Summary:

- Alphabet, Inc. remains a market leader with strong financial performance in 2024, driven by advertising and cloud computing.

- Regulatory challenges and AI safety concerns impact Google’s stock performance, but the company remains innovative and stable in the tech industry.

- Alphabet’s fundamentals are strong, with a high company rating, consistent share price growth, and a diversified revenue stream, making it a potential investment opportunity.

Boy Wirat

Alphabet, Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) remains a market leader with impressive financial performance even in the year 2024. Revenue continues to grow through its strong advertising business and cloud-computing platform that has limited competition in its industry. Strong customer targeting capabilities and core YouTube platform offering give its advertising arm a clear competitive advantage compared to others.

Google’s diversified revenue streams have insulated it from larger macroeconomic volatility. Aside from its strong cloud and advertising business, Google remains a strong innovator in the tech sector. This innovation continues to keep Google ahead of its competition. Growth may be strong, but recent news has impacted the performance of the stock in the short term.

Strong regulatory headwinds continue to drag down the stock performance of Google. Losing its antitrust lawsuit and flip-flopping on cookie removal have continued to bring bad press on Google’s image. This could lead to a potential company breakup that will likely need to be monitored. On the AI front, Google remains a lead player, albeit with concerns related to AI safety potentially impacting the growth in this space long term. Intense competition in this growing industry can also limit some of the potential growth of this company in the AI industry.

Even with these concerns, Alphabet remains a key player in the tech industry and continues to post strong financial performance.

When considering these current stories about Alphabet, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Overall, Alphabet remains an innovative and stable tech company with growth potential. Its diversified revenue streams in advertising and cloud, as well as its innovation and expansion in the AI space, leave room for growth in the stock price. The biggest threat to Alphabet long term is the regulatory challenges with the antitrust lawsuit and increased scrutiny from government agencies. While this is concerning, government regulation can change very rapidly, especially with an election cycle nearing. This dip in Alphabet’s stock price could be a great opportunity for investors to buy at a bargain price.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Alphabet is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Alphabet shows a rating score of 86.125 out of 100. This is a very good score, showcasing strong fundamentals.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

(Source: BTMA Stock Analyzer)

Fundamentals

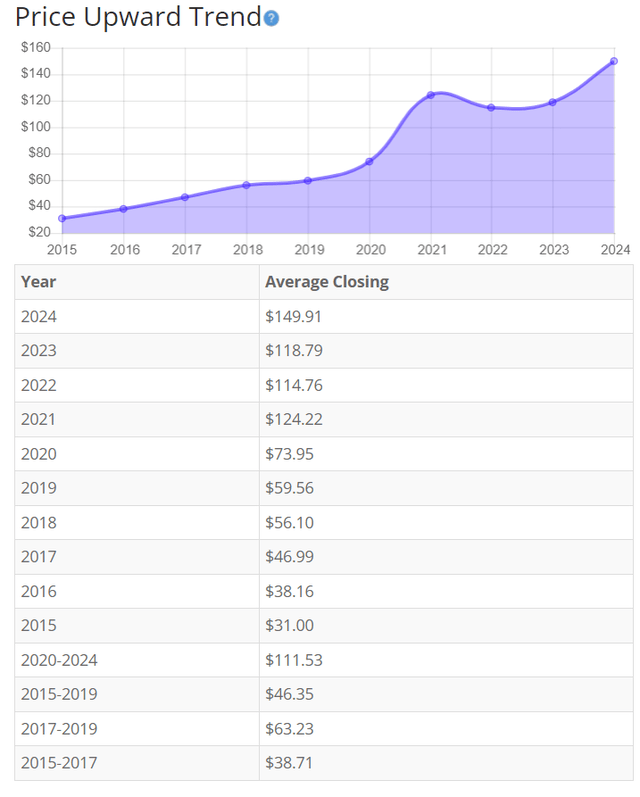

Google’s share price has grown significantly and consistently over the last 10 years. Strong revenue growth and expansion of its cloud business drive further increased valuations of the stock. The potential of the AI industry boom is also a source of potential growth for Alphabet over the long term, leaving room for further increases in the stock price. Overall, the share price average has grown by about 383.58% over the past 10 years, or a Compound Annual Growth Rate of 19.13%. This is a phenomenal return.

(Source: BTMA Stock Analyzer – Price Per Share History)

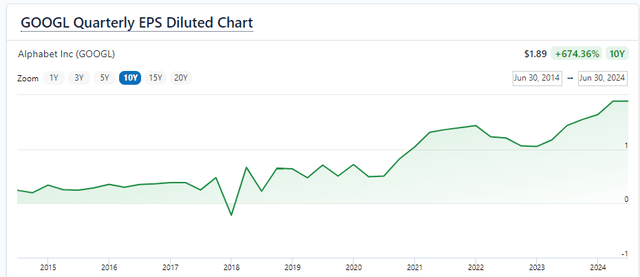

Earnings

Alphabet’s earnings were steadily rising for many years until recently. The advertising revenue volatility and regulatory costs continue to drag down earnings, even with the strong growth of Google. These will likely continue long-term and be a hindrance to EPS growth. Until revenue growth materializes in the AI industry, the operational costs will continue to impact EPS performance as well. While growth is strong in many areas, these increased costs have impacted the performance of earnings in recent quarters.

