Summary:

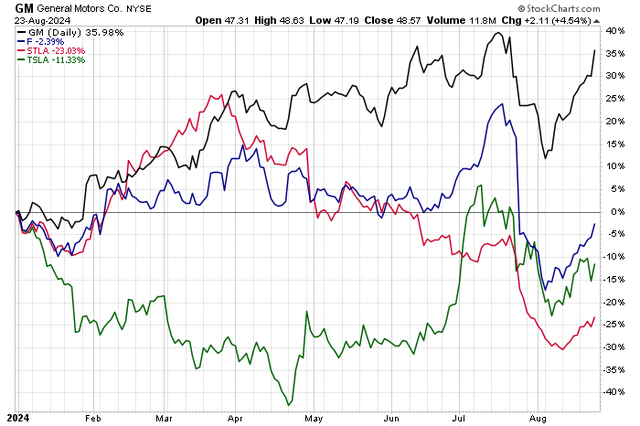

- GM stock outperforms Ford and Tesla in 2024, up 36%, and has recaptured much of its July-early August losses.

- The firm reported strong Q2 earnings and raised its FY 2024 guidance.

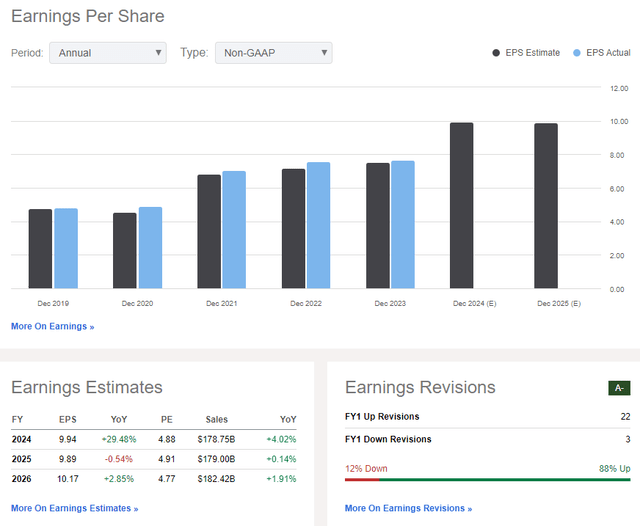

- Analysts expect 2024 EPS growth of nearly 30% with steady profits in the out year, and I provide a refreshed look at my valuation assumptions.

- GM’s chart is also constructive after a summer swoon.

JHVEPhoto

Shares of General Motors (NYSE:GM) continue to shine in 2024. The stock is higher by 36%, dividends included, while Ford (F), which I still like on valuation, is off by 2%. Meanwhile, shares of Tesla (TSLA) have been volatile on the year and are still lower by 11% year to date. Finally, Stellantis (STLA) was in the headlines 12 months ago amid labor strikes, but the domestic stock has failed to hold gains – it’s down 23% in 2024.

GM continues to be a darling of the sellside with a high number of EPS upgrades lately amid a string of EPS beats. The company has ramped up production and improved its efficiency metrics just as consumers shy away from EVs in favor of hybrids and traditional ICE vehicles. Still, GM expects to earn profits in its EV production later this year which could be yet another upside catalyst.

Following a healthy Q2 profit report, I reiterate a buy rating and give the valuation a refresh, along with eyeing new price levels on the chart. Shares are up about 11% since my previous analysis.

GM Trouncing Its Competition in 2024

Stockcharts.com

A month ago, GM posted a healthy set of quarterly numbers. The Detroit-based automaker’s second-quarter non-GAAP EPS verified at $3.06, above the Wall Street consensus target of $2.70. Revenue of $48.0 billion, up 7.2% from the same period a year ago, was a material $2.7 billion beat, too. It was a bullish triple play as its management team hiked its FY 2024 guidance – adjusted diluted EPS is now seen in the $9.50 to $10.50 range, up from $9 to $10 from the previous quarter.

