Summary:

- I bought Amazon 3 times in early August at bargain prices.

- Amazon’s Q2 results showed strong growth in revenue and earnings, particularly in AWS and digital advertising segments.

- Valuation based on operating cash flows suggests significant upside potential for Amazon shares.

4kodiak/iStock Unreleased via Getty Images

Yesterday, I published an article lamenting the rapid bounce back that we’ve seen in recent weeks because I was hoping for more time to buy beaten down blue chips into macro weakness. Well, one thing I can’t complain about is Amazon’s (NASDAQ:AMZN) post-earnings sell-off and the incredible opportunity that investors had recently to buy this big-tech stock at bargain barrel prices.

I bought Amazon 3 times in early August.

Amazon was already a top 10 position within my portfolio coming into the month. And now, after these recent purchases, it’s my 5th largest stake (behind Apple (AAPL), Nvidia (NVDA), Broadcom (AVGO), and Microsoft (MSFT)).

On 8/2 I bought more AMZN at $165.67.

On 8/5 I added again at $160.48.

On 8/8 I made another purchase at $165.70.

When the market gets shaky, I find solace in secular growth trends. It can be difficult for me to allocate capital to the market when there isn’t a dividend involved because of my love of passive income and the organic compounding process that plays out over time with dividend growth and dividend reinvestment. But, as I’ve said many times before, Amazon’s growth runway is special. It’s incredibly long. I think there’s a lot of opportunity for margin expansion here. And most importantly, I think the market is mispricing AMZN shares in a major way.

I highlighted Amazon as a Top Pick For 2024 at the end of last year (alongside Nvidia and Alphabet), saying that shares had upside potential in the 50% range.

In February, I wrote an article saying that the playbook for 2024 was no different than 2023’s…big-tech would be the big winners.

At the time, there were plenty of naysayers who called those picks unoriginal, but that article has aged pretty well. Both AMZN and GOOGL are up ~18% on a year-to-date basis, and NVDA is up by nearly 160%. All 3 stocks are beating the market and the overall basket is crushing it.

I’m heavily invested in all 3 stocks, so 2024 has treated my portfolio well. Yet, even after these strong gains, I’m still bullish on these companies. But to me, AMZN is the best value of the bunch, which is why I’ve been accumulating it so aggressively in recent weeks.

Recently, I highlighted Amazon as one of my Top 20 Highest Quality Companies In The World. In that article, I noted that not many of those blue chips were attractively valued. Many of them were highly overpriced. But Amazon is an exception.

I thought AMZN was cheap at ~$180 prior to earnings.

I thought AMZN was cheap, in the $160’s after it sold off.

And I still think AMZN is cheap today, having regained its post-earnings losses.

This company continues to be one of my highest conviction long-term stock picks because of the unique combination of high growth and discounted value. So today, I’ll analyze AMZN’s most recent quarter and why I liked it so much (despite the market’s negative reaction). I’ll also discuss my fair value estimate for shares, showing why I believe that Amazon offers strong upside potential from here.

Amazon’s Q2 Results

Amazon posted second quarter results on 8/1/2024, missing consensus estimates on the top-line but beating them on the bottom.

AMZN’s Q2 revenues came in at $148b, which missed Wall Street’s estimate by $760m. This shortcoming factored into the stock’s post-earnings sell-off; however, I think it’s important to note that this $148b revenue figure still represented 10.2% y/y growth.

How amazing is that? A company posting nearly $150b in quarterly revenue growing at a 10%+ rate…these are statistics that would have seemed impossible a couple of decades ago.

AMZN did beat on earnings, posting EPS of $1.26 which was $0.23/share above consensus estimates.

Amazon’s retail segments performed well during the quarter, with North American sales coming in at $90b (up 9% on a y/y basis) and International sales coming in at $31.7b (up 7% on a y/y basis; or 10% excluding negative forex impacts).

I think both of these results were fine. The market disagreed, looking for double-digit growth there as well. Yet, the retail side of Amazon’s business isn’t what excites me. It’s essentially an afterthought when looking over AMZN results. If anything, I think AMZN’s online results can speak towards macro trends regarding consumer strength/weakness/sentiment; however, at the end of the day, these are fairly low margin businesses (though, I’ll note that the North American income margin has risen nicely over the past year from the 1% range to the 6% range during the past 4 quarters) and therefore, something that I’d avoid if it wasn’t for the other segments of AMZN’s business.

Yes, there are secular tailwinds behind eCommerce, but I’m not interested in mid-single digit margins, no matter the revenue base. What I am interested in on the consumer side is the advertising business (which certainly benefits from Amazon’s size/scale on the retail side of things).

Oh, and of course, I love the AWS cloud segment.

