Summary:

- Tesla, Inc.’s stock price is disconnected from its fundamental value.

- The high daily volume of options trading could be driving the stock price higher.

- I explain here how this works and why it makes the stock a risky investment for both shorts and longs.

Roman Tiraspolsky

Market maker hedging

When you buy or sell shares on the stock market, your order will be matched with a trader who is taking the opposite side of the trade. Designated market makers will step in to provide liquidity only if there is a temporary imbalance between buyers and sellers.

The options market works differently. Option market makers take the opposite side of a trade and retain the risk associated with that trade. They hedge that risk by buying the underlying stock.

The amount of stock they buy depends on the relative price of the shares and the options. For example, if a $1 increase in the price of a stock is expected to move the option price by 50 cents, the market maker would buy 50 shares of the stock to hedge the sale of one call option contract.

The relative price movement of the options compared to the shares is known as Delta.

Put options have a negative delta, the market maker would sell 50 shares to hedge the sale of a put option with a delta of -0.5.

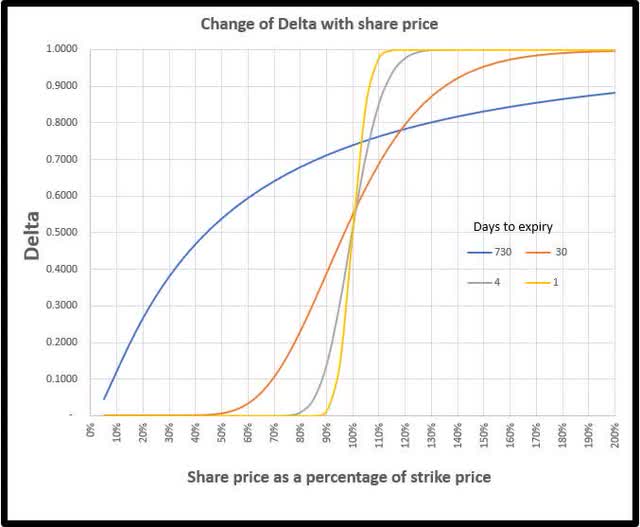

Delta is not fixed, its value primarily depends on the relationship between the strike price of the option and the price of the shares, and on the options expiry date. The chart below shows the value of Delta at various Strike/Share price ratios for call options with four different expiry terms:

Change of delta with share price (Calculated from Black-Scholes formula)

Option market makers are active buyers and sellers of stock to hedge their option positions. But even if there were no option trading, the market makers would be trading shares to maintain neutral positions in response to changes in share price.

The hedging is done rapidly by computers with algorithms designed to minimize risk for the market maker. There is no price discovery, it is an automatic buy or sell at market prices.

The gamma effect

The variation in Delta with share price is known as Gamma. Gamma is represented by the slope of the lines on the chart. As you can see, the lines for “close to the money options” get steeper as the expiry date approaches. Short-dated, “close to the money” options have the highest gamma values.

To hedge a call option the market maker has bought stock. When a share price rises, the market maker buys more shares to cover his exposure.

To hedge a put option, the market maker has shorted the stock. When the share price rises the market maker reduces his short by buying the stock. A rise in share price results in more buying to hedge both call and put options.

Some things to note:

- A change in the share price results in the buying or selling of shares to hedge all outstanding options at all strike prices and all expiries. Although gamma for a single option may be small (~0.02 for an “at the money” short-term option), the cumulative effect of gamma for all outstanding options can be significant.

- The gamma effect results in buying when the share price rises and selling when the price falls. It is the opposite of how an efficiently functioning market should work.

So, there is an inherent instability in the market. Option market makers buy shares to compensate for an increase in share price which results in more buying which in turn further increases the share price, resulting in even more buying.

This instability is known as the gamma squeeze.

Clearly, a stock that has a high option Open Interest, especially in the near-term options that have high gamma, will have a high susceptibility to the gamma squeeze.

Tesla’s vulnerability to the gamma squeeze

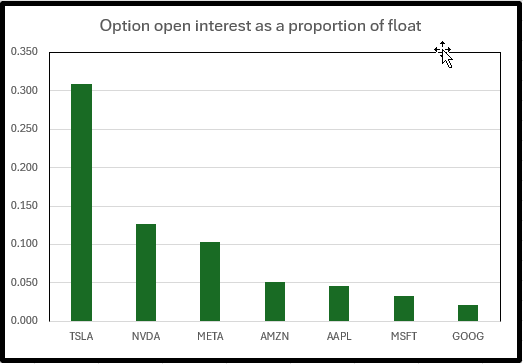

The chart below shows the number of open interest contracts x 100/ float for the “magnificent seven” stocks, based on data published last week by the Options Industry Council:

Mag 7 stocks, open OI (Derived from Options Industry Council data)

Among those popular large-cap stocks, Tesla, Inc. (NASDAQ:TSLA) has the highest option Open Interest relative to its float, with eight million option contracts, representing 800 million shares. Approximately two-thirds of the contracts are call options.

