Summary:

- Innovative Industrial Properties has offered a lower volatility way to invest in the cannabis sector.

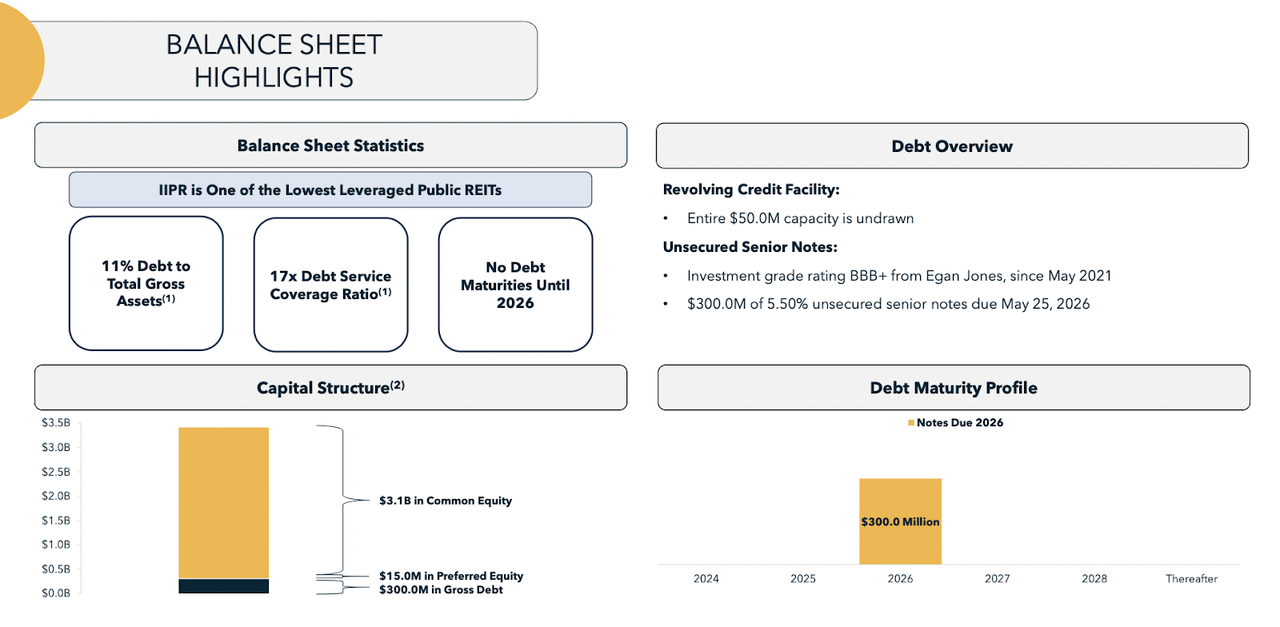

- The company maintains far less leverage than traditional net lease REITs.

- Management has done an exemplary job managing the storm of tenant defaults.

- I explain why the math does not work out for the risk-reward moving forward.

