Summary:

- Qualcomm’s expertise in the smartphone business effectively translates into the automotive industry.

- Apple and Samsung are backward integrating into Qualcomm’s business since its offerings are reaching a point where it just needs to be good enough.

- ARM’s prospect in the PC market, where x86 is currently dominant, is overstated.

- Due to the threat of losing Samsung and Apple’s business, I will call a ‘Hold’ for this stock.

Michael Vi

Introduction

Qualcomm Incorporated (NASDAQ:QCOM), one of the leading semiconductor chip-making companies in the world, is currently facing challenges as two of its major customers, Apple (AAPL) and Samsung (OTCPK:SSNLF), are backward integrating into its business. While Qualcomm is diversifying its business into PC and Automotive to offset the threat of losing significant revenue from its two biggest customers, these efforts won’t fully compensate for this impact. Therefore, I’m calling for a ‘Hold’ on this stock.

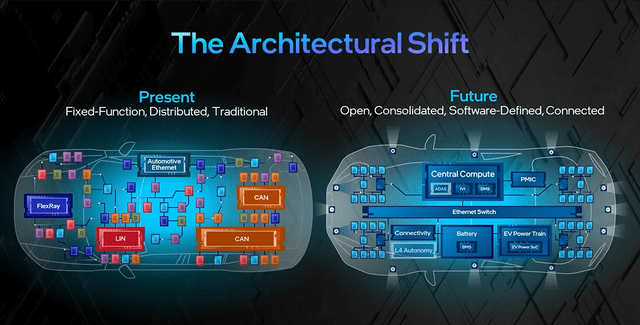

Automotive: Smartphonification Of The Car Industry

The rise of EVs has resulted in an industry shift, which I term the ‘Smartphonification of the Automotive Industry.’ This shift, driven by the advanced technology inside electric vehicles, has prompted traditional automakers to integrate cutting-edge semiconductors into their cars to improve their experience and reliability. Qualcomm’s expertise in the smartphone market positions it well to capitalize on this transformation.

So, what expertise makes Qualcomm such a unique company in this evolving space? That is, Connectivity and Efficient and High-Performing System-on-Chips (SOC).

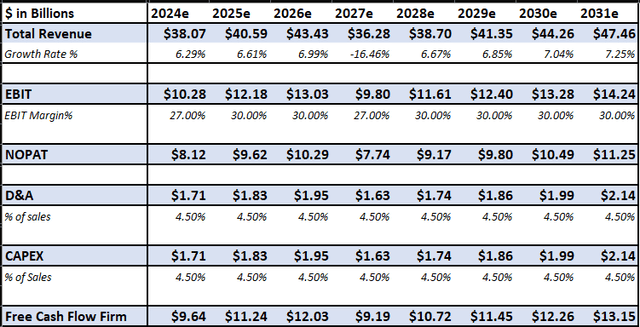

For carmakers’ ultimate ambition of a fully autonomous vehicle to take place, these vehicles must first become ‘smart.’ To be smart, they need access to vast amounts of data that can only be stored in the cloud. Thus, they are strong at their industry-leading 5G Modems, and this is evident with Apple, which, despite its access to vast resources, is struggling to create its own 5G modem in-house that can replace Qualcomm.

Qualcomm Automotive Investor Presentation

Additionally, features such as map navigation, fleet management, safety, emergency alerts, over-the-air updates (OTA), Vehicle-to-Everything (V2X), and artificial intelligence require reliable and secure connectivity. Qualcomm’s expertise and scale in smartphone connectivity will effectively translate into this business, providing a significant advantage over its competitors, who rely on other vendors to provide this function.

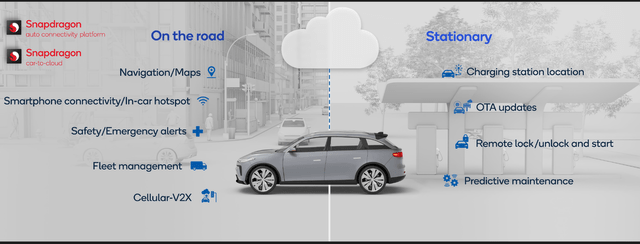

Qualcomm is also well positioned to take advantage of cars becoming more software-defined with Digital Cockpit infotainment experience and Advanced Driver Assistance Systems becoming more reliant on leading-edge semiconductors to function properly and safely. With digital cockpit now having similarities with smartphones in features such as user interface, customization, voice controls, OTA, and software applications, Qualcomm is in a great position to provide solutions to these demands with their Snapdragon System-on-Chip (SOC), which has a strong foundation from the smartphone industry. Furthermore, one of the leading operating systems in the digital cockpit is Google’s (GOOG) Android Auto, which Qualcomm has a long history of working within its smartphone business.

