Summary:

- Accenture has recently acquired several firms, expanding its market and opening opportunities in new areas.

- Accenture’s financials show great relative success in the IT & consulting market.

- Technical analysis of Accenture shows bullish momentum and a promising long-term position for investors.

eEditor’s note: Seeking Alpha is proud to welcome Amrita Marathe as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

HJBC

Thesis

Accenture (NYSE:ACN) has long been a global leader in consulting, various technology services, and strategic operations for companies. Following a relatively stagnant performance in the NYSE over the past 12 months (1.32% yearly growth), I believe recent acquisitions, partnerships, and contracts encourage that notion that the previously flat-lined ACN will have a prosperous and fruitful future. In the near future, ACN’s expansion across multiple platforms and audiences will reach a larger market, indicating future growth for the firm. I believe this larger market and new opportunities will give ACN bullish stimulus for many years, allowing investors to highly consider it for a long-term position.

Recent Earnings

Accenture’s 3rd Quarter Fiscal Reports were released on June 20th, 2024. ACN reported a 22% increase in project bookings since last year, with a value of around $21.1 billion. In my opinion, this value emphasizes the ability for ACN to substantially grow using their new service demand and larger markets. Additionally, ACN has year-to-date earnings of $2 billion in Generative AI sales, showing that they are a pioneer in the up-and-coming Generative AI sector. However, they also reported a decrease in the total revenues of the 3rd fiscal quarter of 2024, with a drop from $16.56 billion in the 3rd fiscal quarter of 2023 to $16.47 billion in the 3rd fiscal quarter of 2024. This drop in total revenue resembles a negative foreign exchange impact, and could cause future investor doubt. On the other hand, ACN increased its dividends to consumers by 15%, a jump from $1.12 per share in fiscal 2023 to $1.29 per share in fiscal 2024. An increase in dividend payments is a strong indicator of growth, and should give investors confidence in ACN’s ability to consistently provide returns and profit.

Bullish Indicators

Accenture Acquisition of BOSLAN

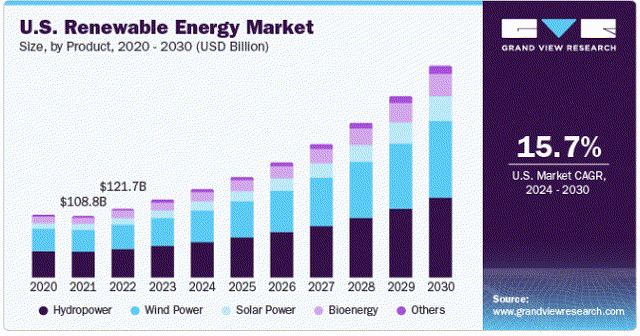

On August 2nd, 2024, ACN acquired BOSLAN, a firm from Bilbao, Spain, specializing in management services for large clean-infrastructure projects. Accenture is aiming to use artificial intelligence and other technology to help clients engineer and finalize net-zero infrastructure projects. The acquisition will help the two firms work together in order to reinvent and optimize project investments in efforts to become carbon-neutral sooner. BOSLAN works with clients to engineer clean-infrastructure such as wind farms, smart grids, solar plants, and even the electric vehicle charging infrastructure, a market that by itself was estimated at $4.10 billion in 2023. The company’s clients include public and private organizations in the renewable energy, oil and gas, and utilities industries as well. With an expansion into these new industries, ACN has prepared itself for steady future growth in a new market.

Chart showing Growth of Renewable Energy Market (Seeking Alpha – Grand View Research)

Looking at the chart, it is evident that ACN’s acquisition of BOSLAN and expansion into the renewable energy market will yield lucrative results for the firm. With an average CAGR (compound annual growth rate) of 15.7% from 2024 to 2030, investors can remain confident about a profitable future for ACN.

This acquisition underscores the recent growth of the reachable market for ACN and projects bullish growth in the near future attributable to a larger market and new opportunities in the previously untapped ACN market of clean infrastructure.

Contract for $81 million from Social Security Administration

On August 1st, 2024, ACN’s Federal Services sector received a contract for $81 million to incorporate artificial intelligence and machine learning to deliver and optimize automation services for documentation of over 250 million forms on survivors and retiree benefits each year. This contract is allowing for ACN to expand and diversify their market by introducing new customers to their name and mission statement along with the services they offer. This opportunity will potentially lead to an increased customer acquisition and market, as the situation is helping additional people to get acquainted with ACN’s services.

