Summary:

- Caterpillar’s Q2 results showed operational improvements, with increased operating profits and margins despite a decline in revenues.

- The company’s business model continues to revolve around producing high-quality products and providing a leading after-sales service.

- Caterpillar still faces real risk from a cyclical demand environment and overall macroeconomic softness.

- My IV calculation suggests shares are trading around a 25% overvaluation which leads to a lack of margin of safety and unsupportive fundamentals.

- Hold rating maintained.

Avalon_Studio

Investment Thesis

Caterpillar (NYSE:CAT) produced what, I believe, were solid Q2 results that ultimately echo the operational improvements witnessed in Q1 and FY23.

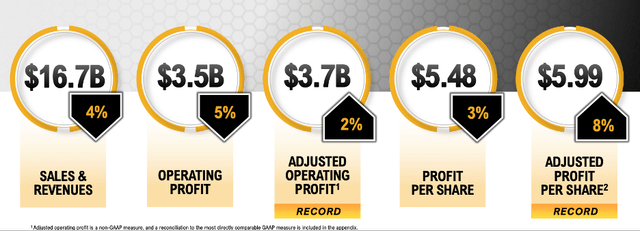

While headline revenues were down YoY, adjusted operating profits and margins increased thanks to solid pricing power and a favourable product mix.

Nevertheless, the current valuation remains quite pricey and makes it difficult to advocate building a position in the firm, given the lack of margin of safety and relatively mute 3% YoY revenue growth estimates.

I therefore continue to rate Caterpillar a Hold.

Business Overview

Texas-based Caterpillar is one of the leading global suppliers of heavy machinery and construction equipment. The firm produces a broad range of products from front loaders to diesel locomotives and all the way to huge commercial mining trucks.

The heavy machinery manufacturer has built a durable and wide economic moat around their business by focusing on producing the highest quality and capability products while also providing a leading after-sales service to clients.

While real competition exists within the industry from the likes of Volvo, Hyundai and newer competitors such as the Chinese XCMG, Caterpillar has retained their position within the market by focusing on higher-end products defined by quality and durability.

I go into much more detail regarding Caterpillar’s business profile and economic moat in my original deep-dive article written just a few months ago. I encourage you to read that piece in order to get a more holistic understanding of the company’s operations.

Fiscal Analysis – Q2 FY24 Update

I also encourage you to read my earlier piece to enjoy a comprehensive financial analysis of the firm. In this update, I will discuss their most recent earnings release and any material updates to their situation.

On that note, second quarter results presented a mixed bag of data for investors to digest, as disappointing revenue figures were compensated for by operational improvements at the company.

Total sales and revenues (which includes a 0.3% contribution from the revenues made from financial products, namely leases and loans to clients) fell 4% YoY to $32.5 billion due to a weaker demand environment in Europe and Asia as well as a reported slowdown in U.S. construction demand.

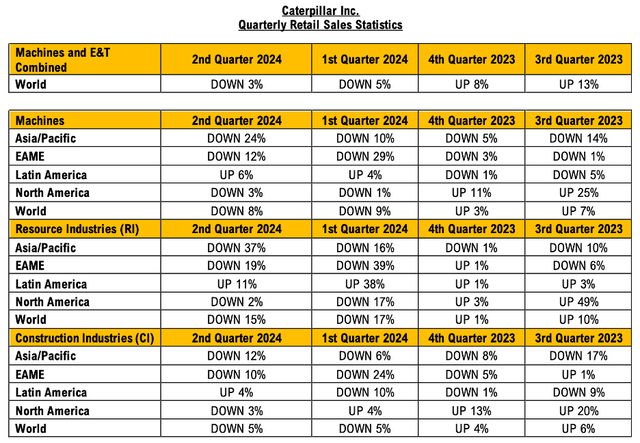

While Caterpillar sells their products across the globe, weakness in the North American construction market has resulted in lacklustre growth, with the softer demand environment being felt across essentially every market demographic Caterpillar sells to.

