Summary:

- AMAT’s 3Q24 results and outlook lead us to believe that the stock will see a soft back end of the year before material outperformance in 2025.

- Our previous expectation of a 2024 WFE rebound was premature; instead, we now expect the rebound to take place in 2025, supported by unit demand recovery and AI-led demand.

- We think the downside from sales to China shrinking as a percentage of total revenue will be priced in by the market in 2H24 and won’t spill into 2025.

- We expect AMAT to outperform in 2025 as leading-edge WFE spending for foundry/logic and DRAM recovers.

Jorg Greuel/DigitalVision via Getty Images

Applied Materials (NASDAQ:AMAT) reported its 3Q24 results and outlook, wrapping up earnings for the key semi-cap players for the quarter after ASML (ASML) and Lam Research (LRCX) announced in July. Our positive thesis on AMAT proposed last November remains intact, but the timeline for it has been pushed out after a lackluster wafer fabrication spend recovery this year. We now expect a lackluster back end of the year for AMAT before material outperformance in 2025. We’ve been watching two metrics closely when it comes to AMAT and gauging its position heading into 2025.

The first is exposure to elevated and unsustainable Chinese customer demand (the unsustainability of which proved to be true with shipments to China declining or normalizing to the 30% range of total revenue, at 32% this quarter, compared to 43% just last quarter). We think the impact of what is now weaker demand from China will weigh on AMAT’s financial performance in 2H24 but won’t stain 2025. This brings us to the second thing we are watching, which will be the primary catalyst for AMAT’s outperformance in 2025: wafer fabrication spend, or WFE.

WFE spend refers to the spend in the market of manufacturers of machines/equipment that later manufacture semiconductors and, in turn, acts as a leading indicator for understanding demand-supply dynamics. Think of it like this: there needs to be an increase in WFE spending to feed future demand for smartphones, PCs, and even AI servers, and vice versa; when there is lower demand, there is less of an upward revision in WFE spend.

We had anticipated WFE spending would rebound towards the end of 2024, but this did not play out due to the macro backdrop weighing on any true demand recovery across the board from PC to smartphone to auto. We now think our expectation of material WFE spend growth will take place in 2025, supported by unit demand growth on edge devices, i.e., PCs and smartphones, coupled with better unit growth from AI servers. The uptick in WFE translates to a tailwind for AMAT due to the company’s central position in the etch and deposition market.

The reason our thesis got pushed out to 2025 is the macro headwinds of a higher for longer interest rate strategy that hindered any catalyst or support for smartphone/PC end demand recovery. Like we said earlier, if there is no increase in demand, it’s tough to have any real rebound in WFE spend. We’re more optimistic about next year as Gartner’s report published in early July forecasts WFE revenue to increase low single digits this year by 2.6% as “market pauses before growth resumes in 2025” and then a 7.5% growth in 2025 and continued high single digit growth in 2026.

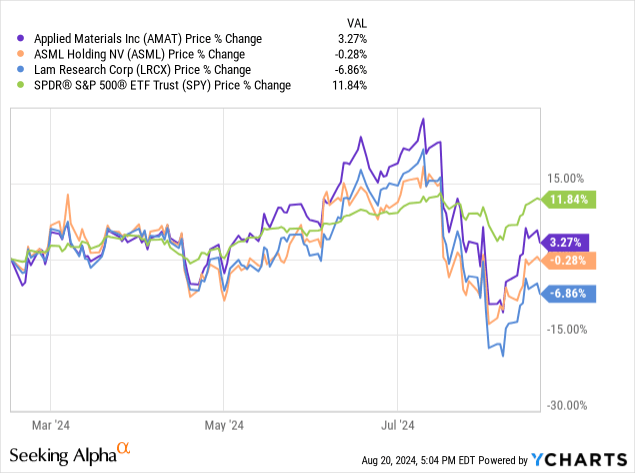

We’re more positive about seeing the necessary cuts from Fed Chair Jerome Powell this Fall as the market anticipates an interest rate cut in September. The lower interest rate environment, coupled with the downside from dependency on China for financial outperformance being recognized, should make AMAT stock better positioned to significantly outperform in 2025. We say we load up on pullback this quarter; AMAT and its semi-cap peer group underperformed the S&P 500, with the semi-downturn in July providing a more attractive risk-reward profile for longer-term investors to begin exploring entry points. The following chart outlines AMAT’s stock performance over the past six months against ASML, LRCX, and the S&P 500.

YCharts

Setting the stage for 2025 outperformance

This quarter’s results confirmed our positive sentiment on AMAT’s FY25 in terms of better-than-expected sales and margin guide supported by 1. better end demand recovery and 2. gate-all-around or GAA demand and ICAPS growth rate picking due to AI inflection. The company reported sales up ~2% Q/Q and 5% Y/Y to $6.78B, with a gross margin of 47.4%, up 100bps Y/Y and 10bps Q/Q. Management is guiding for sales of $6.93B, plus/minus $400M for Q3, relatively in line to slightly ahead of estimates. Factored into this guidance is the forecast for China sales to remain in the 30% range of total revenue, which is a positive as it confirms that the China downside has been priced into the outlook and makes room for more organic outperformance supported by end demand recovery.

