Summary:

- Amazon reported Q2 FY2024 revenue of $148.0 billion, with a 10% YoY increase and beat consensus regarding GAAP EPS. The stock went down on weak retail segment’s results and guidance.

- Analysts’ EPS forecasts for Amazon remain positive, with no significant reductions despite some concerns after Q2.

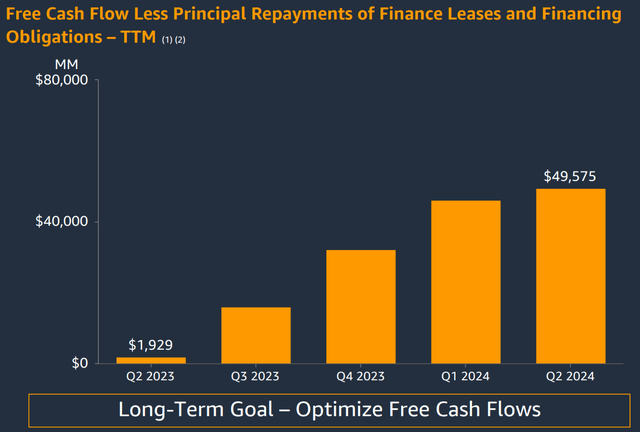

- The FCF, adjusted for certain categories, amounted to $49.5 billion in Q2 (on a TTM basis). This is a significant amount, even for Amazon.

- Amazon’s Q3 EBIT guidance fell short of market expectations, but it assumes an 18% YoY growth anyway. My valuation model says the stock is undervalued by >21%.

- I’d like to reassure long-term investors: even if the selling continues today, I think the recent dip in stock price is a gift for those who want to hold Amazon shares for longer than 5-10 years.

4kodiak/iStock Unreleased via Getty Images

Introduction

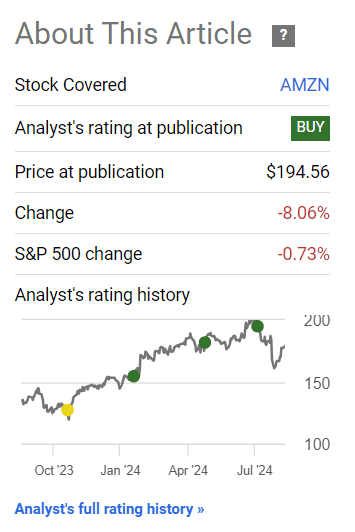

Since I first initiated my coverage on Amazon.com, Inc. (NASDAQ:AMZN) stock here on Seeking Alpha, my ratings have fluctuated between “Buy” and “Hold”, depending on market developments and my assessment of the company’s nearest prospects.

In my last article, published just over a month ago, I provided my earnings preview and maintained my “Buy” rating ahead of the Q2 2024 report. At the time, I anticipated that Amazon had a good chance of exceeding market expectations for EPS, driven by “momentum in AI, cloud technologies, and the recovery of the retail sector in general.” As it turned out, AMZN did surpass the EPS consensus forecast; however, its actual revenue fell short of expectations, which led to increased pessimism and a slight correction in the stock price immediately following the report. After the quick recovery rally, the stock is still down ~8% since my last call, significantly underperforming the broader market:

Seeking Alpha, my last article on AMZN

In my today’s article, I’d like to focus on the recent financial and operational results and examine what has changed in Amazon’s fundamental story. Let’s explore whether the correction we saw recently truly warrants the attention of long-term investors.

Amazon’s Q2 FY2024 Earnings Recap

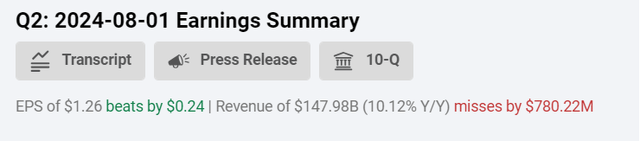

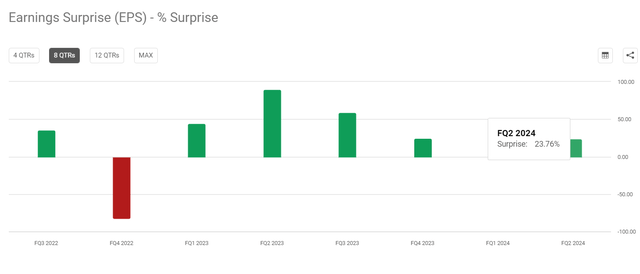

On a consolidated basis, Amazon reported revenue of $148.0 billion for Q2 FY2024 – that’s a 10% increase YoY and a 3% sequential growth from Q1 FY2024. This was within Amazon’s previously announced guidance range but slightly below analysts’ consensus expectations (a miss of ~$780 million, which is indeed like a drop in a bucket for AMZN). What’s noteworthy, Amazon posted a significant jump in GAAP EPS to $1.26, nearly doubling from $0.65 in the previous year and beating consensus by ~$0.24 (or by 23.76%, according to Seeking Alpha Premium).

Seeking Alpha, AMZN Seeking Alpha, AMZN

Let’s look at the individual segments to figure out where this growth came from.

