Summary:

- Altria has returned 28.4% YTD, and I believe it’s an opportune moment to sell as the stock hasn’t been above $50 in the last two years, indicating a low upside.

- As investors, we have to remember that just because something is cheap doesn’t mean it can’t stay that way for a very long time.

- I prefer British American Tobacco over Altria as the current cash flow is in a better position to support buybacks and a growing dividend.

35007/E+ via Getty Images

Introduction

I’ve been long Tobacco since 2020, expanding my position as Altria Group, Inc. (NYSE:MO) kept trading sideways to lower my average cost per share. I ended up with an average price per share of $41.28 with a yield on cost of 9.5%. I happily collected my dividends every quarter, but also tracked the stock in terms of total returns, with the stock having traded sideways most of the time since I picked up my initial bulk of shares. I just sold my shares at $51.53 and therefore locked in a 25% appreciation on top of the dividend. For me, that’s a satisfactory return for the period I held, and I won’t recommend going short because the stock remains cheap, but I believe, as the stock broke through $50 per share, that it is a prudent time to review if it’s an opportune moment to sell and take the win.

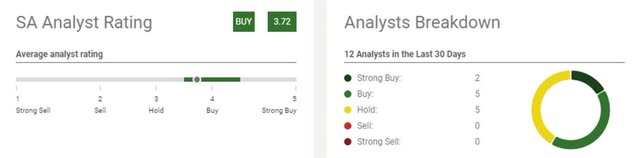

Seeking Alpha Analyst Consensus Altria (Seeking Alpha)

Over a prolonged period of time, there is a majority opinion on Seeking Alpha concerning Altria, that sides with the bulls. While I’m not a bear, I’ll offer some arguments here as to why it’s worth considering if it’s time to let go and find another trade instead. Frankly, I think most analysts are struggling with giving this a sell rating because it is so cheap from a valuation perspective, but that doesn’t guarantee that we are staring at market-beating returns. After all, we have to consider what forms the foundation for the long argument.

I remain long in British American Tobacco p.l.c. (BTI), more on that later.

Argument 1: It’s been more than two years since the stock last traded above $50 per share

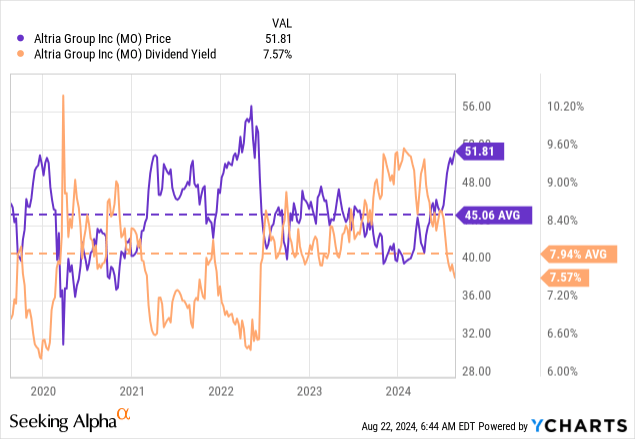

So, the stock hasn’t traded this high in a couple of years, and we must go back to 2018 to observe the last time the stock traded above $60 per share, which would provide slightly less than an additional 20% upside from here. Sure, the financials have improved during that period, but this isn’t a stock that used to trade at triple digits.

The stock has, however, on average traded at an average price per share of $45.06 the past five years, and an average dividend yield of 7.94% in the same period. This would imply, that a return to the mean, would indicate a downside from hereon. Does this guarantee there is a higher probability for downside as opposed to upside? No, it doesn’t, but if we combine it with the other arguments following the first one here, then I think it’s a fair indication that the time might be prudent to leave the dance floor and let someone else take the next dance.

