Summary:

- Nvidia’s momentum persists with a 5.75% stock gain, despite recent insider selling of nearly $500M by CEO Jensen Huang, indicating potential valuation peak risks and investor caution.

- Blackwell series GPUs and Nvidia Inference Microservice (‘NIM’) drive continued AI demand, but diversification in AI chips from big tech firms like Microsoft and Alphabet increases competitive pressures.

- Nvidia’s YoY revenue growth is expected to slow from 111.7% in Q2 2025 to 39.5% by Q2 2026, signaling potential valuation contraction, making it a Hold for now.

photobank kiev/iStock via Getty Images

I last covered Nvidia (NASDAQ:NVDA) in July, and now we are nearing its Q2 earnings results. I mentioned at the time that I expected a correction in H2 2025 or H2 2026, and I still believe this is likely. However, since my thesis, although the stock did drop significantly and momentarily, it has now gained upward momentum again and is currently selling at a 5.75% growth to the price at my last publication on the company.

There has been notable insider selling recently, including Jensen Huang selling close to $500M of Nvidia shares in the summer of 2024, with a record $323M in July alone, which, I think, does caution that we could be near a top in Nvidia’s valuation multiples. Furthermore, with Q2 nearing, growth is expected to remain strong, but I think any further upside could be short-lived. In addition, I am still concerned about the significant reduction in its fundamental growth rates that is expected by analysts moving into 2026 and 2027. Therefore, as a long-term analyst and investor, Nvidia is certainly still a Hold and not a Buy at present.

Blackwell, NIM, Big Tech Adoption Slowdown, & Competitive Chips

There are multiple operational developments that are material to Nvidia’s Q2 earnings results, including its introduction of the Blackwell series of AI graphics processors, including the GB200, marking a significant advancement in AI computing power. This is expected to continue to drive demand with major clients like Microsoft (MSFT), Alphabet (GOOGL) (GOOG), Tesla (TSLA), Amazon (AMZN), and Meta (META). Furthermore, the Nvidia Inference Microservice (‘NIM’) is a recent development that is designed to extend the usability of older GPUs for AI inference tasks, a significant shift toward it becoming a comprehensive platform provider and helping it to consolidate its moat in AI development. In addition, the Nvidia L40S GPU and Spectrum-X, which are designed to improve data center performance, are expected to be accretive to Nvidia moving forward. Finally, the adoption of Nvidia’s automotive computing platforms by electric and autonomous vehicle manufacturers has been ongoing, and the Omniverse 3D simulation platform has substantial growth prospects.

Nvidia’s major big tech clients are expected to continue to drive growth through the remainder of 2025. This is supported by the diverse adoption of AI throughout global industries, which now include healthcare, professional services, law, and defense. This market is clearly not going to shrink, but it is definitely going to slow down in terms of the rate of adoption. This is especially true as the amount of data to train diminishes as AI models scale to “superintelligence”; there is simply a finite amount of data at any one time to train AI models on, despite new data emerging constantly. The initial phase of the AI build-out has been characterized by rapid growth, now leading toward a period of maturity.

It is important to also remember that the AI infrastructure market is now diversifying significantly, with major tech companies like Microsoft, Alphabet, Amazon, and Meta developing their own AI chips to reduce dependency on Nvidia. These include Microsoft’s Azure Maia, Alphabet’s Trillium, Amazon’s Trainium2, and Meta’s Training and Inference Accelerator. While these are designed as complements to Nvidia’s offerings, they are likely to reduce the need for Nvidia’s GPUs in major data centers. Furthermore, both AMD (AMD) and Intel (INTC) are increasing the production of GPUs, which is an indicator of market diversification, increasing the competitive threat. This also includes smaller companies like Groq and Cerebras, which I have touched on in a previous analysis, posing a threat to specific use cases with a competitive advantage in efficiency.

Q2 Growth Expectations, Comparative Analysis, & Medium-Term Price Target

Despite the concerns with long-term growth slowdown, Nvidia is anticipated to achieve $28.6B in revenue in Q2, which is a YoY growth of 111.7%. However, it must be recognized that for Q3, YoY revenue growth is expected to be lower, at 74.25%. By Q2 2026, the company is expected to deliver only a 39.5% YoY revenue growth on consensus. This is foundational to my thesis that we are likely to see a contraction in valuation multiples leading into FY26, which could cause unwarranted selling activity and open up a potential undervaluation. This is why I am not short-term bullish on NVDA right now, but I will likely be in FY26/FY27.

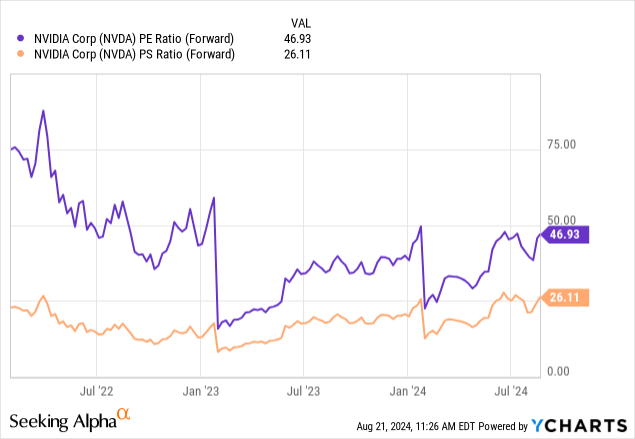

It is important to understand that Nvidia has a very high P/S ratio of 39.5, which on a forward basis is still high at 26. Furthermore, its forward P/E GAAP ratio is 47.