CAT Q2 FY24 Additional Sales Data

Despite the weakness in total net sales, Caterpillar did experience a positive effect on their business from ongoing cost-savings initiatives as well as more favourable pricing power for their products.

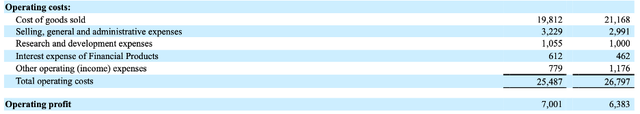

These operational improvements resulted in their COGS decreasing 6% YoY, outpacing the 4% drop in revenues, resulting in a 4pp YoY improvement in gross margins from 35% to 39%.

Adjusted operating profit increased accordingly from $6.3 billion the year prior to $7 billion in Q2.

Astute followers of Caterpillar may be keen to point out that GAAP operating profits decreased 5% YoY. While I am often sceptical of non-GAAP figures, Q2 did see Caterpillar absorb some $277 million in unfavourable impacts resulting from restructuring processes within the business.

The accounted restructuring costs covered losses Caterpillar made on the divestiture of their Longwall Mining business and equipment subsidiary, which was sold to the German specialist hydraulic mining group Hauhinco.

Since the divestiture of this business truly is a one-off accounting expense for the company, I am content to dismiss the impacts of this transaction when analysing the health and efficiency of Caterpillar’s core business.

Of course, the divestiture still had a real impact on profitability in Q2, with GAAP operating profits and EPS decreasing 5% and 3% YoY respectively.

Nevertheless, I really liked the transparency afforded by CFO Andrew Bonfield’s remarks on the earnings call regarding his explanation of the context for the aforementioned fiscal results.

Bonfield noted that the primary reason for declining sales was a 7% decline in Construction Industrials sales and a 10% decline in Resource Industries sales.

Inventory clearing by dealers as a result of ballooning stocks in Q2 FY23 was responsible for some of the decline in new equipment sales, while a general softening in demand particularly in Asian, EMEA and North American markets also contributed to the decline.

While the weaker demand environment and its impacts on Caterpillar are regrettable, I must admit that I see little material damage being done to the company.

Furthermore, the lacklustre demand appears to be coming on the back of an increasingly bearish macro environment which, while unreflected by recent stock market surges, has had a very real impact particularly on capital intensive industrial businesses.

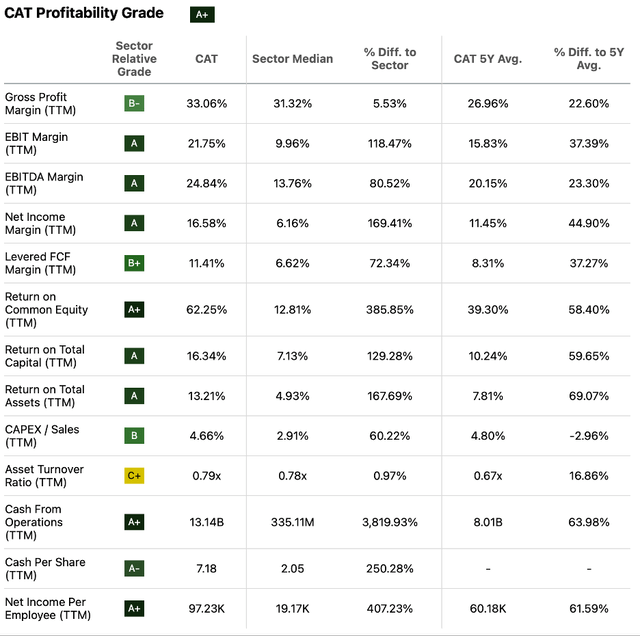

Seeking Alpha | CAT | Profitability Grade

Despite the weaker top-line figures and thanks to the impressive efficiency present at the firm, Seeking Alpha’s Quant continues to rate CAT as having an “A+” profitability grade.

I fully agree with this quantitative evaluation by the Quant and once again reiterate that in my opinion, the qualitative context surrounding these results is more indicative of greater economic weakness across global markets rather than inherent weakness in Caterpillar’s operations.