Honestly, I think there’s an argument to be made that this business alone justifies Amazon’s entire market cap. With that in mind, who wouldn’t want to receive AMZN’s retail + digital ad business for free?

I’ll start with AWS because cloud computing is still one of – if not the most – important market in the tech space, powering all of the major trends that we’re seeing in the space (including AI/automation).

Amazon Web Services is the largest/best cloud provider in the world, in my opinion, and its growth just accelerated from 17% to 19%.

That 19% growth rate is in-line with MSFT’s intelligent cloud growth, but more impressive, in my opinion, due to AWS’s larger size.

Yes, Alphabet’s cloud segment grew faster during the most recent quarter at nearly 29%; however, we’re talking about a $40b annual run-rate there compared to AWS’s $105b annual run-rate. So while GOOGL may be taking a bit of share, it’s still a distant third place and has a lot of catching up to do.

AWS’s operating income was $9.3b during the quarter, representing an operating margin of approximately 35%.

Therefore, AWS is a business with $100b+ of recurring sales (growing at nearly 20%) that generates ~$40b of annual income (growing at ~70% right now). If this were a standalone company, where would the market cap be? It might not be AMZN’s current $1.88 trillion, but I think it would be close.

Remember…Nvidia’s market cap is larger than AMZN’s right now; yet, AWS is a larger business in terms of sales and cash flows that probably has better long-term growth potential as well.

And on top of the AWS behemoth, Amazon also has a leading digital advertising business (another absolute cash cow because of the connection to its retail segment).

During Q2, AMZN’s Digital Ad segment produced $12.77b in sales (up 20% on a y/y basis). The company doesn’t break out its digital ads profitability metrics, though management is clear that it’s a big part of its profit plans overall, and I’m sure that ongoing growth in the Digital Ads segment is contributing to the records of cash flows that AMZN is generating.

Oh, and it’s probably worth mentioning that AMZN’s subscription services business (Amazon Prime, Prime Video, etc) posted $10.8b in sales last quarter, up 10%.

People love companies like Costco (COST) because of the defensive nature of its subscription sales on top of its retail numbers; well, AMZN is following the same path very effectively.

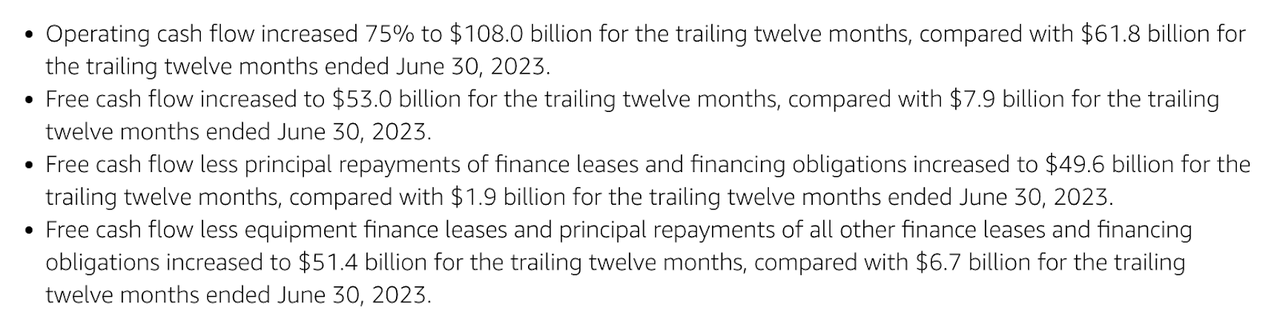

All in all, this company is a cash flow machine. Management has shown before that they can pull profit levers anytime they want (instead of heavy capex investments) and they did that during Q2.

People love to nitpick AMZN about small misses here or there, or share-based comp issues, or macro environment concerns, but to me, this is all that matters:

AMZN Q3 ER

Give me cash flows like that, and I’m going to be a buyer. Especially at AMZN’s current valuation.

Valuation

For years, people have complained that AMZN is too expensive. Yet, all the stock does is defy that suggested gravy, floating higher.

I think the problems that so many people have with this stock from a valuation standpoint stems from paying attention to the wrong metrics.

I track AMZN’s earnings-per-share, but it’s not the primary metric that I use to evaluate the stock.

AMZN’s EPS ebbs and flows because of its inverse relationship to the company’s massive capex endeavors. At the very least, it can be frustrating to track. Also, these unpredictable figures can make the stock difficult to analyze.

Thankfully, there’s another metric that’s more consistent.

I’m talking about operating cash flows.

