Summary:

- Microsoft’s shares have recently depreciated but are gradually recovering, presenting an attractive investment opportunity.

- Strong Q4 earnings report and growth prospects indicate Microsoft’s growth story is far from over.

- My model suggests that Microsoft is undervalued at the current price and offers decent margin of safety for investors.

FinkAvenue

Microsoft’s (NASDAQ:MSFT) (NEOE:MSFT:CA) shares have greatly depreciated in the last month and only recently began to gradually recover. At the current price, it seems that the upside of owning the company’s shares outweighs the risks associated with Microsoft, as the stock is likely to continue to recover while the margin of safety is fairly reasonable right now. Therefore, I’m changing my stance on the company and reopening a long position in it.

Focus On The Bigger Picture

Back in May, I noted that while Microsoft had everything going for it to exceed its expectations, its stock was at risk of correction as the potential market selloff could have a great negative impact on its performance due to the company’s aggressive valuation at that time. While everything was pointing to the fact that Microsoft will release a solid earnings report for Q4 and end the fiscal year on a high note, its shares indeed began to depreciate in the last month and underperformed the broader market since the publication of my latest article on the company in late May.

The good news though is that not only the short-term correction is healthy for any stock in the long run, but Microsoft has also released a solid earnings report a few weeks ago, which made me reevaluate the business’s growth prospects. In Q4, its revenues increased by 15.1% Y/Y to $64.7 billion and beat expectations by $260 million, while its GAAP EPS of $2.95 was above the estimates by $0.02.

What’s more important is that Microsoft delivered double-digit growth across its major business segments, and it has the opportunity to continue to drive growth in the following quarters. If we closely look at the report, we’ll see that the Productivity and Business Processes segment generated $20.3 billion in revenues, up 11%, while the More Personal Computing segment generated $15.9 billion in revenues, up 14%.

Such a performance in part was achieved thanks to the further integration of the company’s generative AI assistant Copilot into various apps and platforms within its ecosystem. During the recent conference call, Microsoft’s management noted that Copilot’s customer count in Q4 increased by over 60% Y/Y and organizations are coming back to acquire additional seats to use the assistant. Considering this, it makes sense to assume that Microsoft’s growth story is far from being over.

On top of that, several macro tailwinds could help Microsoft retain its business momentum in the foreseeable future. First of all, worldwide IT spending is expected to grow by 7.5% this year alone and should help Microsoft grow the sales of its software products in the following months. At the same time, the spending on AI is forecasted to continue to increase, and the generative AI spending could reach over $200 billion and account for a significant portion of the overall AI spending later this decade.

This is good news not only for Microsoft’s software business but for its cloud business as well, as it has also experienced an increase in revenues in part thanks to the greater demand for an infrastructure that powers the ongoing generative AI revolution. In Q4, Microsoft’s Intelligence Cloud division saw its revenues increase by 19% to $28.5 billion, while the revenues for Azure and other cloud services were up 29%. Thanks to its ability to adapt to the changing environment, Microsoft was also able to increase its market share in the cloud market from 17% at the beginning of 2022 to 20% in the recent calendar quarter. As the cloud market is expected to grow at a CAGR of 16.4% in the following years, it makes sense to assume that we’ll continue to see a growth of Azure’s revenues in the coming quarters.

Add to all of this the fact that Microsoft’s own outlook for Q1 indicates that most of its business segments will continue to grow at a double-digit rate, and it becomes obvious that the company’s growth story is far from over.

Considering all of this, it makes sense to assume that Microsoft’s stock could be an attractive investment right now, especially since its shares started to gradually recover from the latest selloff, and it will likely take a while for them to fully recover to the previous all-time high levels. Back in May, my DCF model showed that the company’s fair value is $425.32 per share, which is close to the current price. However, that model was made before the Q4 results came in, which helped Microsoft end its fiscal year in June on a high note. Thanks to the impressive performance in the recent quarter, Microsoft’s revenues and EBIT were slightly higher in comparison to my assumptions from that model. Therefore, I’ve decided to update my DCF model and make some changes that can be seen below.