Qualcomm SVP Nakul Duggal highlighted how their exposure in the smartphone business effectively translates into automotive.

Yes. I think the digital cockpit business, we are very we are very bullish on for a couple of reasons. There are actually several reasons. I think, first of all, there are not many companies who have the type of exposure that Qualcomm does where we are very heavily invested in the smartphone space where the world changes on a 12, 15-months cadence, brand-new consumer technology has to be dealt with. You have to be in advanced process nodes. You have to deal with a variety of different software ecosystems, a global footprint. So it’s a very fast-moving market and the digital cockpit is starting to care about all of the same types of things.

He is right. Their ADAS competitors, such as Mobileye (MBLY), didn’t come from an industry similar to what the automotive industry is becoming-an industry increasingly resembling the smartphone market, where Qualcomm is very strong.

Qualcomm Automotive Investor Presentation

This results in significant cost savings for automakers since they don’t need to integrate multiple chips to run specific functions. Instead, multiple operating systems run on different virtual machines-hypervisor made this possible-such as those for infotainment, ADAS, and safety monitoring, can run on a single Snapdragon SoC rather than requiring a separate chip for each operating system. Furthermore, a high-performance SOC is needed to run these multiple platforms reliably, which Qualcomm is well-known for. This can result in a simpler and streamlined design process since fewer parts must be considered, adding further savings for the automakers.

Interestingly, Intel’s automotive presentation at CES discussed how cars are shifting towards architectures similar to PCs and smartphones.

Intel CES Automotive Presentation

Automotive used to be an unattractive market for semiconductor firms due to a lack of scale and standardization. There are a large number of car variants with different kinds of designs, which require different kinds of specialized chips. Thus, the unit volume required by the semiconductor firms for a target market to be economically viable isn’t there. Future cars being more software-defined will fix this issue, as the new architecture will require more standardization. Developing software for automotive applications requires a standardized platform or operating system to simplify the development process. A platform with wide adaptability is necessary, as developing software for a small user base doesn’t economically make sense.

Qualcomm’s prospects in this business are bright, as features like ADAS, which are crucial for safety, will demand significant research and development. ADAS will require specialized expertise, and OEMs that lack the necessary scale and foundational semiconductor and software expertise will struggle to compete in this area due to the high costs involved. Furthermore, for safety reasons, the certification process for cars is more rigorous than in the consumer electronics market, creating a high entry barrier, as the OEM certification and validation process for semiconductor firms can take multiple years. Recent news on General Motors (GM) laying off 1,000 software engineers confirms this, and I expect layoffs from others to follow.

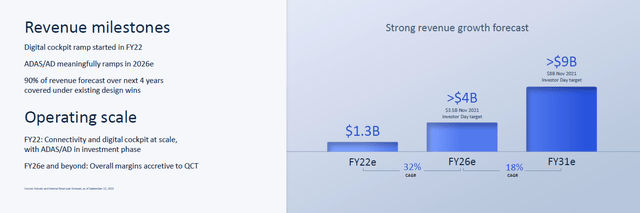

Qualcomm is bullish in this market and forecasts its automotive business to grow at a CAGR of around 24%, from $1.3B to above $9B in revenue from 2022 to 2031.

Qualcomm Automotive Investor Presentation – Financial Forecast

Although ADAS is a young and high-growth market, advancing its capabilities along with autonomous driving will require significant R&D spending, particularly due to its crucial role in ensuring the safety of people inside and outside the vehicle. Regardless of any industry, this is typical for a high-growth one, especially in technology, where companies must invest heavily in R&D to maintain their competitive edge during the early stages of the industry’s development.

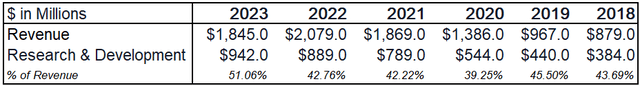

This is evident in Mobileye’s financial statements, where they spend significant revenue on R&D.

Author’s Compilation – Mobileye

As a result, Qualcomm may not enjoy the same level of profitability in the automotive industry as it has in the smartphone industry for the foreseeable future. Additionally, the significantly longer lifecycle of cars compared to smartphones means that Qualcomm’s scale won’t be as beneficial in the automotive industry as it is in the smartphone industry.

Moreover, competition is not standing by; some of their competitors, such as AMD and Intel, are starting to enter this industry. Their expertise in SOC from years of competing in the PC market can also effectively translate into this industry.

