Summary:

- Centene Corporation is a financially healthy company but is assessed a Hold opportunity for retail value investors due to political uncertainties about government healthcare programs and lack of a dividend.

- Despite a positive Q2 ’24 earnings report, Centene stock has exhibited high volatility and faces growth challenges.

- Risks for investors include reliance on government programs, potential regulatory changes, and limited growth opportunities in the healthcare sector.

J Studios

Politics Creates the Unknown

Five months ago, we assessed Centene Corporation (NYSE: CNC) as a Buy opportunity. Centene is still a potentially moderate buy on dips in the share price now near its 52-week high of $81.42 each. Overall, we judge Centene stock as a Hold at this time for retail value investors for several reasons:

- The company has cash and equivalents to offset its debt and substantial free cash flow but pays no dividend.

- Shares have been volatile YTD following many months of low volatility.

- Congress talks about managed care companies like they are war profiteers, an enemy in the war against poverty, responsible for skyrocketing medical service costs and keeping Americans uninsured; lower reimbursement rates, price controls, and narrowing government services are on the political agenda.

- The political positions of the presidential candidates about Medicare’s future and managed healthcare leave us skittish about Centene at this time.

Centene’s stock price average of $71.12 outpaces the S&P 500 and the Relative Strength Index of $65.36 for one year. Centene is +21.48% over the last 12 months but at a slight +5.26% YTD. The share price was about $78 when our last article was posted in March, just about the same as where it closed the second week of August. The stock dived in June and July bottoming at $64.89 per share.

According to researchers at US Growth Equities, in April ’24, Medicare Advantage rates for services to seniors and paid to managed care companies were disappointing; next “medical costs have risen because of post-COVID normalization trends, as many older members seek elective medical procedures that were deferred during the pandemic.” Shares sunk this summer on comments from other CEOs about more procedures since the pandemic curtailed, older Americans are costing the system more money for services like knees and hips, and we foresee a shortage of doctors and nurses sparking higher wages and operating costs.

Profile

Centene is the largest managed healthcare provider in the four largest Medicaid states: California, Florida, New York, and Texas. Centene claims to serve the largest number of military families offering “doctor and hospital coverage, …prescription drug coverage, dental, hearing, vision, fitness memberships, and more. Wellcareoffers Medicare Advantage plans in 37 states as well as standalone Medicare Prescription Drug Plans (PDPs) to 6.4 million members across all 50 U.S. states and Washington, D.C.” State health insurance marketplace business continues to be a notable source of strength for Centene.

Q1 ’24 earnings announcement in April was accompanied by management’s guidance upgrade of the company’s FY ’24 EPS. The company beat EPS estimates by $0.18 and revenue by $4B. Premium and service revenue increased in the first quarter and membership in its Marketplace program jumped 41%. These numbers provided investors with a sense of momentum going into Q2 ’24.

In July, ’24, the company financials filed with the USSEC for Q2

- Adjusted quarterly net earnings were $1.28M up from $1.15M Y/Y.

- EPS was $2.42 compared to $2.10 in Q2 ’23 and $4.68 per share versus $4.21 for 6 months in 2024 and 2023, respectively. Earnings from operations of $1.22M in Q2 ’24 jumped from $1.17M for 3 months ending in 2024 over 2023.

- GAAP SG&A dropped in Q1 ’24 to $2.89M from $3.016M in the first quarter of 2023.

- Cash and equivalents and premium/trade receivables increased ($3.419M) since December ’23 ($3.272M). At the last report, Centene had $17.6B in cash and equivalents, ~$17B in receivables (up from ~$15.7B in December ’23), and long-term debt of $17.5B that is down from $18B in FY ’21.

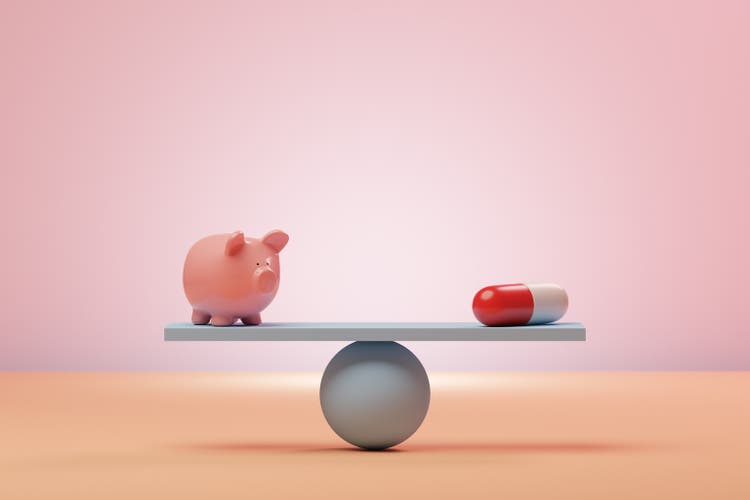

Since 85% of Centene’s revenue source is from government-sponsored programs where growth can be stunted. In the 3 months ending in June, Q2 ’24 revenue increased a modest 3% from Q2 ’23. In our opinion, Medicaid and Medicare will continue to be the mainstays of America’s healthcare payment system for the poor, the working poor, and seniors, for reasons we describe in our book, Healthcare Insights: Better Care, Better Business.

