Summary:

- Google’s fundamentals are intact due to its dominance in digital advertising and YouTube’s strong potential.

- Cloud business is thriving and Google’s financial position is far stronger compared to its major rivals in cloud infrastructure.

- Google’s stock is a Hold at the current price, with potential to add more if it drops below $140 within the next few months.

Savusia Konstantin

My thesis

My analysis of Google’s (NASDAQ:GOOGL) (NASDAQ:GOOG) stock suggests that the company is a true business powerhouse. Therefore, it is no wonder that the stock became overvalued as a result of a massive AI-driven rally during the past several quarters. According to my intrinsic value calculation, GOOGL trades at a 17% premium, which I find way too expensive. On the other hand, my review of Google’s business shows how strong its long-term growth prospects are. I already have Google’s shares in my investment portfolio, but GOOGL is a Hold at the current share price. If within the next several months it goes below $140, I will add more of it to my portfolio.

GOOGL stock analysis

Google’s $2 trillion market cap makes it the fourth-largest company in the world behind Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT) that are all above $3 trillion. Google achieved such a massive scale by building a digital advertising empire.

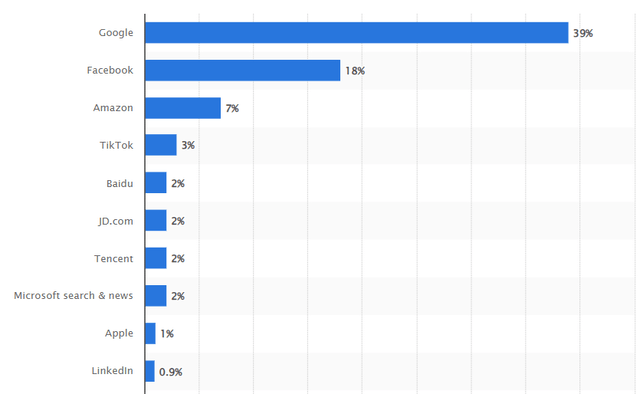

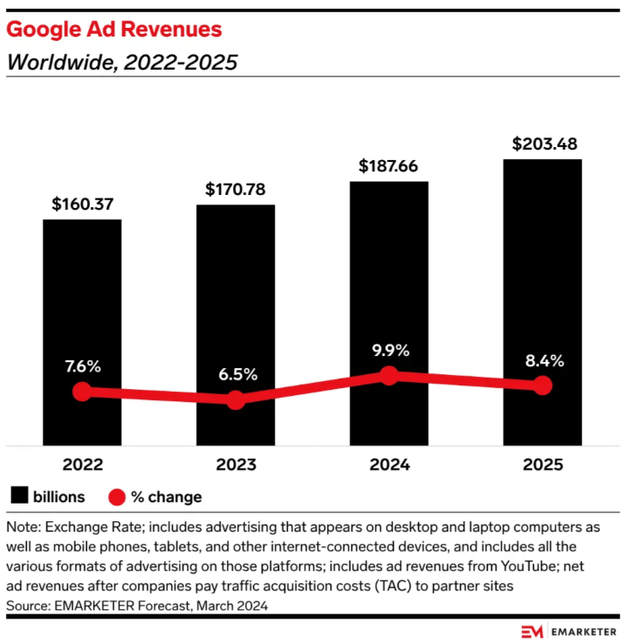

The company boasts a staggering 39% market share in the digital advertising industry worldwide. Google’s market share in digital advertising is more than two times as high as the second place’s. Industry experts are quite positive about the company’s potential to continue driving growth in digital advertising sales. In the below chart EMARKETER forecasts Google’s digital advertising revenue to demonstrate solid growth in 2024 and 2025, notably faster compared to 2022 and 2023.

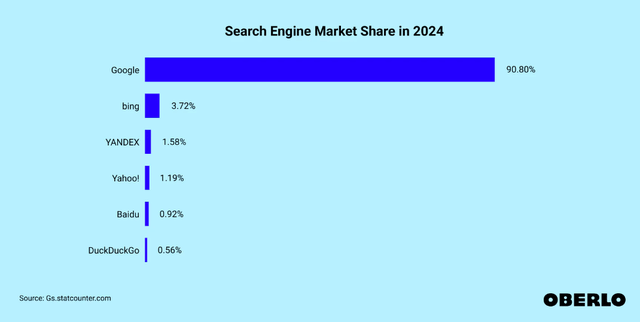

Google’s dominance in digital advertising is backed by its intact positions in web browsing and search engines. According to Oberlo, Google’s Chrome is by far the leading web browser, with a jaw-dropping 65% global market share. Google’s market share in search engines looks almost unbelievable at almost 91%.

