Summary:

- Growth is healthy, both organically and inorganically. Upselling and an improved go-to-market strategy are leading to higher organic growth with great near-term revenue visibility.

- A revenue mix shift toward the software business makes a compelling case for margin expansion and a transition to a negative working capital profile.

- AVGO is valued at a small discount vs peers. Given growth and margin catalysts, I believe there is a case for margin expansion and a premium multiple.

- Relative technicals vs the S&P 500 point bullish, indicating a resumption of the alpha-generating trend.

- Apple and customer concentration is a key risk monitorable, although the acquisition of VMWare is likely to reduce the extent of this risk.

pepifoto

Thesis

I am bullish on Broadcom (NASDAQ:AVGO):

- Growth is healthy, both organically and inorganically

- Mix shift makes a case for margin expansion and transition to negative working capital

- Valuation is attractive vs peers

- Technicals point bullish

- Apple and customer concentration is a key risk monitorable

Growth is healthy, both organically and inorganically

Broadcom made a major acquisition last year by buying cloud computing company VMWare last year for $69 billion. In these kinds of scenarios, to assess operational health of the company, I believe it is important to look at growth both organically and inorganically.

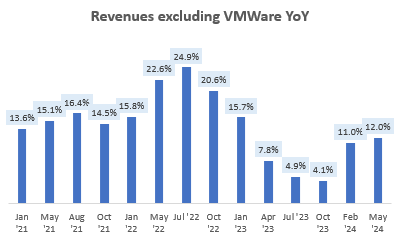

Revenues excluding VMWare YoY (Company Filings, Author’s Analysis)

Overall organic growth for Broadcom over the last couple of quarters has accelerated to 12% YoY.

VMWare sits within the infrastructure software segment of Broadcom’s business. This segment helps enterprises manage and secure their on-premise and hybrid cloud environments. Essentially, this is a software business, whereas the company’s Semiconductor Solutions segments is a hardware products business.

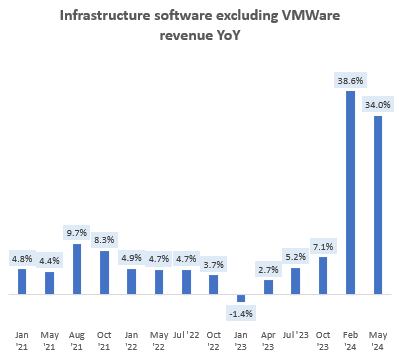

Infrastructure software excluding VMWare Revenue YoY (Company Filings, Author’s Analysis)

Organic growth for Broadcom’s infrastructure software segment is also growing impressively at more than 30% YoY. Upselling of Broadcom’s overall portfolio with a sharper go-to-market approach has been a key driver of this growth:

Since we acquired VMware, we have modernized the product SKUs from over 8,000 disparate SKUs to 4 core product offerings and simplified the go-to-market flow, eliminating a huge amount of channel conflicts.

– CEO Hock Tan in the Q2 FY24 earnings call

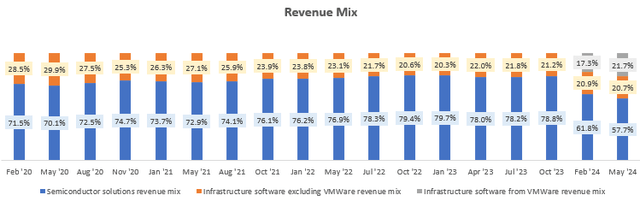

Revenue Mix (Company Filings, Author’s Analysis)

From an overall revenue mix perspective, the addition of VMWare (22% of revenues as of Q2 FY24) has led to a material mix shift in Broadcom’s business, as the proportion of the semiconductor solutions business has dropped from 79% to 58%. Keep this fact in mind when we get into the margin discussion in the next section.

I anticipate VMWare’s growth to outpace that of the overall company in the upcoming quarters. Currently, VMWare is ticking at a quarterly run-rate of $2.7 billion, posting a sequential growth of 30% QoQ in the latest quarter. Management expects this to hit $4 billion/quarter soon, although they have not explicitly confirmed a timeline. However, they have given investors a clue:

Revenue from VMware will grow double-digit percentage sequentially quarter-over-quarter through the rest of the fiscal year.