Backward Integration Of Apple And Samsung

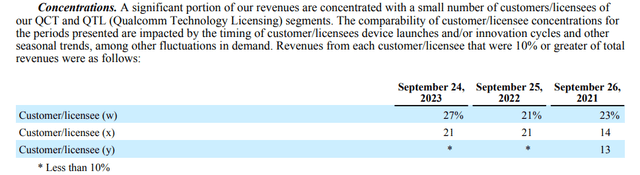

Despite being one of the leading companies for smartphone connectivity and SOCs, Qualcomm is currently at risk of losing significant revenue from Apple and Samsung.

Qualcomm 10k – Customer Concentration

So why are Apple and Samsung eager to replace Qualcomm’s chips with their in-house ones? The differentiation in consumer electronics has shifted from hardware to software, and the hardware is reaching a point where it just needs to be ‘good enough.’ It no longer makes sense to pay a premium for that extra performance.

During the heyday of Moore’s Law, when semiconductors achieved double-digit performance gains with each new generation, it was easy to convince consumers to upgrade, as the tangible performance improvements from the latest against the previous generations were easily distinguishable. However, with the slowdown of Moore’s Law, semiconductor companies like Qualcomm, Apple, AMD (AMD), and Intel (INTC) are increasingly struggling to achieve significant performance gains with each new release. This is evident in recent offerings from AMD and Apple, where performance improvements are minimal compared to their predecessors.

Despite Apple’s struggle with its 5G modems, they recognize that Qualcomm’s 5G modem has minimal contribution to its differentiated user experience, and their customers won’t even notice, even if they use a different 5G modem. Apple is following the same playbook here as they did with Intel. They could use their in-house 5G modem as a marketing theme for future iPhones, just like what they did with M1, which revitalized the MacBook. Furthermore, if we look from the consumer standpoint, the experience of using older iPhones, using older 5G modems, when using apps that require connectivity is subjectively pretty much the same. The average consumer won’t notice the difference. Apple just needs to make sure that replacing Qualcomm’s 5G modems won’t significantly affect the user experience.

Moreover, Samsung understands that while Qualcomm’s Snapdragon SoCs offer the best performance, they only need to get close enough in performance to maintain a comparable user experience. Their latest Exynos 2400 is very competitive against Qualcomm’s latest Snapdragon 8 Gen 3. As a result, Samsung has positioned its Exynos chips in the lower tiers of its flagship s24 models while reserving Qualcomm’s chips for the highest-tier models and regions. Furthermore, it is rumored that they will exclusively use their Exynos on some of the lower flagship models, such as the base model of the S25 phone.

Apple and Samsung know that outside of the enthusiast class, where sophisticated buyers usually reside, most of their customers care more about the improvements in user experience than what components are used inside the phones. Furthermore, the demand for more computing power in software has not kept pace with the improvements in hardware, leading to a performance oversupply. For example, productivity applications like Excel, Word, and PowerPoint continue to run smoothly on three to five years old CPUs. Similarly, the user experience of the latest iPhone can be easily matched by older models, such as the iPhone 11, 12, and 13.

However, Qualcomm has shown in the past that it is a fierce competitor and highly innovative. Despite repeated attempts by Apple and Samsung to move away from Qualcomm’s products, they have consistently failed to do so. Thus, I won’t be surprised if they continue to do so.

AIPC: ARM Vs. x86

Before I delve deeper into this topic, I have made a significant effort in my previous Intel articles to explain why ARM (ARM) is less of a threat to x86 in the PC market than people are making it out to be. I would encourage you to read them.

Although the PC market has lower growth and lower TAM than smartphones, one crucial difference makes it such an attractive business over smartphones: OEMs’ incapability to backward integrate into chip-making.

OEMs like Dell (DELL), HP (HPQ), and Lenovo (OTCPK:LNVGY) have operated as integrators of outsourced hardware components since personal computers became mainstream. These OEMs have never attempted to create high-value components, such as CPUs, unlike Apple, which can integrate backward into high-value components like CPUs and modems. Based on their recent cost-cutting, such as HP’s ‘Future Ready Plan’ and Dell’s focus on AI, it is unlikely that these OEMs will change their approach to the PC business anytime soon, if ever.

According to Morgan Stanley, ARM’s market share in the PC market will be 14% by 2026 from 0% in 2023. Furthermore, ARM CEO Rene Haas predicts that in 2029, ARM’s market share in the Windows PC will be 50%; this is exaggerated and hard to achieve in a mature and slow-growing industry. Before I elaborate, let us quote legendary Intel CEO Andy Grove.