Driving the robust Q2 was healthy demand at home as consumers kept on spending despite signs of weakness in the lower-end cohorts. But weakness in China continued to plague the $55 billion market cap Consumer Discretionary sector firm. Its 60% y/y profit jump along with the sanguine guidance was met with selling in the session that followed, though. I see that reaction as mere profit-taking – and we’ve already seen shares recover most of their July to early August declines.

CEO Mary Barra was confident that GM was on the right track after its strong first half thanks to ICE vehicle sales and a high 16.6% Q2 market share tally in the US. The company also keeps dominating the Trucks market with a global share of 31.9% last quarter, up from 30.2% in Q2 2023. I was pleased to see free cash flow guidance in the range of $9.5 billion to $11.5 billion – plenty of cash available with which to reward shareholders. GM also raised its profit margin outlook in July.

Key risks include emerging weakness among US consumers – auto loan delinquencies are near the highest in the last decade. Also, if we see competitors shift toward EVs and ICE vehicles at scale more efficiently, then that could lower GM’s operational momentum. A slowdown in China is another potential risk.

On the earnings outlook, analysts now expect 2024 EPS growth just shy of 30% with steady per-share profits in the out year. Growth is expected to return in 2025 with operating EPS potentially climbing above $10. Revenue growth, meanwhile, is forecast to hold in a range between 0% and 5% over the ensuing three years. But with rising dividends and share buybacks ongoing, investors are paid to wait even if the stock treads water under its July highs.

GM: Earnings Outlook and Revision Trends

Seeking Alpha

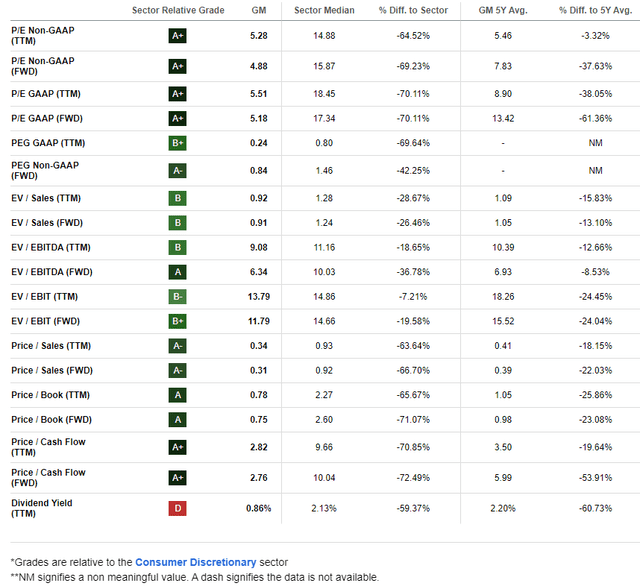

On valuation, I am increasing my EPS assumption following the healthy slate of Q2 figures. If we assume $9.90 of normalized non-GAAP per-share earnings and apply a 7.8x price-to-earnings ratio (its 5-year average), then shares should be $77, an increase from $75 I priced the stock at back during the springtime.

GM also trades inexpensively on an EV/EBITDA and price-to-sales basis, further buttressing my value case for the automaker.

A Compelling Valuation Case Persists

Seeking Alpha

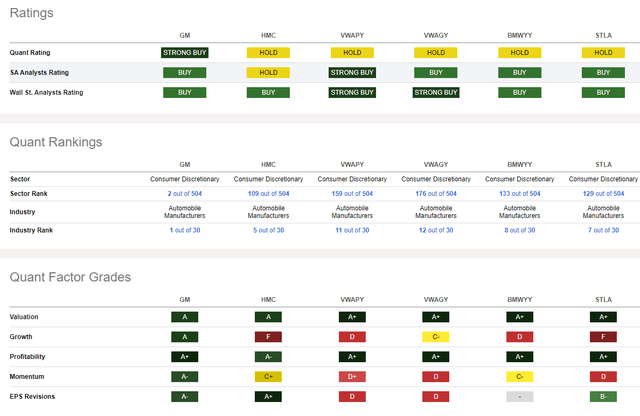

Compared to its peers, GM features very strong quant factor grades. Now ranked No. 1 in its industry and, as of this writing, No. 2 out of 504 in the Consumer Discretionary sector, the firm’s valuation grade is comparable to other automakers.

