Summary:

- IIPR’s rally has not been surprising, thanks to the tailwinds from the potential cannabis rescheduling and the bullish support observed in its stock valuations/prices.

- Its tenants remain profitable enough, securing its dividend investment thesis, aside from the recently added tenant, Ayr Wellness.

- IIPR is an exception to the REIT rule, thanks to its extremely low net-debt-to-EBITDA ratio of 0.70x and growing AFFO per share despite the increased shares outstanding.

- Despite the rally observed in its stock prices, the consistently raised dividends maintain the REIT’s still rich forward yields with the Fed likely to pivot by September 2024 FOMC meeting.

- Investors may want to pay attention to the developing rescheduling story, with any drastic changes likely to reverse the gains observed in IIPR’s stock prices/valuations.

We Are

The Cannabis REIT’s Investment Thesis Remains Promising, Thanks To The Robust Profitability & Macro Tailwinds

We previously covered Innovative Industrial Properties (NYSE:IIPR) in June 2024, discussing the cannabis REIT’s robust performance metrics on top of the raised quarterly dividends.

Combined with the promising tailwinds observed in the (potential) federal reclassification of cannabis and the growing bullish support observed in its stock prices/ valuations, we had reiterated our Buy rating then.

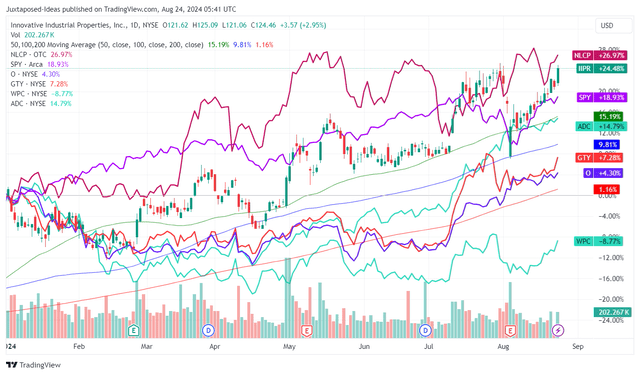

IIPR YTD Stock Price

TradingView

Since that article, IIPR has rallied by +17.5% with a total return of +19.6% (including dividends), well outperforming the wider market at +3.7%.

This rally is not accidental indeed, with the same observed in its cannabis REIT peer, NewLake Capital Partners (OTCQX:NLCP), thanks to promising market developments surrounding the potential reclassification of cannabis to Schedule 3 and the dovish stance held by the two US presidential candidates.

For example, Trump has “agreed a lot more that people should not be criminalized over marijuana, given that it’s being legalized all over the country” at state level.

At the same time, “Harris is now the first major party presidential nominee to advocate for marijuana legalization,” while picking pro-marijuana Governor Tim Walz as a running mate.

With rescheduling likely to occur sooner than later, it is unsurprising that market sentiments surrounding cannabis REITs have drastically lifted as it has on a YTD basis.

IIPR’s prospects are significantly aided by the double beat FQ2’24 performance, with rental revenues of $79.25M (+5.7% QoQ/ +4.3% YoY) and AFFO per share of $2.29 (+3.6% QoQ/ +1.3% YoY).

Much of its tailwinds are attributed to fixed rental increases at a CAGR of +2.91%, based on the projected Future contractual minimum rent (including base rent and property management fees) under the operating leases from $291.26M in 2024 to $326.61M in 2028.

With 95.6% of its properties leased at a weighted-average remaining lease term of 14.4 years and its rental collection still at 100% as of December 2023, we believe that IIPR remains well positioned to generate robust top/ bottom-lines prior to the eventual rescheduling – securing its dividend investment thesis.

This is aside from certain asset re-leasing activities of it vacant assets, subject to state and local approvals.

For now, IIPR’s core assets remain safe, significantly aided by the promising performance observed in the top three tenants, including Ascend Wellness Holdings (OTCQX:AAWH), Green Thumb Industries (OTCQX:GTBIF), and Curaleaf (OTCPK:CURLF), aside from the privately owned PharmaCann and Holistic.

With the three publicly listed tenants reporting more than decent adj EBITDA profitability, we believe that the REIT’s rental collections remain safe – aside from the recently added tenant, Ayr Wellness (OTCQX:AYRWF), with the land cost of $13M comprising 9% of the REIT’s FQ2’24 land of $142.89M.