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

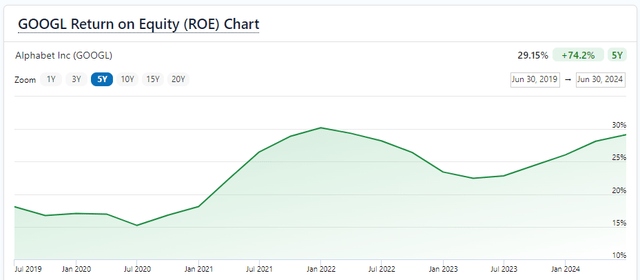

Return on Equity

The return on equity has risen before a recent fall. Many of the reasons for the decline in ROE are the same as the recent decline in earnings. While these increased cost pressures impact the bottom line for Alphabet, ROE will decline unless growth can outperform these pressures. I expect this trend to continue in the short and long term. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Alphabet easily meets this requirement.

Let’s compare the ROE of this company to its industry. The average ROE of 84 software entertainment companies is 23.26%.

Therefore, Alphabet’s 5-year average of 22.28% is on par with its competition.

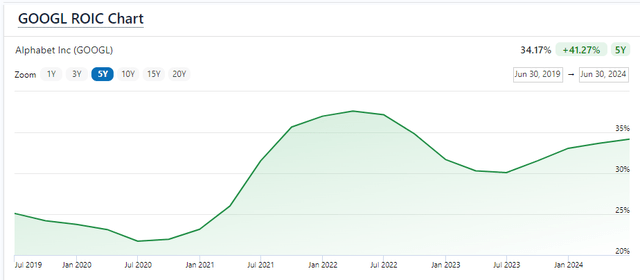

Return on Invested Capital

The return on invested capital shows a recent rise, with a decline in the most recent year. The company has increased capital expenditure year-over-year due to innovation costs, especially in the AI space. The AI industry is still in its infancy, and likely the growth has not outpaced the large costs associated with this technology. I expect this decline to continue until the AI industry actually shows a consistently profitable trend.

For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. Alphabet regularly exceeds this amount.

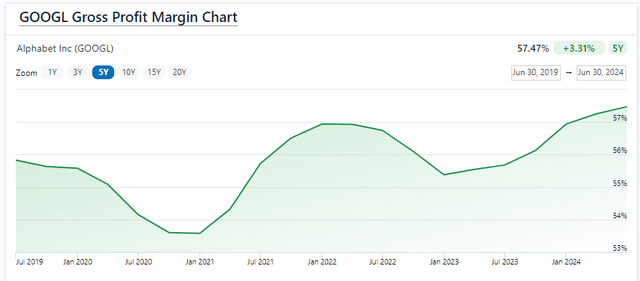

Gross Margin Percent

The gross margin percentage (GMP) has remained stable over the last 5 years. Google’s dominance in digital advertising lends itself to high gross margins. The cost of delivering ads is relatively low compared with the revenue generated. The recent growth in Google’s cloud computing business could impact this long term if it overtakes the main method of growth over advertising. Even with the recent cost increases, I expect Google to maintain a healthy gross margin in the long term.

I typically look for companies with gross margin percent consistently above 30%. Google maintains levels well above this criterion.

Financial Stability

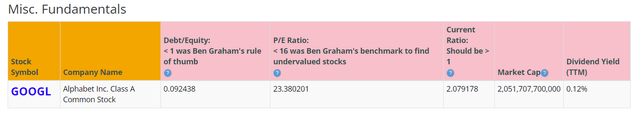

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. Google shows a strong balance sheet with the ability to pay off its obligations.

Google’s Current Ratio of 2.07 indicates it can pay off its short-term debt.

Ideally, we’d want to see a Current Ratio of more than 1, so Google exceeds this amount.

Google does not carry a large debt load, even with its immense innovation costs. This means Google could take out additional leverage if it needed to expand, especially in the AI industry. I have no concerns with Google’s current balance sheet.

Google does not pay a regular dividend.

(Source: BTMA Stock Analyzer – Misc. Fundamentals)

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio (ttm) is 23.38.

The 10-year and 5-year average P/E Ratio of GOOGL has typically been 29.9 and 26.4, respectively. This indicates that GOOGL could be currently trading at a low price when comparing to its average historical P/E Ratio range.

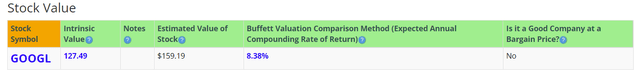

(Source: BTMA Stock Analyzer – Stock Value)

The Estimated Value of the Stock is $159.19, versus the current stock price of $168.40. This indicates that Alphabet is slightly overpriced.

