Summary:

- Amazon’s second-quarter results saw the firm achieve solid revenue growth along with an impressive expansion in operating margins and income.

- The firm continues to excel at integrating new technologies such as generative AI into their operations, while also extracting real profitability from these improvements.

- Valuations have improved thanks to the massive profitability present at the firm, with my base-case scenario suggesting shares are trading at a fair price.

- The firm still faces cyclicality and governance risks, which could create challenges for the firm.

- Buy rating initiated (rating upgrade).

We Are

Investment Thesis

Amazon.com (NASDAQ:AMZN) produced an impressive set of second-quarter results with the firm continuing to increase both the efficiency and scale of their business.

This ability to extract profitability from their businesses has resulted in a bottom-line margin boom and significantly increased operating incomes at the firm.

I believe Amazon’s ability to effectively integrate AI tools and infrastructure into their e-commerce and AWS businesses is impressive especially given that these integrations have actually improved profitability within these segments.

Considering that my base-case intrinsic value calculation suggests shares are trading near a fair valuation, I confidently upgrade my thesis to a Buy rating at present time.

Business Overview

Through their various businesses, Amazon has become a truly indispensable element of life in the 21st century. Whether it’s visiting a website hosted by AWS, purchasing something on Amazon’s e-commerce site or watching movies on Prime, most people in the developed world utilize the firm’s services daily.

Perhaps one of Amazon’s strongest abilities has been the rapid rate at which they innovate within any given industry. By pursuing a significant rate of development for technologies while obsessing over the user experience for customers, Amazon has developed an incredibly competitive host of platforms and services which often exceed the capabilities of rivals.

Amazon’s rapid growth has allowed the firm to attain a truly staggering scale of operations which, combined with the quality of their products has generated a rare mega-economic moat for their businesses.

In my original deep-dive analysis into Amazon I explored in greater detail the fundamental businesses that form their company and contribute towards their mega-moat status. I recommend you read that article to gain a better understanding of all the different businesses currently in operation under the Amazon company.

You can check out that article here: “Amazon: Deep Dive Analysis Reveals Excellent Long-Term Value”.

Fiscal Analysis – Q2 FY24 Update

In this fiscal analysis update, I will be discussing the latest earnings data along with some qualitative changes that have occurred in their businesses over the last quarter.

Amazon’s recent Q2 results confirmed my earlier hypothesis that the firm has become a leaner and more profitable entity since their operational diet post-COVID 19.

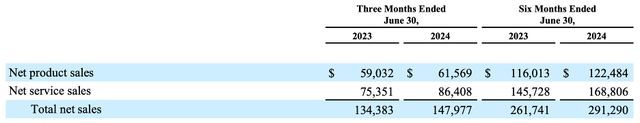

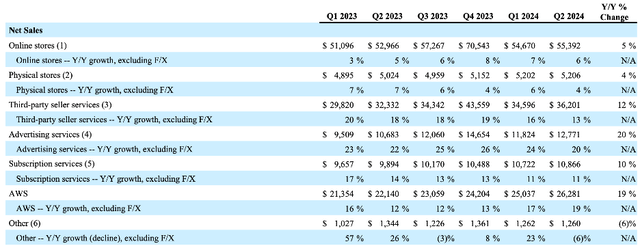

Net sales increased 10% YoY to $148 billion thanks to robust demand from North American and International markets along with a superb 19% increase in AWS revenues.

AWS is Amazon’s web services division which provides IaaS and SaaS services to business customers across the globe.

The firm’s push to integrate their own artificial machine learning intelligence into these platforms has reignited demand in their products thus driving continued revenue growth for the firm.

The service offered by Amazon competes fiercely with rivals from Google (GOOG)(GOOGL) and Microsoft’s (MSFT) Azure. Nevertheless, Amazon managed to get a head-start in the industry which, given the mission-critical nature of most IaaS and SaaS services has allowed Amazon to build a robust and tangible moat around this business.

The dominance of AWS and Prime services allowed Amazon’s total net services sales to grow 14.5% YoY against their product sales growth of just 4.4%.