– CEO Hock Tan in the Q2 FY24 earnings call

Based on this, I believe VMWare is on track to reach a $4bn/quarter run-rate by early FY25.

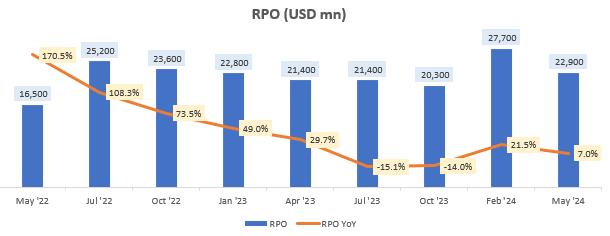

RPO (USD mn) (Company Filings, Author’s Analysis)

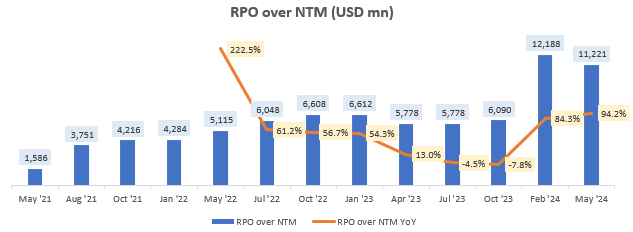

Remaining performance obligations (RPO) is a leading indicator of revenues. Overall, RPOs are growing steadily at 7% YoY. However, what is more eye-catching is the sharp increase in NTM RPOs:

RPO over NTM (USD mn) (Company Filings, Author’s Analysis)

This points toward more revenues, earnings and cash flows recognized earlier rather than later, which is accretive for valuations.

Mix shift makes a case for margin expansion and transition to negative working capital

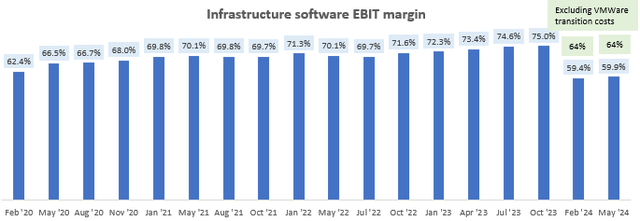

Post the VMWare acquisition, normalized infrastructure software margins are ticking at 64%:

Infrastructure Software EBIT Margin (Company Filings, Author’s Analysis)

The margin outlook is favorable, as the company is expecting realization of greater M&A synergies than previously thought:

…drove our spending run rate at VMware to $1.6 billion this quarter from what used to be $2.3 billion per quarter pre acquisition. We expect spending will continue to decline towards a $1.3 billion run rate exiting Q4, better than our previous $1.4 billion plan and will likely stabilize at $1.2 billion post integration

– CEO Hock Tan in the Q2 FY24 earnings call, Author’s bolded highlight

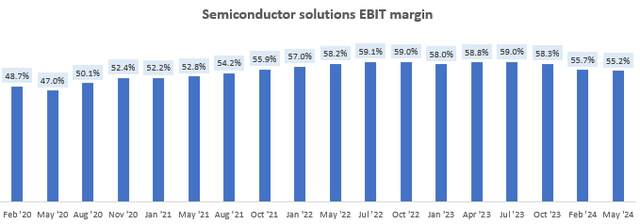

These infrastructure software segments’ EBIT margins are at around 1000bps higher than that of the semiconductor solutions segment:

Semiconductor Solutions EBIT Margin (Company Filings, Author’s Analysis)

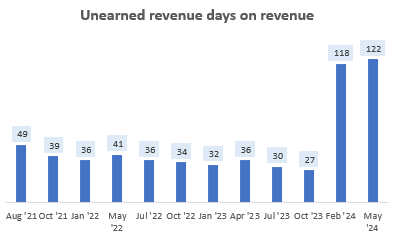

Thus, given the revenue mix shift toward infrastructure software mentioned earlier, I can see this resulting in a structural margin expansion for the company. Furthermore, there are benefits to the working capital profile of AVGO as well, since a subscription software revenue model receives cash upfront. As the CEO noted:

…transitioning all VMware products to a subscription licensing model. And since closing the deal, we have actually signed up close to 3,000 of our largest 10,000 customers to enable them to build a self-service virtual private cloud on-prem.

