Summary:

- Ad revenues are seen slipping due to iOS privacy changes, causing a meltdown in the stock price.

- Negative sentiment surrounding the Metaverse has been affecting the stock price.

- Mark Zuckerberg’s dream of the perfect VR/AR world is burning cash in the short term.

- Ways to diversify revenue streams with increased monetization of WhatsApp and Messenger are on the way.

- The financial health of the company is outstanding. My DCF model shows Meta is undervalued.

Editor’s note: Seeking Alpha is proud to welcome Gytis Zizys as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Meta Platforms gamble on the Metaverse jaanalisette/iStock Editorial via Getty Images

After going through the financials of Meta Platforms (NASDAQ:META), coupled with the current negative sentiment and the Metaverse gamble by Mark Zuckerberg and his team, I believe there is a great opportunity in this name for long-term investors. I have modeled the company’s financials and will go through assumptions for the future, forecast five- and 10-year DCF valuations, and will give my opinion on how the company might perform. In this article, I will focus on how the company is trying to diversify its revenue streams away from the tried-and-true ad revenue and build up a solid stream of revenue from the Metaverse and the peripherals that come with it. I will also discuss how management feels about further monetization of the business messaging platforms Messenger and WhatsApp Business. I will also investigate potential risks and catalysts that might change my investment thesis.

Revenue

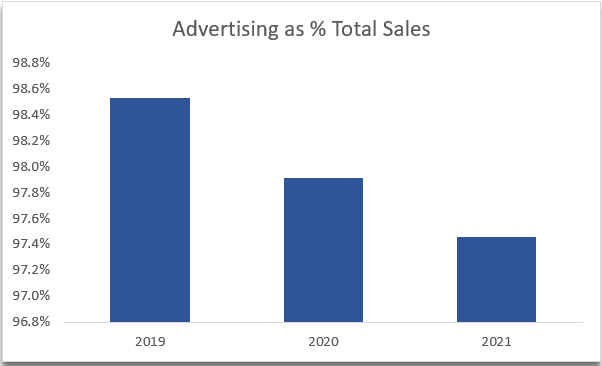

The main revenue stream for Meta Platforms has been advertising. From looking at the most recent 10-Q report, DAU, MAU, DAP, and MAP metrics have seen very little growth YoY at an average of 3.5%. That’s not surprising, considering that they have penetrated almost half of the world. No one expects these numbers to grow significantly in the future, unless China somehow allows all the platforms to operate within the country, but I’m not holding my breath.

What is important to investors is ad revenue. In the most recent quarter, ad impressions on the family of apps (FoAs) have increased by 17%. However, the average price per ad has decreased by 18%, which caused a huge meltdown of the share price (down 60% in the last year). The company expects this revenue to be affected considerably in the future as marketers are spending less because of iOS privacy changes from the early spring of 2021. There are also other factors, such as legislation in the U.S. and EU that affects how they can process personal data.

And what is Zuckerberg going to do about all of this? Well, the company is working on developing its advertising system further and evolving it so that it will depend less on personal information. That means more of the data will be anonymized or aggregated third-party data to deliver relevant ads and measurement capabilities. However, these efforts do not have any tangible benefits as of now, as they will take years to implement.

It might not be all doom and gloom for ad revenue just yet. An ally has recently emerged that can help soften the blow of iOS updates. That ally is Shopify (SHOP). Their new tool, Audiences, is designed to identify and target high-interest buyers with digital advertising. The platform aggregates all of the customer data and uploads it onto Meta’s ad platform to target customers who bought similar products. Time will tell how much of an impact this new tool will have on ad revenue for Meta, but, in my opinion, there is great potential for synergy here.

I also believe that there will be an impact on ad revenue in the short term. However, a company like Meta, with the number of resources they have available, will be able to minimize the impact to where it might not be significant anymore two or three years from now.

Almost all the revenue at Meta has been generated from ads, slowly trending down. (Own calculations)

Metaverse Gamble

If the changing of their name from Facebook to Meta is not a sign that the company is heavily invested in the Metaverse going forward, then I don’t know what is. Zuckerberg is a big proponent of VR, and his lifelong dream was to build something big in this space. With the peak of the pandemic in 2020, the vision became even clearer for Mark that virtual office spaces could be a huge opportunity.

To reach better consumer penetration of the VR/AR space, offices need to be investing in the Metaverse to make any real revenue from this megaproject. The push into the Metaverse has begun. Deloitte is one the bigger players that helps companies navigate the new world of the Metaverse and its capabilities in the future, even going as far as calling the Metaverse a trillion-dollar idea.