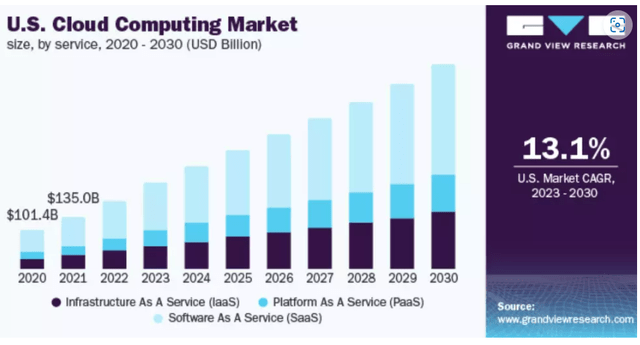

AWS’s revenue went up by 18% YoY to $26.3 billion, while its operating profit surged 74% YoY to $9.3 billion (35.36% margin), driven by “increasing demand for generative AI services.” During the earnings call, the CEO Andy Jassy highlighted 3 key trends driving AWS growth: 1) companies shifting from cost optimization to new workloads, 2) infrastructure modernization, and 3) the growing interest in AI. Yes, we may say that AWS’s margins have decreased slightly compared to the previous quarter. However, despite contributing just 18% of total sales, I still consider this segment crucial for forecasting the company’s future growth due to Amazon’s current position in this market niche. “With over 100 availability zones across 31 geographic regions, AWS holds more than 34% of the global cloud computing market share”, according to Cloudzero’s recent data. Amazon also remains committed to its ambitious plans to invest substantial amounts in third-party startups to continue developing its ecosystem and further solidify its status as a market leader. So, I believe that a significant portion of the forecasted growth that many analysts anticipate for the U.S. cloud computing market will primarily drive AWS’s continued expansion and help sustain relatively high margins.

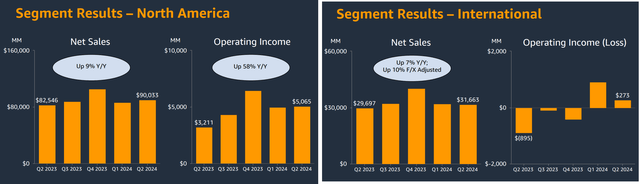

The main Amazon segment’s revenue (North American retail) grew by 9% YoY to $90.0 billion (61% of total sales), while international retail revenue increased by 7% to $31.6 billion. The company’s overall retail operations saw strong growth from third-party merchants, with sales from this segment rising 12% YoY, while sales at physical stores increased by 4%. Online store sales, which include Amazon’s wholly owned products, grew by 5% YoY to $55.4 billion, though this segment’s share of total revenue has decreased as Amazon diversifies its revenue streams. North America is now in focus as the segment’s margins continue to shrink due to investments in areas such as Kuiper/satellites. Management also pointed to expected seasonal margin pressure in Q3 due to lower Prime Day margins, preparation costs for the vacation season in the 4th quarter, and higher Thursday Night Football. But anyway, it seems to me that Amazon should manage to maintain its margins, albeit without a rapid expansion. So overall, I don’t think investors should be too worried about these two segments.

Amazon’s IR materials, notes added

What remains unchanged is the company’s ability to generate substantial free cash flows. Despite total capital expenditures reaching $30.5 billion in the first half of 2024 – higher than initially forecasted and a point of concern for some analysts and investors due to planned increases in CAPEX in AWS infrastructure and artificial intelligence in 2H – the FCF, adjusted for certain categories, amounted to $49.5 billion in Q2 (on a TTM basis). This is a significant amount, even for Amazon.

Meanwhile, the number of shares outstanding has increased by less than 1% over the past year, which is quite modest in my opinion – this increase is more than compensated for by the strong growth in cash flow and earnings that we observed above.

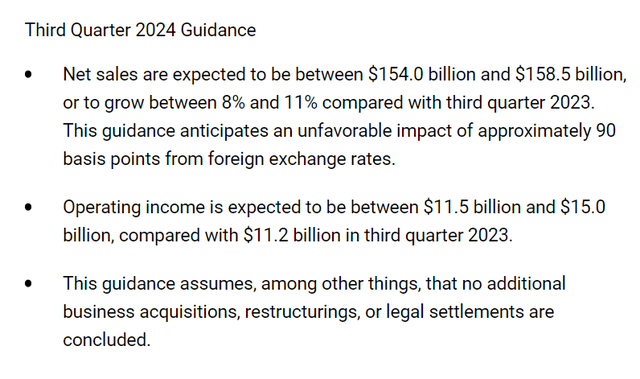

The guidance for Q3 EBIT came in below market expectations, which triggered discussions among investors about Amazon’s investment strategy and current profitability. Nevertheless, the midpoint of the forecast range for operating profit indicates an 18.3% YoY growth in FY2024. In my opinion, this is a very impressive result.

