Summary:

- Danaher’s high valuation and flat 2024 EPS growth might raise eyebrows, but its track record, strategic acquisitions, and long-term growth potential make it a solid buy for those who can.

- Despite trading at a premium, Danaher’s strong history, efficient operations, and potential for double-digit EPS growth in 2025 make it one of the few stocks I’m buying at a lofty price.

- Danaher’s blend of strategic acquisitions and operational efficiency makes it a long-term winner. I’m adding to my position despite the high P/E, expecting strong returns as growth picks up.

PM Images

Introduction

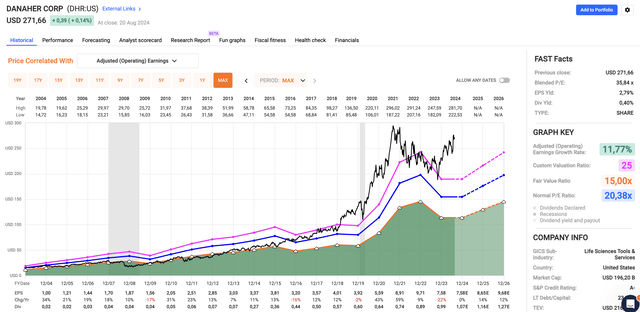

- A blended P/E ratio of 36x.

- 0% EPS growth in 2024.

I think it’s fair to say that this does not look like a winning combination.

Especially in light of what I wrote in a recent article titled “Buying Wonderful Businesses At Fair Prices – The Billionaire Way,” it may be weird that I give you a stock with a lofty valuation and no expected growth in 2024.

One of the “Buffett-style” checklist items was to make sure we buy companies trading at a discount.

[…] do you fully understand the business you’re about to buy? Does the business have an advantage? Does it have a moat? Are you paying a discount price? Does it have a good track record? Can you find better alternatives? Are you putting your money into high-conviction ideas or simply buying investments to diversify?

As the title of this article already gave away, the company we’re about to discuss is the Danaher Corporation (NYSE:DHR), a company that checks all boxes except the one about buying companies at a deep discount.

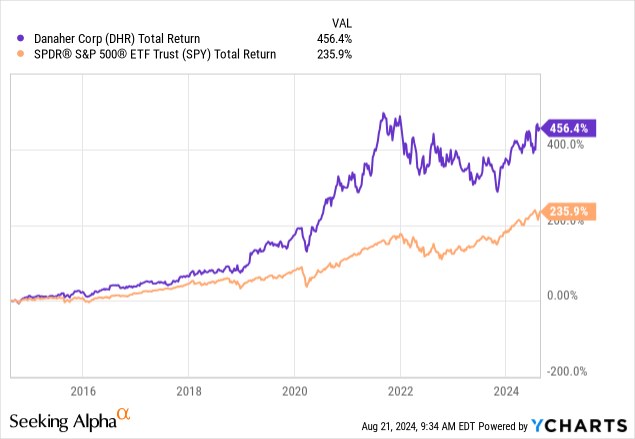

The healthcare giant with a $200 billion market cap has returned more than 450% over the past ten years, leaving the S&P 500’s impressive return of 236% in the dust.

I started buying the company two years ago. It is currently one of two healthcare holdings and my 12th-largest investment.

The reason the company popped up on my screen was because someone in my close circle (I need to be a bit vague as I write under my own name) sold his company to Danaher. Now, it’s part of one of the companies that Danaher has spun off.

One of the things I was told was just how efficiently the company handled the takeover. That makes sense, as the company is a serial acquirer that has built an impressive portfolio of healthcare suppliers.

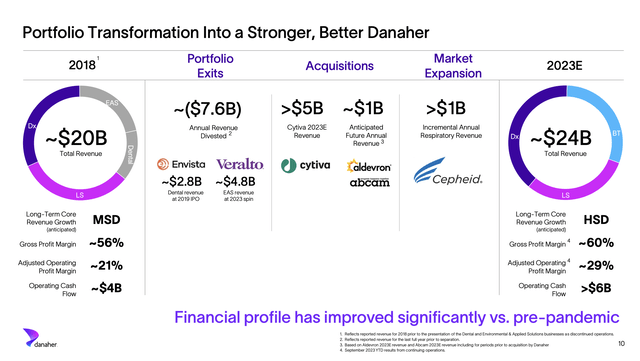

After spinning off Envista Holdings Corporation (NVST) and Veralto Corporation (VLTO), the company is now a pure-play healthcare company with customers in Life Science, Biotechnology, and Diagnostics. This includes major takeovers of Cytiva, Abcam, and Cepheid.