Premium & Services Revenue FY 23 & 24 (Centene Corp)

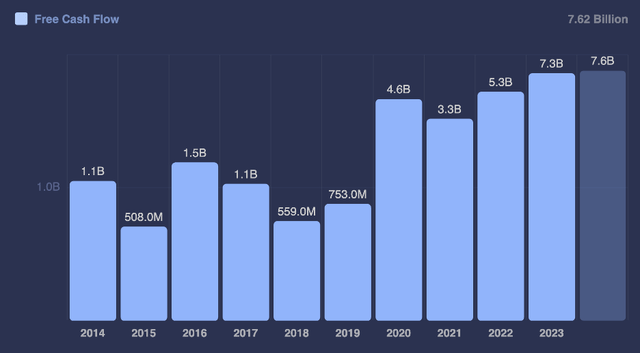

Centene reported in its Q2 ’24 announcement that its cash flow from operations for the first 6 months of 2024 was down to $1.719M versus $6.815M in the 6 months ending June 30, ’23. It is our opinion that the downturn was driven by poor numbers in premium and trade receivables, accounts payable, and accrued expenses.

This can turn into a trend with states covering illegal immigrants under Medicaid and states “expanding Medicaid coverage to adults with incomes up to 138 percent of the poverty level (about $20,780 annually for an individual or $35,630 for a family of three). States that have adopted the expansion have dramatically lowered their uninsured rates,” according to the Center on Budget and Policy Priorities. Centene’s CEO seems aware and told shareholders about developing a timely response to the

unprecedented scale and has driven a similarly unprecedented membership shift that we knew would require the rebalancing of rates to account for the acuity of the members we continue to serve on behalf of our state partners.

Mixed Reviews

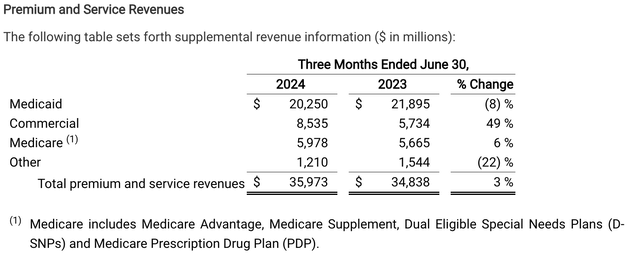

From late 2023 through June, Seeking Alpha rated Centene stock a Buy to Strong Buy opportunity. Since then, the Quant Rating assessment has leaned from Hold toward Sell despite Seeking Alpha’s Factor Grade report still giving high marks for all factors except growth.

Quant Rating & Factor Grades (Seeking Alpha)

Wall Street analysts are evenly divided between a Hold rating and acquiring shares at the current price. Centen’s Levered/Unlevered Beta is a high-side 0.85 for volatility but short interest is less than 2%. Neither metric appears to affect the stock’s price performance; its momentum ticked up from B- to B over 6 months, and its one-year price performance rates a B+ grade when comparing Centene (21.48%) to the healthcare sector median of -11.32%.

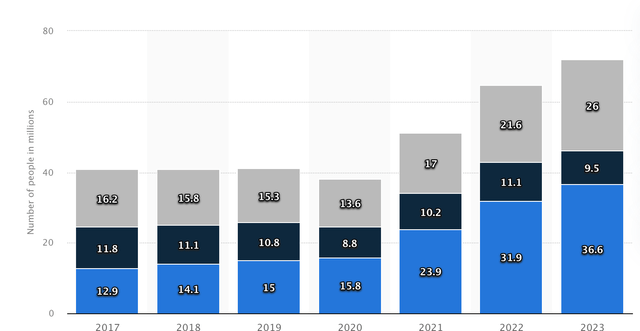

A great opportunity for managed care growth is for the company to focus on marketing on the expanding numbers of 1099 workers. 45% of the workforce or +72M workers are independent contractors. 29% are Gen X, 33% are millennials most likely with families to cover, and 19% are Gen Z. Health and dental coverage are rarely part of the benefit package for 1099 workers leaving them to navigate a complex system usually on their own.