– CEO Hock Tan in the Q2 FY24 earnings call

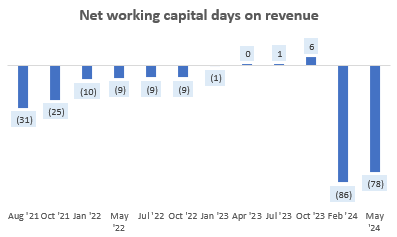

These efforts have resulted in a spike in the unearned revenue (a working capital liability) days profile of Broadcom:

Unearned Revenue Days on Revenue (Company Filings, Author’s Analysis)

Overall, this is transitioning the company’s working capital profile to a materially negative one, which is more efficient:

Net Working Capital Days on Revenue (Company Filings, Author’s Analysis)

Valuation is attractive vs peers

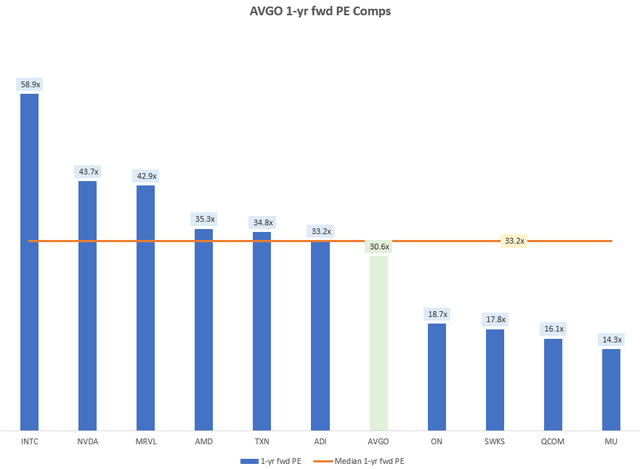

AVGO stock is trading at a 1-yr fwd PE of 30.6x, which corresponds to an 8% discount vs the median 33.2x level of its comps:

AVGO 1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Besides Broadcom (AVGO), the compset includes Intel (INTC), NVIDIA (NVDA), Marvell Technology (MRVL), AMD (AMD), Texas Instruments (TXN), Analog Devices (ADI), ON Semiconductor Corporation (ON), Skyworks Solutions (SWKS), Qualcomm (QCOM) and Micron Technology (MU)

Hence, I think AVGO is priced relatively attractively, too. In fact, I believe the margin and working capital improvements resulting from a greater software business mix makes a case for margin expansion and a premium valuation vs peers.

Technicals point bullish

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of AVGO vs SPX500

AVGO vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the weekly relative technical chart of AVGO vs the S&P 500 (SPY) (SPX), AVGO’s long-lasting uptrend remains intact as the ratio prices have recently posted a sharp V-shaped recovery from weekly support. I anticipate a resumption in the uptrend, which would correspond to continued outperformance of AVGO vs the broader market.

Apple and customer concentration is a key risk monitorable

Despite being a $43 billion company, Broadcom’s customer concentration is quite high. According to the FY23 10-K, Apple (AAPL) alone made up 20% of net revenues in FY23. And the next top 2–5 customers contributed 15% of net revenues in FY23. I think the addition of VMWare would have helped reduce these levels of customer concentration, but the extent to which it would have would be clearer upon the release of the FY24 10-K a couple of quarters from now.

Nevertheless, I believe this makes Apple’s business progress and commentary a key monitorable for Broadcom.

Takeaway & Positioning

I think after its acquisition of VMWare, Broadcom’s business mix is transitioning to one of higher quality as revenue synergies both drive growth and lead to shorter-duration visibility of revenue (as seen in NTM RPO growth). The mix shift toward software, driving a structural margin expansion and more negative working capital profile. The valuations are at a small discount vs the broader peer set and the relative technicals vs the S&P500 point bullish too.

Rating: ‘Buy’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.