Summary:

- Rivian investors have returned to support its recent dips. Is it justified?

- Rivian’s partnership with Volkswagen could improve its balance sheet. However, incremental investments still need to be justified.

- Rivian’s unprofitability is a critical impediment. Heightened competition by Tesla and legacy automakers could complicate its growth prospects.

- RIVN’s recent bottoming is perplexing, as buying momentum has improved. However, it’s not an automatic signal to go long. Here’s why.

RoschetzkyIstockPhoto

Rivian: Don’t Throw Caution To The Wind

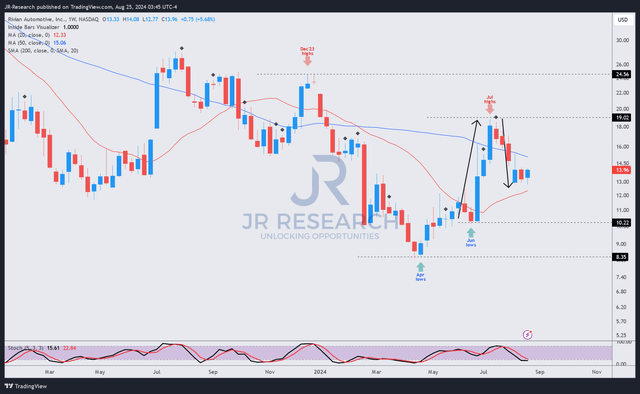

Rivian Automotive, Inc. (NASDAQ:RIVN) investors have endured a pullback since its July 2024 highs, but buyers still managed to help the stock bottom out above the $13 level over the past four weeks. I assessed that the market has turned its focus on an improved production ramp, benefits from the Rivian-Volkswagen partnership, and its transition to the lower-cost R1 Gen-2 platform.

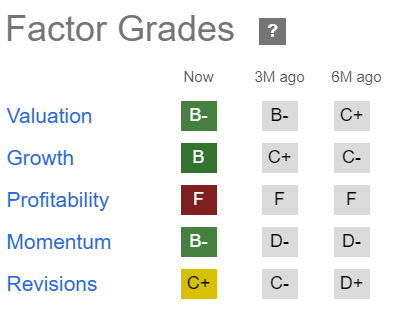

For unprofitable EV makers like Rivian, it has been an incredibly tough year. Notwithstanding the recovery from its April 2024 lows, RIVN is still down 30% YTD, even as the S&P 500 (SPX) (SPY) inches closer to its all-time highs. Despite that, RIVN’s “B-” momentum grade has been somewhat surprising, a marked improvement from its “D-” grade six months ago. It represents a significant upgrade in buying sentiments as the market reassesses the pure-play EV maker’s growth thesis.

In my July update, I urged RIVN investors to be cautious. I highlighted that its Volkswagen partnership hasn’t sufficiently convinced me that its fundamentally weak thesis has been altered. Therefore, I reminded investors not to get carried away by its mean reversion as a signal to go long.

Despite that, bullish RIVN investors could point out that the marked improvement in its buying sentiments potentially signifies the worst could be over. What could these Rivian bulls hang on to as they assessed a way forward for CEO RJ Scaringe and his team?

Rivian’s Bulls Still Hanging On

In Rivian’s Q2 earnings release in early August, the company guided to 57K in production for FY2024. Management indicated that its outlook encapsulates the downtime required for retooling its manufacturing facility is necessary to upgrade its tech stack and incorporate relatively substantial cost reductions. Accordingly, the company anticipates a “30% improvement in production line rate.” I assess that such efforts are necessary to convince the market that Rivian can potentially accelerate its path toward profitability as it raises its production outlook.

Management also indicated it’s on track to achieve a “20% reduction in bills of materials” compared to its R1 Gen-1 platform. Therefore, it corroborates the improved productivity attributed to its retooling efforts, as the fledging EV maker further simplifies its vehicular architecture.

However, whether the demand dynamics in the overall market are conducive remains to be seen. Given Rivian’s unprofitable setup, it needs to define its market more clearly to compete more effectively against its legacy OEM peers. Tesla’s (TSLA) entry with its upcoming Cybertruck could also heighten Rivian’s execution risks, impacting the benefits from Rivian’s anticipated cost reductions.