FatCamera

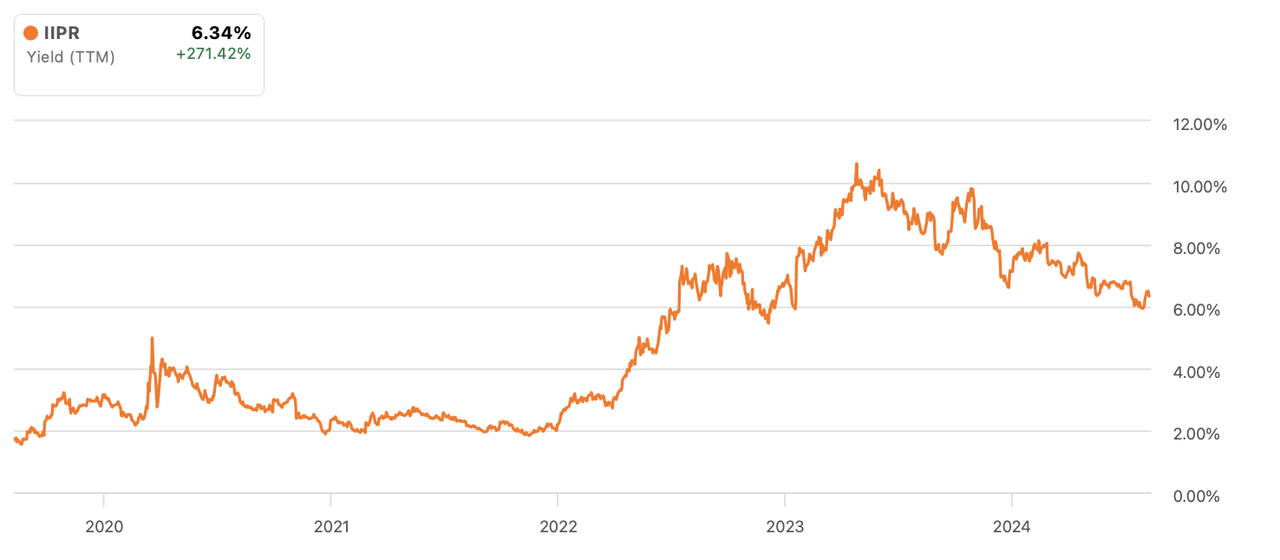

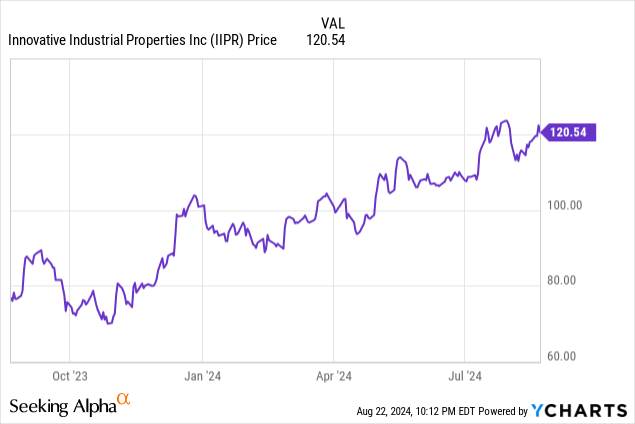

Innovative Industrial Properties (NYSE:IIPR) has been one of the most consistent winners in the cannabis sector. In comparison with the stocks of its operator tenants, which have seen great volatility, IIPR has more or less sustained a stable uptrend since bottoming in early 2023. What has been the difference? Whereas the operators have suffered from incessant price compression, IIPR has been more or less insulated due to earning fixed rent, outside of a handful of troubled properties. This management team has shown a strong ability to execute on dealing with troubled properties and now appears to have weathered any immediate storms. The strong execution may be behind the strong stock price performance, but I am now of the view that the risk reward proposition is no longer favorable, especially given the concrete mathematics of REIT investing. Due to the limited potential upside versus the still-present risk, I am now downgrading the stock to a neutral rating.

IIPR Stock Price

IIPR is still far below all-time highs, but I do not see a quick return to those levels barring a sudden increase in enthusiasm for cannabis real estate, which I find unlikely. I last covered IIPR in June where I rated the stock a buy on account of continued upside from rescheduling, though noted that “it is more difficult to pound the table on the basis of relative valuation given that the discount has narrowed considerably from the lows.” The stock has since delivered double-digit outperformance relative to the broader market.

The stock has now just barely edged out of my desired buying range, and I stress that REIT investing requires a strict adherence to this range due to the uniquely lower growth prospects.