Overall, I found the Q2 results to be quite splendid when considering Caterpillar’s operational efficiency improvements. Despite the declining revenues, it would seem to me that the firm is executing a business strategy centered around maintaining sound enterprise economics and a lean operation so as to position themselves in an adaptable position should a greater market downturn occur.

I rate this strategy highly and believe the firm is making the most out of a weakening demand environment.

Valuation – Q2 FY24 Update

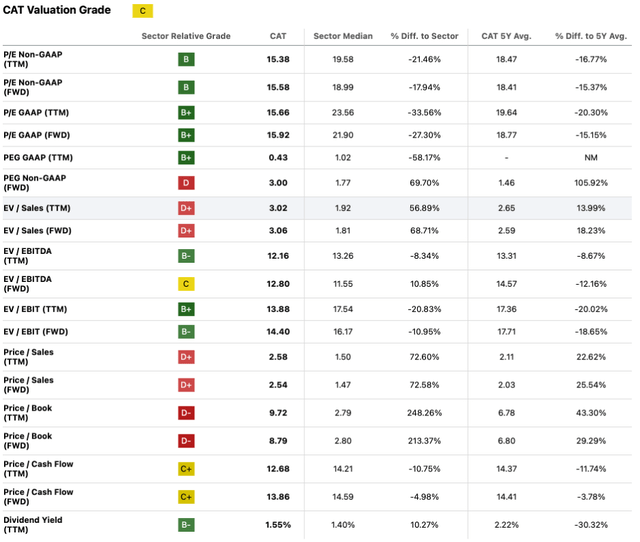

Seeking Alpha | CAT | Valuation Grade

The current Seeking Alpha Quant Valuation rating for CAT stock is a “C” which I believe may be an excessively optimistic evaluation of the current situation.

While a P/E GAAP TTM ratio of 15.66x really is quite acceptable given their consistent ability to generate profits and returns from their business and despite this metric being down almost 20% from 5Y means, I do not believe that Caterpillar will be able to continue generating growth should a weaker business demand environment persist.

Furthermore, the P/S TTM ratio of 2.58x is quite high given an industry average of 1.50x, a sentiment I also hold for their current EV/Sales TTM ratio of 3.02x.

I also find it prudent to consider these metrics against the current analyst estimates for EPS growth, which for the next two years hover between 2.9% YoY up to around 3.5% YoY.

While the valuation metrics above certainly aren’t the sort of nosebleed figures much of the stock market currently appears to hold, they are still quite elevated in my opinion given the relatively mute growth expected from CAT in the coming years.

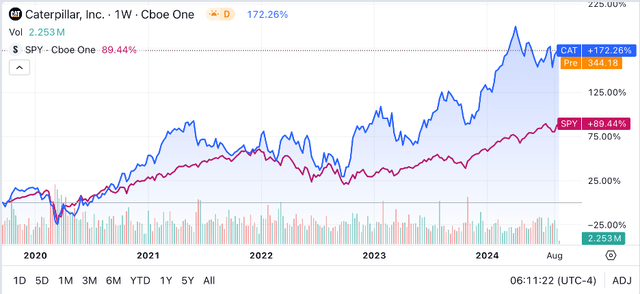

Seeking Alpha | CAT | Valuation Grade Seeking Alpha | CAT | 5Y Advanced Chart

Examination of a 5Y chart for CAT shows the massive degree to which the firm’s stock has outperformed the greater markets, as represented by the massively popular S&P 500 SPY (SPY) index fund.