In addition, hybrids have also been gaining more share and could improve the adoption curve against pure-play EV makers like Rivian. Given its limited production scope and financial resources, I assess it’s challenging for Rivian to segue into hybrids in the near term. As a result, legacy OEMs could also complicate Rivian’s ability to win market share as they look to capture more EV adopters skeptical about full-fledged battery EVs.

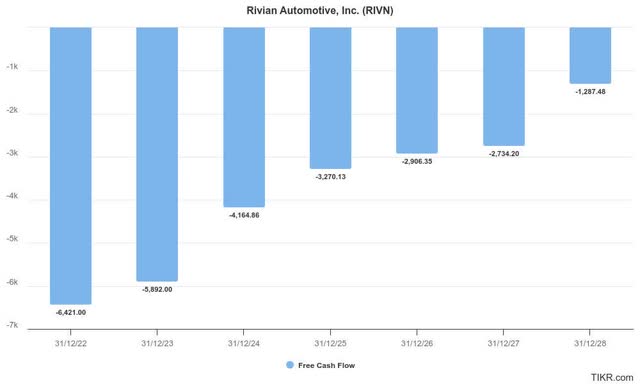

Rivian’s Negative Free Cash Flow Prospects

Rivian free cash flow estimates (TIKR)

Consequently, I urge investors to assess whether they are confident in Rivian’s ability to reach free cash flow profitability. Wall Street’s projections suggest negative FCF margins through the FY2028 forecast period. However, an accelerated production growth cadence and a more robust underlying demand outlook could spur revisions of Rivian’s profitability trajectory.

Volkswagen’s (OTCPK:VWAGY) (OTCPK:VLKAF) partnership has injected the initial $1B into Rivian’s balance sheet. However, the remaining $4B is still “subject to the completion of definitive agreements, the achievement of certain milestones, and the receipt of regulatory approvals.” Therefore, investors must assess the achievement of these milestones, as they are critical to Rivian’s ability to scale while managing negative FCF margins.

As a result, I find there are still substantial execution risks in Rivian’s thesis, even as it telegraphs optimism about its R2 platform. R2 is anticipated to help the company broaden its market reach with a lower-priced platform. However, sustaining the approach with a markedly lower-cost production strategy is necessary. With the R2 estimated to launch in the first half of 2026, we still have time to assess Rivian’s progress. However, I believe the market will be cautious about attributing too much optimism to its transition for now. Given the criticality of R2, the potential for re-rating is palpable, bolstering the outlook for its FCF margins.

RIVN: Not Attractive Considering Weak Fundamenals

RIVN Quant Grades (Seeking Alpha)

As seen above, RIVN is still rated “F” for profitability, underscoring its fundamentally weak proposition. Its ability to accelerate its FCF guidance will be critical to a more aggressive valuation re-rating. While RIVN’s valuation (“B-” grade) seems relatively attractive compared to its sector peers, there are substantial execution risks given the multiple platform transitions.

Furthermore, the increased launch cadence of hybrid competitors from the legacy automakers and Tesla’s Cybertruck must still be assessed against Rivian’s thesis. A more competitive environment could impede Rivian’s growth prospects, hindering its ability to accelerate its FCF profitability. Given its weak profitability outlook, I assess it could lead to a valuation de-rating.

Is RIVN Stock A Buy, Sell, Or Hold?

RIVN price chart (weekly, medium-term) (TradingView)

RIVN’s price action suggests dip-buyers have supported recent dips in June and August 2024. As a result, it seems like the stock could have moved past its 2024 bottom in April. Its “B-” momentum grade corroborates my observation, suggesting a significant improvement over the past six months. Therefore, selling intensity in RIVN seems to have dissipated, notwithstanding its recent pullback from its July 2024 highs.

Despite that, I assess that a cautious view of Rivian’s thesis is still appropriate. Competitive risks could intensify, which may not have been fully reflected in Rivian’s outlook. The market could also have placed too much emphasis on the Volkswagen partnership in bolstering its balance sheet. Despite that, Rivian still needs to execute well to justify the incremental investments, heightening execution risks. Coupled with the numerous platform transitions to lower costs and make productivity improvements, I assess Rivian’s FCF unprofitability as a critical impediment to a more robust re-rating.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!