IIPR Stock Key Metrics

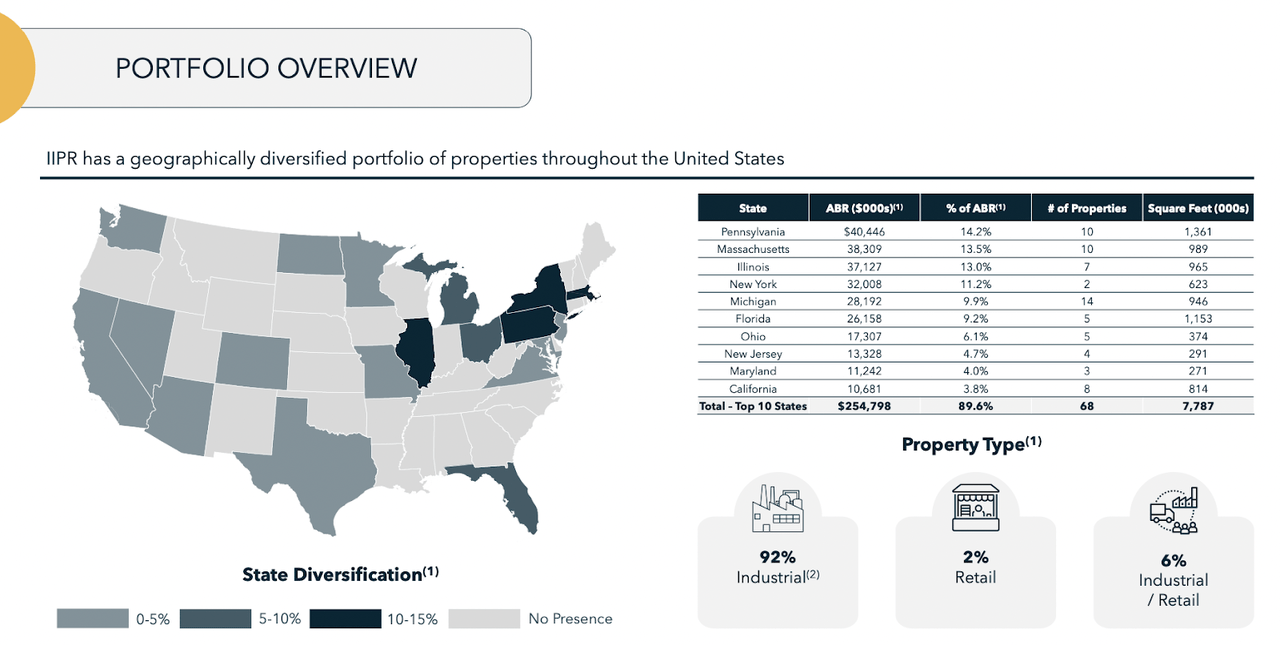

IIPR is the largest publicly traded landlord of cannabis cultivation properties (it does have a small amount of retail dispensary properties). The company is primarily located across 10 of the most significant cannabis markets, many of which have already legalized adult-use sales.

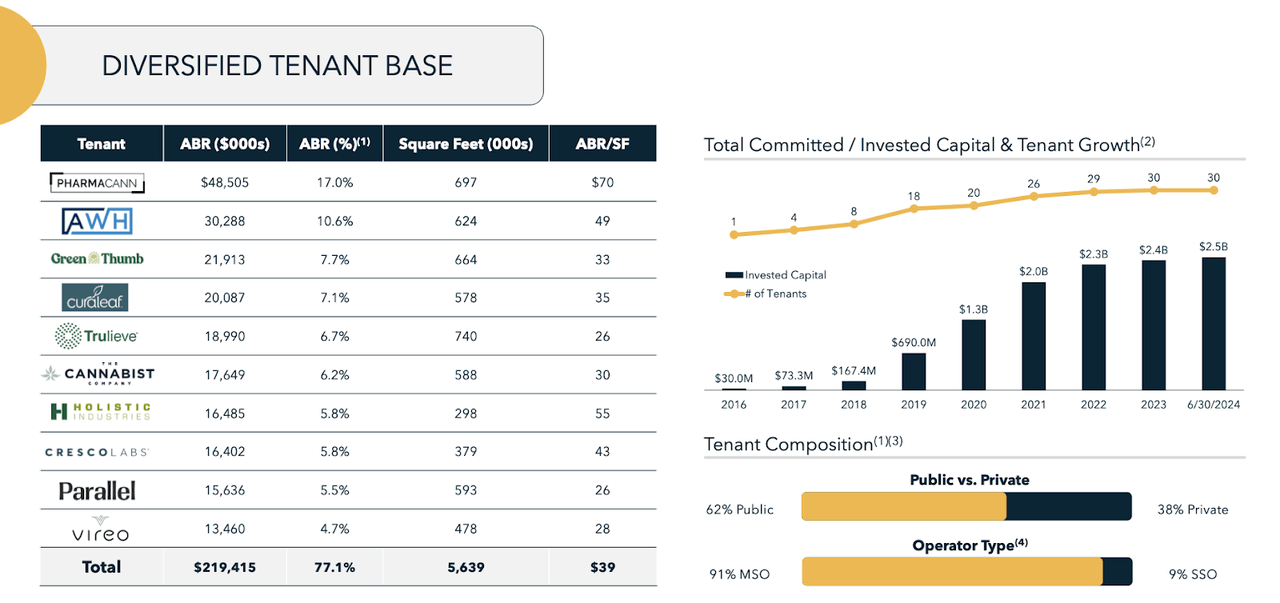

The company’s tenant roster includes all of the well-known names, including Green Thumb Industries (OTCQX:GTBIF), Curaleaf (OTCPK:CURLF), Trulieve (OTCQX:TCNNF), and Cresco Labs (OTCQX:CRLBF), which were once known as “The Big 4” of US cannabis.