Another major company to start experimenting with the Metaverse is the real estate investment company CBRE (CBRE). They have created their own virtual office for onboarding. CBRE is a massive company worldwide and they believe that virtual offices will play a big role in reducing carbon emissions.

Companies are slowly starting to embrace what could be the future of work. If Meta wants to increase revenue in the office space, they will need to have a lot of partnerships with as many companies as they can get on board. I can only speculate if companies will be willing to embrace this idea.

There are quite a few uncertainties about the Metaverse. It comes with a lot of risks. Again, time will tell if this technology will be a novelty or if it can take off and become a decent revenue stream for the company. The way I see it is that Zuckerberg is not giving up on this anytime soon. He will plow billions of dollars into the project. It is possible to come up with something extraordinary if you sink billions of dollars into one thing.

Expenditures

Reality Labs, the segment that works on the Metaverse, accounted for 18% of total OPEX. In their latest 10-Q report, management expects this segment to operate at loss for the foreseeable future. To keep supporting this megaproject they will need sufficient profits from the FoAs and other business segments to generate cash. Meta is on track to lose $13B on Reality Labs in 2022, and the company is going to devote 20% of its funds to the Metaverse in 2023.

This level of expenditure on RL and R&D makes sense as Zuckerberg and the management team are ramping up innovation in this space. It could become very promising in the next few years.

Metaverse Offerings

You cannot go into the VR world without the accompanying accessories. Back in October, the company released its flagship VR headset, Meta Quest Pro. The device is not very accessible at the current price of $1,500. It is a big improvement on their previous headset and initial reactions to how much the headset has improved are great. The screen per eye is much higher quality now, and it’ll only improve with time as Zuckerberg continues to invest money into it. However, I do not see many people adopting the headset at that price. In addition, it might not be the right time to get the headset because there’s no killer app available just yet. The current virtual world of “Horizon Worlds” left a lot to be desired, although with future updates like full facial recreation and a lower entry price for the headset, I could see this taking off.

The Metaverse can become huge. Look at Roblox (RBLX) and what they are doing in this space, or surgeons who are using AR to help with surgeries, or the army buying AR technology from Microsoft (MSFT). There will be many new ways of adopting AR/VR technology in real life in the future. It is hard to put a value on the Metaverse, but I do believe that someday this project will be making money for META instead of burning the cash generated by other segments in the company.

In my opinion, the people who are working on the Metaverse at Reality Labs are doing a great job – just look at this prototype the team has been working on for a while. The new avatars are photorealistic and are rendered in real time. It is light years ahead of what the current avatars look like in “Horizon Worlds.” I can already tell that this technology is revolutionary, and I am very excited to see what will come out in the next few years as Zuckerberg and the team keep investing in R&D.

Monetization of WhatsApp and Messenger

Now that we’ve gotten that part of the story out of the way, let’s focus on something a bit more tangible – e.g., the potential of WhatsApp and Messenger in terms of revenue. Zuckerberg came out recently after major layoffs and said that the next big pillars of their business will be the business messaging apps – WhatsApp Business and Messenger – as they continue their efforts in terms of monetization.

WhatsApp for Business

This app is free of charge for companies and consumers if the company answers the query within 24 hours. If not, they will be charged $0.0085 per message for the first 250,000 and going down to $0.0058 per message above 10 million messages – meaning the more the company responds, the cheaper it gets. The latest statistics I found for how much revenue this app is generating is just under $300m in 2021, which is a very small fraction of the total revenue. I could see this ramping up a lot more since the company will be focusing on these platforms. This initiative shows me that management is not just focusing on the Metaverse play, but rather maximizing revenues in all of the segments of the company.

WhatsApp Pay

This app is a newer service that is only available in Brazil and India so far, and works just like PayPal (PYPL). You can send money to friends, family, or a business, and the receiver is charged around 4% of the money. There aren’t many details on how much revenue Pay is generating because it’s still in the testing phase. However, these regions will be a good gauge of how the app will do considering they are the biggest regions where WhatsApp is used worldwide.

Once the company works out all the kinks in these regions and opens the service up worldwide, we will finally see proper monetization of the platforms and further diversification from ad revenue.

Partnership-Driven Success

The recent partnership of WhatsApp and Salesforce (CRM) is a good example of how to further monetize these two messaging platforms. The integration creates tools so that businesses can contact customers directly through the messaging apps, run ad campaigns, and sell straight through the chat. Another major partnership was with Jio and WhatsApp in India. It is the first end-to-end shopping experience, which allows customers to browse goods through WhatsApp for delivery by simply sending a message.

Business messaging apps are currently in the early stages of monetization. However, partnerships with major companies and global availability have the potential to drive significant revenue growth through targeted advertising and commerce opportunities on apps like Messenger and WhatsApp.