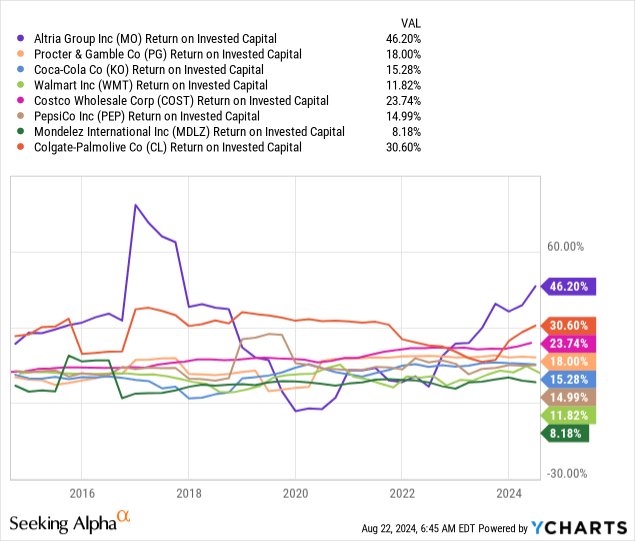

If you, same as I, have gobbled up shares over the past few years, then a 20%+ capital appreciation might also mean that tobacco stocks have become an over-allocated part of your portfolio. In my brokerage account, I have an 8% allocation to consumer staples, which is where tobacco belongs, and it’s difficult to find companies who can challenge the tobacco companies in terms of yield and also return on invested capital. I’ve inserted the top non-tobacco holdings of The Consumer Staples Select Sector SPDR® Fund ETF (XLP) measured on ROIC below, just for your inspiration, and as can be seen, no one can rival Altria. Do note the impact of the failed $12.8 billion JUUL acquisition had on ROIC in the early 2020s where Altria gradually had to write it off entirely over a four-year period.

As such, I think it’s only logical to go with tobacco stocks, all the arguments are there. However, a solid rise in share price has resulted in tobacco stocks having become more than 6.5% of my portfolio, which is higher than I’m comfortable with (observe argument 2 further below). If you take a look at your portfolio, it’s perhaps even worth considering what the stock price appreciation has done to your allocation towards high-yield stocks, which is the category Altria belongs to.

Remember, same as chasing high growth stocks doesn’t mean they will grow double digits forever, similarly, too high exposure to high-yield stocks can also be detrimental to your journey to financial freedom, as there often is a reason why the market sets a discount on these kinds of stocks often suggesting there is some sort of question surrounding the sustainability of their dividend.

Due to the need to write off the JUUL investment between 2019-2023, the price-earnings ratios are a bit all over the place for Altria. If we instead make use of British American Tobacco as a proxy, we can observe the mean P/E ratio over the past five years, which came in at 10.5, suggesting that Altria’s forward P/E ratio most likely should find itself somewhere close to that. Altria currently trades with a forward P/E ratio of 10.1, and as such finds itself close to the relative valuation of its peer. However, in fairness, if we deploy the example of Philip Morris International Inc. (PM) instead, its five-year mean P/E ratio is 17, suggesting there could be a lot of upsides if Altria should trade at similar levels. Perhaps there is, but then Altria’s stock would climb to prices it has never seen before.

Argument 2: Industry Headwind – Forever Sinking

As I mentioned in the previous section, there is often a reason why stocks are trading at depressed valuations, and when it comes to tobacco stocks, it’s fairly evident why. This is an industry that’s operating in an everlasting environment of headwinds. Regulation has created a very attractive marketplace for the companies operating within it, with reference to the strong returns mentioned before, but there is also an everlasting political scrutiny and interest in limiting the reach of smokeable tobacco.

Many countries have enacted tobacco acts with the purpose of reaching a point where generations will be tobacco-free, simply by increasing the age by which you can legally buy tobacco. To put it bluntly, they have defined their tobacco endgame target.