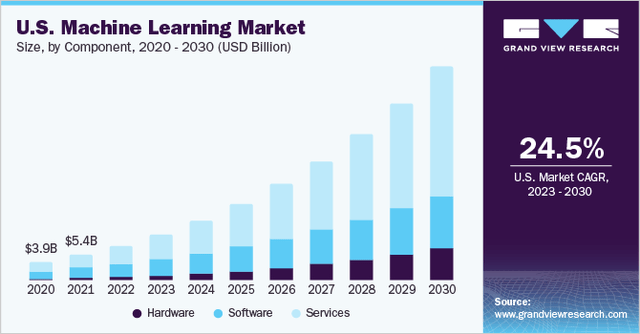

Growth of Machine Learning Market (Grand View Research)

Not only is ACN acquiring new customers in respect with this contract, but it is also widening its client base in an ever-growing market. According to research done by Grand View Research (see graph above), the average CAGR from 2023-2030 is estimated to be around 24.5%, one of the highest growth rates in any current industry. And according to research done by Statista, this percentage is estimated to reach 28.46% by 2030. Once again, investors should see ACN as a long-term position trade, with the new contract from the SSA supporting the presence of ACN in the machine learning industry. In an industry that has a CAGR averaging 25%, ACN is an optimistic choice for investors.

Accenture Acquisition of Fibermind

On July 31st, 2024, ACN acquired Fibermind, a firm from Milan, Italy, specializing in fiber and mobile 5G networks. Within this acquisition, Fibermind is strengthening its services in telecommunications through Accenture’s assets, knowledge, and technology in artificial intelligence and automation. This acquisition will allow Accenture to reach yet another market, the market of consumers in fiber and mobile networks.

Accenture Expands Partnership with SandboxAQ

As of July 30th, 2024, ACN has expanded their partnership with SandboxAQ, a firm specializing in data and Information Technology (IT) encryption. Accenture and SandboxAQ will work together in helping their clients, public and private organizations, secure their sensitive data and strengthen the encryption behind their technologies.

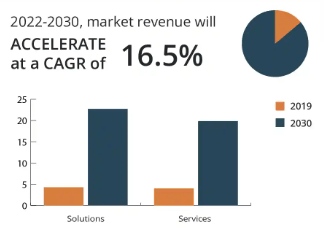

Growth of Data Encryption Market (Reports and Data)

The data encryption market has recently sprung in growth, and is estimated to have a CAGR of 16.5% from 2022 to 2030 (see image above). With Accenture getting their skin in the game in several different growing markets, a long position with ACN is more plausible than ever before. With a now wider customer base, ACN will likely yield profits higher than those of recent years.

Accenture’s Early Grasp on Generative AI

The Generative AI market has been rapidly growing in recent years, and with an average CAGR of 31.2% from 2024 to 2033, is now one of the fastest growing industries. The rapid growth of this market could be a tailwind for ACN, boosting their potential growth as demand for Generative AI grows.

Not only is ACN competing in this market, they also have made large revenues since their entry into the industry. ACN CEO Julie Sweet announced the following when the 3rd Quarter Fiscal Earnings were released: “We also achieved two significant milestones this quarter — with $2 billion in Generative AI sales year-to-date and $500 million in revenue year-to-date — which demonstrate our early lead in this critical technology.” ACN’s trailblazing in the Generative AI market shows that they are adept in catching trends and increasing profitability.

Bearish Indicators

Stagnant Growth

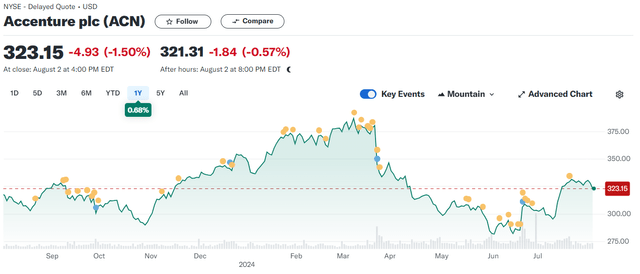

It’s evident that ACN stock hasn’t performed well in the last year, with a less than 2% increase in value.

1 Year ACN Growth Graph (Yahoo Finance)

For such a large company in a growing sector, ACN didn’t perform up to expectations, with a 5-year increase in value of 66%, and a current 1-year increase of only 1.9%. But why is this?

Market Slowdown

Business spending on IT services has slightly declined in recent months. A previous forecast of market growth estimated the growth of IT services spending at 4.3% for 2024, but a recent estimate has declined to 3.2%. This can be attributed to a temporary lower level of spending for consulting and business and data services in the market. Analysts believe this could be for a number of reasons, including change fatigue, rising inflation, consumer uncertainty, or more. In terms of ACN, this market slowdown will lessen potential profits.