Financials

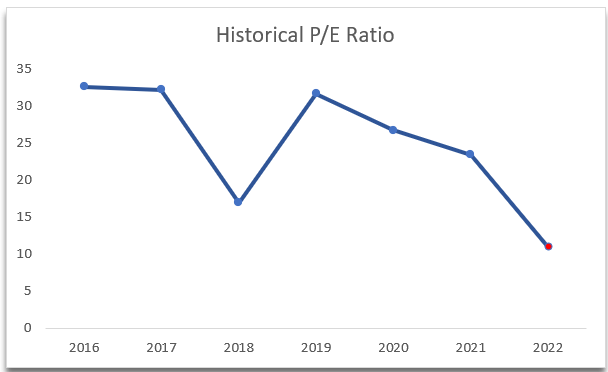

Before we delve deeper into the company’s financials, we can see that the pummeling the share price took over the last year could present a great buying opportunity. First, the P/E ratio of Meta has never been lower, sitting at 11x at the time this article was written. This alone might attract some people’s attention to it. The very first time I invested in the stock was around 2018 when the P/E ratio was at around 27, and even then I thought it was a good investment.

Historical P/E Ratio (Own Calculations)

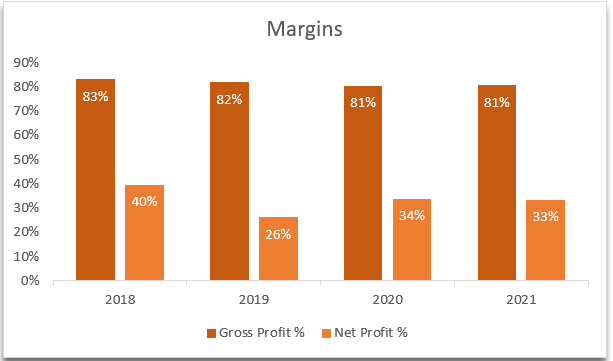

Looking at the financials of the company over the last five years I can see that the company is doing well. Gross and net profit margins have been steady and in really good shape. These figures might be impacted a bit more once we see full-year 2022 accounted for in the next 10-K report, due in February. I would expect net margins to go down to around 20%, but it is still a healthy company that knows how to manage its available resources very well.

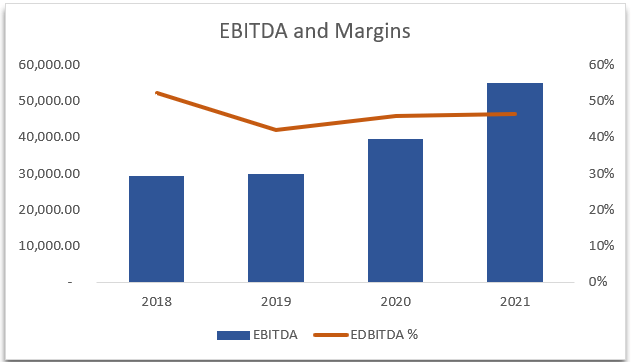

Gross and Net profit Margins from 2018-2021 (Own calculations) EBITDA numbers and EBITDA Margin from 2018- 2021 (Own calculations)

EBITDA and EBITDA margins have been excellent throughout the years and relatively stable. I do expect EBITDA to go down slightly at the end of 2022 to around the 35%-40% range, as the company has spent a lot more money on R&D, and further impact ad revenues. But that’s only in the short term; I’m more focused on a longer time frame.

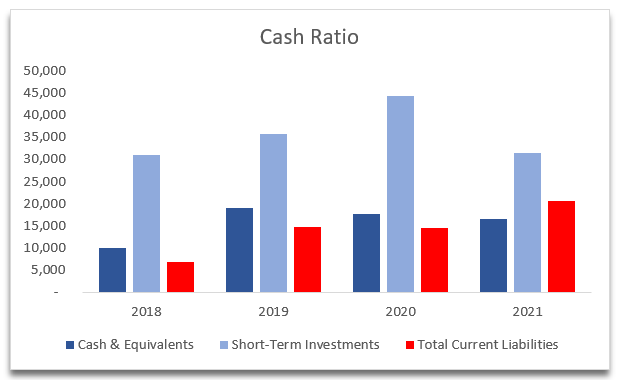

Cash Ratio Chart of Cash & Equivalents to Total Current Liabilities 2018-2021 (Own calculations)

Meta Platforms has been a cash machine for the longest time, and has enough cash and equivalents to cover all its short-term obligations and even its total liabilities. I like investing in companies that have very little or no debt at all. Meta has very little debt, around $9 billion, which is easily covered by cash and marketable securities as shown above. The company is essentially unleveraged and that is a very good position to be in, in my opinion.

