Summary:

- Goldman Sachs’ stock reached an all-time high, surpassing the $500 mark for the first time and outperforming the Capital Markets ETF by 13.3%.

- Due to the rise of nearly 64% since November, the P/E multiple has expanded considerably to 16x, which is far away from its historical average, limiting potential for further expansion.

- Fees from M&A and underwriting have been slowly recovering, and imminent rate cuts would most likely help their core division boost revenues.

- After combining different aspects, I rate the stock of Goldman Sachs as a hold at the current valuation.

Dan Totilca

The stock of Goldman Sachs (NYSE:NYSE:GS) has recently achieved all-time highs, surpassing the $500 mark for the first time. Furthermore, during the year, the stock of GS has outperformed the general market by approximately 11.6% and by 13.3% the SPDR® S&P Capital Markets ETF (KCE). In this analysis, I will analyze the company’s situation, outlook, and valuation, to justify my reasons for holding the stock.

Goldman Sachs’s Business Segments and Revenue Distribution

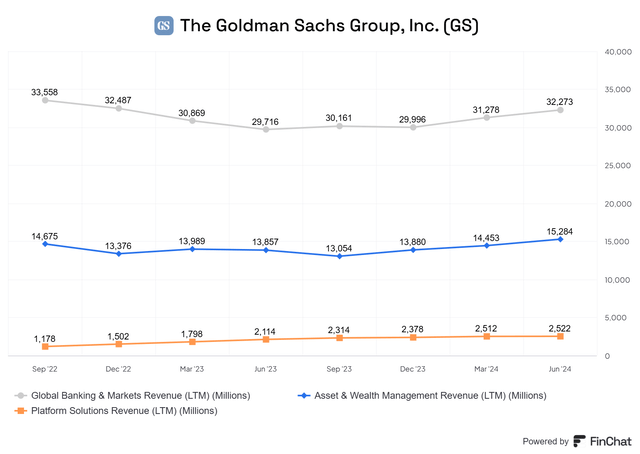

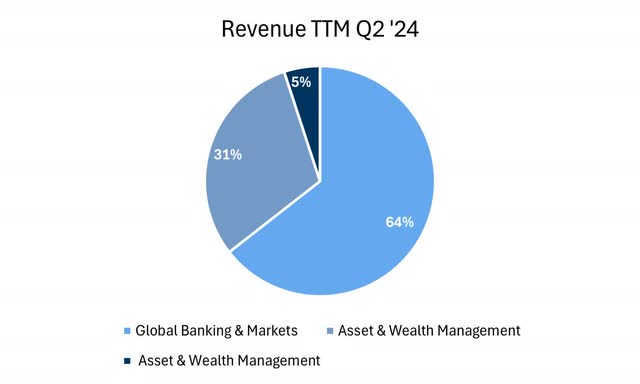

Goldman Sachs is the largest company in the Investment Banking and Brokerage industry, with approximately $170 billion in market cap and $11 billion in trailing net income. The firm is divided into three operating segments which are Global Banking & Markets (64%), Asset & Wealth Management (31%), and Platform Solutions (5%).

Author’s Compilations | Data FinChat.io

The core business comes from the Global Banking & Markets segment, which together provide classical services such as investment advisory, underwriting, research, and market-making activities in FICC and Equities. Not long ago, these were two independent segments but were consolidated into one following a business reorganization plan. Although most of the revenues come from this segment, it has the particularity of holding the highest amount of cash flow uncertainty, since revenues here are highly dependent on market activity.

Next, the Asset & Wealth Management segment offers investment products to the general public and financing and investment solutions for wealth management clients. In addition, their consumer banking platform, Marcus, was consolidated within this segment together with the proprietary investments of the firm across different public and private assets (CIE).

Last, Platform Solution is just a tiny part of the group and is the segment responsible for producing banking services for corporate and institutional clients, with the most notable one being Apple’s credit card and savings account.

GS’s Investment Banking Revenue: Picking Up

In terms of income, 2022 was a challenging year for many investment banks and asset managers. On one side, deal activity plummeted, and on the other, market performance in both equity and fixed income was lackluster.

From Asset and Wealth Management, asset valuations have risen greatly since 2023, making the investment management arm surpass the trailing revenue achieved in Q3 ’22. Although this segment is also market-dependent as management fees are for the most part collected from AUM, the cashflows are significantly more stable than the IB segment.

Moving on to the investment bank, the top line has been hit over time as a result of lower underwriting and M&A activity. In the last quarter, FICC and Equity brought collectively 3.66x more in fees. A situation that was completely different in the past. For example, in Q4 ’21, fees from Investment Banking vs. Global Markets were roughly the same and now there is a notable divergence.