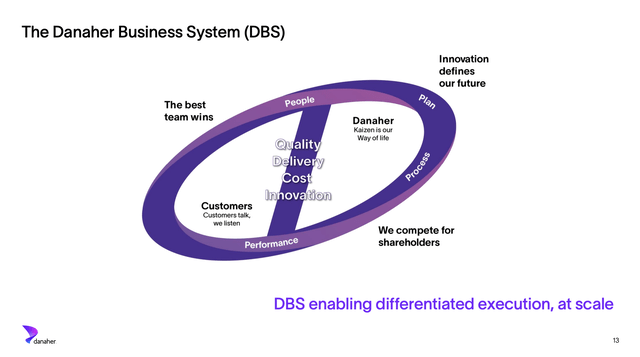

These companies have been integrated using the Danaher Business System (“DBS”), which is the company’s system to consistently improve its operations. This includes generating more patents, accelerating revenue growth, and winning market share.

This has allowed the company to play what I like to call “real-life monopoly,” which goes something like this (painting with a very broad brush):

- Danaher buys Company A. It takes on debt to get the deal done.

- Danaher integrates Company A, improving its operations and free cash flow.

- Free cash flow is used to reduce debt.

- Now, Danaher has a bigger footprint, a healthy balance sheet, and stronger free cash flow capabilities.

- Danaher buys Company B.

- Et cetera.

When adding strong secular growth in healthcare and the company’s fantastic position as a high-margin supplier of critical equipment and consumables, we get a fantastic wealth-compounding opportunity.

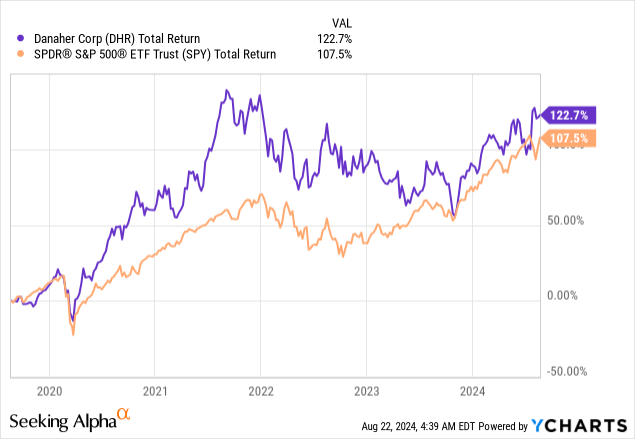

My most recent article on this company was written on April 25, when I went with the title “Value Vs. Growth? Danaher Says Why Not Both?” Since then, shares have returned 9%, fueled by strong earnings.

In this article, I’ll update my bullish thesis and explain why Danaher is one of the few companies with a “lofty” valuation that I really like.

So, let’s get to it!

The Rebound Is Heating Up

As I have written in prior articles, Danaher is a tricky stock to deal with. That is mainly based on the challenging pandemic period. Because of the pandemic, demand for research exploded, supported by accelerating R&D funding. It was one of the best periods to own DHR in recent history.

However, once the pandemic ended, pandemic-related benefits obviously faded. The result was a stock with a high P/E ratio and contracting EPS. Generally speaking, that’s a horrible combination!

As a result, the stock went down between mid-2021 and the end of 2023. Since then, DHR shares have started an uptrend.

The good news is that while sluggish post-pandemic growth is still an issue, the company is seeing a path to higher growth. That’s enough for investors to start loading up on DHR stock again.