Readers may want to pay attention to Ayr Wellness indeed, since the MSO has been reporting declining profitability on a QoQ/ YoY basis, potentially triggering headwinds to IIPR’s portfolio performance.

Even so, while REITs typically dilute their existing shareholders due to capital raises along with heftier debt leveraging, it is apparent that IIPR is an exception to the rule, with the latter reporting an extremely low net-debt-to-EBITDA ratio of 0.70x compared to the diversified REIT average ratio of 5.31x.

This is on top of the growing AFFO per share despite the growing shares outstanding.

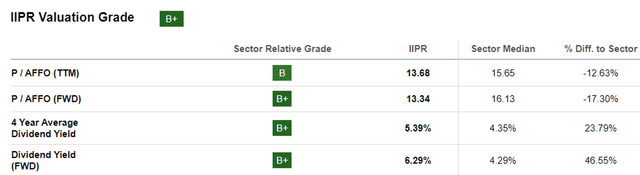

IIPR Valuations

Seeking Alpha

While the consensus forward estimates remain stable since the last article, with IIPR expected to generate an excellent top/ bottom-line growth at a CAGR of +3.3%/ +2.1%, the growing bullish support observed in its stock valuations is undeniable indeed.

At the time of writing, IIPR boasts a relatively higher FWD Price/ AFFO valuation of 13.34x, compared to the previous article at 11.74x and 1Y mean of 10.68x while halfway to its 5Y mean of 16.09x.

This development is highly promising indeed, with it implying a potential for further capital appreciation assuming an eventual upgrade to its 5Y mean, which shall be discussed in the next segment.

So, Is IIPR Stock A Buy, Sell, Or Hold?

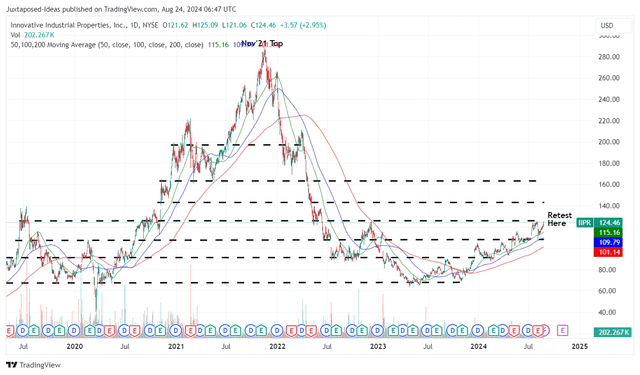

IIPR 5Y Stock Price

TradingView

For now, IIPR has continued to chart higher highs and higher lows since the October 2023 bottom, allowing it to consistently run away from its 50/ 100/ 200 day moving averages.

As with all dividend stocks, the cannabis REIT continues to offer a rich forward yield of 6.29%, compared to its 4Y mean of 5.39% and the sector median of 4.35%.

This is especially since the market is already pricing in a 25 basis point rate cut in the Fed’s upcoming FOMC meeting in September 2024, building upon the 25 basis point cut observed in the EU by June 2024.

With the US Treasury Yields also declining to a range of 3.65% and 5.13%, we believe that IIPR remains highly compelling based on the extremely rich AFFO payout ratio of 82.9%, similar to NLCP at 81.9%, compared to the diversified REIT sector of 74%.

With Seeking Alpha Quant still rating IIPR’s dividend safety at B+, its dividend investment thesis is a no-brainer indeed, significantly aided by the promising developments surrounding the US cannabis federal rescheduling.

At the same time, based on the consensus raised FY2025 AFFO per share estimates from $9.28 to $9.47 and the REIT sector’s upgraded FWD Price/ AFFO mean valuation from 14.77x to 16x, we are looking at an updated bull-case long-term price target from $137 to $151.50.

As a result of the highly attractive risk/ reward ratio at current levels, we are reiterating our Buy rating for the IIPR stock here.

Risk Warning

It goes without saying that the (potential) federal rescheduling remains uncertain, with President Biden yet to deliver on the “adult-use marijuana decriminalization, moderate rescheduling, federal medicinal legalization” since the 2020 election.

At the same time, readers must note that there may be potential competition from deep pocketed diversified REITs once rescheduling occurs, with it potentially triggering market losses to cannabis-focused REITs, such as IIPR.

As a result, investors may want to pay attention to the developing rescheduling story, with any drastic changes likely to reverse the gains observed in the REIT’s stock prices/ valuations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.