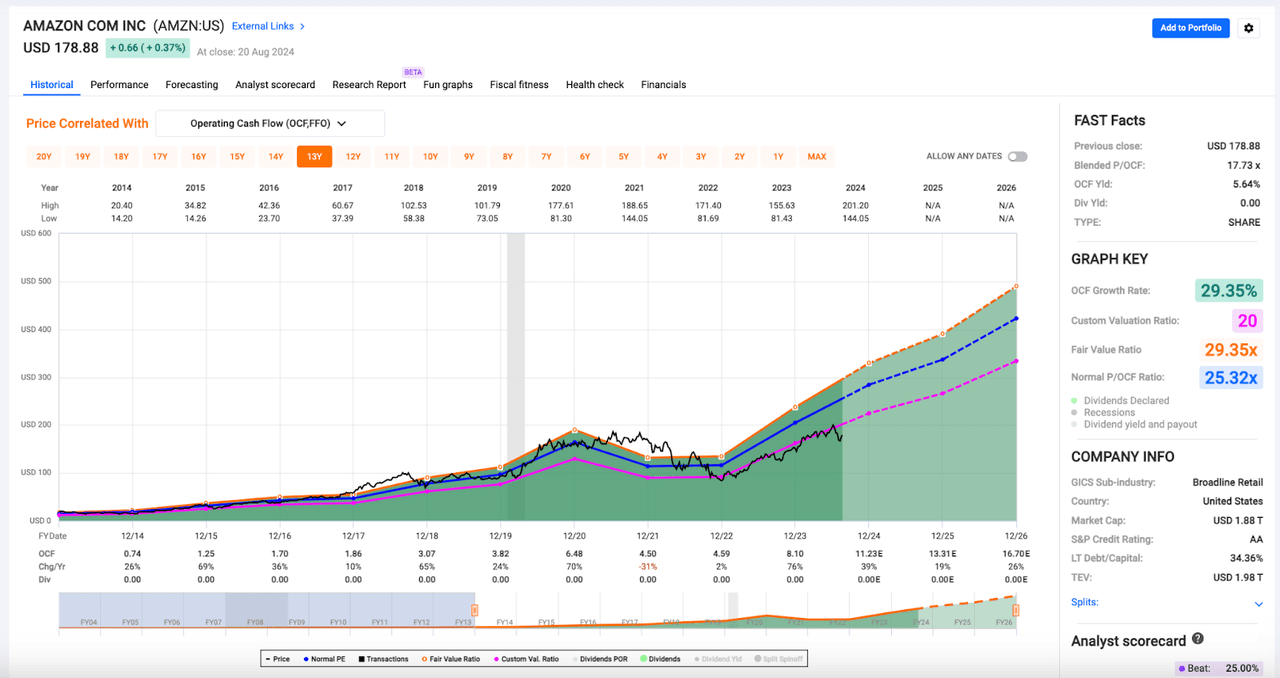

AMZN’s OCF growth has been much more consistent over the years, and I don’t think it’s a coincidence that the company’s P/OCF multiples have been fairly stable over the years as well.

As you can see, AMZN’s y/y OCF growth has only been negative once during the past decade (during the COVID-19 disruption).

The same thing cannot be said of the company’s non-GAAP EPS, which has seen major swings…down 188%, up 340%…up 55%, down 108%, up 1200%…etc, etc, etc.

This EPS volatility makes it difficult for anyone to declare where Amazon shares should trade (regarding their P/E multiple). Yet, the relatively consistent OCF data makes it a lot easier to compare the present (and future growth estimates) to the past, which is a major part of deciding where fair value lies.

Above, you’ll notice that for years, the stock followed the blue line (~25x OCF) and then in a post COVID world, AMZN appears to have been re-rated lower towards the 20x P/OCF level.

Until the stock’s recent pullback, AMZN had followed that 20x OCF multiple like a charm. Could we be witnessing the beginning of another downward re-rating? Possibly. But, since AMZN’s ongoing OCF growth trajectory isn’t all that different from its historical one, I think it’s more likely that we’ll see mean reversion back up to the 20x mark…or even that 25x area, both of which would result in massive upside from.