Even if a given country hasn’t gone this far (yet), many countries assign limits by law on where you may smoke in public, such as public institutions, squares, etc. I will not be a judge of what vices people have, that’s their own business, but from an investor perspective, I must consider if this is a marketplace that can, over time, remain attractive.

The durability of a given business model and balance sheet is key. If the business is shrinking and the balance sheet isn’t in tip-top shape, it can prove to be a thesis breaker over time. I don’t want to fight gravity, and similarly, I will always keep a close eye on my tobacco stocks and their performance due to this simple fact.

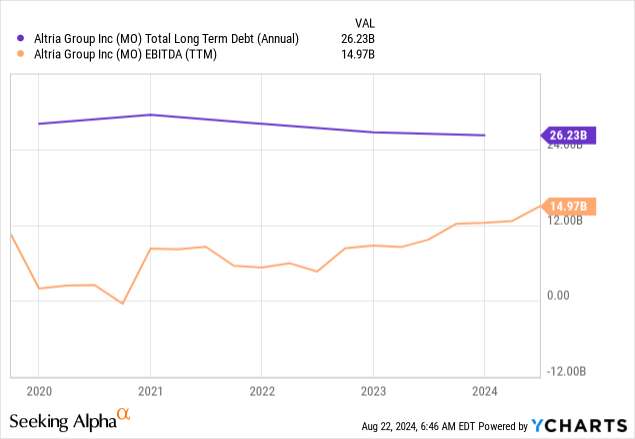

Altria remains in fine financial shape as it isn’t leveraged beyond what’s manageable with a 2.1x debt-to-EBITDA ratio. EBITDA continues to tick upwards due to efficiency despite the annual single-digit decline in volumes of its traditional smokeable tobacco business and total debt is on a stable level, ever slowly declining.

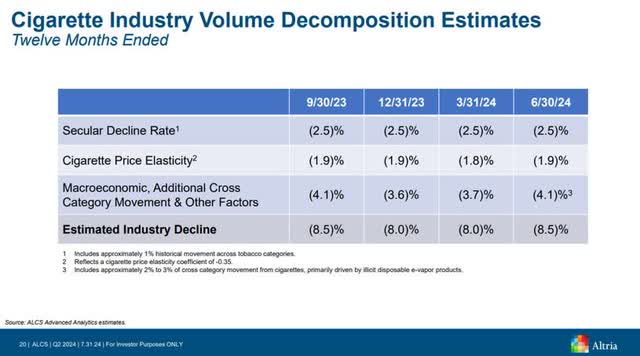

Altria Q2 2024 Cigarette Volume Development (Altria Group Investor Relations)

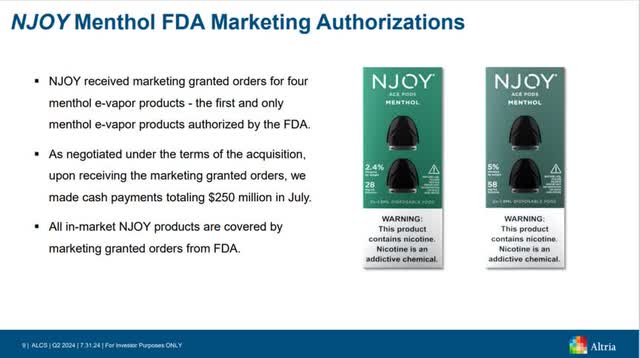

In addition, the smoke-less alternatives, led by NJOY, are showing good traction, much better than the days of JUUL.