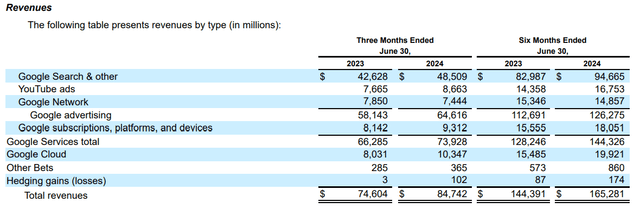

As penetration expansion of the Internet is naturally slowing down, Google’s growth in digital advertising from search and browsing will also inevitably cool down. To mitigate this factor, Google has a rising digital advertising star, which is YouTube. Advertising revenue generated by YouTube is the fastest growing revenue stream among all advertising streams. For example, in Q2 2024 YouTube’s advertising revenue grew by 13% YoY.

I believe that YouTube is positioned extremely well to be a long-term revenue and profitability growth driver for Google. YouTube already dominates the market of streaming platforms. Competitors like Netflix (NFLX) and Disney (DIS) are formidable, but YouTube’s business model appears to be able to demonstrate stronger operating leverage. While Netflix and Disney need to invest substantial amounts to produce content, YouTube does not have these substantial costs with high level of uncertainty regarding payback periods. Considering Google’s dominance in web search, and unique business model of YouTube, I think that the company is poised to retain its dominance in digital advertising for decades ahead.

YouTube does not only help in driving advertising revenue, but also helps to drive growth in subscriptions business. According to the management’s discussion section of the Q2 10-Q report, growth in paid YouTube subscribers was the main driver of growth in “Google subscriptions, platforms, and devices” that delivered a solid 14% YoY growth.

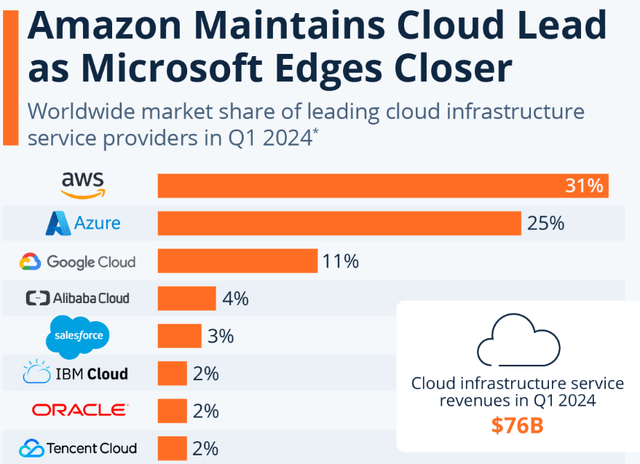

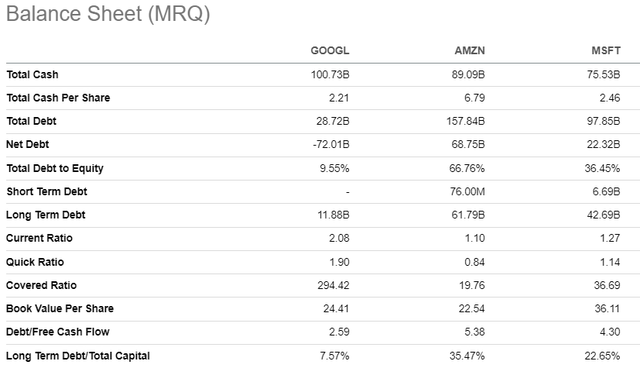

Revenue concentration in digital advertising is high (76% of total revenue in Q2 2024), but Google has strong potential to diversify its mix. With a massive 29% YoY growth in Q2 2024, Google Cloud is one of the company’s fastest growing business. According to the above screenshot, Amazon (AMZN) and Microsoft are well-ahead of Google in the cloud infrastructure market, but the gap is consistently closing. Google had a 9% market share in cloud in 2021, but the latest report suggests that its market share has expanded to 11%. Despite the gap between Google and the cloud market’s leaders, I am quite optimistic about the company’s potential to continue closing the gap. All three companies are well-known for their commitment to innovate, but Google has far more financial resources than AMZN and MSFT. All three giants boast massive cash piles, but Google has almost no debt, with a massive $72 billion net cash position. AMZN and MSFT are both in net debt.