In the latest quarter, IIPR saw revenues jump 4% YoY to $79.8 million. In general, the growth was driven by the common levers including annual lease escalators as well as a general increase in rent-generating investments. The company did receive $3.9 million in termination fees connected with the sale of its Los Angeles property, but that was offset by less rent earned from vacant properties. Adjusted funds from operations per share (‘AFFO’), a suitable proxy for earnings, grew at a slower 1% pace due to elevated property expenses as well as dilution associated with the redemption of the convertible senior notes (the company issued 28,408 shares to redeem the 3.75% notes this year.

On the conference call, management noted that the aforementioned sale of the Los Angeles property occurred at a total consideration of $13 million, which exceeded their net carrying value as of the prior quarter. I note that the company has not recorded any significant impairment charges – it is notable that the company was able to effectively sell an underperforming property at or above cost minus depreciation expenses.

Management also noted that some of the other properties which have since been re-tenanted will not generate rental revenue until the tenants have successfully acquired regulatory approval to commence operations – management believes that these should occur by at least late next year.

IIPR ended the quarter with $297 million of debt, which represents just a hair over a 1x debt to EBITDA ratio. For reference, traditional net lease REITs like Realty Income (O) typically have ratios in the 5x debt to EBITDA range. These notes do not mature until 2026 but due to the low leverage profile, I am not concerned about refinancing risk.

Management noted that they acquired a 145,000 sq ft industrial property in Florida and signed a long-term lease with Ayr Wellness (OTCQX:AYRWF). The property was acquired for $13 million (or $90 psf) and the company committed an additional $30 million to redevelop the building for use as a cannabis cultivation facility. This investment makes sense given the possibility of adult-use legalization in the state come this November, but I view AYRWF to be a highly indebted operator and IIPR investors cannot be blamed for wondering if this proves to be a risky purchase, especially if the adult-use ballot does not pass. While the company is for the most part beyond the vicious wave of troubled tenants of the last few years, management noted that they still have some vacant space in Pittsburgh, California, Texas, and Michigan left on their plate.

Is IIPR Stock a Buy, Sell, or Hold?

IIPR management deserves great praise for their swift and efficient handling of the last several years, as they have worked through large tenant defaults such as King’s Garden in California. The stock had briefly sold off into a double-digit dividend yield but the market has rewarded the stock price given the strong execution. The stock recently traded hands at around a 6.2% dividend yield.

That still represents some discount to the 5.2% dividend yield at Realty Income, but the relative discount is obviously lower than just a year ago. Sure, IIPR benefits from faster annual lease escalators at around 3% versus 1% for Realty Income, but one arguably should not interpret that to mean 300% faster internal growth but to instead mean 200 bps of faster growth. While these are mathematically the same meaning, the interpretation is clearly different. When IIPR was trading around a 10% yield, this faster internal growth rate could arguably be enough to justify strong upside. But when IIPR trades at the currently smaller relative discount, it is hard to get excited about near term upside when the internal growth rate is only 200 bps faster. While I can see a case for additional upside, I can also see the argument that the relative discount and higher annual lease escalators are more than offset by the higher risk profile of the tenant base. Sure, IIPR might have still generated a higher return on assets than Realty Income even at the depths of the 2022 to 2023 crash in the cannabis sector, but that is missing the point: investors are likely to always prefer a lesser-drama story especially when we are talking about REIT income investments. Now that the market has seen in full force the long term threat from pricing pressures, I am doubtful that IIPR can fully narrow the relative discount to traditional NNN REIT peers – this limits the potential upside from multiple expansion.

Conclusion

IIPR has been a strong performer and I continue to like the lower leverage on the balance sheet. I can see the stock continuing to deliver positive returns from here, but the risk-reward no longer looks compelling. I do not see a compelling case for a compression of the relative discount, leading the potential annual upside to be in the low-double-digit range, at best. I am downgrading the stock to a neutral rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TCNNF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio, a collection of the highest quality growth compounders in the market today.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!