Altria Q2 2024 Smokeless NJOY Development (Altria Group Investor Relations)

Argument 3: Capital Allocation & An Uncertain Marketplace

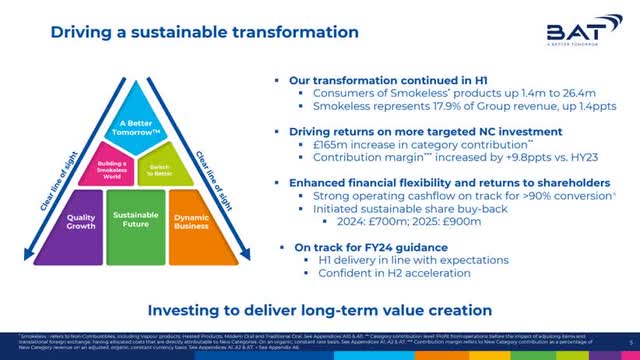

This brings me to the last topic – capital allocation. Here, Altria is not in any way unique compared to its competitors. Its legacy business is buried at the bottom of the quarterly earnings deck, despite the fact that it alone is responsible for the stellar financial returns. If it wasn’t for the legacy business, there wouldn’t be an opportunity for investments in the future. It is, probably due to argument 2, hidden at the bottom under the tag of “responsibly leading the transition of adult smokers to a smoke-free future”. This is the most important mission of all the big players, to carve out an attractive marketplace for a future without tobacco. It’s a fight against time and gravity as lawmakers lean ever heavier on the companies. BTI labels it “building a smokeless world”, but it’s all the same. The same struggle to build a profitable alternative to what will probably perish over time.

I already mentioned the failed $12.8 billion JUUL acquisition. Something that came at a steep price for shareholders despite not even being a majority stake leading to control. Over several tranches, Altria had to write off the entire investment due to health concerns and litigation associated with the products. As such, the capital allocation hasn’t been stellar, and despite Altria and all its major peers showing good volume growth, FDA authorizations, and customer satisfaction, it remains a marketplace where we are yet to fully understand adaption and transition towards these alternatives. Research is also ambiguous as potential health concerns are yet to be fully uncovered. I’m not suggesting this won’t prove to be an attractable marketplace, but the lack of complete knowledge results in uncertainty, and then we are back to the depressed valuations characterizing the industry.

At the very start of the article, I mentioned that I’m also long BTI. So why did I decide to sell my stake in Altria and not BTI?

British American Tobacco 1H 2024 High Level Development (British American Tobacco Investor Relations)

It’s a fairly straightforward answer. Both companies deploy the majority of their cash flow towards shareholder distributions, primarily in the form of dividends. If we look at Altria, then they deploy 70%+ of the cash flow in dividends, while for BTI, that number is around 55%. BTI carries higher leverage, as Debt to EBITDA comes in at 2.5x, but despite this, the cash flow allows for more flexibility and sustainable share buyback programs. With such depressed valuations, I prefer buybacks as opposed to a growing dividend. However, with less of the cash flow tied to the current distributions, it’s also in theory more likely that BTI can grow their dividend faster than Altria.

Conclusion

Having enjoyed strong returns in tobacco YTD, the exposure had become too large in my portfolio, and I concluded it was time to rid myself of one of my positions. With the stock climbing higher than it’s been in years, a relatively poor capital allocation track record, slightly more strained free cash flow, and the everlasting fight against regulation and lawmaker scrutiny, the choice fell on Altria, while I keep my BTI, with tobacco now representing a healthier percentage of my portfolio compared to before.

Right now, I think the opportunity is showing its face, and I’ve decided to go through that door.

Over the past year, Altria beat the S&P 500 by providing a total return of 32.7% compared to the 29.7% of the S&P 500. However, if we zoom out, then Altria (and BTI) both lose out on both the 5- and 10-year horizon.

What will I do with my proceeds? I don’t know yet, but ironically, I’m considering setting aside some to buy more BTI if the industry-wide stock price drawback I expect becomes a reality. Besides that, I wish to keep my portfolio allocation to the defensive consumer staples, especially as we at some point should expect to experience a contracting global economy. As such, I’ll add to some of my existing positions as well.

Only time can tell if I’m on the right or wrong side of this bet, but regardless, I believe any portfolio benefits from reallocation once exposure gets too large to a given sector, and this time, it was tobacco who was on the chopping block.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.