Summary:

- Snowflake investors are experiencing an unanticipated AI winter.

- Snowflake’s recent earnings release corroborates intensely competitive headwinds.

- SNOW’s AI capabilities could be tested as Databricks, and the hyperscalers invest more aggressively to gain more share.

- SNOW’s extremely expensive valuation metrics suggest the market likely has no patience for disappointment.

- I argue why I was wrong to upgrade SNOW in my previous update. I assess that SNOW could be stuck in an AI winter for a while. Read on.

J Studios

Snowflake’s AI Winter

Snowflake Inc. (NYSE:SNOW) investors felt the AI winter in August 2024, as the stock of the data lakehouse company scored a new low. The recent dip-buying from SNOW’s August lows saw a significant reversal this week as investors reassessed Snowflake’s weak guidance at its recent earnings scorecard.

The company posted a double-beat in Snowflake’s FQ2 earnings release, although its outlook likely disappointed the market. SNOW’s guidance suggests that FQ3’s revenue is expected to slow further as Snowflake adjusts to a more competitive AI landscape that its competitors seem to have gained the upper hand against. Berkshire Hathaway’s (BRK.A) (BRK.B) decisions to offload its stake in SNOW entirely could also have lowered the market’s confidence. Furthermore, Snowflake’s decision to invest more aggressively in its revised go-to-market strategy has intensified its execution risks to meet its full-year FY2025 outlook. Coupled with its incredibly expensive valuation metrics, I assess that the market de-rated SNOW in anticipation of lower visibility and confidence in its FY2025 roadmap.

I had anticipated a more constructive consolidation could help the stock bottom out in my previous article. In my bullish Snowflake article in May 2024, I highlighted the need for management to provide more confidence in its enterprise AI roadmap. Given the stock’s relative underperformance since then, I assess that the market is justified in reflecting their concerns, as the confidence was clearly missing in Snowflake’s outlook.

Snowflake’s Outlook Disappointed

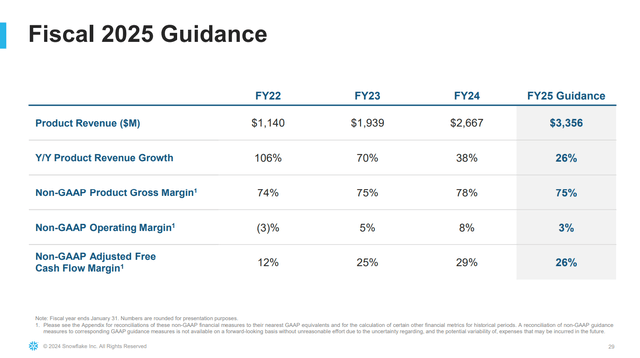

Snowflake guidance (Snowflake filings)

As seen above, Snowflake’s FY25 guidance suggests an adjusted operating margin of only 3%, a sharp decline from last fiscal year’s 8% metric. The company’s revenue growth is also expected to fall to 26%, suggesting an ongoing deceleration phase. While Snowflake isn’t expected to record the triple-digit topline growth rate it posted in FY2022, the market likely needs to see a substantial improvement in Snowflake’s operating leverage. Therefore, Snowflake’s outlook corroborates the significant competitive challenges, behooving the company to adjust its GTM strategy and OpEx drivers to potentially compete more aggressively.

Of particular note is the pressure heaped by arch-rival Databricks. The hyperscalers have also intensified their data analytics and management efforts. Cloud behemoths such as Microsoft (MSFT) have been observed offering cross-selling product integration in their bid to migrate these customers to their computing infrastructure. Hence, Snowflake is expected to contend not just with the reportedly more advanced data science and AI capabilities of Databricks but also with more sales aggression from the cloud hyperscalers.

Snowflake has attempted to level up its AI capabilities to compete more effectively. However, these efforts are not expected to materially improve its revenue in the near term while potentially increasing costs. There are also inherent risks with using Iceberg tables, attributed to the possible storage migration out of Snowflake.

Hence, Snowflake’s revenue growth normalization could be impacted further, even as it deals with the volatility inherent in its consumption-based revenue model. Therefore, I assess that the market is justifiably concerned about whether Snowflake’s AI capabilities can overcome these competitive headwinds. Moreover, the company’s disappointing FY2025 guidance suggests SNOW’s buying sentiments are expected to be unfavorable for some time.

Is SNOW Stock A Buy, Sell, Or Hold?

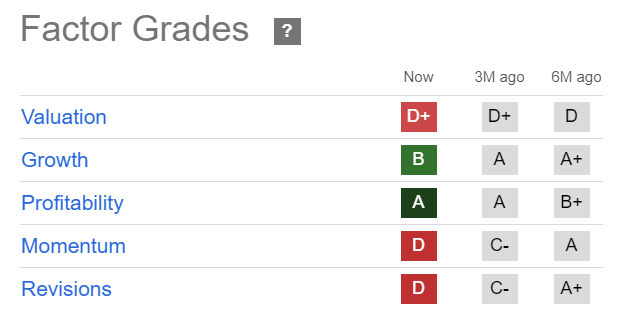

SNOW Quant Grades (Seeking Alpha)

SNOW’s “D+” valuation grade is a solemn reminder that the stock is still priced for growth. Therefore, investors aren’t expected to be forgiving, as Snowflake’s forward outlook disappointed. Investors are justified in expecting rock-solid execution and assured guidance with clear visibility of improved operating leverage. That would have given investors confidence that Snowflake could credibly fend off competition without slowing its profitability trajectory.

Consequently, I assess that the stock’s momentum has cratered (from “A” to “D” over the past six months), corroborated by its increasingly weak execution (plunge in earnings revisions from “A+” to “D”). It justifies the market’s pessimism that Snowflake faces increasingly tough competition against its peers, heightening its execution risks.

SNOW’s forward adjusted EBITDA multiple of 154x suggests no room for disappointment, as it’s well above its tech sector median of 14.5x. Based on SNOW’s forward adjusted PEG ratio of 9.4 (Vs. sector median of 1.94), I assess the stock could be stuck in the penalty box for a while.

The market will likely need to assess a sustained improvement in execution and a growth inflection in its operating leverage before a potential re-rating. Otherwise, the pain might not be over.

Risks To SNOW’s Thesis

My caution suggests Snowflake’s AI strategy hasn’t been adequate to mitigate the potentially more advanced capabilities of its peers. The hyperscalers are expected to accelerate their efforts to migrate more customers to their compute infrastructure as they attract them with their increasingly broad and diverse AI offerings.

However, Snowflake’s net revenue retention rate of 127% corroborates the stickiness and robustness of spending on its platform. While it invests more aggressively in FY2025 against its peers, it’s not expected to be a structural headwind. Snowflake’s robust NRR metric doesn’t support fears about a sharp drop in consumption. Management has also not observed an outward migration from its storage revenue due to the increasing use of the Iceberg tables. Coupled with the enhanced AI capabilities on its platform, Snowflake’s ability to monetize its AI offerings could be understated.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!