While a greater rate of growth in product sales would be nice to see, I am not overly concerned by this slowdown and view it more as an illustration of falling disposable income among consumers rather than any inherent weakness in Amazon’s core product sales businesses.

Amazon’s advertising business also continued to grow at a rapid rate with 20% YoY net sales growth for the segment increasing business revenues to $12.8 billion. While the segment is still one of the smallest at Amazon, it is critical to realise that their online advertising services now generate more revenues than their Prime subscription service and physical stores do.

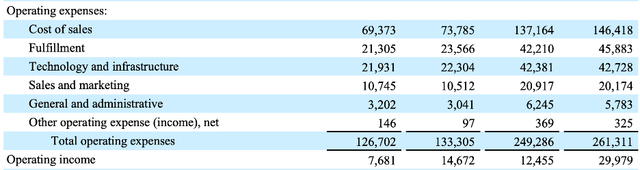

The solid gains in net sales were accompanied by what I consider to be superb improvements in operating efficiency with Amazon’s total operating income growing a whopping 90% YoY to $14.7 billion.

The key boost to operating income came thanks to a range of efficiency-focused improvements across Amazon’s businesses finally beginning to bear fruits for the firm.

Since executing their post-covid diet regarding headcount accompanied by a newfound desire to not only grow the business but also make it more profitable, Amazon has been expanded their bottom-line results massively.

This has confirmed the hypothesis from years gone by that Amazon has the potential to be a massively profitable business with healthy margins and returns accompanying the significant growth at the firm.

Considering that every single business segment saw quite significant margin expansions in Q2 relative to the previous year, I expect Amazon to continue such expansion albeit at a slightly reduced rate moving forwards given the law of diminishing returns.

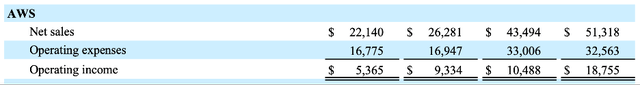

While the firm’s core e-commerce and Prime products generate massive revenues and now importantly, profits, the most valuable business segment by operating margin continues to be AWS.

Indeed, on a YoY basis AWS operating margins expanded a whopping 11pp to 35.5% thanks to a reacceleration in the demand from corporate customers for cloud infrastructure modernisations as well as the desire to benefit from generative AI advancements.

Amazon’s own core AI product range dubbed “Amazon Q” has developed rapidly and extensively since my last analysis of the firm back in February.

The industry giant now has a comprehensive range of AI tools, services and infrastructure on offer to business customers through their AWS business designed to cater to essentially every avenue of AI integrations a client could desire.

Services like SageMaker and Bedrock allow businesses to deploy, develop or even train their own foundation models while App Studio has been enhanced to allow generative AI features to be incorporated into existing enterprise-oriented applications.

I believe Amazon has once again excelled at the one thing they tend to do best: innovation. While they were not the first to the AI table, their ability to integrate these new, in-demand technologies into their existing businesses is outstanding.

It must also be appreciated that these integrations have been accomplished with the result of increasing the profitability of their existing businesses which fundamentally illustrates the firm’s current ability to harness returns from their investments.

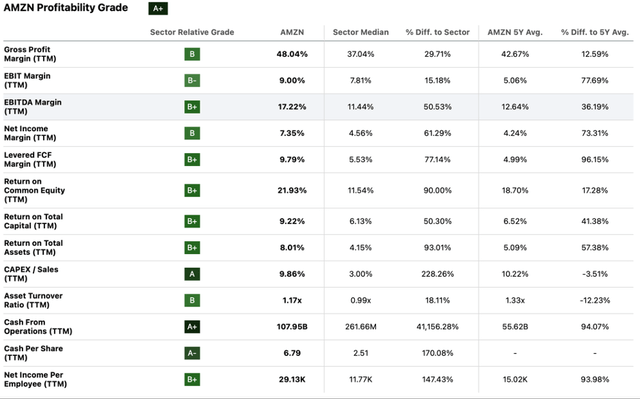

Seeking Alpha | AMZN | Profitability

Seeking Alpha’s Quant rates Amazon with a profitability grade of “A+” at present time which I agree with entirely. The now boosted gross margin of 48% and increased ROTC of 9.22% are manifestations of the positives impacts their efficiency improvements have had on their bottom-line results.