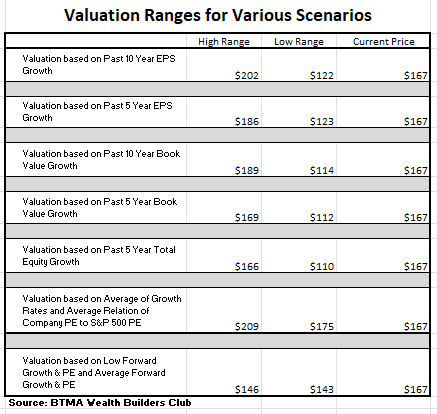

For more detailed valuation purposes, I will be using a conservative diluted EPS of 5.80. I’ve used various past averages of growth rates and P/E Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare the growth rates of EPS, Book Value, and Total Equity.

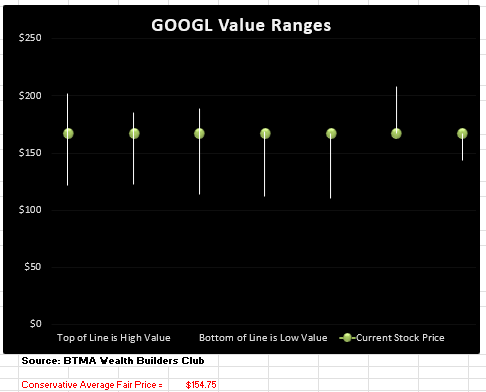

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club

BTMA Wealth Builders Club

BTMA Wealth Builders Club

(Source: BTMA Wealth Builders Club)

This analysis shows an average valuation of around $155 per share versus its current price of about $167, this would indicate that Alphabet is slightly overpriced.

Summarizing the Fundamentals

It’s hard to find a company with such strong fundamentals. Alphabet has a diversified revenue stream with a high incumbency advantage that is difficult to compete against. Its price per share consistently increases, and its gross margin remains high. The recent decline in ROE, ROIC, and earnings is mostly driven by regulatory concerns and high innovation costs, not from a decrease in demand for Alphabet’s products. Alphabet’s balance sheet remains strong, with no concern about debt load or its ability to take on leverage long-term. Overall, the fundamentals for Google remain strong.

In terms of valuation, my detailed analysis shows that the stock is slightly overpriced.

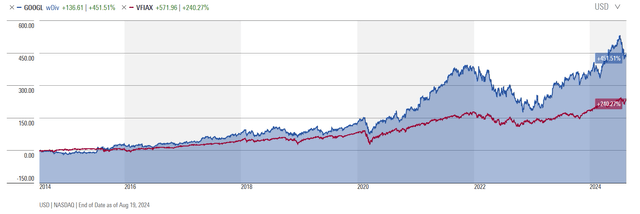

Google Vs. The S&P 500

Now, let’s see how Google compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, Google outperforms the stock market on a consistent basis. I think the stock is also in a prime position to continue to outperform the market in the long term, with the potential growth of the AI industry driving stock price increases for investors. I expect this stock to continue to outperform the overall market.

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 18.6%.

In addition, the average one-year price target for this stock is $181.93, which is about an 8% increase in a year.

The Expected Annual Compounding Rate of Return is 8.38%.

Does Alphabet Pass My Checklist?

- Company Rating 70+ out of 100? Yes (86.12)

- Share Price Compound Annual Growth Rate > 12%? Yes (19.13%)

- Earnings history, mostly increasing? Yes

- ROE (5-year average 16% or greater)? Yes (22.3%)

- ROIC (5-year average 16% or greater)? Yes (19.8%)

- Gross Margin % (5-year average > 30%)? Yes (55.6%)

- Debt-to-Equity (less than 1)? Yes

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? Yes

- Do I think this company will continue to successfully sell the same main product/service for the next 10 years? Yes

Alphabet scored 10/10 or 100%. Therefore, Alphabet seems like a wonderful company to add to a portfolio if you can pick it up at a fair to bargain price.

Is Google currently selling at a bargain price?

- Price Earnings less than average 10 year (29.9) and 5-year P/E (26.4)? Yes (23.4)

- Detailed Valuation greater than the Current Stock Price? No (Value $155 <$167 Stock Price)

Alphabet represents an opportunity for investors based on its strong fundamentals and the potential of a growing AI industry driving further growth. Alphabet remains the leader in the AI and innovation space with large capital to innovate its products. The advertising and cloud business drive a diversified revenue stream that continues to grow Google top-line revenue and give it the ability to innovate into other major industries. Its large-scale and competitive barriers insulate it from much competition aside from the big tech players in the industry. This is one of the main reasons for the recent regulatory concern that pose the largest risk for Google long term. While government regulation will need to be followed, volatility in government law could change rapidly.

Recent news states that the Department of Justice is considering to break up the company. As a shareholder, or potential shareholder, this is worrisome. However, I’m still confident in the company’s business models. I also feel that there is currently no sufficient alternative search engine to replace Google.

Therefore, I am watching how this situation unfolds, and I am interested in taking advantage of a possible dip in stock price, caused by this regulatory concern, to purchase Alphabet at a bargain price. A company breakup caused by these regulatory pressures could be a dreadful situation, but I feel that Alphabet could overcome this due to its innovation, diversification, and its ability to adapt.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.