This initially doesn’t seem too high if one has a knowledge of typical big tech valuation ratios. However, it is worth comparing it to other leading big tech companies to ascertain whether the valuation is problematic moving forward along with its anticipated growth rates.

| Company | TTM P/E Non-GAAP Ratio | FWD Normalized EPS Growth Rate |

| Nvidia | 70.5 | 39.3% (January 2026, Annual, YoY) |

| Amazon | 43 | 22.7% (December 2025, Annual, YoY) |

| Meta | 27 | 14% (December 2025, Annual, YoY) |

Based on this, it does not seem unreasonable to admit that Nvidia is relatively fairly valued at the moment. In my opinion, this does position it for long-term growth that is sustainable. However, for the fiscal period ending January 2027, Nvidia is expected to achieve a much lower 15.9% annual YoY normalized EPS growth. This could significantly reduce the valuation multiples to be more in line with other big tech companies. Perhaps it is fair to ascertain that Nvidia should trade at a TTM P/E non-GAAP ratio of 30 in the fiscal period ending January 2027. If that is true, its EPS estimate of $4.42 for January 2027 would mean a stock value of $132.60 as fair some time before January 2027. Unfortunately, that indicates a CAGR of just 3.7% from the current stock price of $127.90.

While I do understand that the market could treat Nvidia irrationally, and the stock returns could be much higher than this, I believe this is speculative, given my comparative analysis. As a result, I think the stock is a hold right now, but it could present a more appealing, slower and steadier investment opportunity over the next couple of years.

AI Demand Shifts, Western Economic Recession Concerns, & Supply Chain Constraints

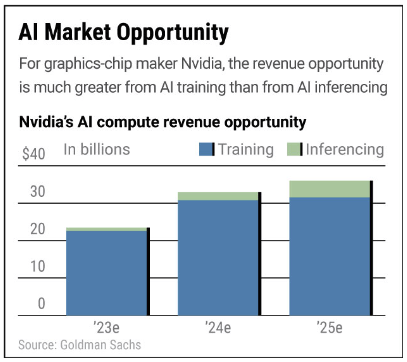

While AI training has been a significant driver of Nvidia’s growth, the market is shifting towards inference, which involves deploying trained models for real-time decision-making. Inference requires different hardware capabilities compared to training, which could affect Nvidia. Also, smaller models are gaining popularity for efficiency and fewer hardware requirements. This could diminish the need for Nvidia’s high-end GPUs, which are designed for large-scale model training. I do think that the market for AI is going to expand significantly, and while cloud services are still likely to dominate, we are going to see diversified, unique, and smaller AI infrastructures that are independent of big tech. This might take some time, but I believe that the monopoly practice of big tech in AI might not be as significant as we currently assume. This could lower the anticipated returns in big tech related to AI, including for Nvidia.

Investor’s Business Daily & Goldman Sachs

Furthermore, there is a concern about a general economic slowdown and a potential recession in the United States and the West in general at the moment. This is largely a result of high inflation and a rapidly expanding federal debt, which is causing geopolitical weakness in the States. I am currently concerned that without proper federal budget restraint, the American dollar could become devalued, weakening the West’s position in global economics and the attractiveness of Western stocks. In addition, the high levels of inflation could reduce consumer demand and spending capacity, resulting in lower big tech revenue and, hence, lower capex on Nvidia’s GPUs, resulting in Nvidia’s valuation multiples contracting significantly. I am still bullish long-term on Western global leadership, but at this time, I am tempted to begin diversifying internationally due to current political uncertainties. As many others are beginning to feel the same, this could cause a big selloff in Western tech stocks that significantly reduce future CAGRs that are currently anticipated.

Nvidia is also facing a complex environment related to supply chains, with delays in the construction of new fabrication plants, such as TSMC’s (TSM) Arizona site, exacerbating supply issues. In addition, trade tensions, particularly between the United States and China, and environmental regulations have further strained the semiconductor supply chain. These ongoing semiconductor component shortages could limit Nvidia’s ability to meet the high demand for its GPUs and AI products, which could lead to earnings misses and affect the valuation significantly as a result. That being said, management is working to accelerate chip production and reduce bottlenecks by strengthening its partnerships with its key suppliers, including TSMC and Synopsys (SNPS). Therefore, this risk is reduced but still a potential inhibitor of future growth potential, especially if geopolitical conditions worsen.

Conclusion

In my opinion, this is not an intelligent time for long-term investors to add to their Nvidia positions. I believe that this stock will continue to rise in the long term, but the valuation and future growth rates right now indicate volatility over the next couple of years. I believe that it is better to wait until FY26/FY27, when the valuation is likely to be more appealing, to invest in Nvidia for the first time or to add to a position. I am bullish on Nvidia over the next decade, but as Q2 nears, any growth following it is likely short-term momentum, not a strong long-term growth and value outcome.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.