Amazon’s balance sheets continue to be in wonderful condition. Total liabilities of $318.4 billion continue to be easily outweighed by their $554.8 billion in assets with the giant of industry now also holding a substantial $71.2 billion in cash in their coffers.

When combined with their $102 billion in operating cash flows from Q2, it is easy to see how well Amazon continues to manage their enterprise economics even amidst significant growth and the now much improved levels of profitability.

Valuation – Q2 FY24 Update

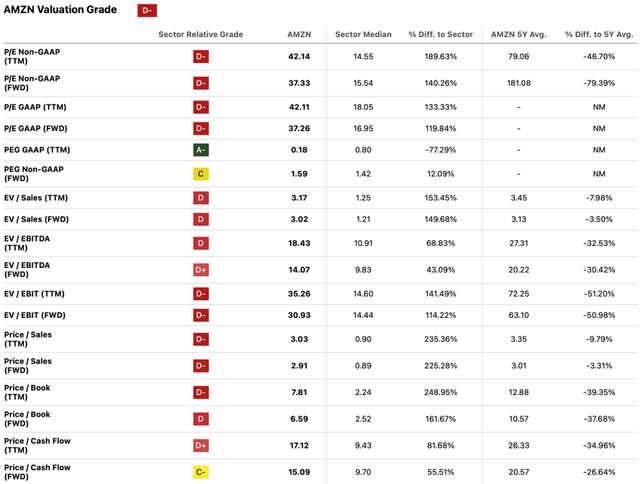

Seeking Alpha | AMZN | Valuation

AMZN stock currently earns a “D-“ valuation grading from Seeking Alpha’s stock which I am not entirely in agreement with.

Considering Amazon’s current revenue growth estimates of about 18% per annum and their massively improved operating incomes, I believe the current P/E GAAP TTM ratio of 42.11x is not excessive at all especially considering it is down around 46% from Amazon’s 5Y averages.

The current P/CF TTM ratio of 17.12x is also down 35% from the stock’s 5Y mean. Furthermore, I once again find this relatively elevated metric to still be quite reasonable given the massive amounts of cash Amazon utilises in investing activities to further grow their operations instead of hoarding it on their accounts.

I believe the ultimate reason for the relatively negative letter grades is due to Amazon being compared against the consumer discretionary sector which tends to see much more muted valuation metrics.

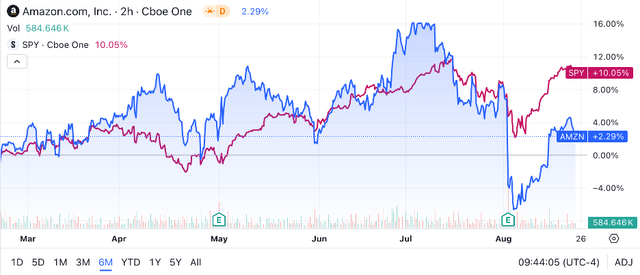

Seeking Alpha | AMZN | 6M Advanced Chart

Analysis of a 6M chart for AMZN stock reveals that the company has experienced quite a significant amount of volatility relative to the ever-popular S&P500 tracking SPSY (SPY) index fund.

While the overall performance over such a short time-frame is relatively unimportant in the context of a long-term investment thesis, I still find it prudent to consider what impact on share prices recent catalysts may have had. Indeed, this can be a relatively good qualitative way in which to understand the current market sentiments towards the stock.