DCF Valuation

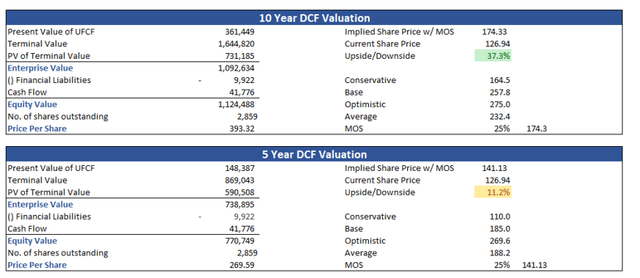

I created a DCF model for the company, taking into account current financials and future developments, and generated three scenarios to evaluate the company’s attractiveness. Case one is conservative, case two is base, and case three is optimistic.

Varying assumptions have been implemented in the model, providing extra detail on ad revenues, RL revenues, and R&D costs. For the conservative case, I took out all of the RL revenue but left its costs to make it look as if the company is essentially burning cash with no benefit. That’s because I wanted to see if that would affect the valuation by a lot. It did not, because most of the revenue is coming from ads. I have modeled every income statement item; however, I only mentioned the ones that would make the most impact on the valuation.

I calculated the WACC to be 8.86% at the time of modeling (late December 2022) and I chose a terminal growth rate of 2.5%. Applying a margin of safety of 25% to all scenarios and taking an average, my model suggests that Meta, under a 10-year DCF valuation, has an upside of 37.3% and 11.2% under the five-year DCF valuation (as shown below).

10- and 5-year DCF valuations of Meta Platforms with MoS of 25% (Own calculations)

Future Risks

There are a number of risks to consider here. The Metaverse might not work out. The company might not have enough experience in consumer hardware and VR/AR technology, which could lead other companies to compete more effectively than META. R&D expenditure could be for nothing if they are unable to make key partnerships and grow trust in the Metaverse.

Continued pressure from regulators in the U.S. and EU might hinder the growth and success of Meta. The EU recently opened a new case against them for breaching antitrust rules regarding their integrated marketplace on Facebook, in which they say other marketplace companies are not able to compete with the advantage that Facebook has amassed over the years. This is an $11B lawsuit. But I do not believe it will get far at all, as to me it makes no sense that Meta is being essentially penalized for having a good product like the Marketplace integrated into their social media platform.

Pressure from TikTok will take away screen time from the family of apps, of course, but the perfect storm for Meta in 2023 would be the continuing chaos of Twitter (TWTR) and Elon Musk in the social media space, and tighter regulations of TikTok that could benefit Meta greatly.

The only thing that would change my bullish thesis on the company is if Meta were not able to adjust their algorithms and machine learning to combat the iOS privacy changes, and we start to see ad revenue getting hammered. If revenues are hit hard by the changes, let’s say 10%-20%, that is essentially 10%-20% of all of the revenue. That would result in a significant loss for the company, and it might struggle to maintain its current operations and growth. It would be important for the company to explore other revenue streams or diversify its revenue sources in order to mitigate the impact of such a loss.

Macroeconomic factors are a big risk for all tech companies, not just Meta. The most recent Fed meeting saw Fed Chair Jerome Powell indicate that he will do everything in his power to lower inflation to the 2% mark, so we will continue to see interest rates going up for the next while. The terminal rate now stands at around 5.25% for 2023.

The above-mentioned risks could drive revenues down if all of them come true. If Meta is not able to overcome these obstacles, that could bring a lot more negativity to the company and depress its share price further.

Catalyst

The share price has been on a downward trajectory since its high in September 2021. It is trying to break out from this trend since it hit a low of $88 in November of last year. What could change this year-long downward trajectory would be a very good end-of-year earnings report. This would shift the negative sentiment surrounding the company. If we see good growth in user numbers and advertisers start to pay more for the ads, this could potentially put the stock into rally mode.

On the other hand, if user growth has plateaued and ad prices continue to fall – coupled with the increases in interest rates – the downward trend of the stock price will continue, and will most likely test the lows again.

Conclusion

In my opinion, Meta is in great shape overall financially, despite the Metaverse gamble hanging over the company’s head for the next few years and ad revenue uncertainty. The financials are outstanding, and I believe that investors have oversold the stock. The company now looks very attractive for long-term investors.

I am excited about the possibilities of the Metaverse. The worst that can happen is it fails, and the company will have $10 billion every year back on its balance sheet after it stops funneling all that money into RL. Or they could pivot the whole concept toward gaming instead of completely dropping it, since what they do have on their hands is promising. I am bullish overall on the company, but I would wait a little while longer to see what happens with the next couple of earnings reports and how this macroeconomic environment is going to change over the next few months.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.