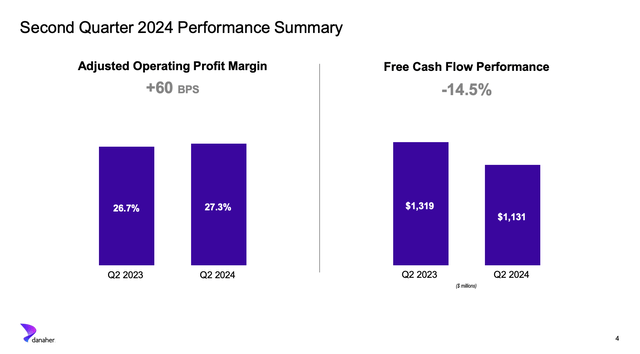

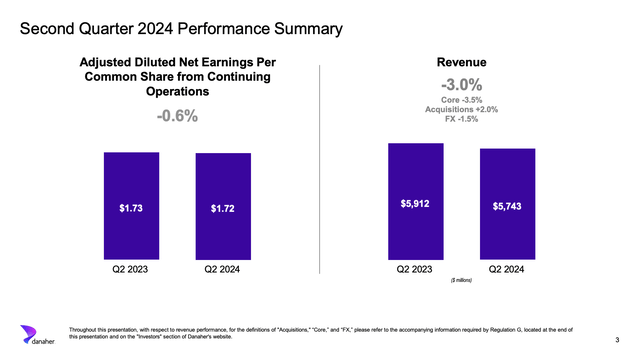

For example, while 2Q24 core sales were down 3.5% to $5.7 billion, the adjusted operating margin improved by 60 basis points to 27.3%. This was mainly due to the successful implementation of cost-saving initiatives that offset lower volumes.

This kept the adjusted EPS decline limited at just 0.6%.

Moreover, the company did what it does best, which is generating a lot of free cash flow. In the second quarter, the healthcare giant generated $1.1 billion in free cash flow. This brought the year-to-date result to $2.6 billion.

Although the 2Q24 result is down 14.5%, the year-to-date free cash flow conversion rate was 129%, meaning it turned every dollar of net income into $1.29 of free cash flow, a sign of high-quality earnings.

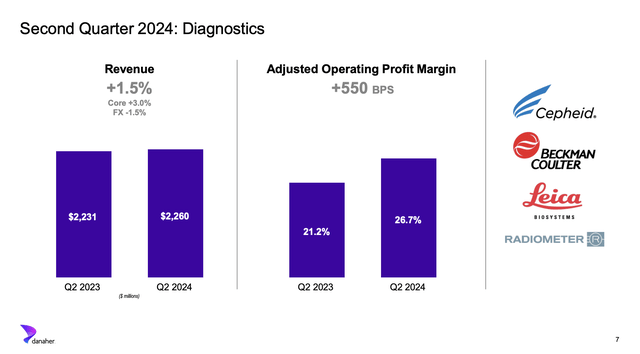

With that in mind, just one of the company’s segments saw growth in the second quarter. That segment was Diagnostics, which had 3.0% core growth and 550 basis points higher operating margins to 26.7%.

What I found interesting is that Danaher mentioned $300 million in respiratory revenue from Cepheid, which benefitted from strong demand for its 4-in-1 test for COVID-19, Flu A, FluB, and RSV. On a full-year basis, Danaher expects roughly $1.6 billion in respiratory revenue alone, supported by market share gains.

The company also sees strong tailwinds from an increasing installed base, as customers are increasingly investing in capabilities to better reach patients. I added emphasis to the quote below.

We also continued to expand our nearly 60,000 system installed base, as many existing healthcare systems and integrated delivery network customers are adding new instruments at sites further out in their networks and closer to patients. In June, the FDA granted Cepheid marketing authorization for its hepatitis C RNA test. Hepatitis C diagnosis has traditionally been a multistep process requiring follow-up appointments and leading to treatment delays. With Cepheid’s test, which is the first molecular-based point-of-care test for hepatitis C, patients can be tested and receive treatment during the same health care visit. – DHR 2Q24 Earnings Call

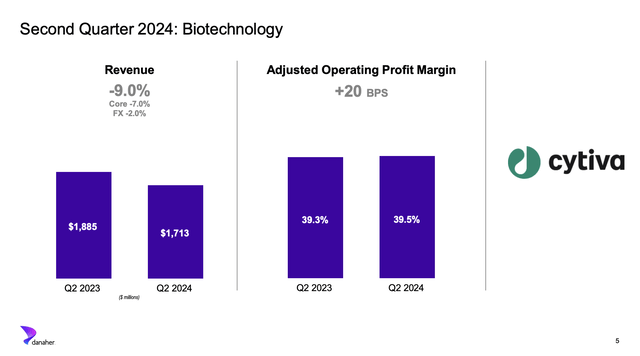

Then there’s Biotechnology, a segment dominated by Cytiva. It saw 7% lower core revenue growth but kept strong operating profit margins of almost 40%.

Although there’s nothing positive about a 7% decline in core revenues, the company noted that the future is bright, as its bioprocessing business saw orders in the U.S. and Europe increase by high-single digits compared to 1Q24. This indicates that the worst of the inventory de-stocking is behind them.

That’s what the market wanted to hear!

