Summary:

- Dell Technologies to report q2’25 earnings on August 29, 2024, with analysts mostly bearish on the name, potentially opening the door for a major earnings surprise.

- Capital investments in networking and infrastructure technologies have been reignited, as suggested by Dell’s peers. This could lead to stronger margins in the coming periods.

- Increased price target of $202/share with optimistic outlook for revenue growth and operating margin expansion. Dell shares are tactically positioned for a major upswing.

Erik Isakson/DigitalVision via Getty Images

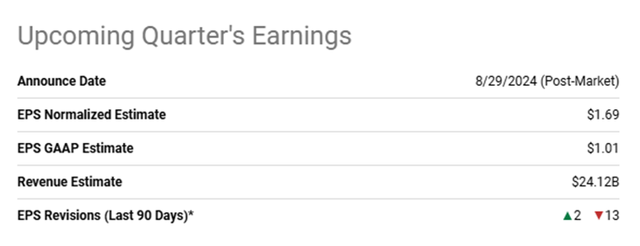

Dell Technologies (NYSE:DELL) is set to report q2’25 earnings on August 29, 2024, after market close. Analysts are relatively bearish on the name with 13 downward revisions and a mere 2 upward revisions.

Seeking Alpha

Despite the general pessimism, I believe this will open the door for a decent earnings surprise as the broader technology market has experienced substantial growth in most segments. I reiterate my STRONG BUY recommendation with an increased price target of $202/share.

You can review my previous reports covering Dell here:

Dell’s Selloff Opens The Door For A Buying Opportunity

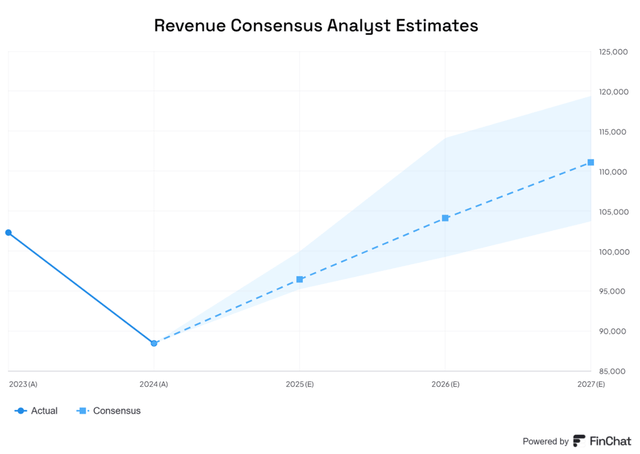

FinChat

One of the biggest headwinds the IT infrastructure industry has faced throughout the last year centered around the high levels of inventory for networking equipment. Competitors in the networking space, including Arista Networks (ANET) and Cisco Systems (CSCO) have each suggested that inventory digestion has been completed and that data center and enterprise campus customers have begun their next buying cycle.

We think the inventory digestion is complete and we’re now returning to a more normalized demand environment.

In fact, Cisco signed several $100mm+ transactions for network modernization driven by enterprise demand, as reported in their recent q1’25 results. Though this isn’t necessarily the powerplay subsegment for Dell, I believe it can be suggestive of further growth across the portfolio as faster bandwidth rates will grow in tandem with server power.

On the server side, Advanced Micro Devices (AMD) reported strong performance for their data center and client processor chips as hyperscalers deploy AMD’s 4th generation EPYC CPUs. In addition to this, the firm realized further strength for their MI300X GPUs.

Dell, HPE, Lenovo, and Supermicro all have Instinct platforms in production, and multiple hyperscale and tier-2 cloud providers are on track to launch MI300 instances this quarter.

Lisa Su, Chair & CEO, AMD

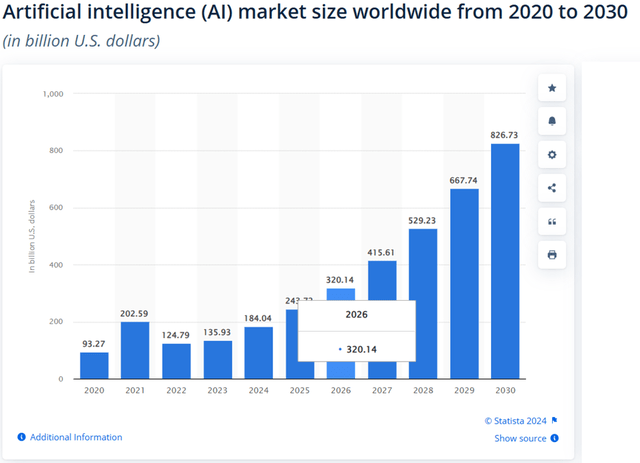

This gives me reason to believe that Wall Street may be underestimating the growth trajectory for Dell as AI infrastructure build-outs remain in hypergrowth mode. Management at AMD suggested in their q1’24 earnings call that the total addressable market for AI compute is expected to grow to $400b in 2027. Statista analysts anticipate this figure to double by 2030, suggesting a major tail-end ramp-up. I suspect this will be the result of AI training moving to production applications as the infrastructure and networks are built out to support such applications.

Statista

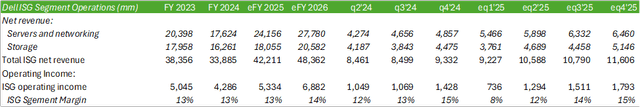

Given these factors, I believe that I had initially underestimated the growth trajectory for Dell’s ISG segment. I am revising the segment’s revenue from $9.6b to $10.5b for eq2’25.