1099 workers in the U S from 2017 to 2023, by frequency (Statista)

Valuation

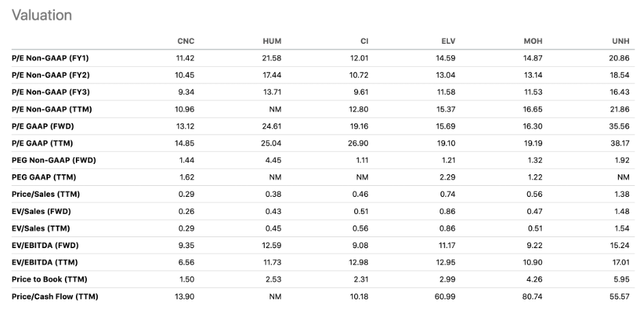

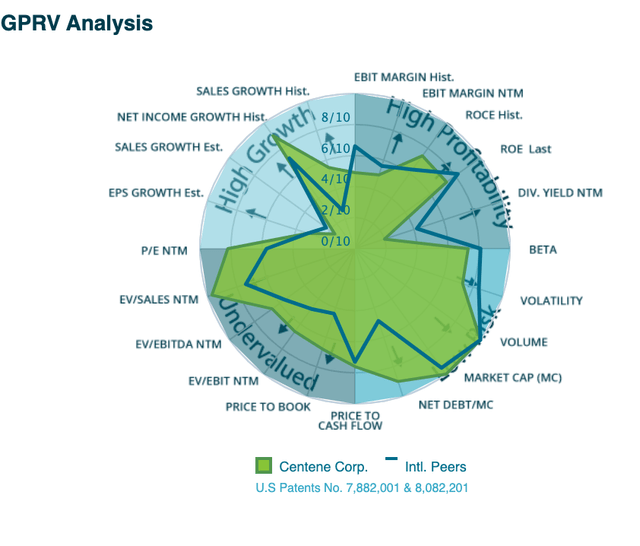

Based on the estimated 2024 earnings forecast by a consensus of analysts of $6.75 to $6.84 times the PE of 11.42, Centene stock is selling at a fair value of over $78 per share. By nearly every metric Centene beats the healthcare sector metric medians. The stock is moderately undervalued and can, with high momentum underpinning the stock, move to an average target price of $85 during the remainder of this year. One analyst has a target price of $92 expecting the company to maintain its healthy margins and positive guidance from management for the full year. The company reported excellent profits in Q2 ’24, as well. Though the gross profit margin is a low 15.45% garnering a D Factor Grade versus the sector median of gross profit of $57.55%, all other metrics beat the sector medians: EBIT margin, EBITDA, and net income. But compared to peers, the Centene valuation has room for improvement:

Centene Valuation to Peers (Seeking Alpha)

Risks

Risks facing retail investors include owning a stock that exhibited high volatility lately; the Beta is up from 0.47 over 24 months to 0.85 currently. Lacking a dividend when competitors pay makes Centene appear too conservative. Most of Centene’s competitors pay dividends, though the managed care industry is notorious for low payout ratios and yields. A company that reported a second-quarter profit of $1.1B and nearly $40B in revenue can afford to pay its retail investors a dividend. That move will spark a pop in the share price.

FreeCash Flow Centene Corp (MacroAxis)

Another risk is the F-assigned Centene for growth. The lack of growth in an industry where 27M Americans do not have coverage seems inexplicable. Revenue growth at Centene has been below average, fails for EBITDA growth, EPS FWD, Free Cash Flow per share growth, and operating cash flow growth, and falls below the sector median of -16.97% for CAPEX growth at -24.35% Y/Y. These numbers are bound to be hit by the recent announcement, “Centene will exit the Medicare Advantage market in at least six states in 2025… These states account for about 3% of Centene’s (Wellcare) Medicare Advantage membership.” Susan Morse, editor, of Healthcare Finance, surmises that “higher patient acuity and utilization of services” with inadequate Medicare reimbursement may account for the decision.

Other risks facing Centene investors are its reliance on government-sponsored programs and the vagaries of political whim that undergird them. At times, the company’s operational costs can exceed reimbursements hurting cash flow, eating away at profit margins, and requiring internal cost-cutting to reduce efficiencies. Last year’s EPS for Q3 ’23 was $2; our estimated EPS this year is about $1.63 to $1.65 which will be announced tentatively on October 25, ’24. The company has consecutively beaten the estimated EPS for the last 9 quarters. Over 99% of the outstanding common shares are owned by institutions.

Centene Analysis (Infront Analytics)

Takeaway

Centene Corporation is on sound financial footing at present. Acquiring shares modestly at lower prices in dips can be a wise move but overall our judgment is to rate the stock a Hold opportunity. Growth opportunities are limited as the focus is on government healthcare sector programs. Centene’s insiders have been selling their shares this year when the price generally topped $75 per share. They have sold $67,000 worth in the last 3 months. At the close of 2023, 50 hedge funds owned shares but only 49 owned Centene at the end of Q2 24.

The primary concerns that force us to take this conservative position on Centene are the lack of dividends and the company’s reliance on government reimbursements that might degrade with an activist Congress or push by the Executive branch to re-writ regulations to cut the federal budget deficit; rising administrative costs from increasing patient use and skilled services an older population requires can dampen profitability and margins.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.