I believe the results for Q2 FY2024 were quite good. Firstly, AWS increased its top-line growth rate to 19% in Q2, compared to 17% in the 1st quarter, benefiting from various tailwinds, and I think we should continue to see this trend going forward. Secondly, the consolidated EBIT was actually higher than consensus expectations (according to Goldman Sachs data, proprietary source), and consolidated EBIT margins also looked quite good. Despite a slowdown in growth and some stagnation in retail, I see some signs of stable consumer demand, which is a positive indicator for the next several quarters at least.

No Actual Pessimism In Earnings Expectations

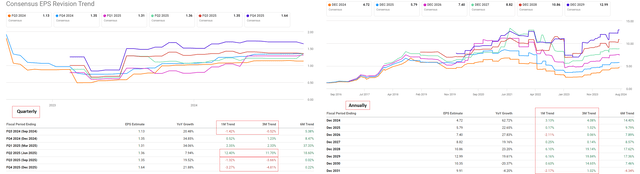

The conclusions I made above are confirmed by changes in EPS forecasts for the next few quarters and years ahead. According to Seeking Alpha, after the publication of the second-quarter report, analysts’ opinions were divided regarding the Q3 (with 19 estimates for a decrease and 13 for an increase). However, upon closer examination, we see that no one is seriously reducing estimates. While there’s a 1-4% decrease, for example, for Q3-Q4 FY2025, we actually observe almost ideal positive changes in the EPS forecast by looking several years ahead:

Seeking Alpha, AMZN’s EPS revisions, notes added

Thus, the overall picture of forecast changes from Wall Street analysts seems bullish to me, even though concerns about the company’s retail segment have grown, and the stock has fallen quite noticeably since the publication of Q2 results.

Amazon’s Valuation Update

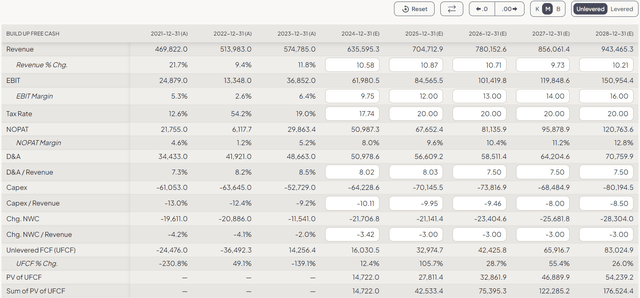

Last time, I valued Amazon using DCF modeling, which showed an undervaluation of ~23.7%. Now, taking into account the latest financials, let’s update my model.

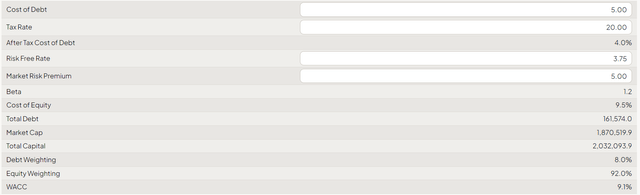

Compared to last time, I’ve adjusted my input data regarding revenue growth by incorporating the current consensus forecasts. I’ve also clearly reduced my forecasts for future operating profit margins: I’m deliberately making my model more conservative than before to avoid bias. Overall, I haven’t changed other operating metrics much, as their inputs didn’t seem to be significantly affected by just one quarter. Here’s what I have in an intermediate form:

In just over a month, the risk-free rate has fallen by almost 50 basis points. Therefore, even if I don’t change my input data for the market risk premium and the cost of debt, I get a WACC that is 0.5% lower than last time (9.1% vs. 9.6%).

I assume that the terminal value of Amazon should be calculated the same way as the last time, with the stock trading at 44x its enterprise value to free cash flow multiple. Thus, even with modified assumptions regarding EBIT margins for FY2025-2028, the stock still appears to be undervalued, though by a more modest amount than I previously calculated.

Concluding Thoughts

As I mentioned last time, I may be wrong in my bullish stance on Amazon today. If Jeff Bezos continues to sell his shares, of which he still has many left, the pressure on Amazon’s stock price may persist. In addition, the stock’s large institutional and insider holdings, such as the 934.3 million shares held by insiders and the large investments by mutual funds (Argus Research proprietary source, May 2024 data), suggest a potential vulnerability in case there’s a meltdown in the market. In addition to this risk, there’s also the danger that cloud competitors such as Microsoft’s (MSFT) Azure could force AWS to lower its prices, which could significantly impact its profitability and overall future sales growth. Furthermore, given the company’s vast ecosystem, there are potential risks of malfunctions, outages, or cyber-attacks that shouldn’t be overlooked as potential risk factors.

Despite the obvious risks surrounding the company today, I believe that long-term investors should remain calm. Management’s approach to diversifying the business over the last few years is starting to pay off, with consolidated revenue continuing to grow quarter after quarter. I think the share of the company’s cloud/AI business will increase as artificial intelligence plays a larger economic role both in the US and globally. Amazon will likely continue to play an important role as one of the most innovative companies and a market leader in this area.

My valuation model shows that Amazon shares are still undervalued. Wall Street analysts are still very positive, despite the pessimism about certain segments of the company, and their EPS forecasts continue to rise. Therefore, I’d like to reassure long-term investors: even if the selling continues today, I think the recent dip in stock price is a gift for those who want to hold Amazon shares for longer than 5–10 years.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!