The Options Industry Council publishes the open interest daily for all strike prices and expiries. However, they don’t distinguish between long and short interest. For example, if a trader opens a long call contract and another trader opens the same contract but short, it is recorded as two open interests, but for the market maker, it nets out to zero. Because the published information is incomplete, we cannot calculate the total number of shares that the market makers are holding.

Daily option volume averages about 2 million, equivalent to 200 million shares. The daily average trading volume is less than 100 million. I can only speculate that most of the open options are long, and the market makers are holding numerous shares for option hedging and are responsible for much of the day’s trading.

Since index funds hold about 50% of the float and only trade based on inflows and outflows to the index funds or changes to the index composition, shares required for option hedging represent a significant piece of total trading shares.

Speculative option trading and the associated gamma squeeze are probably driving the trading of Tesla shares and may be responsible for the disconnect between Tesla’s share price and its fundamentals.

Option trading provides leverage

I use Thursday, August 15th as an example, but similar trading patterns can be easily identified two or three times a week in Tesla shares.

Within three minutes of the opening of trading on August 15th, 54,000 call options, expiring the next day, were traded at strike prices of a few percent higher than the pre-market share price. Those trades included ten thousand $207.50 call option contracts and eighteen thousand $210 call option contracts, which I will use here to illustrate the leverage and the effect of the gamma squeeze.

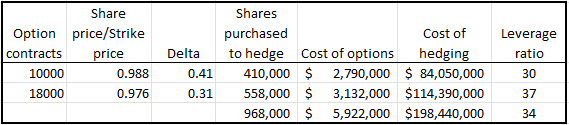

In the table below, I have calculated the cost of those option trades and the value of shares that would have been purchased by the market makers to hedge those trades:

Effect of option purchases (Calculated from options pricing data)

For a premium of about $6 million, the option trades triggered a purchase of about $200 million worth of shares, a 34 to 1 leverage.

A purchase of that magnitude over a very short time will always drive up the share price, and three minutes from the opening of trading, Tesla shares had risen to $208.50. That price change increases the delta of the options, forcing a further purchase of about 350,000 shares to hedge those options.

However, the gamma squeeze affects more than the initially purchased shares. Delta increases for all the 8 million or so open option contracts, both puts and calls (positive for long open contracts and negative for short contracts)

The options are not held to expiry

When I check the daily change in open interest for options with short expiry dates, it is usually less than 10% of the daily trading volume for that option. Clearly, the option buyers do not hold the options beyond the close of trading. I believe the options are sold off during the day, but the early increase in share price attracts momentum traders, allowing the option buyers to take their profits without causing a major decline in the share price.

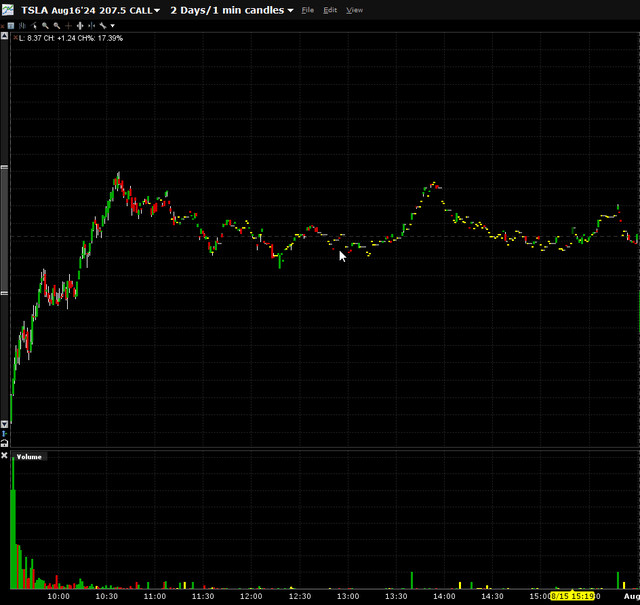

Here is the chart for the 207.50 Aug 16th expiry call option trading on August 15th:

207.5 call option trading data Aug 15th (Interactive brokers)

You can see the heavy option volume in the first three minutes of trading. However, you don’t see similar volumes later in the day because the options are sold off in smaller packages to give the market time to absorb the order flow. The result is that the stock price may drop later in the day, but often remains above the opening price.

The share price is not connected to the fundamental value

The recurring gamma squeezes could explain the disconnect between Tesla’s share price action and its declining fundamentals. Financial results show negligible revenue growth, declining margins, and declining earnings since the shares hit a low after the Q4,2022 results, yet the share price has almost doubled in that period.

Based on fundamentals, Tesla should be rated a strong sell. However, it is a very dangerous stock to short. I believe the high volume of options trading is driving the stock price with no reference to the stock’s real value.

Holders of the stock should also be aware that the gamma squeeze works in both directions, magnifying the effects of share price changes on the way down and on the way up.

I own very long-dated put options, and I try to hedge those by taking long positions in the stock or buying short-dated calls. I expect it will be a while before I find out whether that strategy works, but I do believe that the stock price will eventually return to its fundamental value.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Short via long-dated puts

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.