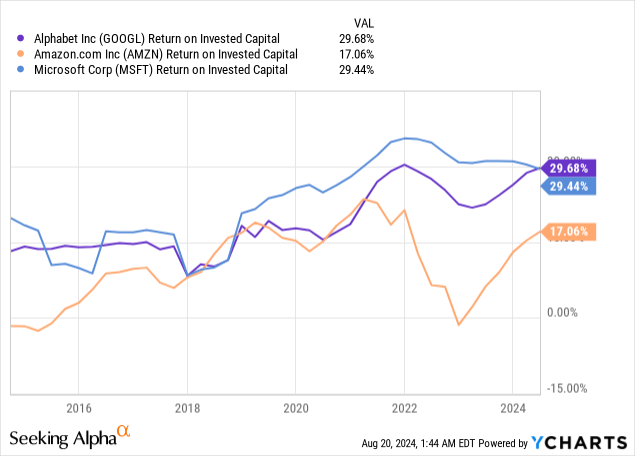

Confidence in Google’s ability to invest in profitable ventures is backed by its exceptional return on invested capital record. Google’s ROIC is very close to Microsoft’s and is far above Amazon’s. Grand View Research expects cloud computing market to grow with a 21.2% CAGR by 2030, which is a strong secular tailwind for Google.

To wrap up my stock analysis, Google is a well-rounded business. Its intact positioning in digital advertising allows it to generate exceptional profitability, and spare capital is invested heavily in new ventures. It also has two stellar young businesses like YouTube and Google Cloud, which will help to sustain revenue growth for longer. The company’s $72 billion net cash position is comparable to the GDP of a rich European country like Luxembourg, meaning there is a massive potential to reinvest in growth.

Intrinsic value calculation

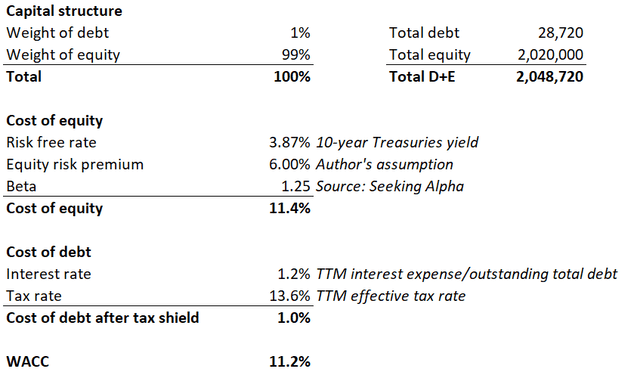

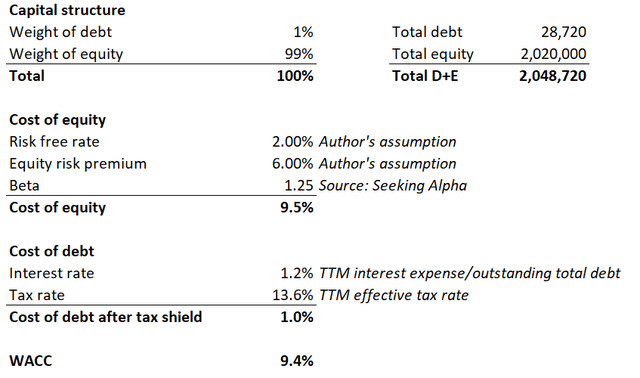

Discount rate is a vital assumption for the discounted cash flow (DCF) model. Therefore, I start with calculating the weighted average cost of capital (WACC) using the capital-asset pricing model (CAPM). Below working outlines my WACC calculations. GOOGL’s WACC is 11.2%.