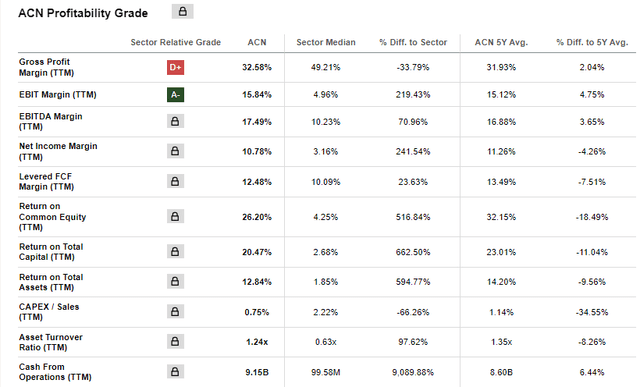

ACN’s Financials

ACN’s gross profit is 32.6%, which is 33.8% worse than the consumer discretionary median, sitting at 49.2%. This means that in order to re-spark growth in the near future, ACN will have to either rapidly gain more clients and projects, or increase their consulting prices to an MSRP where they won’t be competitive anymore with other IT & consulting firms like IBM (IBM), Deloitte, Cognizant (CTSH), or Slalom Consulting. This is a troubling financial statement for ACN’s growth.

However, not all of their financials show troubling signs. In fact, ACN’s Asset Turnover Ratio is 1.24x, 97.6% better than the sector median at 0.63x. This shows that ACN’s assets are a great representation of their ability to earn revenue for the firm, and that they can do so better than the median firm in the IT & consulting market. Additionally, ACN’s Return on Total Assets (ROTA) is 12.8%, which is a massive 594.8% larger than the sector median at 1.85%. This shows that ACN has a very profitable pre-tax earnings to assets ratio, one that’s much larger than the market median.

Investors looking at ACN’s financials can remain optimistic about future growth when taking into account the ROTA and Asset Turnover Ratio.

Additional Risk Factors

Problems in acquisitions

Although several factors indicate future success for Accenture, there are some risks necessary to observe. Albeit Accenture’s recent acquisitions will create a larger addressable market, it must be considered that these types of partnerships have their drawbacks. For starters, due to a new and foreign market for Accenture (such as BOSLAN in Europe), there might be delays in profitability attributable to the difference in consumer behavior and preference with respect to the U.S. On top of that, ACN and the acquired firm could have cultural integration and synergy issues, having trouble or hinderances in working together, which could lessen potential growth and profits.

Competition

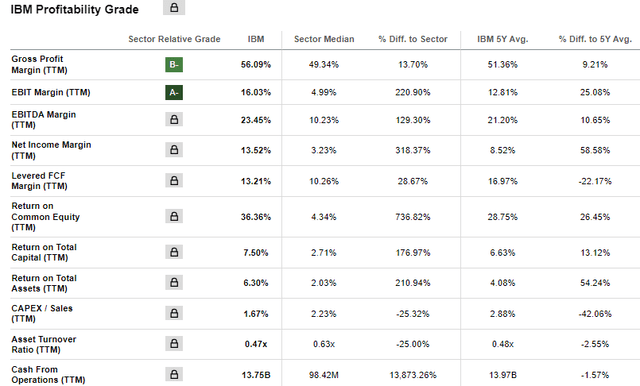

Due to ACN operating in a rapidly growing and competitive field, large firms such as IBM and Deloitte pose threat to the firm’s potential profits.

IBM, for example, has a gross profit margin of 56.1%, 13.7% better than the consumer discretionary median, while ACN has a gross profit margin of 32.6%, 33.8% worse than the sector median. This large difference underscores that IBM has significantly larger amounts of revenue with respect to business costs like labor, materials, and production. Moving on, IBM also has a higher Net Income Margin of 13.5%, 318.4% better than the sector median, as opposed to ACN’s 10.8% Net Income Margin, which is 241.5% over the sector median. This means that IBM has a higher proportional profitability than ACN.

Aside from taking financial statements into consideration, it must also be noted that IT & consulting sector leaders like IBM and Deloitte also have a large opportunity for growth in this relatively newer industry, potentially grasping a higher market share and gaining clientele. Although ACN has shown steady growth in the past, they will have to compete with more and more firms in the up-and-coming industry of Generative AI and Machine Learning, and potentially lose market share to these firms. A loss of market share would result in a loss of profits for ACN, lowering the firm’s stock value.

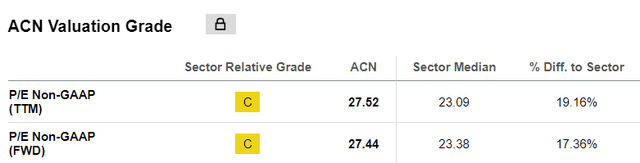

Valuation of ACN with Multiples

In order to value ACN, let’s use the multiples’ method, focusing on the non-GAAP P/E ratio (FWD), or non-GAAP P/E ratio using a projected EPS for the next fiscal year. I’ve chosen the P/E Ratio (FWD) rather than the P/E ratio (TTM) or other multiples because of the abundance of data for the P/E Ratio (FWD), and its inherent nature that provides a forward-looking perspective by considering the company’s expected earnings in the next fiscal year, helping investors anticipate future growth. I additionally chose the P/E Ratio (FWD) over the EV/EBITDA due to the EV/EBITDA not including a firm’s capital expenditures, which can lead to an inaccurate representation of the firm’s value.