Moreover, Danaher noted the broader market for biologics remains healthy, with the number of new FDA approvals for biologic and genomic medicines doubling in the first half of 2024 – compared to the first half of 2023.

Essentially, this is a great sign of strength and the need for innovation, putting Danaher in a great spot, as it’s a prime supplier of laboratories.

As a result, the company is aggressively investing in research and development. This includes new Supor Prime filters at Cytiva. These are designed to handle high-concentration biological drugs. This addresses the issue of premature filter blockage in some cases. This reduces potential drug losses of clients, making their operations more efficient.

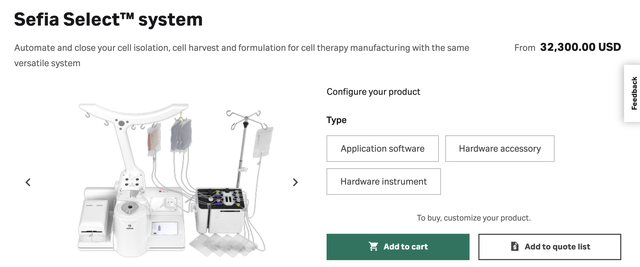

Speaking of efficiency, Cytiva also introduced the Sefia cell therapy manufacturing platform. According to Danaher, this presents a major advancement in CAR-T cell therapy manufacturing.

According to the American Cancer Society:

Chimeric antigen receptor (“CAR”) T-cell therapy is a way to get immune cells called T cells (a type of white blood cell) to fight cancer by changing them in the lab so they can find and destroy cancer cells.

To add some numbers, this system can increase productivity by up to 50%, which significantly reduces costs and improves patient access to life-saving therapies, according to the company.

On top of that, it expands Danaher’s market share and paves the way for long-term growth.

In the Life Sciences segment, the company saw 5.5% lower core revenue growth and 360 basis points lower profit margins. This is mainly due to weak global pharma and biotech demand. The good news is that the company is seeing a rebound in China, which will likely lead to higher orders in 2025.

In general, the company believes conditions will normalize in the Life Science segment in 2024. Hence, I think it’s fair to assume 2025 will be the first year where all segments see lasting tailwinds.

What does this mean for shareholders?

Danaher’s Shareholder Value

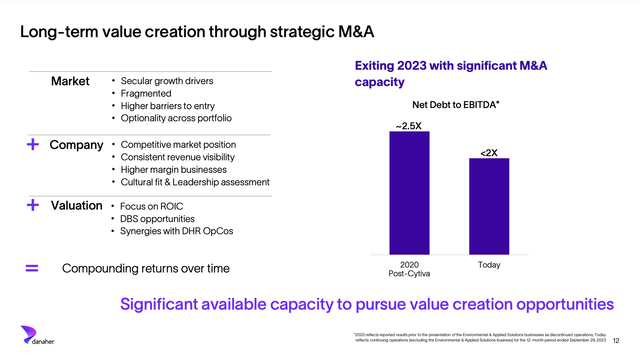

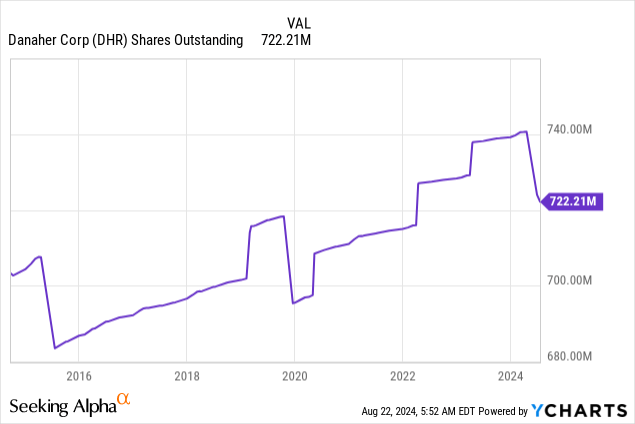

One of the most interesting developments is the fact that Danaher started buying back stock again. While one could make the case that this shouldn’t be done at elevated valuation multiples, it seems to be a sign of confidence in long-term opportunities.

While M&A remains our bias for capital deployment, we believe these repurchases will provide an attractive return given the strength of our long-term organic growth, earnings, and cash flow outlook. – DHR 2Q24 Earnings Call

In the second quarter and July, DHR bought back 19 million shares. This translates to roughly 2.6% of the company’s total shares. However, please note that DHR is not a buyback-focused company – at least not in the past.