But GM’s growth trajectory is best in class, so too are its profitability trends. Moreover, with high share-price momentum and much love from the sellside, there are technical and fundamental reasons why the stock should continue to perform well.

Competitor Analysis

Seeking Alpha

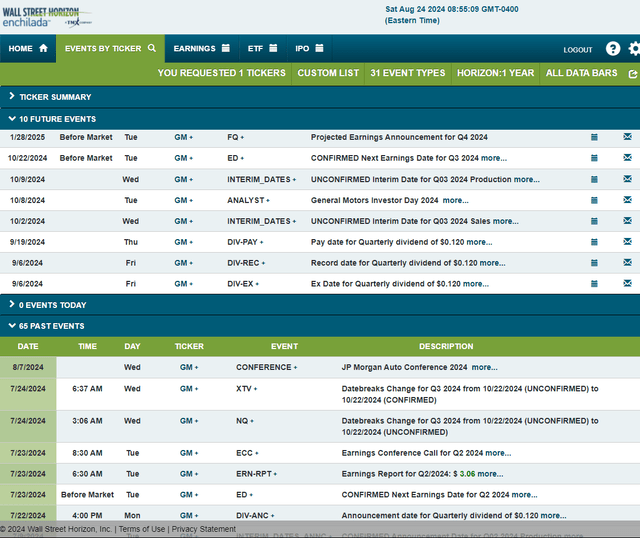

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Tuesday, October 22 BMO.

Before that, the company holds its annual Investor Day on Tuesday, October 8. Finally, shares trade ex a $0.12 dividend on Friday, September 6.

Corporate Event Risk Calendar

Wall Street Horizon

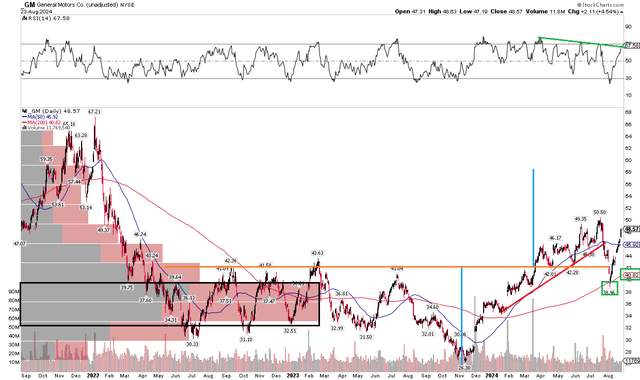

The Technical Take

There were concerns on GM’s chart just a few weeks ago when the stock broached key support I had previously noted at the $42 mark. But that dip met buyers at another important technical indicator – the long-term 200-day moving average. After penetrating a previous support mark, the fast 20% correction now appears to be more of a bullish false breakdown since the stock is within earshot of a fresh high going back two and a half years.

Also take a look at the RSI momentum oscillator at the top of the graph – if we see a new high in price, momentum could confirm it based on the high rate of change in the RSI. That would be a positive confirmation signal.

Bigger picture, I see an upside measure move price objective to about $60 based on the $17 range from early 2022 through the first quarter of this year. While that is still below my intrinsic value target, I think it’s certainly in play over the balance of the year.

Finally, notice how GM found support right at the top end of a range of high volume by price. That offers further evidence that pullbacks are likely to be seen as buying opportunities going forward.

Overall, support is at the rising 200dma while resistance is at the July high and near $60.

GM: Shares Correct to the 200dma, Back on the Rise

Stockcharts.com

The Bottom Line

I have a buy rating on GM. I see the automaker as having very strong free cash flow while continuing to reward shareholders. With strong technical momentum coming back into the stock and a low P/E, I am bullish through at least the end of 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.