Market share is gained and lost at times of transition.

Times of transition occur when innovation disrupts incumbent products by offering significantly lower costs, higher performance, greater ease of use, and other advantages, leading to a shift in consumer preferences and a redefinition of the marketplace. Famous examples of disruptive innovations include the transition from mainframes to personal computers and from feature phones to smartphones. However, ARM is not a disruptive innovation for the x86 architecture because it doesn’t introduce something fundamentally new to the market.

ARM’s advantage in efficiency can be effective in the laptop segment of the PC, but AMD and Intel are now addressing this with their upcoming chips. The competition between ARM and x86 moving forward will be about weighing the pros and cons of both architectures, where choosing x86 may compromise a bit of efficiency in exchange for greater performance and vice versa. Despite this, ARM has a place in the PC market. However, I still see the x86 architecture continuing to dominate the PC for the foreseeable future due to decades of software development that has been put into this architecture.

Valuation

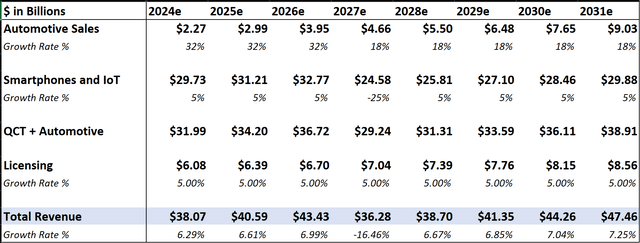

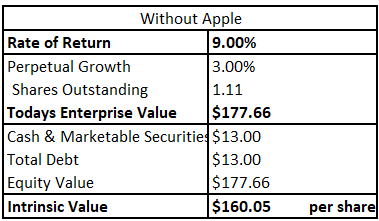

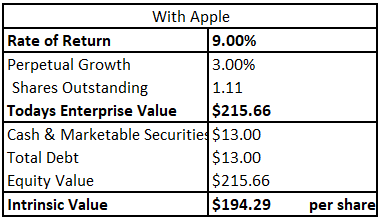

For valuation, I will use the Discounted Cash Flow method. I will present two models: one in which Apple continues to use Qualcomm Modems and another in which it does not.

On my revenue assumptions, according to IDC, smartphone shipments from 2024 to 2028 will grow at a CAGR of around 2.3%. Since these are shipments, I will settle for a CAGR of around 5% for Qualcomm’s revenue to account for its pricing power. We will use Qualcomm’s forecast for automotive, which I mentioned earlier. I will assume that Qualcomm will lose around $8 billion in 2027 due to Apple not extending its modem deal. As for licensing revenue, this usually correlates with smartphone TAM, so I will assume a 5% growth.

For EBIT, I will use their historical EBIT margin based on their historical revenue levels.

As for others, such as D&A and CAPEX, Besides not being as capital intensive as the rest of the semiconductor industry, based on their recent analyst presentations and interviews, I believe that Qualcomm won’t partake in a strategy that will require significant investment moving forward. Therefore, I will use D&A and CAPEX as a percentage of sales based on their historical averages.

Author’s Intrinsic Value – Without Apple Author’s Intrinsic Value – With Apple

I believe Qualcomm is selling at fair value at its current price. With Qualcomm’s management providing a forecast for its automotive business and Apple’s expiring modem deal in early 2027, these factors have already been priced into the stock. The only factors that, I believe, aren’t priced are the potential further loss of the Samsung business and their prospect in the PC market due to uncertainty. Considering what I said about Samsung and AIPC, I expect Qualcomm to gradually lose revenue at a consistent pace from Samsung moving forward and a continued dominance of the x86 architecture in the PC market. Therefore, I will call for a ‘Hold’ in this stock.

The factors that will convince me to put a ‘Buy’ rating on this stock are the following:

- If it’s selling at a decent discount, say 25% of its fair value.

- Significant performance and efficiency leadership over Intel, AMD, and Samsung.

Factors that will put this on a ‘Sell’ rating are:

- If it is selling at an absurd valuation, that detached valuation from actual business fundamentals.

- Intel, AMD, and Samsung maintain their performance and efficiency competitiveness against Qualcomm’s Snapdragon.

Conclusion

Qualcomm is one of the industry’s fiercest and most competitive semiconductor firms. However, despite its unfavorable market position-surrounded by companies with significant bargaining power and technological prowess-Qualcomm finds itself in a precarious situation where no innovation seems enough to compensate. Nevertheless, the management has strategically positioned the company for long-term success. Unfortunately, I prefer to buy the stock at a decent discount to compensate for the uncertainty that surrounds the Samsung business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.