Corporate Reports

Given the higher enterprise-driven demand in the segment, Dell may experience some margin expansion for their server and networking equipment in eq2’25.

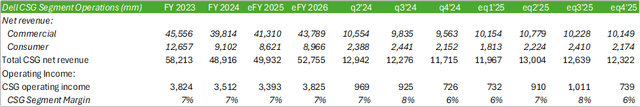

Looking to their Client Solutions Group segment, I believe Dell may realize some upside as AI PCs are in higher demand than initially expected. Intel (INTC) released their q2’24 earnings on August 1st, 2024, with some interesting results. Intel pulled forward for their A20 in order to gain market share for the AI PC space. Though the move will result in lackluster margins for the chipmaker, this could be an indicator for the broader consumer and commercial PC market. Management suggested that 40mm AI PCs will be shipped by the end of CY24 and over 100mm by the end of 2025.

Translating this to Dell’s share of the market, Dell may realize a second quarter of sequential growth in their commercial PC subsegment as enterprises seek to upgrade their infrastructure to cater to AI applications. Given this optimistic outlook, I am increasing my eq2’25 forecast for the CSG segment to $13b in revenue with an operating margin of $910mm.

Corporate Reports

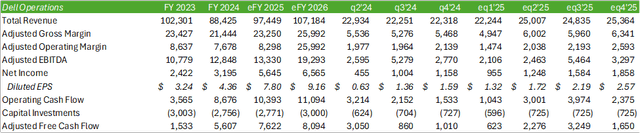

Overall, I believe Dell will grow their top line to $25b, a 9% year-over-year increase from q2’24. This will result in 10% growth for all of eFY25 paired with an $8.3b adjusted operating margin. This should ultimately uplift adjusted free cash flow generation to $2.27b for eq2’25 and $7.6b for eFY25.

Corporate Reports

I believe that much of the growth will be driven by the growth for AI infrastructure, networking, and AI PCs. In addition to this, Dell has been hinting that general compute servers have been returning to growth with storage demand stabilizing. If buying patterns for CPU servers run in tandem with networking equipment, I believe that Dell may realize a strong upswing in eq2’25 as customers digest the inventory stock. Given that enterprise sales have turned sequential growth for the networking names listed above, Dell may experience a similar shift for both server and storage infrastructure as well across private data centers.

Risks

Bull Case For Dell Technologies

Dell is in the early innings of a large megatrend for AI applications as hyperscalers and enterprises invest in building out their AI-enabling infrastructure. This will include everything from CPUs & GPUs, storage, networking, and endpoints in order to support the data-intensive applications. AI applications, specifically Palantir’s (PLTR) platform, have been found to help save & make enterprises cash through optimized operations and automation. Whether hosted in the cloud or on-prem, infrastructure will likely need to be upgraded in order to support these powerful applications.

Bear Case For Dell

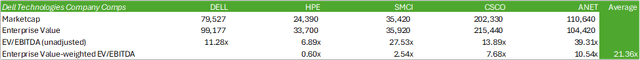

The enterprise market could potentially slow down as a result of a more turbulent economy. This could lead to fewer investments across endpoints, networking, and CPU servers. Fewer enterprise sales may also result in tighter margins. Dell currently trades at a premium when compared to its infrastructure hardware peer, Hewlett Packard Enterprise (HPE).

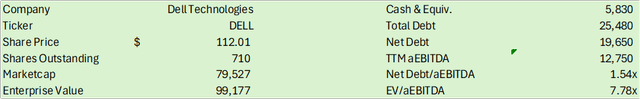

Valuation & Shareholder Value

Corporate Reports

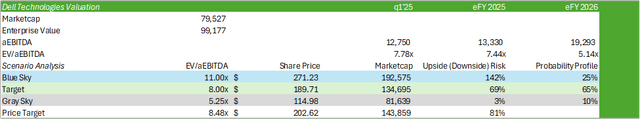

DELL currently trades at 7.78x EV/aEBITDA after a large pullback from their high watermark of $180/share. On average, DELL shares trade at a discount to its infrastructure and networking peers on an unadjusted basis.

Seeking Alpha

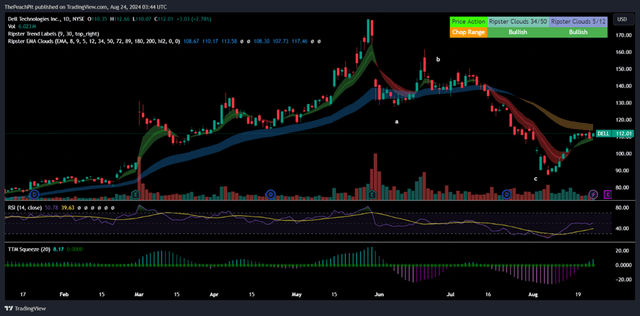

Looking at the shares from a tactical perspective, DELL shares appear to be lining up for their next upcycle after their retracement, pulling the share back from $180/share to the low of $90/share.

TradingView

Given both the fundamental and tactical factors, I believe that DELL shares may have a strong possibility of making a big move post-earnings. This is driven by the broader downward revisions by analysts, allowing for a larger earnings surprise, and the tactical positioning, setting DELL shares up for the next upward wave cycle.

Corporate Reports

Using an internal valuation based on the historical trading valuations and my financial forecast, I believe DELL shares should be valued at $202/share at 8.5x EV/aEBITDA and reiterate my STRONG BUY recommendation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, HPE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.