The company beat the market without buybacks, as it mainly allocated cash to strategic M&A. Going forward, I do not expect that to change.

If anything, as I already briefly mentioned, I believe recent buybacks are a clear sign of confidence, as the company is telling the market it believes the future is bright. This is supported by favorable demand developments.

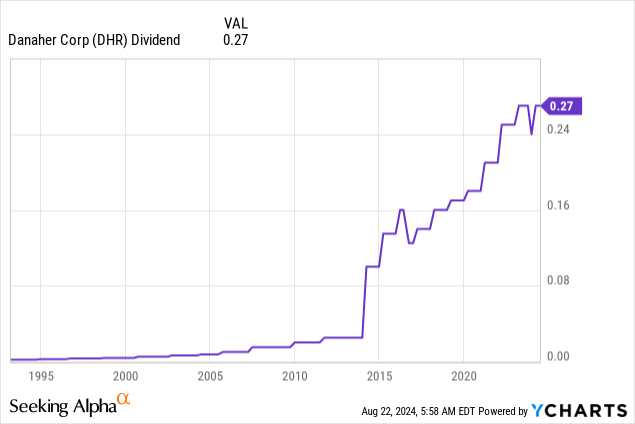

Dividend-wise, DHR currently yields 0.40%. This dividend comes with a payout ratio of just 14% and a five-year CAGR of 12.4%.

Although I cannot make the case that DHR should be bought for its dividend, on a long-term basis, I expect the dividend to have a meaningful impact on its total return.

Now comes the bad part. While the company has clearly shown confidence in its path to higher growth and valuation, we’re dealing with a company that trades at a blended P/E ratio of 35.8x. That’s a mile above its long-term average of 20.4x. Its ten-year average is roughly 25.0x.

The company, which has an A- credit rating, is expected to accelerate its EPS growth from 0% in 2024 to 14% and 12% in 2025 and 2026, respectively.

Technically speaking, this implies a fair stock price of $242, 11% below the current price.

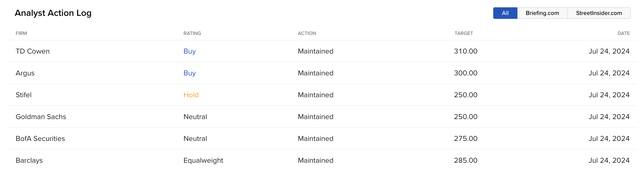

Nonetheless, analysts are increasingly upbeat.

These are the price targets after the earnings release, with targets up to $310, 14% above the current price.

All things considered, putting a valuation on DHR is tricky. Demand growth is returning and 2025 will likely be the start of a long-term growth streak with annual EPS growth in double-digit territory. That is the reason why investors are buying DHR at more than 30x earnings.

Personally, I have consistently added to DHR this year. I will continue to do so on 5-10% stock market pullbacks, as I believe the company is a perfect dividend growth stock for my portfolio.

Hence, it’s also the only company I’m buying at what looks like a very unattractive valuation.

Takeaway

Despite its current valuation and flat EPS growth in 2024, the company’s strong track record, strategic acquisitions, and efficient operations make it a long-term winner.

While the post-pandemic period has been challenging, signs of a rebound are emerging, supported by favorable comments during its earnings call. This means 2025 could mark the beginning of a sustained growth upswing.

As a result, I’ve been steadily adding DHR to my portfolio this year and plan to continue doing so during market pullbacks.

While it is not a deep-value investment, for me, it’s a high-conviction pick, even at a premium price.

Pros & Cons

Pros:

- Proven Track Record: Danaher has consistently outperformed the market, with a 450% return over the past ten years. This was provided by smart acquisitions, efficient operations, and strong secular growth.

- Strategic Acquisitions: The company’s ability to integrate and optimize acquired businesses is impressive and creates a solid portfolio in high-margin healthcare sectors.

- Growth Potential: With demand growth returning and the potential for double-digit EPS growth in 2025 and beyond, I believe Danaher is in a great spot for long-term success.

- Consistent Dividend Growth: Although DHR does not have a high yield, its dividend growth is consistent, supported by a low payout ratio and an A-rated balance sheet.

Cons:

- Valuation Concerns: DHR’s current valuation, trading at a relatively high P/E ratio, may keep the stock price performance subdued in the short term.

- Post-Pandemic Challenges: While the company remains strong, post-pandemic growth challenges like subdued revenue growth could impact its short-term returns.

- Market Volatility: Like any stock, DHR is subject to market fluctuations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.