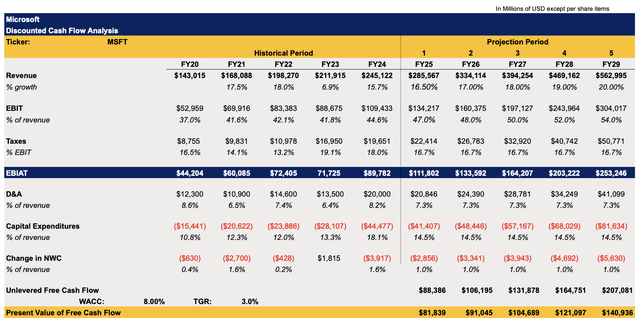

In the updated model, the revenue assumptions and EBIT are increased in FY25 as Microsoft is likely to continue to utilize its dominant position in the software business with the help of its latest generative AI tools, which should help the company continue to exceed expectations in the future. At the same time, the further expansion of its AI products should lead to the gradual improvement of margins in the following years. The assumptions for other metrics closely correlate with Microsoft’s historical performance in recent years. The WACC in the model remains at 8%, which is close to the market’s average cost of capital rate, while the terminal growth rate remains at 3%, which is commonly used as the average long-term growth rate in the investment banking world.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

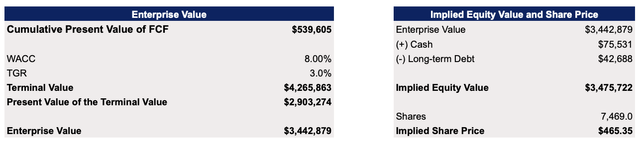

Thanks to the upward revision of several assumptions, the updated model shows that Microsoft’s fair value is $465.35 per share, which indicates that the shares currently represent an upside of ~10%.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

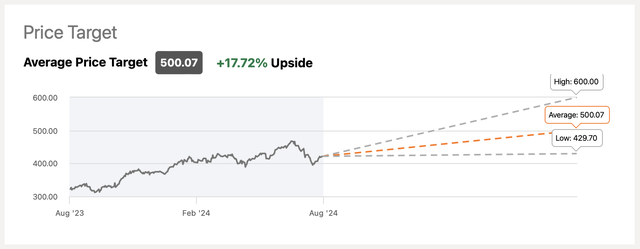

At the same time, I wouldn’t call my assumptions too optimistic, since the consensus on the street is that Microsoft’s shares currently represent an even greater upside of ~18%, while some major firms have placed a price target of over $500 per share for the company’s shares. Considering this, it’s indeed safe to assume that Microsoft appears to be an attractive investment at the current price.

Microsoft’s Consensus Price Target (Seeking Alpha)

Macro Risks To Consider

There are nevertheless several risks that could make it harder for Microsoft to achieve its goals in the foreseeable future. First of all, at the beginning of this month, the market experienced a broad selloff due to the conflicting unemployment data that could signal an upcoming recession. While some investment banks don’t fully agree with this, there’s a risk that the Federal Reserve took too long to cut interest rates, which could have negative implications for the American economy in the future.

On top of that, the potential escalation of the Sino-American trade war in the future could also negatively affect the global economy, which could prompt businesses to cut their spending on software and generative AI tools. Under such a scenario, Microsoft’s performance could be negatively affected, and its growth story would be undermined at the same time.

The Bottom Line

While macro risks are outside of Microsoft’s control, it seems that the growth opportunities outweigh most of the major risks at this stage. By being undervalued and trading at a forward P/E of 32x, which is close to the market’s average ratio, Microsoft’s shares offer a decent margin of safety for investors. At the same time, if macro risks subside, then it’s unlikely that anything will be able to stop the company from growing at an impressive rate in the following quarters. This is why I believe that after the recent correction and the latest earnings report, Microsoft’s shares have become a good investment for growth and value investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.