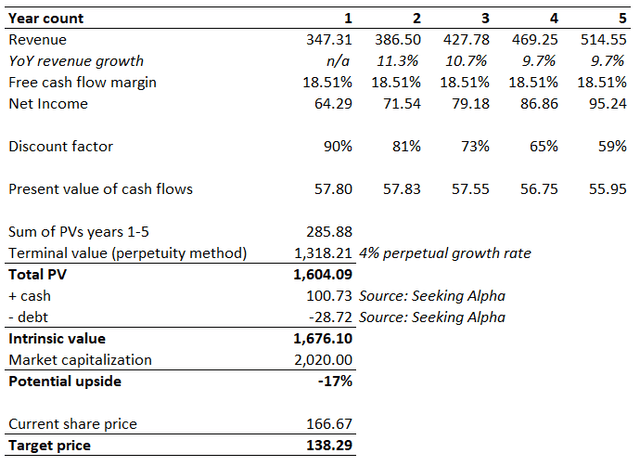

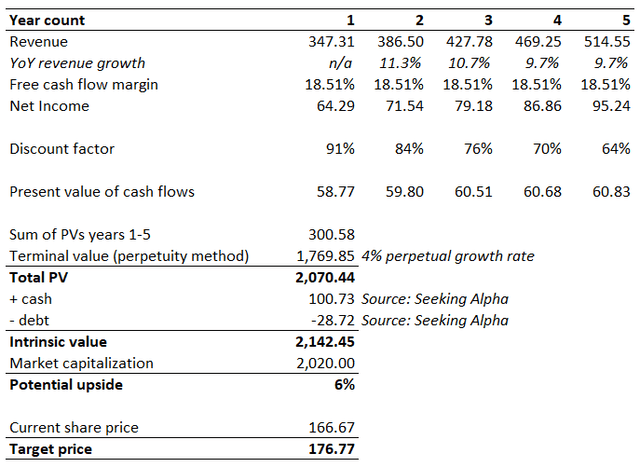

Consensus estimates appear conservative, as they forecast a low double-digit revenue CAGR for the next five years. A 18.51% TTM levered FCF margin which is the company’s last five years’ average. The perpetual growth rate is 4% for Google due to its fundamental strength.

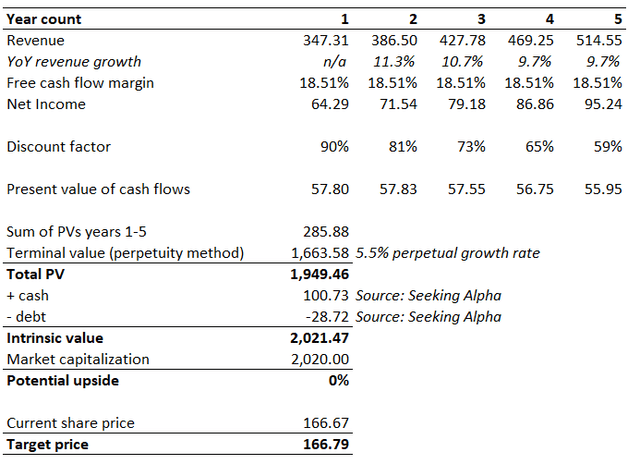

Google’s intrinsic value is $1.7 trillion, meaning that there is a 17% potential downside. I have played with the perpetual growth rate, and it appears that the market prices in a 5.5% perpetual growth rate. Such a perpetual growth rate appears to be too high, as it means that the company will significantly outpace the U.S. economy’s growth forever. Therefore, GOOGL’s valuation does not look attractive.

What can go wrong with my thesis?

My thesis is mixed because the GOOGL’s fundamentals are very strong. On the other hand, it appears that unrealistic optimism is already incorporated into the share price. I am not buying this stock at the current price and if the stock rallies further it will mean that I was wrong.

My DCF with a 4% perpetual growth rate suggests that GOOGL’s intrinsic value is around $1.7 trillion. Nevertheless, the company’s market cap rallied towards $2.2 trillion relatively recently, which might mean that some of my assumptions are too pessimistic. An 11.2% discount rate might be too aggressive for Google’s DCF. The uncertainty around the Fed’s timing of the monetary policy pivot is high. I will try to simulate another scenario with a 2% risk-free rate for my WACC working. With the lower risk-free rate implemented, the WACC decreases notably to 9.4%.

With a 9.4% WACC and a 4% perpetual growth rate, the stock now looks much more reasonably valued. With a lower WACC, the stock is now 6% undervalued, meaning there is still room for the rally to continue. What I am trying to demonstrate with this sensitivity test is that GOOGL’s investors might react with strong optimism to the first interest rates cuts, as it significantly improves the valuation and might fuel further rally.

Summary

GOOGL is a Hold at the current share price. Fundamentals are intact, but I think there will be better buying opportunities than paying a 17% premium over the stock’s intrinsic value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.