Here’s AMAT’s business breakdown: AGS sales grew 3% Q/Q to $1.58B; SSG were relatively flat Q/Q at $4.92B; Display and Adjacent markets rebounded Q/Q to $251M. DRAM continues to be the main catalyst supported by AI-led demand for HBM, with DRAM sales up 50% Y/Y this quarter, while NAND sales also improved but at a slower pace, up 10% Y/Y.

Part of why we’re not too optimistic about the 2H24 is because 1. China sales that had supported a lot of the DRAM demand earlier this FY24 are fading. 2. DRAM and NAND spot prices are declining, confirming the weaker smartphone and PC market in the near term. Logic/foundry demand continued to grow, with management now guiding for over $2.5B in sales from gate-all-around nodes in CY2024 and potentially double that in CY2025. ICAPS continues to show strong momentum, but we don’t see it driving substantial outperformance, considering its heavy exposure to auto and industrial end demand that continues to correct in 2H24.

Management didn’t give too much in terms of hints of FY25 guidance but pushed the narrative of strong AI energy supporting a rebound in memory not only in DRAM but also in NAND. Capex will be at a higher run rate than in the past; highlight that Q1 will be a normal step up for pay-related increases for modeling and tax rate at ~14% versus 12.5% in FY24 due to more of the mix being U.S.-related.

Valuation & Word on Wall Street

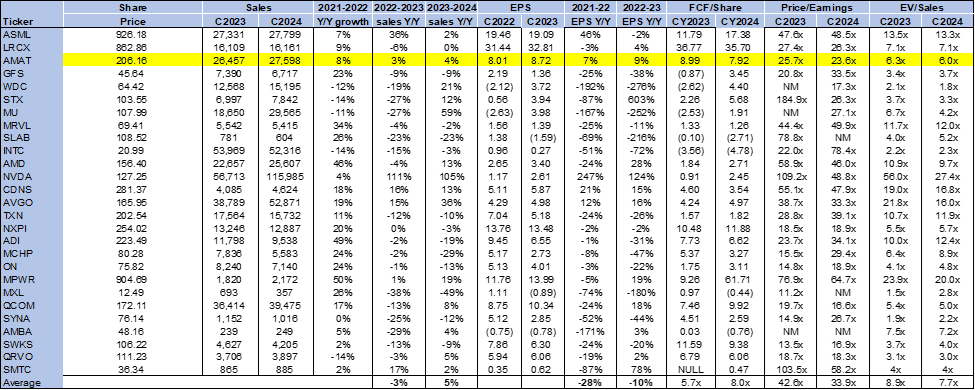

AMAT is not expensive, considering the AI-led premium multiples we’re seeing in the semi peer group. The stock is trading at 6.0x EV/C2024 Sales compared to the peer group average of 7.7x and naturally higher than its ratio of 4.9x last November. On a P/E ratio, the stock is trading at 23.6x C2024 versus a group average of 33.9x and 19.7x back in November. We think AMAT is fairly valued with potential upside in 2025, given its position in the etch and deposition market during an upturn in WFE spending due to 1. unit demand growth and 2. increased customer investment in AI (particularly in high-bandwidth memory or HBM capacity). Keep in mind that TSMC (TSM), which is Nvidia’s (NVDA) fab, is a 10% customer at AMAT. The following chart outlines AMAT’s valuation against the peer group.

TechStockPros

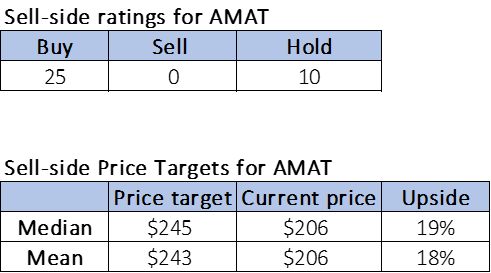

Wall Street shares our bullish sentiment on the stock, with 25 out of the 35 analysts covering the stock recommending a buy and 10 recommending a hold; that’s also a notable improvement from the sentiment last time we wrote on AMAT when there were more bearish sell-side ratings. Sell-side price targets on the stock confirm more of the same, with the median sell-side price target for $245 and the mean for $243, with a potential upside of 18-19% compared to the forecasted upside of 2-3% late last year. The following charts outline AMAT’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

Management was careful not to commit itself to any guidance for FY25, which is a wise move to let the full downside play out instead of prematurely pricing in the positives of a healthier end-demand environment. But, we see signals of a better-than-expected 2025 when you look at the broader picture: the PC industry cannot continue to operate at the current run rate, Microsoft Windows End of Life or EOL coupled with better interest rates should trigger a refresh cycle for corporate players to resume hiring and spending next year. This has historically increased the need for DRAM spend and, by extension, WFE spend. AI will also be an added booster to this cycle as heightened AI server demand will also push demand for high-bandwidth memory or HBM further in 2025. Aside from edge devices’ general demand rebound, we should see more substantial demand for ICAPS as auto and industrial markets correct, which make up roughly half of the ICAP growth.

AMAT’s outperformance, carrying it to its early July highs, was supported by the business mix in China, and now the rest of the world’s demand rebound should kick in for 2025. We expect to see more DRAM demand due to customer investment in DRAM capacity at an even higher capacity than NAND due to AI use. There’s a lot set in place for AMAT to outperform in 2025, but we do believe investors will need to wait out the near-term lull in exchange for that longer-term return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.