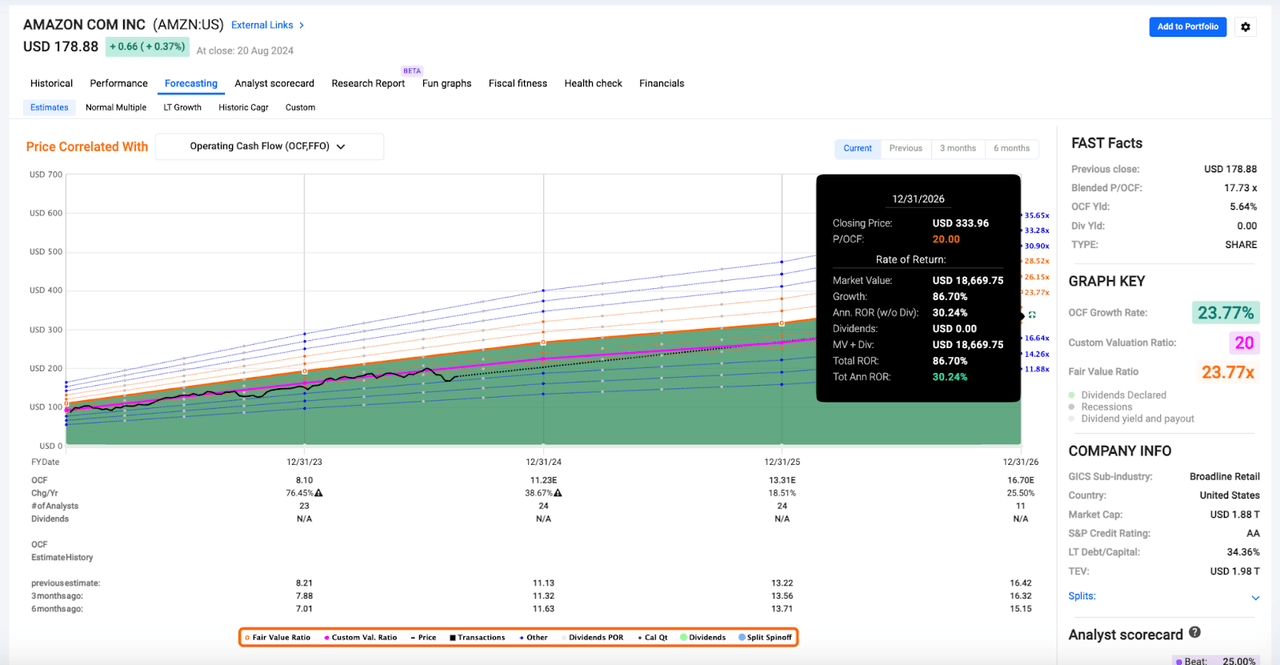

20x the consensus estimate for AMZN’s OCF in 2025 would be $266/share (representing 48% upside potential).

25x that same 2025 consensus OCF estimate would be $333 (representing 85% upside).

I’m not calling for a near-term double here, but I do think that very strong double-digit upside is likely here.

Being that AMZN’s OCF is expected to grow by 19% next year and 26% the year after that, even if we don’t see any multiple expansion from today’s ~18x level over the next couple of years, a stagnant multiple would still result in ~25% annualized returns between now and the end of 2026 based purely upon fundamental growth.

Because of this fundamental growth, I think the downside is fairly limited from here. If AMZN posts the OCF growth that Wall Street expects to see over the next 2 years and the share price moves sideways, then we’d be talking about an ~11x multiple on a stock growing its bottom-line at a 20-25% clip. That’d be ridiculous.

Conclusion

No stock comes without risks. Obviously, AMZN has to continue to execute on its growth initiatives while maintaining leadership in the cloud space for this OCF growth to play out. But, I have strong faith in this company’s management team due to their ability to consistently execute over the years. I don’t see any meaningful competition outside of MSFT and GOOGL entering into the cloud space (and AMZN has been able to hold them off for years). And lastly, and potentially most importantly, AMZN doesn’t appear to be facing the same regulatory headwinds that several of this big-tech peers do right now as far as potential anti-competitive practices goes.

That removes a potentially large overhang above the stock price and if the issues that names like Alphabet, Apple, and to a lesser degree, Microsoft face right now get worse, then I could imagine a world where tech-hungry investors rotate into AMZN.

I hate this anti-tech stance in DC. I think US politicians and regulators should celebrate our biggest, most innovative companies. But who knows…maybe these regulatory headaches will be the spark that leads to increased demand for AMZN shares (and therefore, multiple expansion).

I think AMZN is worth about $240/share right now and therefore, even though I’ve been buying this company aggressively in recent weeks, AMZN remains at the top of my personal watch list.

Don’t be surprised to hear about me buying more Amazon in the near future. Especially as the market’s rally causes value to dry up elsewhere.

I’ll be happy to push my position even further overweight because of the attractive risk/reward that I see when I look at this ticker.

~30% upside with limited downside expectations? I’ll make that bet any day of the week.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, AWK, BAH, BIL, BLK, BKNG, BR, CME, CNI, CP, CPT, CRM, CSL, DE,, ECL, ELV, EMR, ENB, SPAXX, GOOGL, HON, ICE, JNJ, KO, LIN, LMT, MA, MAIN, MCD, MCO, META, MSCI, MSFT, NNN, NOC, NVDA, O, OBDC, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TD, TXN, USFR, UNH, V, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.