The first value in this row (27.44x) shows ACN’s non-GAAP P/E (FWD) ratio in ACN’s sector. When multiplied by ACN’s projected EPS in the 2025 fiscal year ($12.88), it yields a valuation of $353.43. It’s important to note that since this value is based on a projected EPS for the 2025 fiscal year, this valuation will hold true only if the EPS estimates are met and the P/E ratio doesn’t change.

Another valuation method would be to take individual competitors of ACN, rather than just ACN, and use that to relatively value the firm. Here are some of Accenture plc’s competitors, including IBM, Infosys Limited (INFY), Gartner, Inc (IT), and Capgemini SE (OTCPK:CGEMY).

| Ticker | TTM P/E Multiple |

| IBM | 19.08x |

| INFY | 28.83x |

| IT | 41.54x |

| CGEMY | 17.94x |

The average, or mean non-GAAP P/E (FWD) Multiple here is 26.84x. When the average non-GAAP P/E (FWD) Multiple is multiplied by ACN’s earnings per share for the next fiscal year ($12.88), it shows an estimated value of $345.69. This also holds true only assuming the earnings are met and average P/E multiple for the four firms does not change.

In both cases, whether ACN’s non-GAAP P/E (FWD) Multiple is used, or the mean non-GAAP P/E (FWD) Multiple from a selection of firms in ACN’s industry is used, the two valuations are on par with, if not slightly over ACN’s current price of $328.52. This shows that ACN could be considered more or less correctly valued, or slightly undervalued, as its current price is just below the two valuations. Since the discrepancy in valuation and current price is small, this could change with a rise in current price. This is why, although there are many bullish indicators above such as acquisitions, contracts, and market growth, I believe investors should currently look at the barely undervalued ACN as a “hold” position, with a promising probability for growth in the future.

ACN Under Technical Analysis

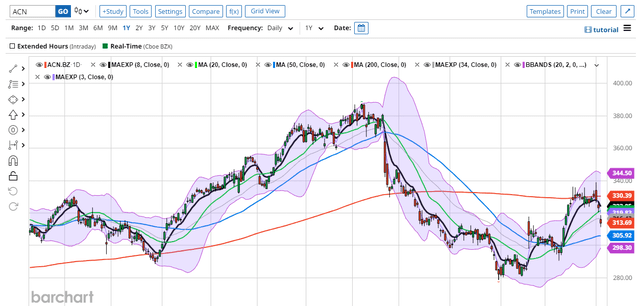

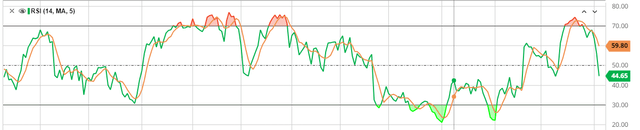

Barchart RSI for ACN (Barchart)

Looking at the 1 year Barchart and RSI graphs, ACN demonstrates potential for growth. ACN bottomed out at around June 13-20. Since then, it has been making a series of higher lows, as seen by the candlesticks on the Barchart. Recently, due to the broader market, the stock is under selling pressure. It’s not inherently ACN that is being over-sold, but rather all companies in the IT sector. At the current point of time, ACN has already dropped below the 200-day average (red line) but could bounce back once it reaches the 50-day average (blue line). The current RSI for ACN is at around 45, which is neither overbought nor oversold and fairly within the 30-70 range. For short-term investors, ACN would be advised to be bought at the dip below 30, in oversold territory. It would then bounce back to a higher level or average out.

Although the Barchart and RSI display are more regarding short-term trading, ACN’s recent behavior of higher lows and habit of bouncing off the 50-day average show growth in the near future.

Conclusion

All in all, ACN shows room for growth in the long run from multiple fundamental and technical viewpoints. ACN’s many recent acquisitions and contracts along with a heavily growing market and great ROTA and Asset Turnover Ratio outweigh its bearish indicators. ACN will likely use its now-expanded market from acquisitions to generate profit in areas that weren’t possible before. While the AI and machine learning sector is growing, ACN has consistently shown financials well above the consumer discretionary averages for the sector. At the moment, fundamental valuations of ACN show that it is correctly valued, if not slightly undervalued, and technical analysis of ACN under Barchart and the RSI shows its potential for promising future growth. This is why I believe investors should currently look at the near-correctly valued ACN as a “hold” position that has a promising probability for growth in the future. In conclusion, ACN is likely to perform well as a long-term growth stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.