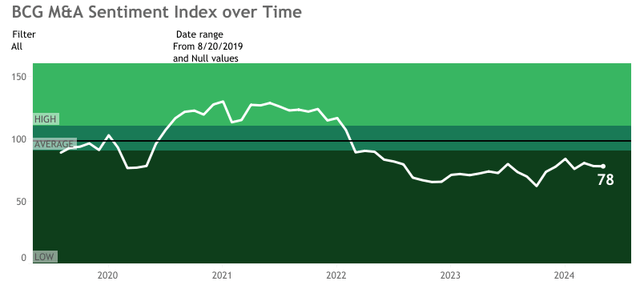

Nevertheless, as seen in the graph above, the revenue component of the whole segment has been progressively recovering from its lows due to a slight recovery in deal activity and higher trading volumes. This is consistent with the Boston Consulting Group M&A Index, that since November of 2023, sentiment in deal activity has been slowly rising. At the same time, the current index mark of 78, is still far away from the historical average of 100. This will provide more room for firms such as Goldman Sachs to recover their revenue entrance from M&A in the future. Finally, tailwinds such as the cuts in interest rates would most likely be a new market condition that would accelerate acquisition activity.

Goldman Sachs’ Move: Divesting Consumer Banking to Focus on Capital Markets

In 2016, Goldman Sachs started adventuring in the consumer banking business with the launch of digital bank Marcus. Later on, a partnership with Apple (AAPL) started, offering the Apple Card. Nevertheless, some years later, this venture towards consumer banking didn’t end up as expected and now GS is in the process of slowly divesting from this business as it turned out to result in accumulated losses. So far, the firm has sold GreenSky, plans to exit the credit card program with General Motors (GM), and based on CNBC, Apple has proposed Goldman end their partnership. This is in addition to offloading its Marcus Invest customers, among other Marcus debt divestments. With this, the group plans to focus on what they know best, which are the capital markets, and reduce their exposure to consumer banking.

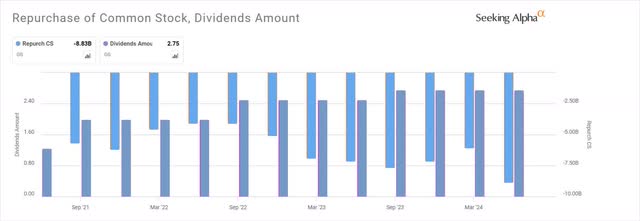

Dividends and Repurchases of GS

One appealing aspect of Goldman Sachs is its balance sheet. Currently, they have $206 billion in cash and equivalents and just $77 billion in short-term borrowings. Giving them the ability to be resilient in terms of their dividend payments in case things in the economy unfold as was considerably feared some weeks ago. So far in H1, Goldman has paid approximately $1.856 billion in common dividends and spent $5 billion in share repurchases. This is without considering the $3 dividend per common share paid recently in Q3.

Now, when adding the dividends paid and shares repurchased in H1, with two dividend payments of $3, multiplied by the latest total common shares outstanding, implies a shareholder yield of approximately 5.2%. Yet, shareholder yield within the G-SIBs should be taken with a grain of salt as their heavy regulatory surveillance may restrict them from ongoing share buybacks or even their dividend payments, so these distributions are in part Basel III dependent. Nonetheless, GS currently has a CET1 ratio of 13.0%, which is comfortably above the minimum requirement for global systemic banks.

Peer and Historical Multiple Valuation of Goldman Sachs

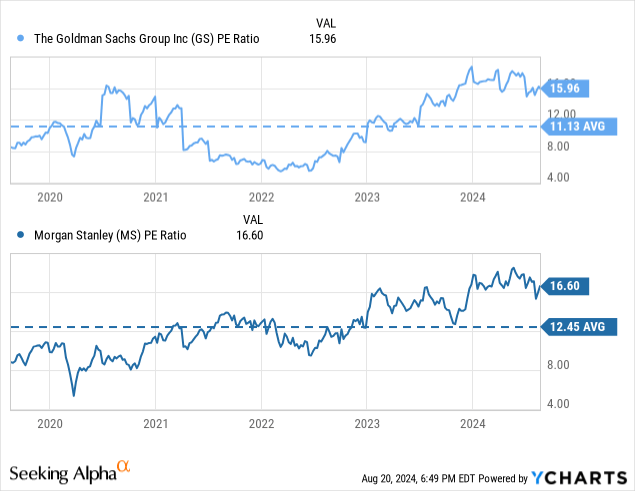

Since November, the price return of GS has been approximately 64%, due to an improved outlook in terms of interest rates. Yet, that upward trend has come with some valuation costs. Currently, the stock of GS trades at almost 16x which is far away from its 5-year average of 11x, implying that the potential for multiple expansions is most likely minor.

Compared to its closest peer Morgan Stanley (MS), Goldman Sachs trades modestly above, but historically (past five years), MS has maintained a slight valuation premium over the stock of Goldman Sachs, but also still sits overvalued compared to its history. This concludes that the top-tier investment banks—excluding JPMorgan (JPM) due to its consumer banking composition— are trading well above their history due to strong gains since November.

Takeaway and Stock Rating

Although a multiple expansion that trades far above its history might trigger a sell sign, due to tailwinds from rate cuts, and a modest recovery in M&A activity with the potential to rebound back again to historical levels, I will rate the stock of Goldman Sachs as a hold. Also, it could be (or not) the case that rising earnings alone in Q3 could easily make the multiple normalize without the stock necessarily dropping. But what is true, is that the 64% rise since November, is mainly an industry phenomenon, as other investment banks have also gained similar returns within those levels. Therefore, a hold makes more sense to me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.