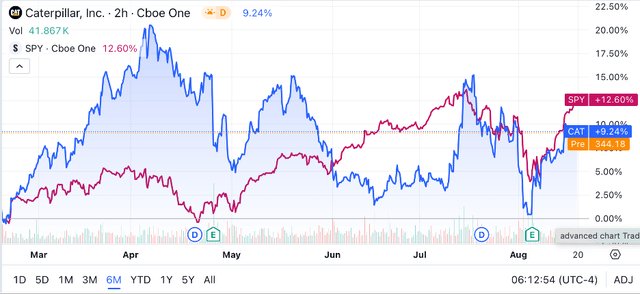

Seeking Alpha | CAT | Valuation Grade Seeking Alpha | CAT | 6M Advanced Chart

While the last six-months have been more flatline for the stock, it is important to note the volatility that has accompanied the shares, as illustrated by a beta of 1.11x. This is quite common for shares that are trading at a premium valuation, which I have confirmed through my IV calculations.

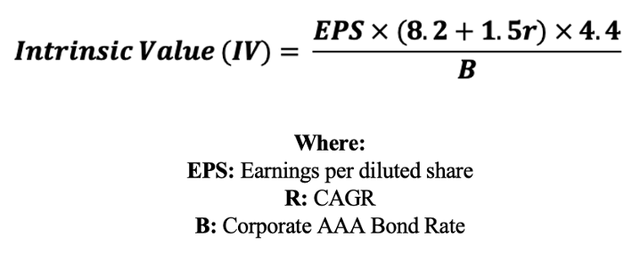

Indeed, by using the current share price of $344.65, a 2024 analyst consensus EPS estimate of $22.06 a realistic “r” value of 0.03 (3%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.12x, I derive a base-case IV of $274.90 per share.

This implies a current overvaluation of 25% given my base-case model.

In my bear-case model I considered CAGR to reduce to 2% given the impacts weak demand would have on top-line figures and accounting for some potential cost-savings and contingent operational improvements. In this scenario, shares would be valued at $237 which translates to a 45% overvaluation.

As a result of both my base and bear case valuation models suggesting a real overvaluation in shares, I remain quite hesitant to make any bullish short-term (1-12 month) predications for the stock.

While positive news surrounding U.S. economic measures or the election cycle could cause shares to rally, I believe the persistent and substantial overvaluation is more likely to place real downward pressure on shares should the softening macroeconomic indicators continue to surface.

Nevertheless, I believe that the long-term outlook for Caterpillar is positive and see the firm continuing to improve their operating economics while also returning to around 3-4% YoY revenue growth.

EPS growth could potentially pace around 5-6% YoY as the firm continue to execute on their share buyback initiatives.

Caterpillar’s Risk Profile

I conducted an in-depth analysis into Caterpillar’s risk profile in my original deep-dive article, Once again, I suggest you read that section to gain a slightly deeper analysis into the firm’s risk profile.

Nevertheless, no real change has occurred to Caterpillar’s risk profile with the firm still facing clear cyclicality and competitive pressures.

Given that demand for heavy machinery is ultimately tied to the demand for natural resources, construction and energy production, Caterpillar is undoubtedly going to continue to see real cyclicality in demand from their customers for their products.

While this does impact all competitors equally, it is important to consider when hypothesising about investing in the firm as late-stage boom-times may lead to some disappointing returns for more short-term investors should a downturn manifest itself.

Caterpillar also continues to face real pressure from the likes of XCMG who produce similar products but at much cheaper prices. While mature economic markets may still favour the durability, quality and reputation of CAT products, it is not inconceivable that emerging market clients may be more price elastic when it comes to purchasing these goods.

Summary

I do not believe the Q2 results were as negative as they first appeared. While top-line growth may have taken a hit and GAAP operating profit fell too, the underlying business at Caterpillar has in my opinion actually gotten stronger.

So long as the profitability improvements have not been made by cutting corners with their products, and if the gains have truly come due to increased pricing power and a more favourable product mix as management states, then I believe the firm is truly firing on all cylinders.

Unfortunately, the valuation has not improved since my last deep-dive on the stock and thus I am reluctant to make a change to my rating for Caterpillar. I have noticed this feeling of reluctance to shift towards a buy-oriented rating also increases as I consider the potential for what could be a minor yet material slowdown in economic growth.

With these factors in mind, I continue to rate CAT a Hold at present time and will continue to seek a more lucrative entry point into the stock before beginning to build a position for myself or any clients.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. The opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.