Target could secure 10 million members at $99 each, the program could generate nearly $1 billion in annual recurring revenue from membership fees alone.

Target has also listened to consumers’ appetite for convenience with various innovations. Drive-up services continue to grow strongly, increasing at a low teen rate to more than $2 billion in Q1. This follows two years of double-digit growth in 2022 and 2023. While drive-up services require more legwork than traditional in-store shopping, they don’t come without perks for Target. Customers who use drive-up services tend to spend 20% to 30% more at Target thereafter. Target has further enhanced convenience by allowing customers to add Starbucks to their orders and enabling drive-up returns.

These customer-focused innovations will be the key driver of long-term market share gains. Competitors cannot match many of these incredibly “sticky” features, which is key in today’s convenience-obsessed culture.

Valuation

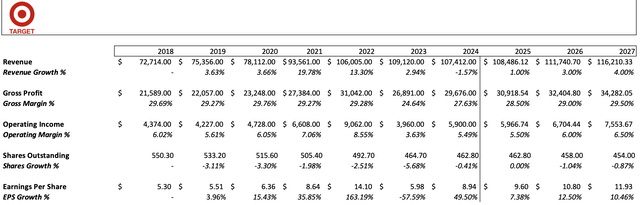

Target Investor Relations, Author’s calculations

Starting with the top-line sales growth forecast for FY2025, I used the midpoint of management’s guidance range of 0% to 2%. I forecasted sales growth to gradually increase to 4% by FY2027, which is in line with management’s long-term guidance and TGT’s historical averages.

For gross margin, I estimated an expansion of just under 100 basis points for FY2025, with sequential growth leading to margins of 29.5% by FY2027. This margin expansion is predicated upon several factors, including a higher contribution from “owned brands,” a reduction in shrinkage expected to become a tailwind in FY2025, and reduced freight costs.

Operating margins are projected at 5.5% for FY2025, with sequential improvements to 6.5% by FY2027. This forecast is in line with management’s expectations of a “modest” increase from last year’s 5.49% and their long-term target of above 6%.

While management has indicated a “possible” return to share repurchases within this fiscal year, I elected to keep shares outstanding unchanged for conservatism. However, I forecasted a modest return to share repurchases starting in FY2026, leading to a reduction of just under 2% by FY2027.

I used the high end of management’s FY2025 guidance for EPS, forecasting $9.60. This assumption is based upon a strengthening U.S. consumer backdrop, successful Target Circle week, favorable back-to-school trends, and a strong holiday season.

My model projects FY2027 EPS of $11.93. Applying a P/E ratio of 18x, just below TGT’s five-year average of 19x, results in a share price of $215. This price target implies a nearly 50% potential upside from the current share price. Over three years, this boils down to a 14.35% compound annual growth rate before considering the growing 3.11% dividend yield.

Risks

While I remain highly optimistic about Target’s long-term bull case, there are always risks to consider with any investment. Key risks include:

- Slowdown in consumer spending: Target’s positioning as a “premium” brand means it relies more heavily on discretionary spending. Consumer confidence or a downturn in spending could lead to further market share losses.

- Increased competition: The retail sector is highly competitive and has few switching costs. If Target fails to differentiate itself from its rivals, growth could continue under pressure.

- Shift in consumer behavior: Target’s increased investment in brick-and-mortar stores might not yield the expected returns if consumer behavior shifts towards digital and e-commerce.

Bottom line

While Target may not be the flashiest company on the market, I am confident they are positioned to outperform in the long term. Given its attractive valuation and easing cyclical headwinds, Target offers investors a phenomenal play on the recovery of the U.S. consumer. I have been aggressively adding shares lately, viewing the recent pullback as an excellent entry point for long-term investors. I am assigning a “Strong Buy” rating on TGT, with a price target of $215.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.