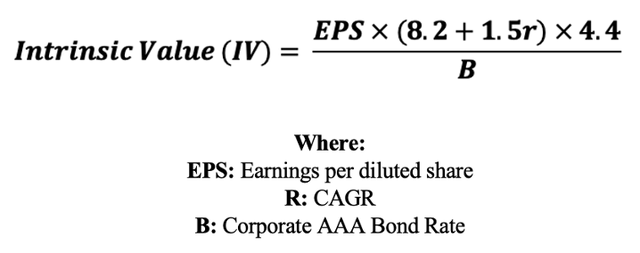

However, in order to gain a more objectively derived quantitative understanding behind the current valuation of AMZN stock, I used my intrinsic value calculation.

Using the current share price of $176.99, a revised analyst consensus estimated 2024 EPS of $4.70, a realistic “r” value of 0.18 (18%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.12x, I derived a base-case IV of $180.

Compared against current prices, this implies a fair valuation at present.

I modelled a more negative bear-case scenario by reducing the CAGR rate to just 14% which would illustrate the impacts a recessionary environment would have on their revenue growth while also accounting for some cost savings through mothballing capital.

In this scenario, shares are priced at around $147 implying an overvaluation of 20%.

Despite the current valuation appearing to be quite fair both in a base and bear-case scenario, I am reluctant to make short-term (1-12 month) predictions for two key reasons. Firstly, significant uncertainty surrounds the macroeconomic situation in the U.S. due to persistently high interest rates and the ongoing election cycle.

Secondly, Amazon’s stock has been quite sensitive to market news in recent months which suggests any negative or positive catalysts could have an outsized impact on valuations.

Regardless, I believe the firm has once again proven with their earnings data that they are well positioned to continue generating real returns for shareholders in the long-term thanks to their massive economic moat and improved operating economics.

Amazon Risk Analysis

The company’s broad range of operations increases the overall volume of risks that they must continue to contend with. Amazon’s key threats to operations include the impacts of market cyclicality, competitive pressures and governance concerns arising from their scale.

Considering that a vast chunk of Amazon revenues arise from their e-commerce business, it goes without saying that the firm could experience a real drop in headline figures should a recessionary environment limit the spending power of ordinary consumers.

Even AWS could see a drop in revenue growth should such a market dynamic emerge as businesses would reduce or delay digital infrastructure upgrades in effort to reduce their own expenses.

Amazon also faces real competitive pressures from other players in the various different markets in which they operate. The surprisingly resilient strength of brick-and-mortar retailers such as Target (TGT) and Walmart (WMT) continue to present some challenges to Amazon’s core web sales business while Microsoft’s Azure and Google IaaS competitors are formidable opponents to AWS.

Despite my conviction that Amazon continue to excel at execution in their respective businesses, I want to emphasise that they have gotten to their current position through relentless innovation and dedication to the customer experience. Should these core principles be forgotten or eroded, I fear Amazon’s moat in these businesses would slowly begin to be eroded.

Google’s parent company Alphabet is facing one of the most comprehensive anti-trust cases of the modern era with the ultimate rulings from this case having direct implications for Amazon.

While Amazon may not have such a direct monopolistic business position in any one market, the sheer scale of their operations and integration into the daily lives of billions across the globe could raise some warning flags among EU and U.S. regulators.

Should such a scenario arise, Amazon could quickly find themselves facing potential limitations on further acquisitions (the recent refusal of their purchase of iRobot (IRBT) by the EU comes to mind) or even the threat of forced break-ups of businesses into entirely separate entities.

While many of these threats are hypothetical, they are of crystalline importance to consider when evaluating Amazon’s stock as an investment opportunity.

Summary

The latest quarter saw Amazon extract some superb operating results from their businesses.

Solid revenue growth across the businesses illustrates how sticky the firm’s services and products are to consumers while a rapidly expanding margin continues to support the thesis that Amazon’s real profitability potential is only just beginning to be unlocked.

By reducing bloat and excess within the company, Amazon is becoming a leaner and more optimised business fit for decades to come.

The valuation is also quite reasonable given their improved profitability with the massively improved bottom-line results almost halving the current P/E.

As a result of my analysis, I confidently upgrade Amazon to a Buy rating at present time and will continue adding to my position in the company. I believe Amazon’s massive moat, growth opportunities and fair valuation make it an attractive GARP opportunity at present time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. The opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.